Oil Market Update: Key Price Movements And Analysis For April 23rd

Table of Contents

Crude Oil Price Movements on April 23rd

Brent Crude Oil Analysis

Brent Crude, the global benchmark for oil pricing, saw considerable volatility on April 23rd. Let's examine the key price data:

- Opening Price: $85.50 per barrel

- Closing Price: $87.20 per barrel

- High: $87.80 per barrel

- Low: $84.90 per barrel

- Percentage Change (Day-over-Day): +2.0%

- Percentage Change (Week-over-Week): +4.5%

[Insert chart illustrating Brent Crude price fluctuations throughout April 23rd here]

The price surge was largely attributed to the aforementioned geopolitical uncertainties, creating concerns about potential supply disruptions. A sudden, unexpected drop in reported oil inventories in the US also contributed to the upward pressure on prices. These price fluctuations highlight the sensitivity of the crude oil price to global events.

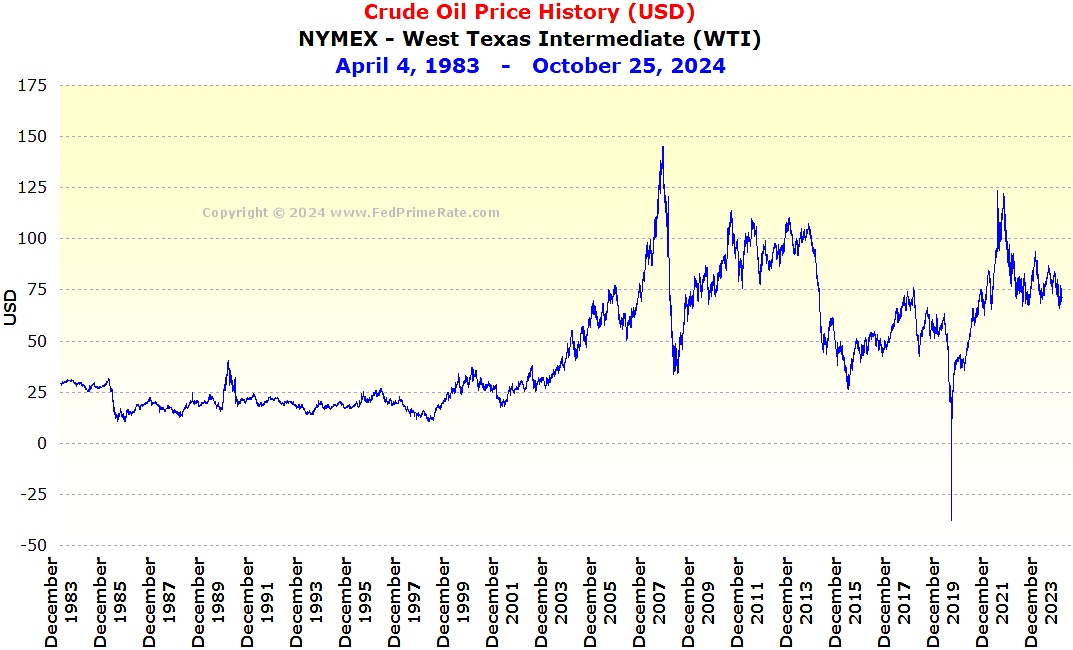

West Texas Intermediate (WTI) Crude Oil Analysis

West Texas Intermediate (WTI) crude oil, the US benchmark, mirrored the upward trend observed in Brent Crude, although the movement was slightly less pronounced.

- Opening Price: $82.00 per barrel

- Closing Price: $83.70 per barrel

- High: $84.20 per barrel

- Low: $81.50 per barrel

- Percentage Change (Day-over-Day): +2.1%

- Percentage Change (Week-over-Week): +3.9%

The correlation between WTI Crude and Brent Crude price movements remained strong, indicating a synchronized response to global market forces. The slightly smaller increase in WTI compared to Brent might be attributed to specific factors affecting the US market, such as domestic production levels and refining capacity.

Key Factors Influencing Oil Prices on April 23rd

Geopolitical Events

The escalating geopolitical situation in Eastern Europe played a dominant role in driving up oil prices on April 23rd. The potential for further disruptions to oil supplies from the region, coupled with existing sanctions on major oil-producing nations, significantly impacted market sentiment. This geopolitical risk fueled uncertainty and increased demand for safe-haven assets, including oil.

OPEC+ Production Decisions

OPEC+’s decision regarding oil production quotas also influenced the market. While a production increase was announced, it was smaller than anticipated by many analysts, leading to a tighter supply situation. This fueled speculation about potential future supply shortages and contributed to the rise in oil prices. The OPEC+’s decisions significantly impact oil supply and therefore oil quotas.

Economic Indicators and Market Sentiment

Positive economic indicators from several major economies fueled expectations of increased oil demand. Coupled with already low oil inventories, this boosted investor confidence, contributing to a bullish market sentiment. Concerns about persistent inflation also played a role, as rising inflation often leads to increased demand for commodities like oil as a hedge against inflation. The interplay between economic growth, inflation, and market sentiment all greatly influence oil demand.

Oil Market Outlook Following April 23rd Movements

Short-Term Predictions

Based on the events of April 23rd and the prevailing market conditions, a cautiously optimistic short-term outlook for oil prices is warranted. Further escalation of geopolitical tensions could lead to further price increases. Conversely, unexpected increases in OPEC+ production or a significant improvement in the global economic outlook could exert downward pressure.

Long-Term Considerations

The long-term outlook for oil prices remains uncertain. The ongoing energy transition and the increasing adoption of renewable energy present significant challenges to the dominance of fossil fuels. However, the substantial global demand for oil, especially from developing economies, suggests that oil will likely remain a crucial part of the energy mix for many years to come. The impact of government policies promoting sustainable energy will play a considerable role in shaping the long-term oil price.

Oil Market Update: Key Takeaways and Future Analysis

This Oil Market Update highlighted the significant price increase in crude oil on April 23rd, primarily driven by geopolitical tensions, less-than-expected OPEC+ production increases, and positive economic indicators. The short-term outlook remains somewhat volatile, while the long-term perspective anticipates the continued influence of the energy transition and global economic conditions on oil prices.

Stay informed about crucial oil market developments with our regular oil market updates. Subscribe to our newsletter for continuous analysis of oil price movements and insightful commentary.

Featured Posts

-

Crude Oil Price Report April 23rd Market News And Insights

Apr 24, 2025

Crude Oil Price Report April 23rd Market News And Insights

Apr 24, 2025 -

Watch John Travoltas Pulp Fiction Inspired Steak Dinner In Miami

Apr 24, 2025

Watch John Travoltas Pulp Fiction Inspired Steak Dinner In Miami

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts

Apr 24, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse Spoilers And Predictions For His Survival

Apr 24, 2025

The Bold And The Beautiful Liams Collapse Spoilers And Predictions For His Survival

Apr 24, 2025 -

Why Current Stock Market Valuations Are Not A Cause For Concern Bof A

Apr 24, 2025

Why Current Stock Market Valuations Are Not A Cause For Concern Bof A

Apr 24, 2025