Recent Ethereum Price Action: Hints Of An Impending Rally

Table of Contents

Analyzing Recent Ethereum Price Trends

Short-Term Volatility and Consolidation

Ethereum's price has shown considerable short-term volatility in recent weeks. We've seen periods of sharp increases followed by equally dramatic drops, creating a period of consolidation. Understanding these fluctuations is crucial to interpreting the current Ethereum price action.

- June 15th: A significant price drop followed a negative news cycle surrounding regulatory concerns. Trading volume spiked during this period, indicating heightened market activity.

- July 10th: A notable price surge occurred after a positive announcement regarding an upcoming Ethereum upgrade. Trading volume again increased, showcasing investor enthusiasm.

- August 1st: The price consolidated around $1800, showing a period of sideways movement following the price surge.

These short-term fluctuations highlight the inherent risk and reward in the cryptocurrency market. Analyzing the volume associated with these price movements provides crucial context. High volume during price drops may signal strong selling pressure, while high volume during price increases indicates substantial buying interest. News events significantly impact the Ethereum price, underscoring the need to stay updated on relevant announcements and regulatory developments.

Key Technical Indicators Suggesting a Potential Rally

Technical analysis offers valuable insights into potential price movements. Examining key indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can reveal potential trends.

- 50-Day Moving Average (MA): Currently, the 50-day MA is acting as support, suggesting potential upward momentum.

- RSI: The RSI is showing signs of recovering from oversold territory, indicating reduced selling pressure. A sustained move above 50 could confirm an uptrend.

- MACD: The MACD is exhibiting a bullish crossover, a signal often interpreted as a potential buy signal.

[Insert chart here illustrating MA, RSI, and MACD for Ethereum]

These technical indicators, when considered together, paint a picture of a potential upcoming rally. However, it's crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Fundamental Factors Influencing Ethereum's Potential Rally

The Ethereum Merge and its Long-Term Impact

The successful transition to proof-of-stake (PoS) via the Merge was a monumental event for Ethereum. This upgrade dramatically reduced energy consumption and improved scalability.

- Environmental Impact: The shift to PoS significantly lowered Ethereum's carbon footprint, attracting environmentally conscious investors.

- Scalability Improvements: The Merge paved the way for faster transaction speeds and lower fees, boosting the network's efficiency and user experience.

- Investor Sentiment: The successful execution of the Merge significantly boosted investor confidence in Ethereum's long-term prospects.

These fundamental improvements are long-term bullish factors for Ethereum's price.

Growing DeFi Ecosystem and NFT Market

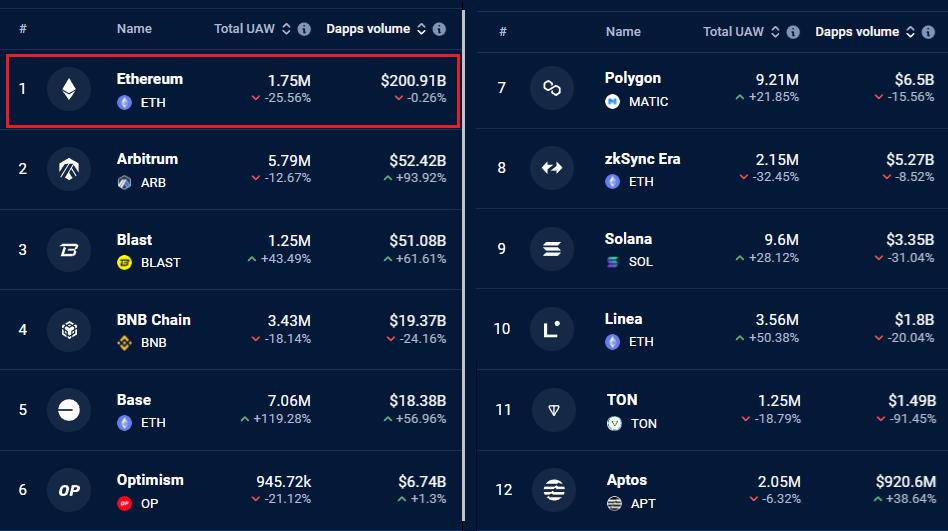

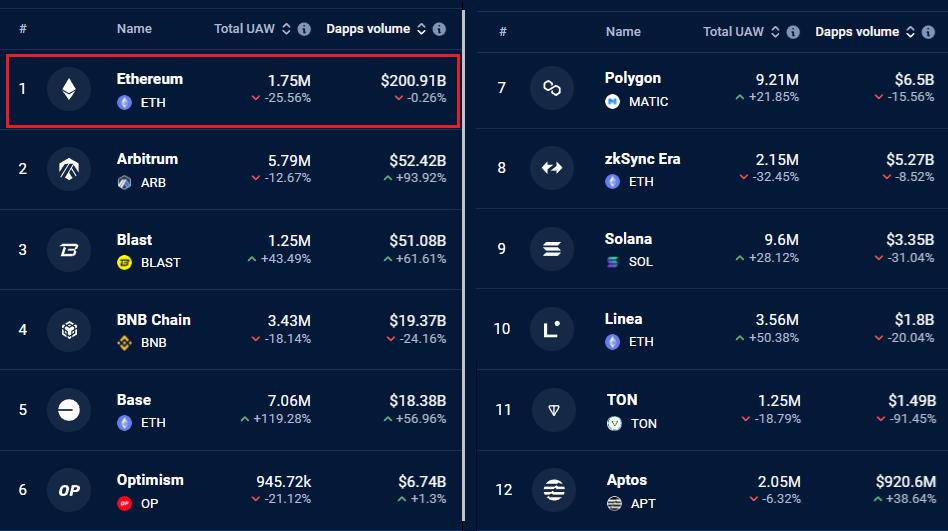

Ethereum's dominance in the decentralized finance (DeFi) and Non-Fungible Token (NFT) sectors continues to grow.

- DeFi Adoption: The increasing adoption of DeFi platforms built on Ethereum drives demand for the ETH token, used for transaction fees and governance.

- NFT Market Growth: The continued popularity of NFTs, many of which reside on the Ethereum blockchain, fuels demand for Ethereum.

- New Developments: The constant emergence of innovative DeFi applications and NFT projects keeps Ethereum at the forefront of blockchain technology.

The vibrancy of these ecosystems strengthens Ethereum's fundamental value proposition and contributes to its potential price appreciation.

Potential Risks and Challenges

Macroeconomic Factors and Market Sentiment

Broader economic conditions and overall market sentiment can significantly influence the price of cryptocurrencies, including Ethereum.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact risk assets like cryptocurrencies.

- Market Downturns: A broader market downturn could trigger a sell-off in the cryptocurrency market, impacting Ethereum's price.

- Regulatory Uncertainty: Unclear or unfavorable regulatory frameworks can dampen investor enthusiasm and negatively affect the price.

Competition from Other Blockchains

Ethereum faces competition from other blockchain platforms, which could potentially erode its market share.

- Solana, Cardano, Polygon: These are examples of competitors vying for market share in the DeFi and NFT spaces.

- Strengths and Weaknesses: Competitors offer varying strengths and weaknesses concerning transaction speed, fees, and scalability.

- Market Share Erosion: The potential for market share erosion is a risk to consider when assessing Ethereum's future price performance.

Conclusion

Recent Ethereum price action presents a mixed picture. While short-term volatility persists, technical indicators suggest a potential upward trend. Fundamental factors, such as the successful Merge, the growing DeFi ecosystem, and the vibrant NFT market, support the possibility of an impending Ethereum price rally. However, macroeconomic factors, market sentiment, and competition from other blockchains pose potential risks. Therefore, it is crucial to stay informed about the latest developments in the Ethereum market and conduct thorough research before making any investment decisions. Stay tuned for further analysis of Ethereum price action and consider diversifying your crypto portfolio.

Featured Posts

-

Dwp Breaks Silence On New Universal Credit Six Month Policy

May 08, 2025

Dwp Breaks Silence On New Universal Credit Six Month Policy

May 08, 2025 -

Okc Thunder Players Clash With National Media

May 08, 2025

Okc Thunder Players Clash With National Media

May 08, 2025 -

Collymore Calls For Artetas Accountability Latest Arsenal News

May 08, 2025

Collymore Calls For Artetas Accountability Latest Arsenal News

May 08, 2025 -

Bitcoins Price Surge A Deeper Look At The Market Recovery

May 08, 2025

Bitcoins Price Surge A Deeper Look At The Market Recovery

May 08, 2025 -

Andor Season 1 Where To Watch Episodes Online

May 08, 2025

Andor Season 1 Where To Watch Episodes Online

May 08, 2025