China's Response To Trade Tensions: Lower Rates, Easier Lending

Table of Contents

Lowering Interest Rates: A Key Tool in China's Arsenal

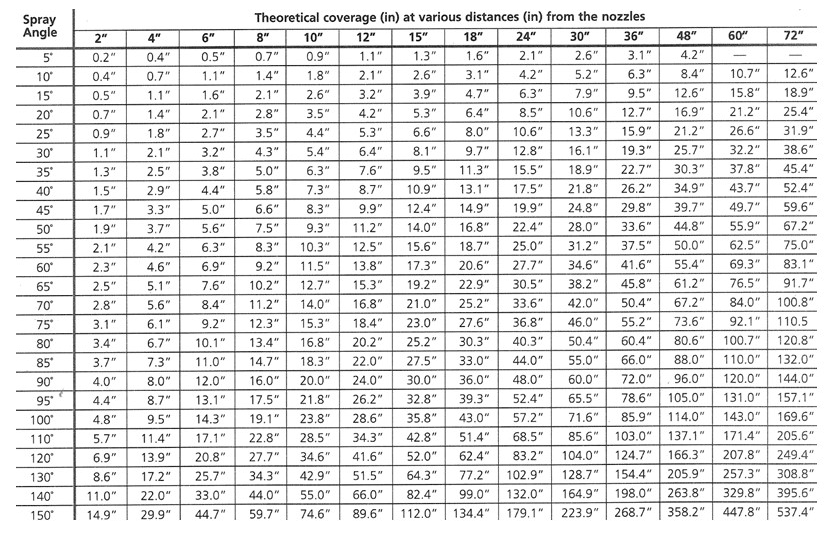

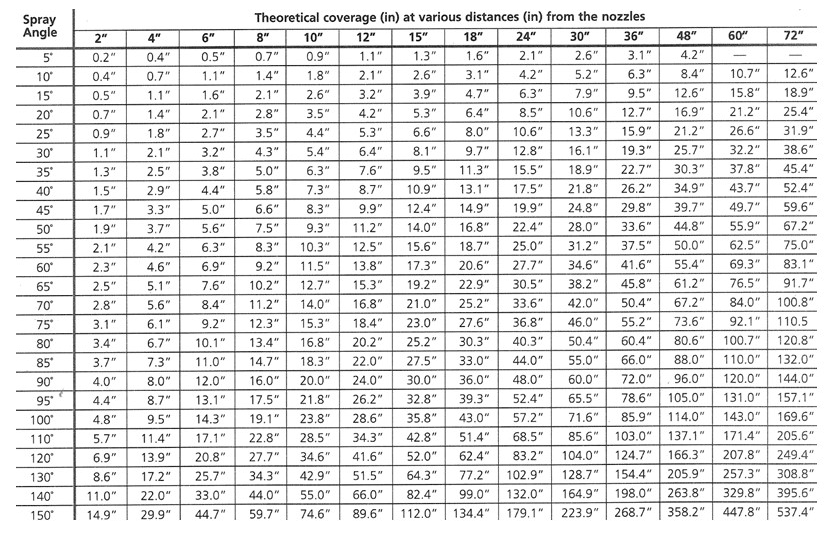

The People's Bank of China (PBoC), the central bank, has employed interest rate cuts as a primary tool in its arsenal to combat the economic slowdown stemming from trade tensions. This monetary easing strategy aims to inject liquidity into the market and stimulate both investment and consumption. Keywords relevant to this section include: interest rate cuts, monetary easing, People's Bank of China (PBoC), benchmark interest rates, and liquidity injection.

-

The PBoC's Actions: The PBoC has implemented several benchmark interest rate reductions in recent years, lowering the loan prime rate (LPR) – a key reference rate for banks – and reducing reserve requirement ratios (RRR). These actions aim to lower borrowing costs for businesses and individuals.

-

Stimulating Investment and Consumption: Lower interest rates make borrowing cheaper, encouraging businesses to invest in expansion and modernization, while lower consumer loan rates can spur increased spending on durable goods and services.

-

Impact on Borrowing Costs: The decline in interest rates has translated into lower borrowing costs for businesses, allowing them to access credit more easily and finance expansion projects. Similarly, consumers have benefited from lower mortgage rates and personal loan interest.

-

Potential Downsides: Aggressive rate cuts can have potential downsides. While stimulating growth, they could also fuel inflation if demand outpaces supply. Furthermore, continuous rate cuts might lead to currency devaluation, impacting the value of the Chinese Yuan. Data and charts illustrating the recent trends in Chinese interest rates would provide a clearer picture of the PBoC's actions and their impact.

Easing Lending Regulations: Encouraging Investment and Growth

In addition to lowering interest rates, the Chinese government has implemented measures to ease lending regulations, further encouraging investment and economic growth. Keywords important for this section are: lending regulations, credit easing, loan approvals, financial institutions, reserve requirement ratio (RRR), and small and medium-sized enterprises (SMEs).

-

Loosening Regulatory Constraints: The government has streamlined loan approval processes, reduced bureaucratic hurdles for businesses seeking credit, and encouraged financial institutions to extend more loans.

-

Focus on SMEs: Small and medium-sized enterprises (SMEs) are a vital component of the Chinese economy. The government has specifically targeted support for SMEs by easing lending conditions and providing access to government-backed loan programs.

-

Encouraging Bank Lending: The PBoC has used various tools, including lowering the RRR, to increase the amount of money banks have available to lend. This injection of liquidity encourages banks to extend more credit.

-

Impact on Investment and Economic Activity: Easier access to credit has led to increased investment levels, particularly in infrastructure projects and technological advancements. This increased investment contributes to overall economic activity.

-

Risks of Increased Lending: While increased lending stimulates the economy, it also carries risks. A surge in lending can lead to a rise in non-performing loans (NPLs), which could destabilize the financial system.

The Effectiveness and Challenges of China's Approach

Evaluating the effectiveness of China's approach requires careful consideration of both its successes and potential challenges. Keywords to focus on here include: economic stimulus effectiveness, challenges, debt levels, economic slowdown, and global trade uncertainty.

-

Mitigating Trade Tensions: The combination of lower rates and easier lending has offered some short-term relief in mitigating the negative impacts of trade tensions. However, the long-term effectiveness remains to be seen.

-

Assessing the Stimulus Package: The overall effectiveness of China's economic stimulus package needs to be evaluated against its intended goals and compared to alternative approaches.

-

Challenges and Risks: Rising debt levels present a significant challenge. Increased borrowing by businesses and consumers could lead to financial instability if not managed properly. The potential for inflation, as mentioned earlier, is also a concern.

-

Long-Term Implications: The long-term implications of these policies for the Chinese economy are complex and depend on various factors, including the evolution of global trade relations and domestic economic reforms.

-

Comparison to Other Countries: China's approach can be compared to how other countries, facing similar economic pressures, have responded. This comparative analysis can provide valuable insights into the effectiveness and potential drawbacks of various policy options.

Conclusion

In response to escalating trade tensions, China has implemented a strategy of lowering interest rates and easing lending regulations to stimulate economic growth and counter negative impacts. While these measures have provided some short-term relief, the long-term effectiveness and potential risks associated with increased debt levels warrant close monitoring. The interplay between global trade uncertainty and China's domestic economic policies continues to shape the global economic landscape. Stay informed about China's evolving response to trade tensions and the impact of its monetary policy adjustments on the global economy. Continue reading our analyses on China's interest rates and lending policies for further insights.

Featured Posts

-

Honest Take Jayson Tatum Comments On Steph Currys All Star Performance

May 08, 2025

Honest Take Jayson Tatum Comments On Steph Currys All Star Performance

May 08, 2025 -

Instituto De Cordoba Vs Central Evaluacion Del Estado Fisico De Central En Su Estadio

May 08, 2025

Instituto De Cordoba Vs Central Evaluacion Del Estado Fisico De Central En Su Estadio

May 08, 2025 -

Googles Response To Dojs Antitrust Lawsuit Concerns Over User Trust

May 08, 2025

Googles Response To Dojs Antitrust Lawsuit Concerns Over User Trust

May 08, 2025 -

Andor Season 1 Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season 1 Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

Ahsan Advocates For Tech Adoption To Boost Made In Pakistan Globally

May 08, 2025

Ahsan Advocates For Tech Adoption To Boost Made In Pakistan Globally

May 08, 2025