Canadian Project Delayed: Dow Cites Volatility Concerns

Table of Contents

Dow Chemical's Official Statement and Reasons for Delay

Dow Chemical's official statement cites a confluence of factors contributing to the Nova Chemicals expansion project delay. The company highlighted the need for a reassessment of the project's feasibility given the current economic climate.

- Specific concerns cited by Dow: Fluctuating energy prices, persistent inflation impacting construction costs, and geopolitical instability impacting supply chains were all mentioned as key contributors to the decision. The company also expressed concerns about potential currency fluctuations impacting profitability.

- Financial Impact: While precise financial figures haven't been publicly released, Dow indicated the delay would result in a significant, though unspecified, postponement of capital expenditure and a revised project timeline. They emphasized the need to ensure a robust return on investment before proceeding.

- Relevant Quote: A section from Dow's press release stated, "Given the current macroeconomic uncertainties and the significant investment required, we believe it's prudent to reassess the project's viability and timeline before proceeding. We remain committed to our long-term strategy in Canada but must prioritize responsible financial stewardship."

Impact on the Canadian Economy and Employment

The delay of the Nova Chemicals expansion project carries substantial implications for the Canadian economy and its workforce.

- Job Losses: While the exact number remains unclear, the delay will inevitably impact job creation, both directly within the construction and operational phases of the project and indirectly through related industries. Potential delays in hiring for hundreds of skilled and unskilled workers are expected.

- Impact on Related Industries: The ripple effect extends to businesses involved in supplying materials, equipment, and services to the project. These companies will experience reduced demand, potentially leading to decreased revenue and impacting their own employment levels.

- Regional Economic Impact: Alberta, the project's location, will be particularly affected. The delay represents a substantial blow to the regional economy, potentially impacting local businesses, communities, and government revenue streams from taxes and royalties.

- Loss of Government Revenue: The delay translates to a loss of anticipated tax revenue for both provincial and federal governments, adding further pressure on already strained public budgets.

Analysis of Market Volatility and Investment Risk

The current market environment significantly contributed to Dow's decision. Several factors amplified the investment risk associated with the Nova Chemicals project.

- Types of Volatility: Significant currency fluctuations, especially between the Canadian dollar and the US dollar, alongside volatile energy prices (crucial for the petrochemical industry), created uncertainty about project costs and profitability.

- Increased Investment Risk: The combination of inflation, supply chain disruptions, and geopolitical instability increased the overall project risk profile, making it less attractive for Dow in the short term.

- Alternative Investment Opportunities: The delay may suggest that Dow is exploring alternative investment opportunities perceived as less risky in the present market conditions, possibly delaying the project until a more favorable environment emerges.

Comparison with Similar Projects

The delay of the Nova Chemicals expansion isn't unique. Several large-scale industrial projects in Canada and globally have faced similar postponements due to market volatility.

- Similar Projects: Several other resource-intensive projects across various sectors, from mining to energy, have experienced similar delays or cancellations as companies reassess their investment strategies in light of fluctuating commodity prices and global uncertainty.

- Lessons Learned: These instances highlight the crucial need for robust risk assessment, flexible project designs, and contingency planning to mitigate the effects of market instability.

Future Outlook and Potential Mitigation Strategies

To prevent future project delays, several strategies could be implemented.

- Mitigation Strategies: Hedging strategies against currency and commodity price fluctuations, rigorous risk assessment frameworks integrating geopolitical and macroeconomic factors, and comprehensive contingency planning are crucial.

- Government Support: Governments could play a role by providing incentives and support for large-scale projects, including stabilizing policies to minimize the impact of market volatility. This could include investment tax credits, streamlined regulatory processes, and support for supply chain diversification.

- Project Resumption: The possibility of project resumption depends on market stabilization and the potential for Dow to secure more favorable financial conditions.

Conclusion

The delay of the Nova Chemicals expansion project underscores the critical need for proactive risk management and robust contingency planning in navigating volatile global markets. Dow Chemical's concerns about market volatility and their impact on the Canadian economy are significant. This situation highlights the interconnectedness of global markets and their impact on Canadian investments. The delay's repercussions on employment, regional economies, and government revenues are significant concerns.

Call to Action: The delay of this significant Canadian project underscores the importance of proactive risk management and robust contingency planning in navigating volatile markets. For investors and project developers, a thorough understanding of market volatility is crucial to avoid similar setbacks. Stay informed on market trends and develop comprehensive strategies to protect your investments and navigate the uncertainties of the Canadian project landscape. Learn more about mitigating risk in Canadian projects and ensuring their success in a dynamic global economy.

Featured Posts

-

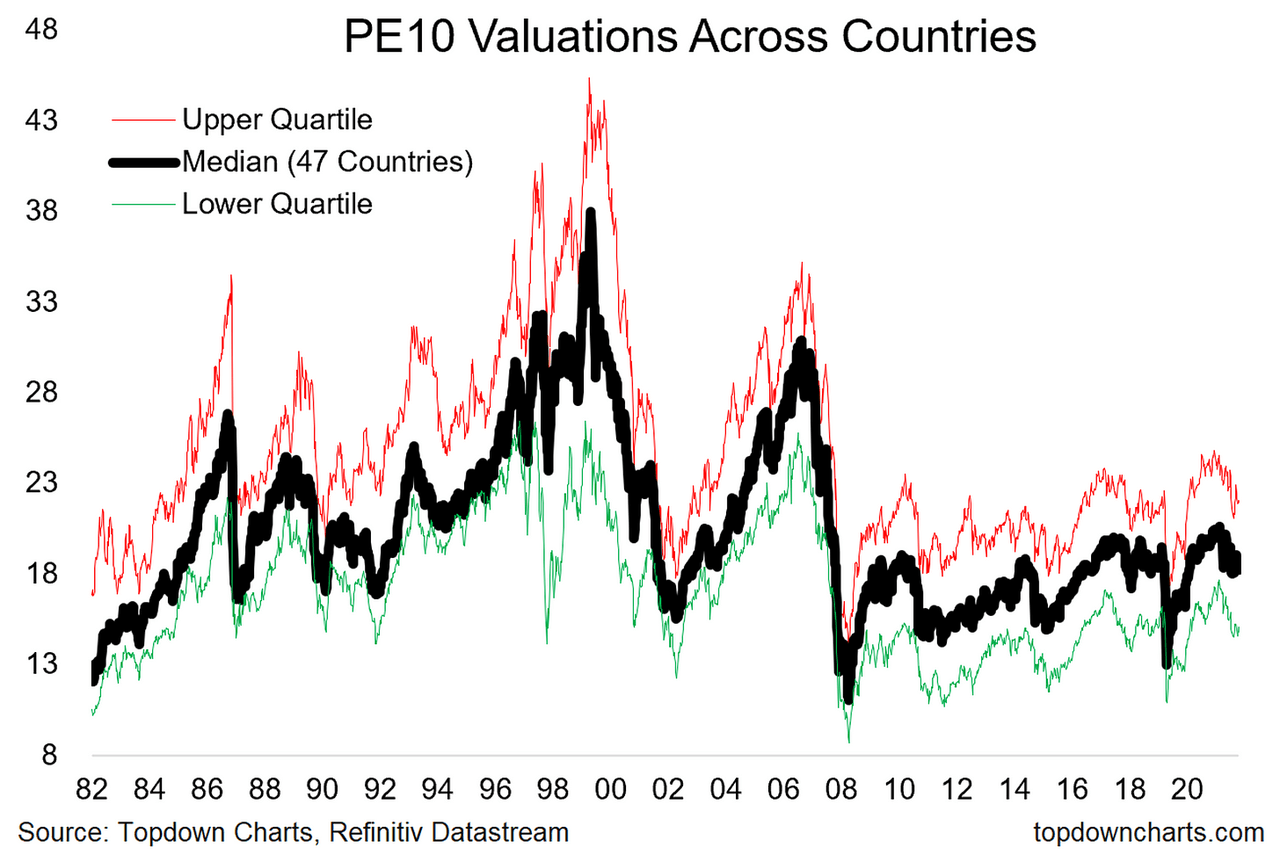

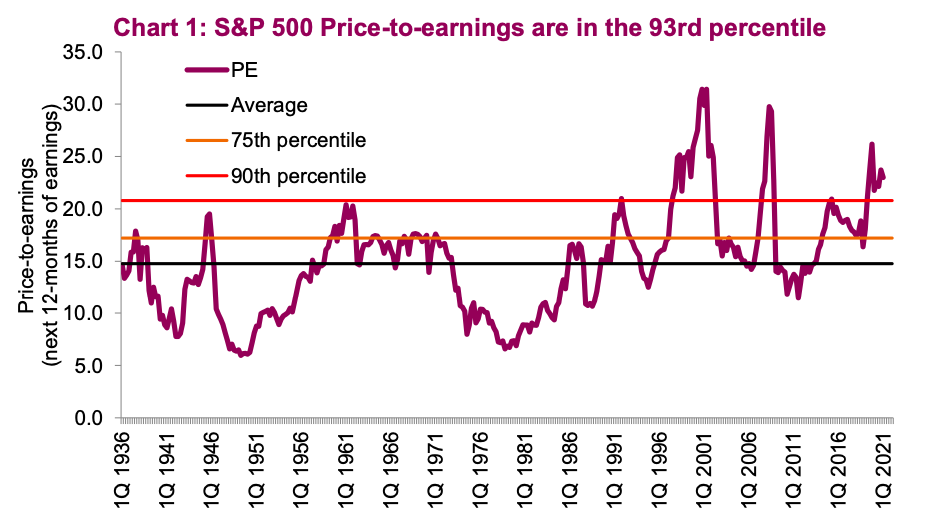

Bof As View Why High Stock Market Valuations Are Not A Red Flag For Investors

Apr 27, 2025

Bof As View Why High Stock Market Valuations Are Not A Red Flag For Investors

Apr 27, 2025 -

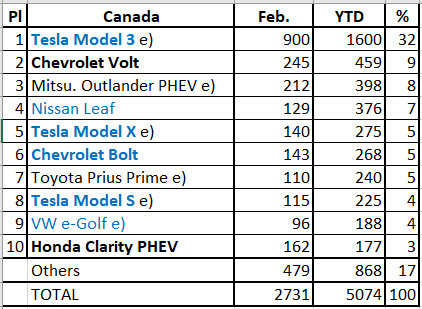

Ev Sales In Canada A Three Year Decline

Apr 27, 2025

Ev Sales In Canada A Three Year Decline

Apr 27, 2025 -

Understanding Stock Market Valuations Bof As Argument For Investor Calm

Apr 27, 2025

Understanding Stock Market Valuations Bof As Argument For Investor Calm

Apr 27, 2025 -

Napoleon Ceo Emphasis On Buying Canadian Goods

Apr 27, 2025

Napoleon Ceo Emphasis On Buying Canadian Goods

Apr 27, 2025 -

Anti Vaccine Activists Appointment To Review Autism Vaccine Link Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Appointment To Review Autism Vaccine Link Sparks Outrage

Apr 27, 2025