BofA's Take: Are High Stock Market Valuations Cause For Concern?

Table of Contents

Assessing Current Stock Market Valuations

Understanding the current market landscape requires analyzing key valuation metrics. BofA, like other financial institutions, utilizes several tools to gauge whether stock prices are justified.

Metrics Used to Evaluate Valuation

Several metrics help assess whether current stock market valuations are sustainable. These include:

-

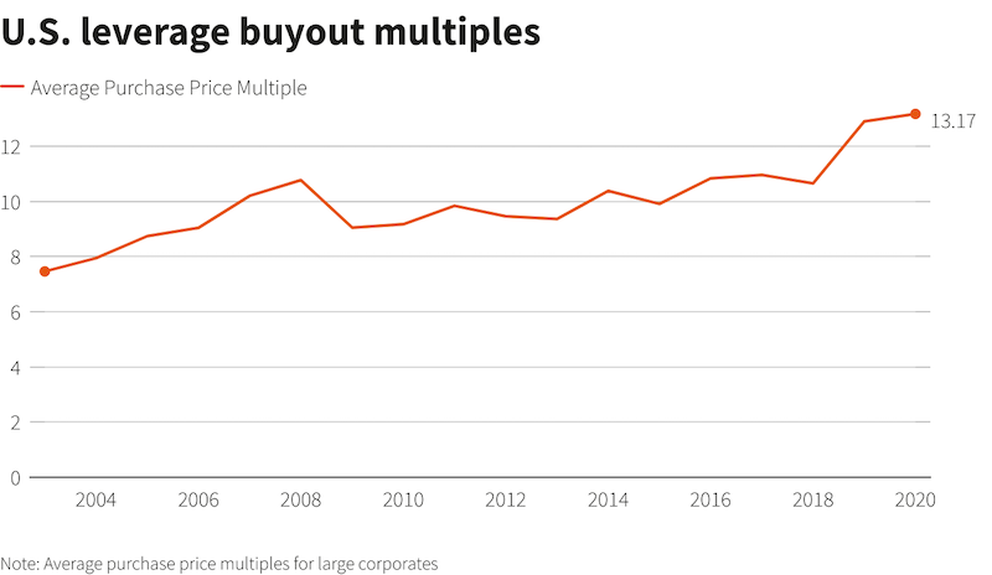

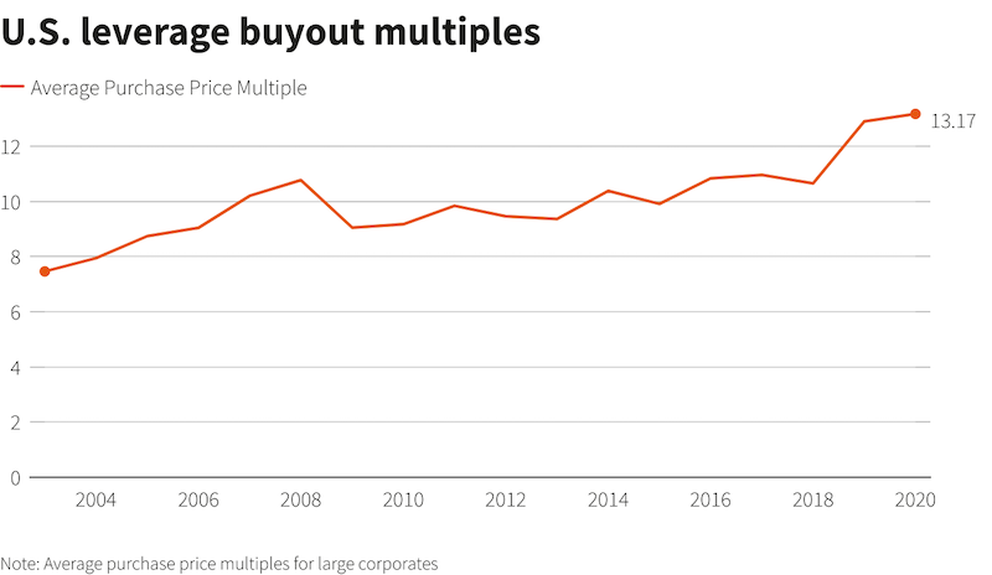

Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. BofA's research likely incorporates P/E ratios across various sectors to identify potential overvaluation.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue per share. It's useful for valuing companies with negative earnings, providing a broader perspective than P/E alone. BofA might use P/S data to identify potentially overvalued growth stocks.

-

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): This metric, also known as the Shiller P/E, smooths out earnings fluctuations over a 10-year period, providing a more stable valuation measure. BofA's analysis likely incorporates CAPE to account for economic cycles and long-term trends.

Examples: Let's assume BofA's research shows the current S&P 500 P/E ratio is significantly above its historical average. Similarly, the CAPE ratio might be elevated, suggesting a potentially inflated market. Specific data points from BofA's reports would need to be included here for a complete analysis. (Note: Replace this with actual data from BofA research if available).

Factors Contributing to High Valuations

Several factors might be contributing to these high stock market valuations:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and investors, encouraging investment and driving up stock prices. BofA's analysis likely highlights the impact of these low rates on market valuations.

-

Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, pushing up asset prices, including stocks. BofA’s research would likely consider the influence of QE programs on market valuations.

-

Strong Corporate Earnings (or Expectations Thereof): Robust corporate earnings or positive future earnings expectations can justify higher stock valuations. BofA's analysts would evaluate the strength and sustainability of these earnings.

-

Investor Optimism: Periods of strong investor confidence and optimism can lead to higher stock prices, even if underlying fundamentals don't fully support the valuations. BofA’s analysis would gauge current investor sentiment and its role in high valuations.

BofA's Perspective on the Risks

While high stock prices can be positive, BofA likely highlights associated risks.

Potential Downside Risks

BofA's analysis likely emphasizes several potential downside risks associated with high stock market valuations:

-

Rising Interest Rates: Increased interest rates can make borrowing more expensive, potentially dampening economic activity and reducing corporate profitability, leading to a market correction.

-

Inflation: High inflation erodes purchasing power and can trigger central bank intervention, potentially impacting stock valuations negatively.

-

Geopolitical Instability: Global events and political uncertainty can create volatility and negatively impact market sentiment.

-

Change in Investor Sentiment: A shift in investor sentiment, perhaps triggered by one of the above factors, could lead to a sell-off, causing a market correction.

BofA's Recommendations for Investors

Given these risks, BofA likely provides specific recommendations to investors:

-

Diversification: BofA likely advises diversification across asset classes (stocks, bonds, real estate, etc.) to mitigate risk.

-

Risk Management: Employing stop-loss orders or other risk management techniques can help limit potential losses during a market correction.

-

Strategic Asset Allocation: Adjusting portfolio allocation based on risk tolerance and market outlook is crucial. BofA might suggest overweighting certain sectors (e.g., those less sensitive to interest rate hikes) and underweighting others. (Specific sectors would require referencing BofA’s actual recommendations).

Comparing Current Valuations to Historical Precedents

Analyzing historical data helps contextualize current valuations.

Historical Market Cycles and Corrections

History provides valuable lessons:

-

Dot-com Bubble: The late 1990s saw a massive stock market bubble driven by technology stocks, followed by a significant correction.

-

2008 Financial Crisis: The subprime mortgage crisis led to a sharp decline in stock prices and a global recession. (Note: More historical examples and data comparisons are needed here, ideally using data from BofA's analysis).

Lessons Learned from Past Market Corrections

Past corrections offer crucial lessons:

-

Importance of Diversification: Spreading investments across various asset classes helps mitigate losses during market downturns.

-

Long-Term Investment Strategy: Focusing on long-term goals can help navigate short-term market fluctuations.

-

Risk Management: Proper risk management, including diversification and stop-loss orders, is essential for weathering market corrections.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis highlights the potential risks associated with current high stock market valuations, emphasizing the need for cautious optimism. While strong corporate earnings and low interest rates have contributed to these high stock prices, factors such as rising inflation and geopolitical uncertainty pose significant challenges. The key takeaways for investors include the importance of diversification, robust risk management strategies, and a long-term investment approach. Understanding BofA's insights into high stock market valuations is crucial for making informed investment decisions. Stay informed and proactively manage your portfolio to navigate this dynamic market. Conduct your own thorough research and, if needed, seek professional financial advice to create a strategy aligned with your risk tolerance and financial goals in this environment of high stock market valuations.

Featured Posts

-

Challenges To Trump S Tax Plan From Within The Republican Party

Apr 29, 2025

Challenges To Trump S Tax Plan From Within The Republican Party

Apr 29, 2025 -

German Ministries Fly Flags At Half Mast For Popes Death

Apr 29, 2025

German Ministries Fly Flags At Half Mast For Popes Death

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 29, 2025 -

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025 -

Trumps Tariffs How Higher Prices And Shortages Impact The Us Economy

Apr 29, 2025

Trumps Tariffs How Higher Prices And Shortages Impact The Us Economy

Apr 29, 2025

Latest Posts

-

Unc Shooting One Killed Six Injured In Campus Violence

Apr 29, 2025

Unc Shooting One Killed Six Injured In Campus Violence

Apr 29, 2025 -

Tragedy Strikes Georgia Deputy Killed Colleague Injured In Traffic Stop

Apr 29, 2025

Tragedy Strikes Georgia Deputy Killed Colleague Injured In Traffic Stop

Apr 29, 2025 -

Tragedy At North Carolina University Seven Shot One Fatality

Apr 29, 2025

Tragedy At North Carolina University Seven Shot One Fatality

Apr 29, 2025 -

Fatal Shooting Of Georgia Deputy During Traffic Stop

Apr 29, 2025

Fatal Shooting Of Georgia Deputy During Traffic Stop

Apr 29, 2025 -

North Carolina University Shooting Leaves One Dead Six Wounded

Apr 29, 2025

North Carolina University Shooting Leaves One Dead Six Wounded

Apr 29, 2025