BofA Reassures Investors: Why Current Stock Market Valuations Are Not A Problem

Table of Contents

BofA's Rationale Behind the Positive Outlook

BofA's positive stance on current stock market valuations rests on several key arguments, supported by a robust analysis of economic indicators and future growth projections. Their assessment considers a complex interplay of factors, leading them to believe that the current market isn't overvalued to a concerning degree.

-

Strong Corporate Earnings: BofA points to consistently strong corporate earnings reports, indicating healthy underlying economic activity. These earnings, despite inflationary pressures, are demonstrating resilience, bolstering the overall market value. They cite specific examples of robust performance in certain sectors, supporting their projections.

-

Interest Rate Projections: BofA's analysis incorporates their predictions for interest rates. While acknowledging the impact of rising rates on valuations, their forecast suggests a more moderate increase than some market analysts predict, thus mitigating the negative impact on stock prices. They anticipate interest rates stabilizing at a level that, while higher than historically low levels, remains supportive of continued economic growth.

-

Inflation Moderation: BofA's assessment accounts for ongoing inflation. While acknowledging its impact, their projections show inflation moderating over time, reducing pressure on corporate profit margins and lessening concerns about overly inflated stock prices. This moderation, they argue, will ultimately support long-term growth.

-

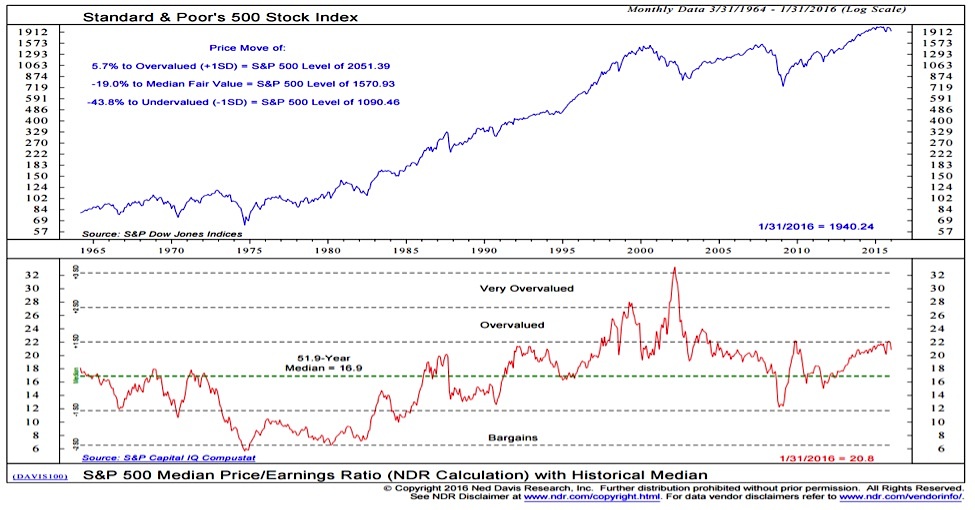

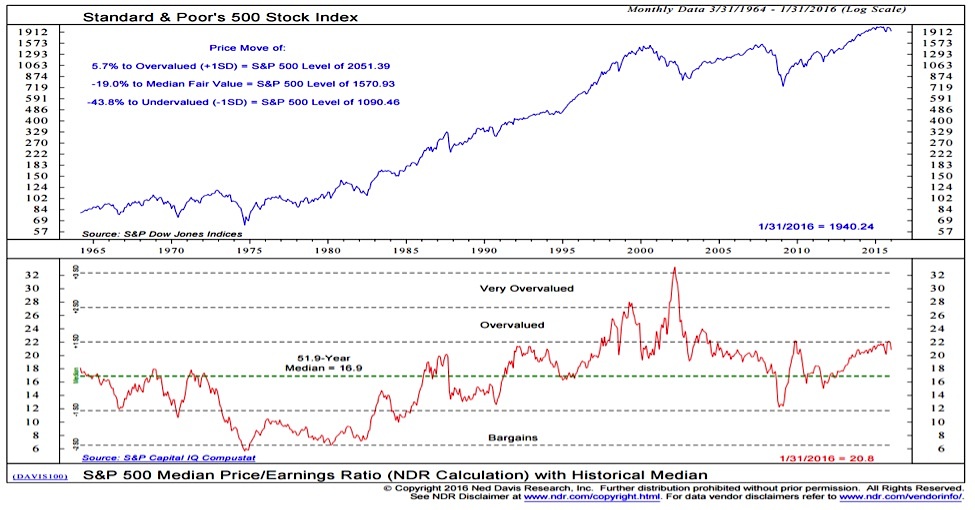

Sector-Specific Analysis: BofA isn't offering a blanket positive outlook across all sectors. Their analysis identifies specific areas they believe are undervalued or poised for strong growth, counterbalancing concerns about overall market valuations. Technology and certain consumer staples sectors are identified as areas of particular strength. They provide detailed P/E ratio comparisons and dividend yield data to support their claims.

Addressing Common Investor Concerns about High Valuations

Many investors are understandably anxious about high valuations, fearing a market bubble or a significant correction. BofA directly addresses these concerns:

-

Historical Context: BofA argues that current valuations, while seemingly high compared to historical averages, are not unprecedented. They cite historical examples of periods with seemingly high valuations that were followed by periods of sustained growth. This historical context helps to temper concerns about an imminent crash.

-

Long-Term Growth Potential: BofA highlights the considerable potential for long-term growth in various sectors, driven by technological advancements and robust global economic expansion (with caveats for potential geopolitical headwinds). This future potential, they suggest, justifies current valuations to a certain extent.

-

Addressing Bubble Concerns: While acknowledging the possibility of localized bubbles in specific sectors, BofA's analysis suggests that the overall market isn't experiencing a broad-based bubble. Their detailed sector-specific analysis helps to mitigate these fears, showing that growth and valuation are often correlated, and that high valuations aren't necessarily unsustainable.

The Role of Interest Rates in Shaping Stock Market Valuations

Interest rates play a crucial role in shaping stock market valuations, influencing investor behavior and investment choices. BofA's perspective on this relationship is central to their positive outlook.

-

Investor Behavior: Rising interest rates generally lead to higher borrowing costs for companies, potentially impacting profitability and reducing investor appetite for stocks. Conversely, falling interest rates can stimulate economic activity and increase demand for stocks. BofA carefully considers these dynamics in their analysis.

-

Alternative Investments: BofA acknowledges the appeal of alternative investments, like bonds, when interest rates are higher. However, their analysis suggests that the projected interest rate increases don't negate the potential for attractive returns in the stock market, given the robust growth projections across various sectors.

-

BofA's Interest Rate Forecast: BofA's relatively moderate interest rate forecast plays a key role in their positive assessment of stock market valuations. This forecast lessens the impact of rising rates on future stock performance, offering investors a more optimistic scenario.

Long-Term Growth Prospects and Their Influence on Valuation

BofA's long-term growth projections are fundamental to their view on current valuations. Their analysis considers several factors:

-

Technological Advancements: BofA emphasizes the role of ongoing technological innovation in driving economic growth and boosting corporate earnings. This innovation, they argue, supports higher valuations in technology and related sectors.

-

Global Economic Growth: BofA considers global economic factors, acknowledging potential headwinds while remaining optimistic about continued long-term growth. This optimism, tempered by realistic assessments of geopolitical risks, underlies their positive outlook.

-

Geopolitical Factors: While acknowledging potential risks associated with geopolitical instability, BofA's analysis suggests that the overall impact on long-term growth will be manageable, not significantly altering their positive assessment of current valuations.

BofA's Reassurance and a Call to Action

In summary, BofA's analysis offers a reassuring message to investors concerned about current stock market valuations. By considering strong corporate earnings, moderate interest rate projections, inflation moderation, and long-term growth prospects, BofA concludes that current valuations, while high in some sectors, are not necessarily a cause for alarm. Their sector-specific analysis and historical context further support this viewpoint.

Don't let concerns about stock market valuations deter you. Learn more about BofA's insights and strategies for navigating the current market by visiting their website and exploring their research resources. Understanding BofA’s perspective on stock market valuations can be crucial for making informed investment decisions.

Featured Posts

-

German Wind And Solar Expansion Pne Group Receives Permits For Three Projects

Apr 27, 2025

German Wind And Solar Expansion Pne Group Receives Permits For Three Projects

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Spd Assures Coalition Stability

Apr 27, 2025

Bsw Leader Crumbachs Resignation Spd Assures Coalition Stability

Apr 27, 2025 -

Gensol Engineering Faces Pfc Complaint Over Alleged Falsified Documents

Apr 27, 2025

Gensol Engineering Faces Pfc Complaint Over Alleged Falsified Documents

Apr 27, 2025 -

Power Finance Corporation Dividend Update 4th Cash Reward Expected March 12 2025

Apr 27, 2025

Power Finance Corporation Dividend Update 4th Cash Reward Expected March 12 2025

Apr 27, 2025 -

Canadas Rising Tourism Outpacing The Us

Apr 27, 2025

Canadas Rising Tourism Outpacing The Us

Apr 27, 2025

Latest Posts

-

Posthaste Measuring The Us Economic Fallout From The Canadian Travel Boycott

Apr 28, 2025

Posthaste Measuring The Us Economic Fallout From The Canadian Travel Boycott

Apr 28, 2025 -

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025 -

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025