BofA's View: Why High Stock Market Valuations Are Not A Red Flag For Investors

Table of Contents

BofA's Rationale: Why Current Valuations Aren't a Cause for Alarm

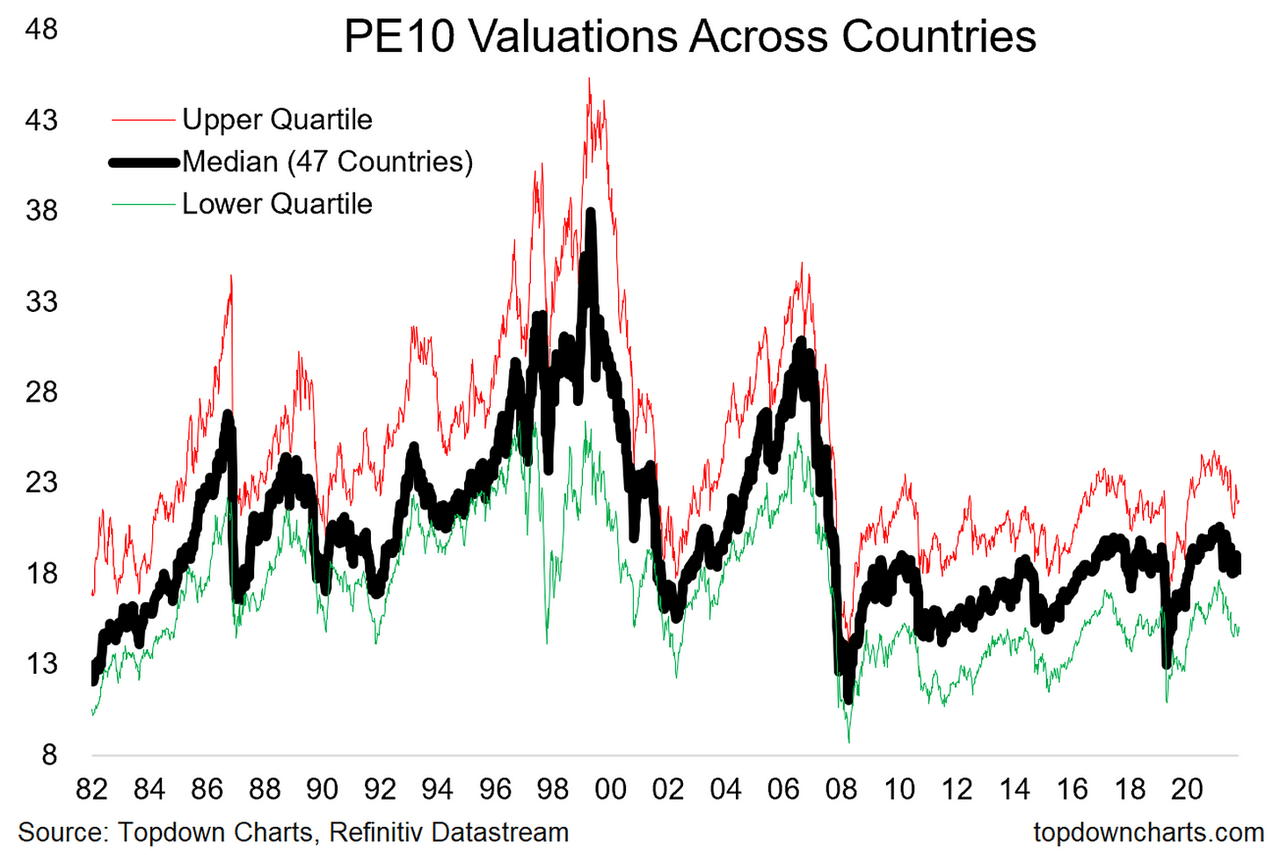

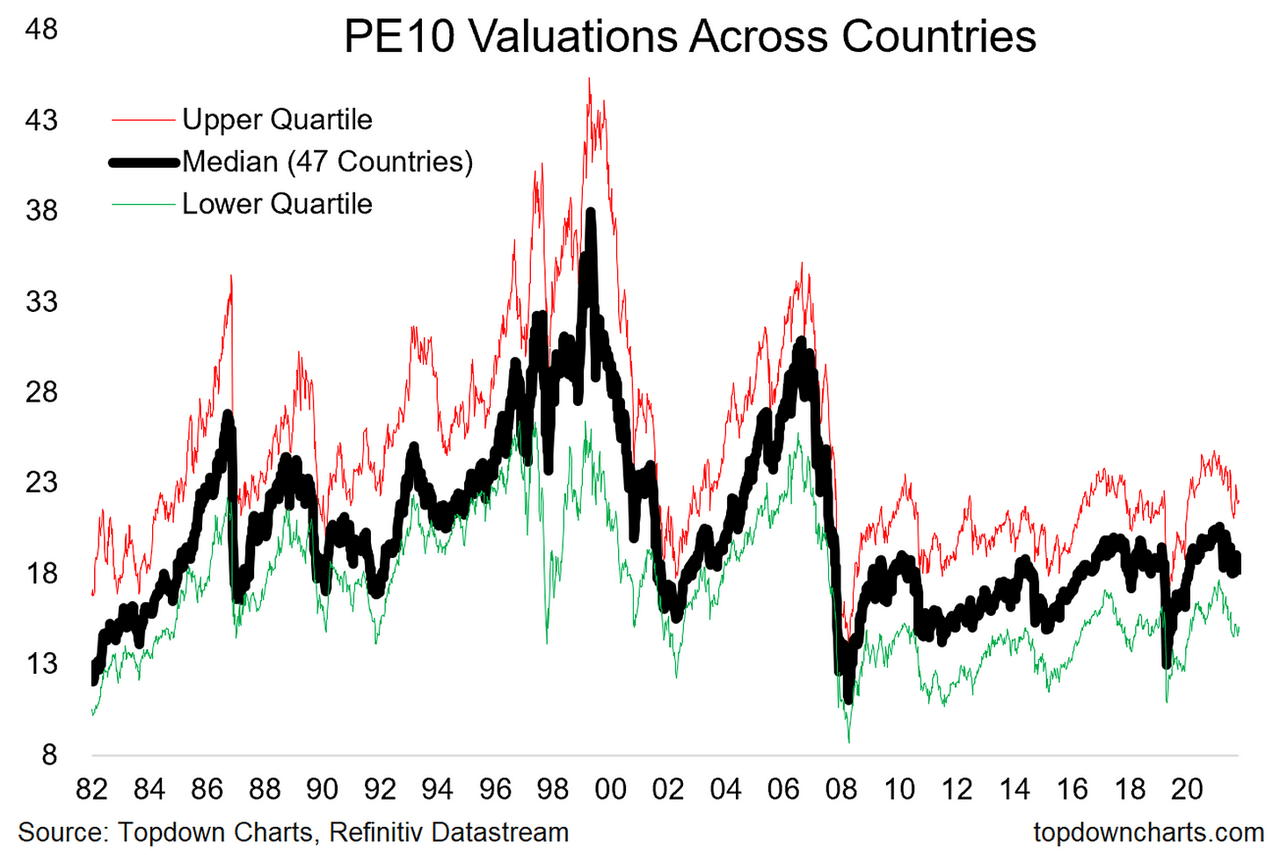

BofA's argument against viewing high valuations as a bearish indicator rests on several key pillars. Their research, often reflected in reports circulated to clients and available through financial news outlets, emphasizes a nuanced understanding of the current market conditions. They contend that simply looking at price-to-earnings ratios (P/E ratios) in isolation provides an incomplete picture.

-

Low interest rates supporting higher valuations: Historically low interest rates significantly impact discounted cash flow models, allowing companies to justify higher valuations based on future earnings potential. Lower borrowing costs translate to increased profitability and higher stock prices.

-

Strong corporate earnings growth exceeding valuation increases: BofA points to robust corporate earnings growth in many sectors, exceeding the pace of valuation increases. This indicates that the market isn't solely driven by speculation but also by strong underlying fundamentals.

-

Positive long-term economic growth projections: BofA's analysts typically maintain a positive outlook on long-term economic growth, fueling their belief that current valuations are sustainable. This positive projection supports the idea that higher valuations are justified by strong future prospects.

-

Focus on specific sectors driving growth and justifying valuations: BofA's analysis often highlights specific sectors – such as technology, healthcare, and certain consumer staples – that demonstrate exceptional growth and strong earnings, justifying their elevated valuations within a broader market context. These sectors often exhibit higher growth potential, supporting higher P/E multiples.

-

Specific metrics used by BofA: Beyond P/E ratios, BofA employs a range of valuation metrics, including Price-to-Sales ratios (P/S) and Price-to-Book ratios (P/B), to paint a more comprehensive picture. They analyze these metrics across various sectors and consider them alongside other economic indicators to arrive at their conclusions.

Understanding the Factors Driving High Stock Market Valuations

Several contributing factors fuel the current elevated stock market valuations:

-

Impact of low interest rates on discounted cash flow models: As mentioned earlier, low interest rates significantly influence valuation models. Lower discount rates used in these models lead to higher present values of future cash flows, resulting in higher stock prices.

-

Technological advancements and innovative companies boosting valuations: The rapid pace of technological innovation, particularly in sectors like software and biotechnology, leads to the emergence of high-growth companies with potentially disruptive business models. These companies often command higher valuations due to their growth potential.

-

Increased investor confidence and market liquidity: Increased investor confidence and ample market liquidity contribute to higher demand for stocks, driving prices upward. This increased liquidity makes it easier for investors to buy and sell stocks, contributing to market volatility but also facilitating price increases.

-

Global economic recovery and its impact on stock prices: A global economic recovery, although uneven across regions, generally leads to higher corporate profits and increased investor optimism, further boosting stock valuations.

-

Inflation concerns: While inflation is a legitimate concern that can impact valuations, BofA generally assesses the overall impact and adjusts their forecasts accordingly. Their analysis usually accounts for the potential dampening effect of inflation on future earnings and incorporates it into their valuation models.

Mitigating Risk in a High-Valuation Market: BofA's Suggested Strategies

Even with BofA's optimistic outlook, mitigating risk in a high-valuation market is crucial. They generally advise a multi-pronged approach:

-

Diversification across asset classes and sectors: Diversification is paramount to reduce portfolio volatility. Investors should spread their investments across various asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate the risk of significant losses in any single area.

-

Focus on quality companies with strong fundamentals: BofA stresses the importance of selecting companies with solid financial fundamentals, including strong earnings, healthy balance sheets, and sustainable business models. This minimizes the risk associated with companies that are overvalued solely based on speculation.

-

Long-term investment horizon to weather market fluctuations: Maintaining a long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

-

Regular portfolio rebalancing: Regularly rebalancing the portfolio ensures that asset allocations remain consistent with the investor's risk tolerance and long-term investment goals. This helps prevent overexposure to any particular asset class or sector.

-

Consider value investing strategies alongside growth: BofA may suggest combining growth stock investments with value investing strategies to balance risk and reward. Value investing focuses on identifying undervalued companies with the potential for future growth.

Specific Sectors BofA Favors (If applicable)

While specific sector recommendations can change based on market conditions and internal BofA research, they frequently highlight sectors with strong growth potential and resilient business models. For example, in periods of economic uncertainty, they might favor defensive sectors like consumer staples and healthcare, while during periods of expansion, technology and industrial sectors could be emphasized. These recommendations are usually based on in-depth analysis of industry trends, competitive landscapes, and earnings projections.

Conclusion

BofA's perspective on high stock market valuations emphasizes that they aren't inherently a bearish signal. Their analysis considers factors such as low interest rates, robust corporate earnings, and positive long-term growth projections. By diversifying your portfolio, focusing on quality companies, and adopting a long-term investment horizon, you can mitigate risk and potentially benefit from the continued growth of the market. Don't let the perception of high stock market valuations deter you from potentially lucrative investment opportunities. Understand BofA's analysis and incorporate the suggested strategies to navigate this market effectively. Learn more about BofA's investment outlook and develop a robust investment strategy that aligns with your goals. Contact a financial advisor to discuss how to incorporate BofA's insights into your portfolio.

Featured Posts

-

Garantia De Gol El Metodo Alberto Ardila Olivares

Apr 27, 2025

Garantia De Gol El Metodo Alberto Ardila Olivares

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 27, 2025 -

Impresionante Derrota En Indian Wells Favorita Eliminada

Apr 27, 2025

Impresionante Derrota En Indian Wells Favorita Eliminada

Apr 27, 2025 -

Pne Ag Ad Hoc Mitteilung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Ad Hoc Mitteilung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Latest Posts

-

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

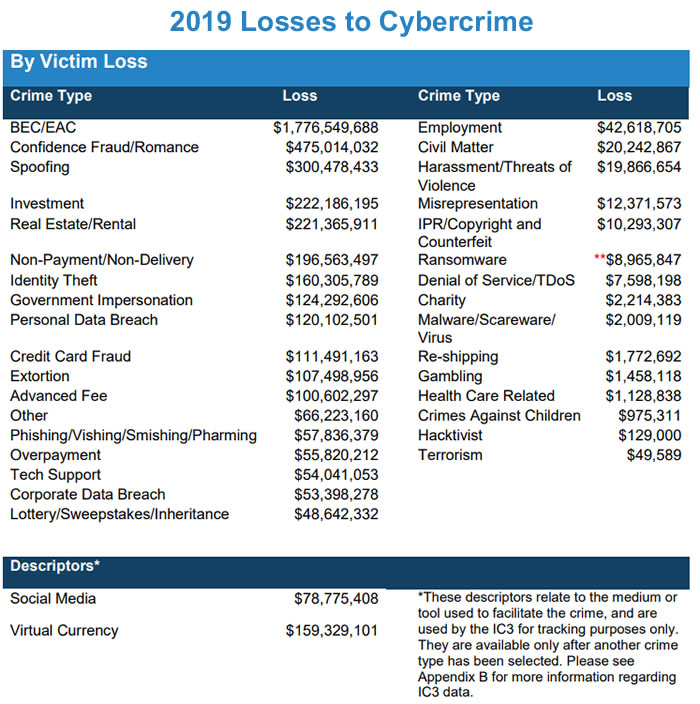

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025