BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

The Limitations of Traditional Valuation Metrics

While assessing stock market valuations, relying solely on traditional metrics can be misleading. Understanding the nuances is crucial to avoid knee-jerk reactions.

PE Ratios and Their Context

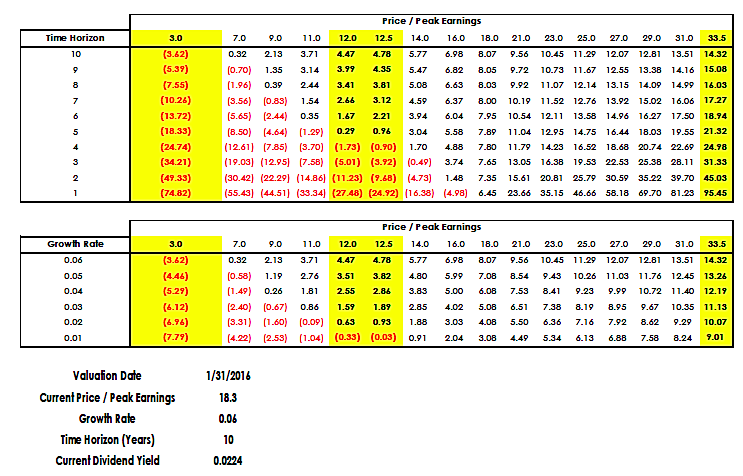

The Price-to-Earnings ratio (PE ratio), a common valuation metric, compares a company's stock price to its earnings per share. A high PE ratio often signals an overvalued stock. However, this isn't always the case. Low interest rates, for example, can significantly impact valuations. When borrowing costs are low, companies can invest more aggressively, leading to stronger future earnings which justify a higher PE multiple.

- Examples: Many technology companies, known for their high growth potential, often boast high PE ratios, reflecting investors' confidence in their future earnings. However, comparing their PE ratios to mature, slower-growth companies in different sectors is inappropriate.

- Industry Benchmarks: It's essential to compare PE ratios within the same industry sector. A high PE ratio within a high-growth sector may be perfectly reasonable, while the same ratio in a stagnant sector might signal overvaluation.

- Forward PE Ratios: Instead of using trailing twelve-month (TTM) earnings, consider forward PE ratios which are based on projected future earnings. This provides a more forward-looking perspective on valuation.

Beyond PE Ratios: A Multi-Factor Approach

A comprehensive valuation requires a holistic approach. Relying solely on PE ratios is insufficient. Consider a broader range of metrics:

- Price-to-Sales (P/S): Useful when evaluating companies with inconsistent or negative earnings.

- Price-to-Book (P/B): Compares a company's market value to its net asset value. Helpful for valuing asset-heavy businesses.

- Dividend Yield: Indicates the annual dividend payment relative to the stock price. Attractive for income-oriented investors.

- Discounted Cash Flow (DCF) Analysis: A more sophisticated method that projects future cash flows and discounts them back to their present value to determine a company's intrinsic value.

The Impact of Low Interest Rates and Monetary Policy

Current market valuations are significantly influenced by prevailing macroeconomic conditions, particularly low interest rates and expansive monetary policies.

Low Interest Rates and Discounted Cash Flows

Historically low interest rates profoundly impact the present value of future earnings. Lower discount rates used in DCF analysis lead to higher valuations for companies with strong future growth prospects.

- Simple Example: A company with projected high earnings further into the future will see a significant increase in its present value if the discount rate (influenced by interest rates) is low.

- Federal Reserve's Role: The Federal Reserve's monetary policy significantly influences interest rates. Any shift in policy could impact the market's valuation.

Quantitative Easing and Market Liquidity

Quantitative easing (QE) programs inject liquidity into the financial system, increasing the money supply. This increased liquidity can drive up asset prices, including stocks, even if underlying fundamentals remain unchanged.

- Monetary Policy and Market Valuations: QE has a direct impact on market valuations. Increased liquidity often leads to higher stock prices.

- Risks and Benefits of QE: While QE can stimulate economic growth, it also carries the risk of inflation and asset bubbles.

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and positive growth prospects significantly support higher stock valuations.

Profitability and Sustainable Growth

Many sectors are currently experiencing strong earnings growth, supporting higher valuations. However, it's crucial to differentiate between temporary gains and sustainable growth.

- Sectoral Analysis: Analyze individual company performance within sectors rather than relying solely on broad market indices. Some sectors might be overvalued, while others offer genuine growth opportunities.

- Sustainable Growth: Focus on companies demonstrating consistent profitability and sustainable growth potential.

Technological Innovation and Disruption

Technological advancements are driving substantial growth in certain sectors, justifying higher valuations.

- Examples: The technology sector, renewable energy, and biotechnology are prime examples of sectors experiencing significant innovation-driven growth.

- Disruption and Valuation: Companies disrupting established industries often command higher valuations, reflecting their potential to capture significant market share.

Long-Term Investing Strategy Remains Key

Navigating stretched stock market valuations requires a long-term perspective and a well-defined investment strategy.

Time Horizon and Risk Tolerance

Short-term market fluctuations shouldn't dictate long-term investment decisions.

- Long-Term Approach: Maintain a long-term investment horizon aligned with your risk tolerance.

- Dollar-Cost Averaging: A strategy of investing fixed amounts at regular intervals, irrespective of market fluctuations.

- Diversification: Spreading your investments across different asset classes and sectors to mitigate risk.

Ignoring Market Noise and Focusing on Fundamentals

Focus on the underlying fundamentals of companies rather than reacting to short-term market volatility.

- Disciplined Approach: Conduct thorough research and due diligence before making any investment decisions.

- Fundamental Analysis: Focus on a company's financial health, competitive advantage, and growth prospects.

Conclusion

While stretched stock market valuations might seem alarming, several factors—low interest rates, strong corporate earnings, technological innovation, and robust growth in many sectors—mitigate the risk for long-term investors. Adopting a holistic approach to valuation and a long-term investment strategy is crucial. Don't panic based solely on perceived high valuations. Instead, develop a well-informed, long-term investment strategy that considers the factors discussed here, understanding stock market valuations in their proper context. Successfully navigating stretched market valuations requires a clear understanding of both the challenges and opportunities. Develop a strategy that allows you to confidently address these challenges and capitalize on the opportunities.

Featured Posts

-

Stock Market Valuation Concerns Bof A Offers A Calming Perspective

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Calming Perspective

Apr 29, 2025 -

Convicted Cardinals Demand To Participate In Papal Conclave

Apr 29, 2025

Convicted Cardinals Demand To Participate In Papal Conclave

Apr 29, 2025 -

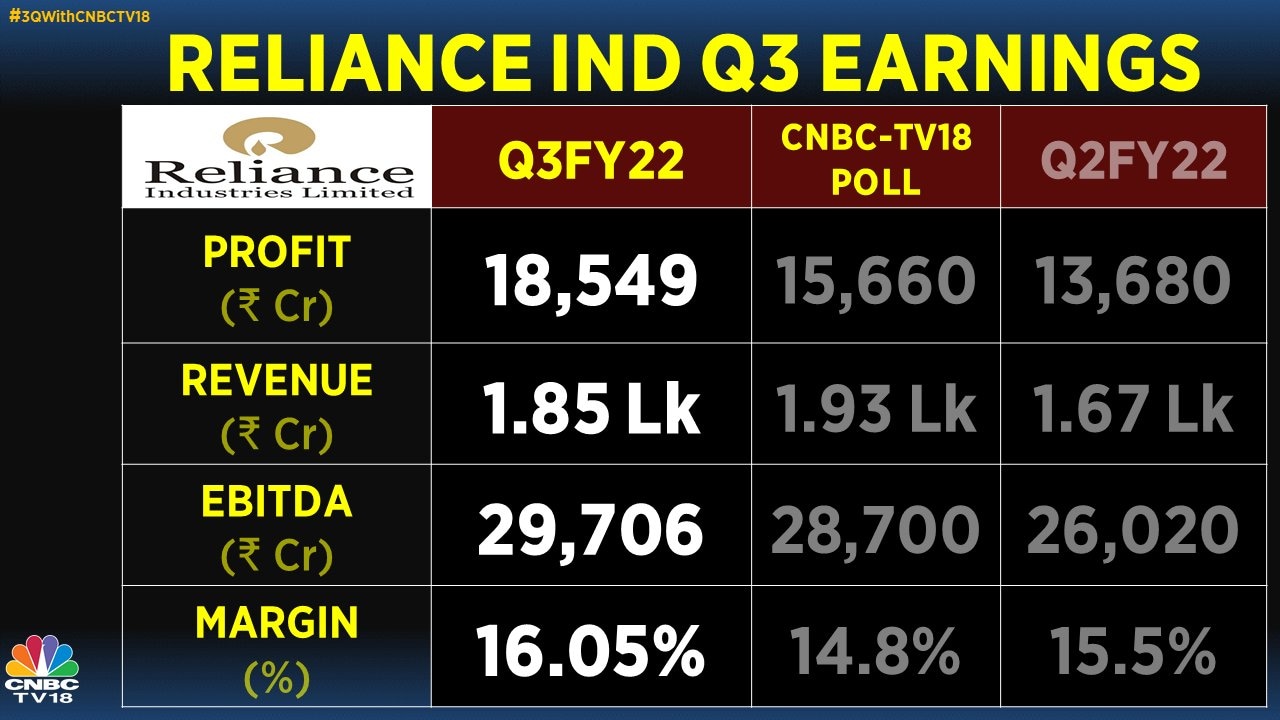

Reliance Shares Post 10 Month High Following Earnings Report

Apr 29, 2025

Reliance Shares Post 10 Month High Following Earnings Report

Apr 29, 2025 -

Are Republican Infighting And Policy Differences Dooming Trumps Tax Plan

Apr 29, 2025

Are Republican Infighting And Policy Differences Dooming Trumps Tax Plan

Apr 29, 2025 -

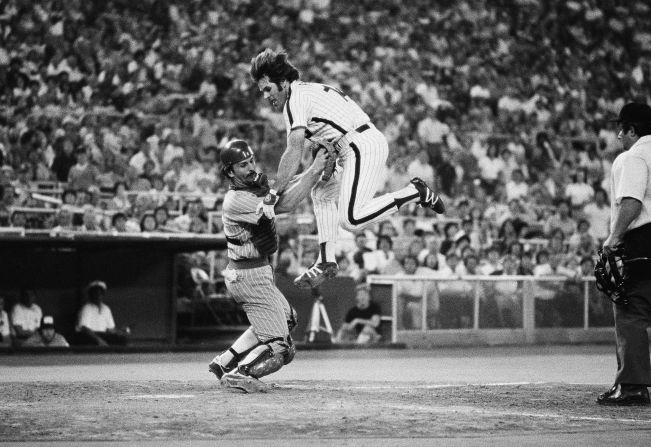

Mlb Considers Petition To Reinstate Pete Rose A Report

Apr 29, 2025

Mlb Considers Petition To Reinstate Pete Rose A Report

Apr 29, 2025