Canada's Economy And The Overvalued Canadian Dollar: A Timely Analysis

Table of Contents

Factors Contributing to an Overvalued Canadian Dollar

Several interconnected factors contribute to the perception of an overvalued Canadian dollar. Understanding these elements is crucial to navigating the complexities of the Canadian economy.

Commodity Prices and Their Impact

Canada's economy is heavily reliant on resource exports, including oil, natural gas, lumber, and potash. High commodity prices generally lead to increased demand for the Canadian dollar, strengthening its value against other currencies. This is because foreign buyers need Canadian dollars to purchase these resources.

- High demand: When global demand for Canadian commodities is strong, the influx of foreign currency seeking to purchase these goods boosts the Canadian dollar exchange rate.

- Price volatility: However, this reliance on commodity prices creates significant risk. Fluctuations in global commodity markets can cause dramatic swings in the Canadian dollar's value, creating uncertainty for businesses and investors. For instance, a sharp drop in oil prices can weaken the Canadian dollar considerably.

- Example: The surge in oil prices in the early 2000s significantly strengthened the Canadian dollar, while the subsequent price crash in 2014-2016 had the opposite effect.

Interest Rate Differentials

The Bank of Canada's monetary policy plays a crucial role in influencing the Canadian dollar's value. Higher interest rates in Canada compared to other major economies attract foreign investment, increasing demand for the Canadian dollar.

- Attracting foreign capital: Higher interest rates make Canadian bonds and other investments more attractive to international investors, leading to increased capital inflow and strengthening the currency.

- Balancing act: The Bank of Canada faces a delicate balancing act. While higher interest rates can strengthen the currency, they can also slow down economic growth by making borrowing more expensive for businesses and consumers.

- Comparative analysis: A comparison of Canadian interest rates to those of the US Federal Reserve or the European Central Bank provides valuable insights into this dynamic.

Geopolitical Factors and Safe-Haven Status

Canada's reputation as a politically stable and economically sound country often leads investors to view the Canadian dollar as a safe-haven currency during times of global uncertainty.

- Flight to safety: During periods of geopolitical instability or economic turmoil elsewhere in the world, investors often seek refuge in currencies perceived as safe and stable, such as the Canadian dollar.

- Global events impact: Events such as wars, financial crises, or political upheavals in other countries can boost demand for the Canadian dollar, driving up its value.

- Relative stability: Canada's relatively stable political environment and diversified economy contribute to this safe-haven status. However, this is not a guarantee, and global events can still significantly affect investor sentiment.

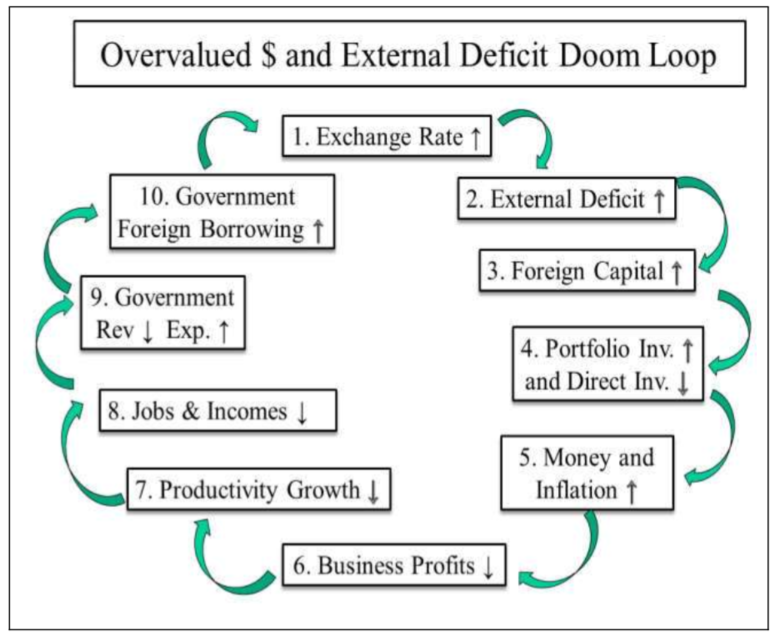

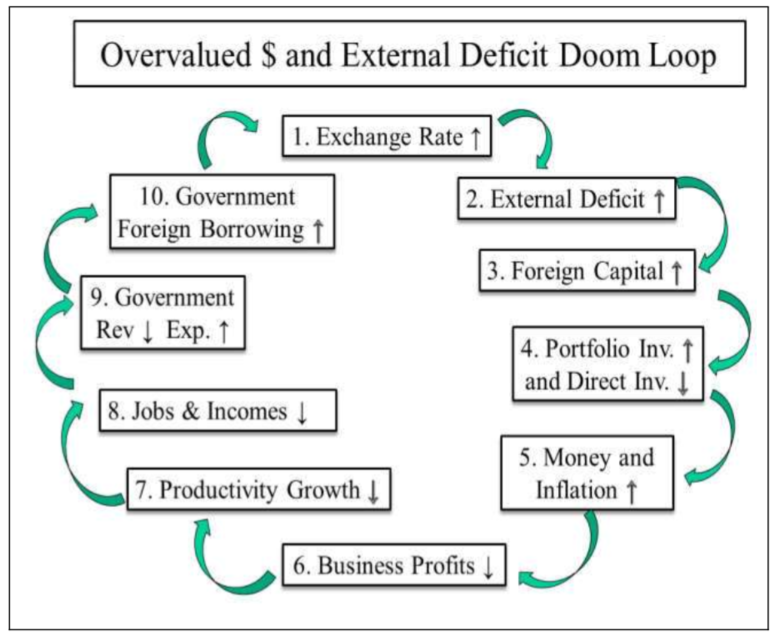

Economic Implications of an Overvalued Canadian Dollar

An overvalued Canadian dollar, while potentially beneficial for consumers through lower import costs, presents significant challenges for the Canadian economy.

Impact on Exports

A strong Canadian dollar makes Canadian exports more expensive in global markets, reducing their competitiveness.

- Reduced competitiveness: Canadian businesses find it harder to compete with producers in countries with weaker currencies, leading to a decline in exports and potentially job losses in export-oriented sectors.

- Sectoral impact: The impact varies across different sectors. Manufacturing and resource-based industries are particularly vulnerable to a strong Canadian dollar.

- Trade deficit: A persistent overvaluation can lead to a widening trade deficit as imports surge and exports decline.

Impact on Imports

An overvalued Canadian dollar makes imports cheaper for Canadian consumers and businesses.

- Lower prices for consumers: Consumers benefit from lower prices on imported goods, increasing their purchasing power.

- Increased competition: Domestic businesses face increased competition from cheaper imported products.

- Potential for inflation: While cheaper imports can help curb inflation, a dramatic shift in import costs could create other economic imbalances.

Impact on Economic Growth

The overall impact of an overvalued Canadian dollar on economic growth is generally negative.

- Reduced export revenue: The decline in export revenue reduces overall economic output and can hamper GDP growth.

- Job losses: The decreased competitiveness of Canadian businesses can lead to job losses, particularly in export-oriented sectors.

- Interconnectedness of sectors: The impact is not isolated; a struggling export sector can have knock-on effects on other parts of the economy.

Conclusion

In conclusion, the perceived overvaluation of the Canadian dollar is a complex issue with far-reaching economic implications. Factors such as high commodity prices, interest rate differentials, and Canada's safe-haven status contribute to a strong Canadian dollar. However, this strength presents challenges to the competitiveness of Canadian exports, potentially impacting economic growth and job creation. To fully understand the health of the Canadian economy, it is crucial to monitor the overvalued Canadian dollar and its effects on various sectors. Stay updated on the fluctuations of the overvalued Canadian dollar by following relevant economic news and analysis to make informed decisions in this dynamic environment.

Featured Posts

-

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025 -

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025 -

800 Million Week 1 Analyzing The Potential Impact Of Xrp Etf Approval

May 08, 2025

800 Million Week 1 Analyzing The Potential Impact Of Xrp Etf Approval

May 08, 2025 -

2025 Ptt Alimlari Kpss Li Ve Kpss Siz Pozisyonlar Ve Basvuru Tarihleri

May 08, 2025

2025 Ptt Alimlari Kpss Li Ve Kpss Siz Pozisyonlar Ve Basvuru Tarihleri

May 08, 2025 -

How Glen Powell Achieved Peak Fitness For The Running Man

May 08, 2025

How Glen Powell Achieved Peak Fitness For The Running Man

May 08, 2025