Dow Jones & S&P 500: Stock Market News For April 23

Table of Contents

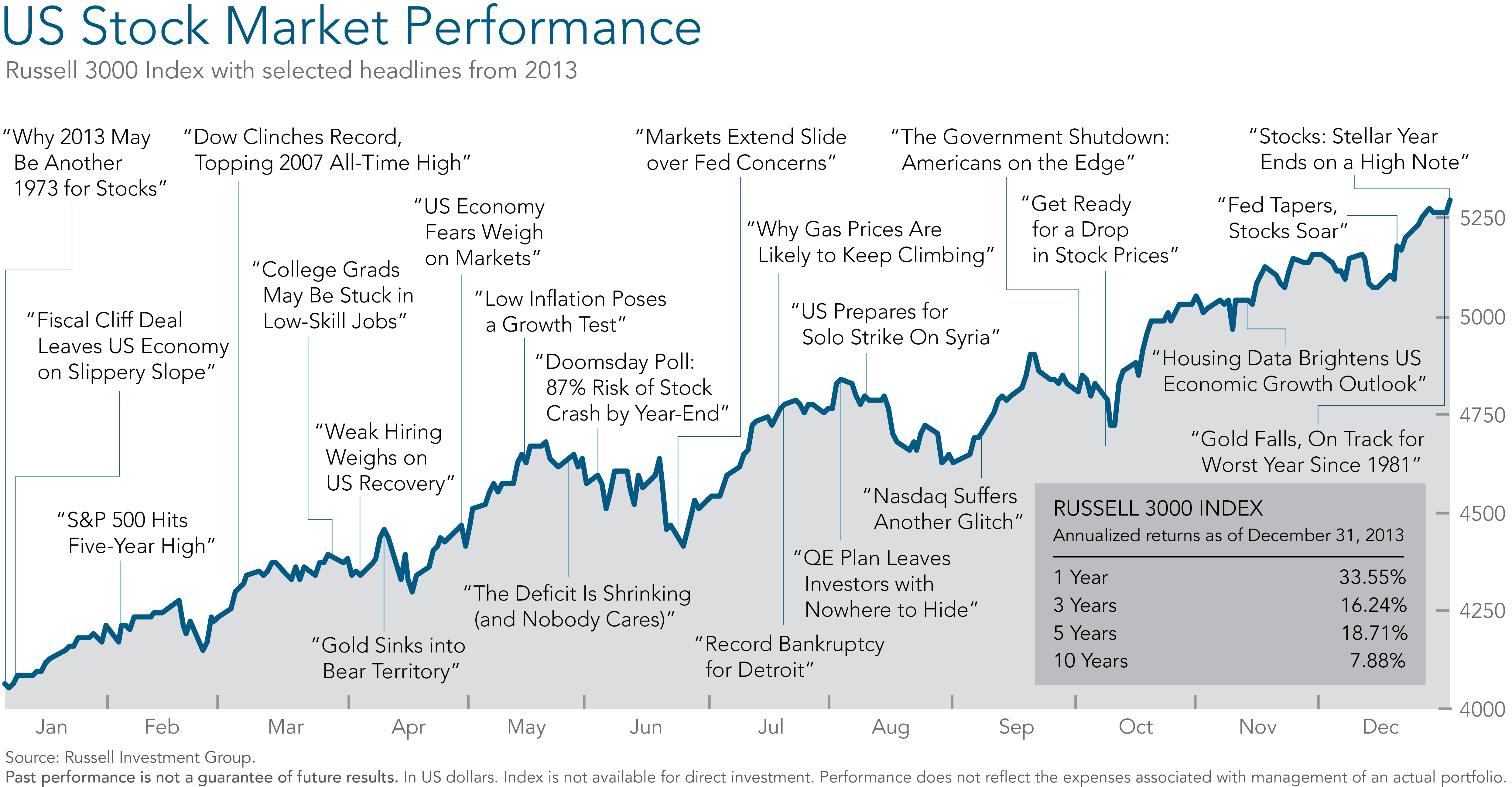

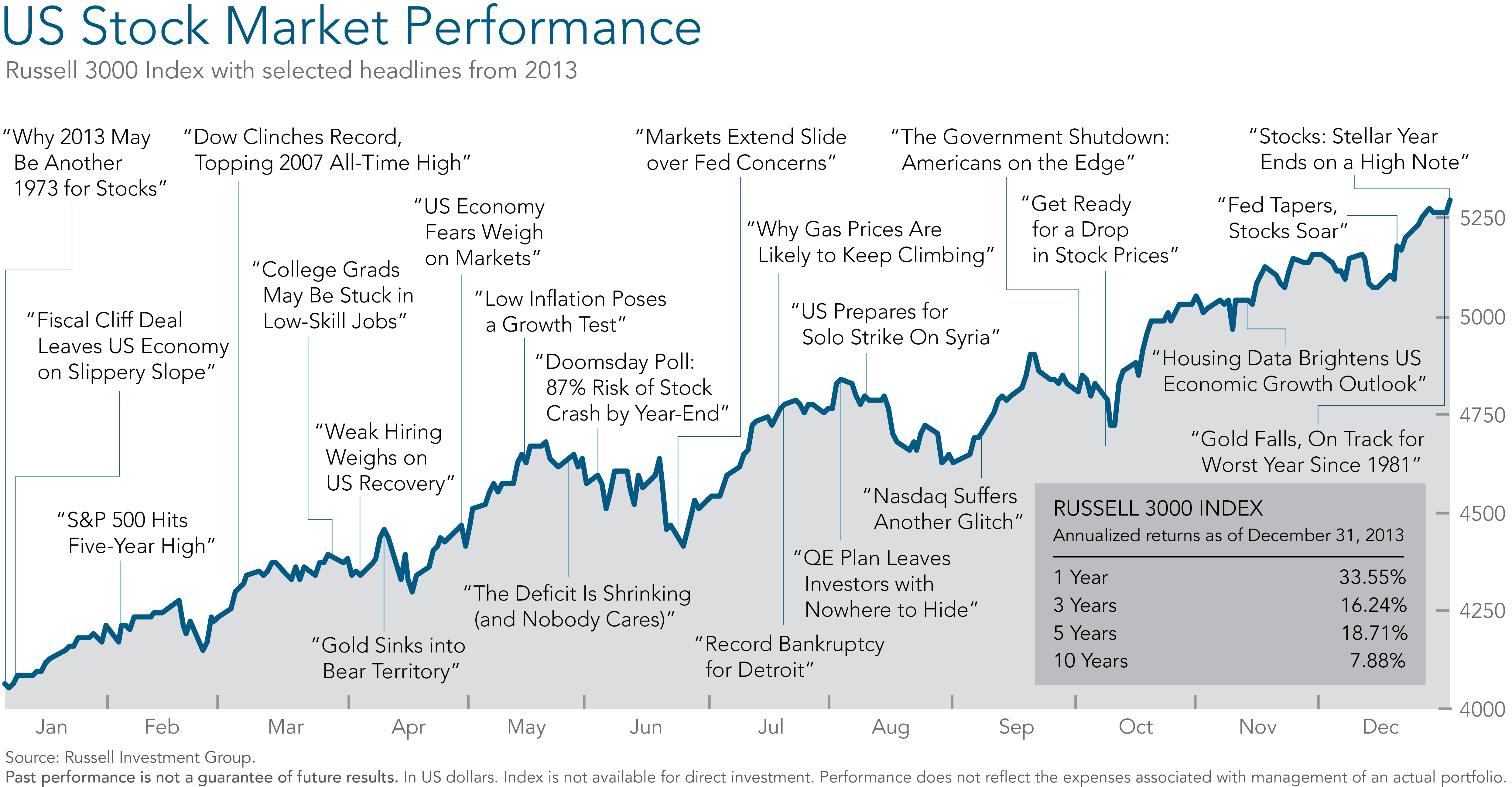

Dow Jones Performance Analysis for April 23rd

Opening and Closing Values:

The Dow Jones Industrial Average opened at 33,820.50 and closed at 33,916.50, representing a gain of approximately 0.28% for the day. This positive close, however, masked significant intraday fluctuations.

- High: 34,010.00

- Low: 33,750.00

- Volume Traded: [Insert actual volume traded data here - source needed]

Key Contributing Factors:

Several factors contributed to the Dow Jones' performance on April 23rd. These included:

- Positive Earnings Reports: Strong Q1 earnings reports from several blue-chip companies within the index boosted investor confidence, driving upward momentum. [Link to relevant news source]

- Easing Inflation Concerns: Some analysts interpreted recent economic data as suggesting that inflationary pressures might be easing, lessening concerns about aggressive interest rate hikes by the Federal Reserve. [Link to relevant news source]

- Tech Sector Strength: The technology sector, a significant component of the Dow Jones, experienced robust growth, pulling the index higher. [Link to relevant news source]

- Geopolitical Developments: Ongoing geopolitical uncertainties in [mention specific region/event] created some market nervousness, leading to intraday volatility. [Link to relevant news source]

- Consumer Confidence Index: A slightly improved consumer confidence index provided a mild boost to market sentiment. [Link to relevant news source]

Sector-Specific Performance:

Sectoral performance within the Dow Jones on April 23rd varied significantly:

- Technology: +1.5%

- Finance: +0.8%

- Energy: -0.5%

- Industrials: +0.3%

- Healthcare: +0.2%

S&P 500 Performance Analysis for April 23rd

Opening and Closing Values:

The S&P 500 index opened at 4,145.00 and closed at 4,139.00, reflecting a slight decrease of approximately 0.15%. Unlike the Dow Jones, the S&P 500 experienced a more subdued performance.

- High: 4,155.00

- Low: 4,130.00

- Volume Traded: [Insert actual volume traded data here - source needed]

Key Contributing Factors:

The S&P 500's performance was influenced by several factors, some overlapping with those affecting the Dow Jones:

- Mixed Earnings Season: While some companies reported strong earnings, others fell short of expectations, leading to a more cautious investor sentiment compared to the Dow Jones' more positive response. [Link to relevant news source]

- Interest Rate Hike Speculation: Concerns about further interest rate hikes by the Federal Reserve continued to weigh on investor sentiment, impacting the broader market represented by the S&P 500 more significantly than the Dow Jones. [Link to relevant news source]

- Bond Market Behavior: Movement in the bond market played a role in the S&P 500's performance, as investors shifted allocations between equities and fixed-income securities. [Link to relevant news source]

- Small-Cap Underperformance: Underperformance in the small-cap segment of the market exerted downward pressure on the S&P 500. [Link to relevant news source]

Comparison with Dow Jones Performance:

The Dow Jones and S&P 500 exhibited contrasting performances on April 23rd. While the Dow Jones closed slightly higher, driven by strong earnings and sector-specific gains, the S&P 500 experienced a minor decline, reflecting broader market concerns. The divergence highlights the different sensitivities of these indices to various economic and company-specific factors.

- Similarities: Both indices experienced intraday volatility, reflecting the overall market uncertainty.

- Differences: The Dow Jones was more resilient due to strong performances in specific sectors, while the S&P 500 was impacted more by broader economic concerns and less positive earnings across a wider range of companies.

Market Outlook and Predictions (Optional)

Short-Term Predictions:

The short-term outlook for both the Dow Jones and S&P 500 remains uncertain. Further economic data releases and corporate earnings announcements will significantly influence near-term market movements. Potential catalysts for upward movement include continued strong earnings reports and easing inflation concerns. Conversely, potential downward pressure could arise from renewed inflation fears or geopolitical instability.

Long-Term Considerations:

Long-term investors should consider the potential impact of persistent inflation, interest rate changes, and geopolitical risks on both indices. A diversified investment strategy remains crucial for managing risk and capitalizing on long-term growth opportunities.

Conclusion:

April 23rd presented a day of mixed signals for the Dow Jones and S&P 500. The Dow Jones, benefiting from robust earnings and sector-specific gains, closed slightly higher. Conversely, the S&P 500 experienced a minor decline, reflecting broader market concerns. Understanding the factors influencing these indices is crucial for informed investment decisions. Stay tuned for tomorrow's Dow Jones and S&P 500 market update and continue to monitor these crucial stock market indices for informed investing.

Featured Posts

-

California Gas Prices Surge Governor Newsom Seeks Industry Collaboration

Apr 24, 2025

California Gas Prices Surge Governor Newsom Seeks Industry Collaboration

Apr 24, 2025 -

April 23 Stock Market Summary Dow S And P 500 Performance

Apr 24, 2025

April 23 Stock Market Summary Dow S And P 500 Performance

Apr 24, 2025 -

Oil Market Update Key Price Movements And Analysis For April 23rd

Apr 24, 2025

Oil Market Update Key Price Movements And Analysis For April 23rd

Apr 24, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 24, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 24, 2025 -

The Crucial Role Of Middle Managers In Boosting Company Performance And Employee Satisfaction

Apr 24, 2025

The Crucial Role Of Middle Managers In Boosting Company Performance And Employee Satisfaction

Apr 24, 2025