Escape To The Country: Nicki Chapman's Successful £700,000 Home Investment

Table of Contents

The Allure of Nicki Chapman's Countryside Retreat

The appeal of Nicki Chapman's country home lies not only in its substantial value but also in its idyllic location and desirable features. While the exact details of her property may remain private, we can infer from her public persona and the show's focus on desirable rural locations that her investment embodies the key elements of a successful country property. The investment's success hinges on several factors linked to its location and inherent characteristics.

- Prime Location: The desirability of a rural property often stems from its location. Proximity to scenic landscapes, charming villages, and convenient access to local amenities contribute significantly to its value. We can assume Nicki's property boasts such features.

- Property Features: A substantial property size, likely including multiple bedrooms, ample land, and perhaps charming period features, significantly increases its value and appeal. Outbuildings, like stables or a workshop, add further desirability.

- Tranquil Setting: The tranquil setting, away from the hustle and bustle of city life, is a primary draw for those seeking a country escape. The peace and quiet, coupled with the surrounding natural beauty, contribute to the overall value and desirability.

- Local Amenities: Access to essential services and attractions within reasonable proximity further enhances the property's appeal. A vibrant local community and nearby attractions add to the overall lifestyle appeal.

Smart Investment Strategies: Analyzing Nicki Chapman's Approach

While the specifics of Nicki Chapman's investment strategy remain undisclosed, we can analyze potential factors that contributed to its success. Her approach likely incorporated a combination of shrewd market analysis, strategic planning, and perhaps even some renovation work.

- Market Research: Thorough market research is crucial. Understanding local market trends, average property prices, and rental yields (if applicable) would have been key to her decision-making process.

- Long-Term Growth Potential: Investing in a property with strong long-term growth potential is essential. Factors like population growth, infrastructure improvements, and increasing demand for rural properties contribute to future value appreciation.

- Return on Investment (ROI): The potential ROI would have been a key consideration. This includes not just capital appreciation but also rental income, if the property is let out.

- Renovation and Improvements: Renovation projects can significantly enhance a property's value. By carefully selecting improvements that increase desirability, Nicki likely enhanced her property's value. This could range from cosmetic upgrades to more significant structural changes.

Lessons Learned: Investing in a Country Escape Like Nicki Chapman

Nicki Chapman's success highlights the importance of a strategic and well-informed approach to rural property investment. Aspiring investors can learn several key lessons from her example:

- Due Diligence: Thorough due diligence is paramount. This involves conducting comprehensive property surveys, checking legal documentation, and understanding any potential hidden costs or issues.

- Financial Planning: Secure appropriate financing. This may involve mortgages, loans, or other financial arrangements, and requires careful planning to ensure affordability and manage risk.

- Reputable Agent: Partner with a reputable estate agent specializing in rural properties. Their local market expertise is invaluable.

- Renovation Costs: Accurately assess potential renovation costs and timelines before committing to any project. Unexpected expenses can significantly impact profitability.

Avoiding Common Pitfalls in Country Property Investment

Rural property investment presents unique challenges:

- Higher Maintenance Costs: Maintaining a larger property, potentially with outbuildings and extensive gardens, incurs higher costs compared to urban properties.

- Remoteness: The remoteness of some rural locations can impact accessibility and resale value.

- Slower Market Turnover: Rural property markets often have slower turnover rates than urban areas, making it more challenging to sell quickly if needed.

Conclusion

Nicki Chapman's successful £700,000 home investment demonstrates that a strategic and well-researched approach to rural property investment can yield significant returns. Her success story highlights the importance of location, smart investment strategies, and thorough due diligence. By learning from her example and carefully considering the potential challenges, you can begin your own journey toward finding your perfect country escape. Start your property investment journey today and find your own country escape! Research the market and begin building your successful property portfolio.

Featured Posts

-

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025 -

A Relaxing Escape To The Country Tips For A Stress Free Retreat

May 24, 2025

A Relaxing Escape To The Country Tips For A Stress Free Retreat

May 24, 2025 -

Sterke Stijging Aex Na Uitstel Trump Analyse Van De Winnaars

May 24, 2025

Sterke Stijging Aex Na Uitstel Trump Analyse Van De Winnaars

May 24, 2025 -

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025

Latest Posts

-

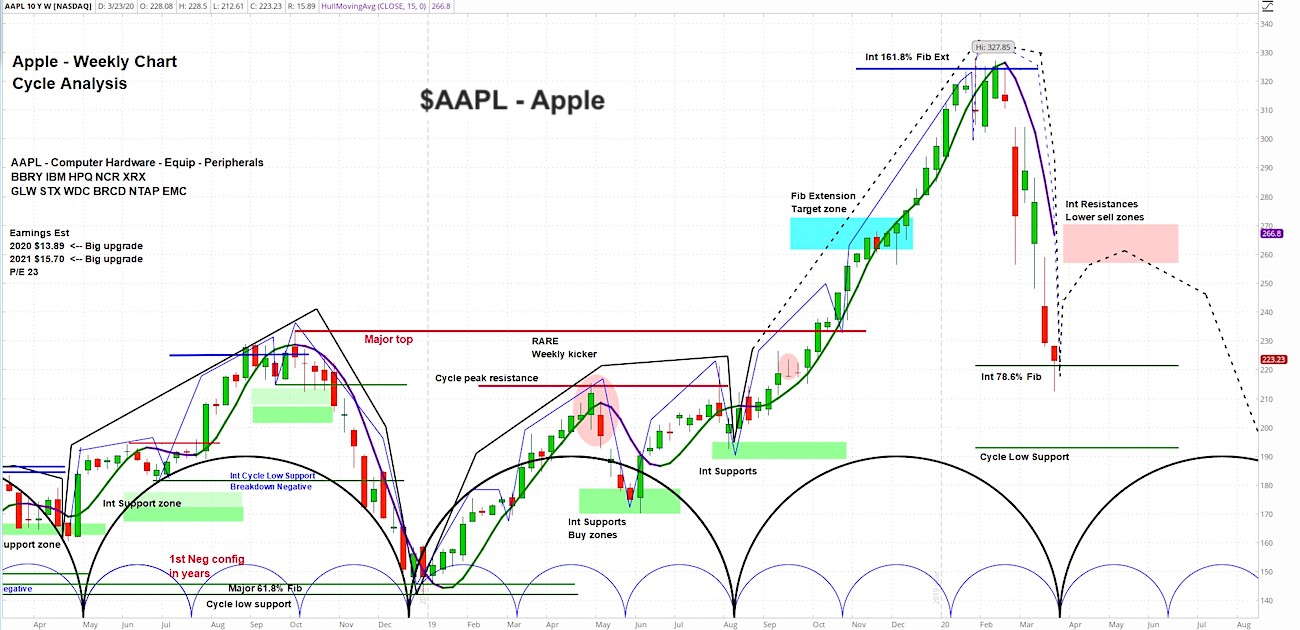

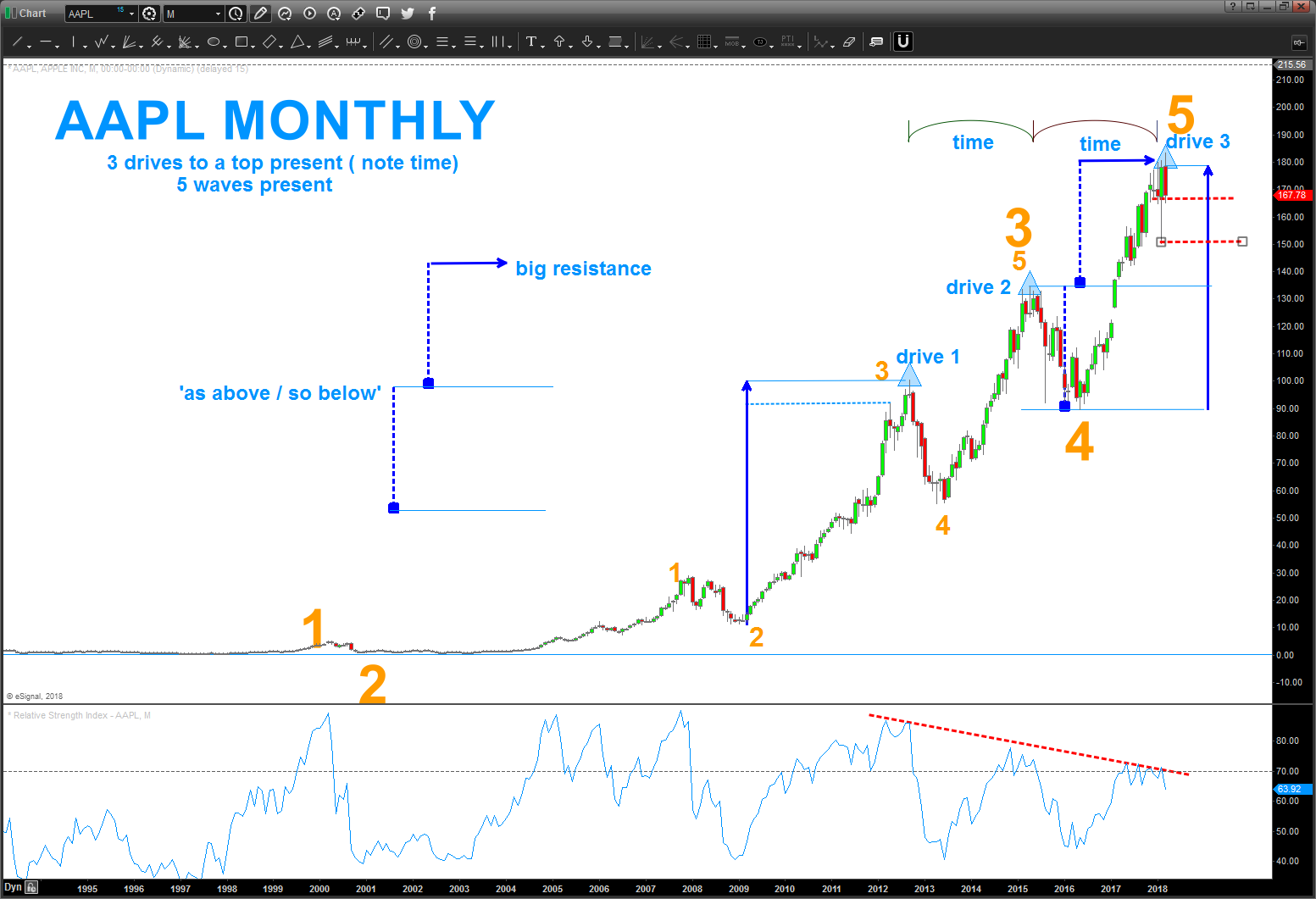

Apple Stock Aapl Where Will The Price Go Next A Technical Analysis

May 24, 2025

Apple Stock Aapl Where Will The Price Go Next A Technical Analysis

May 24, 2025 -

Forecasting Apple Stock Aapl Price Important Levels To Consider

May 24, 2025

Forecasting Apple Stock Aapl Price Important Levels To Consider

May 24, 2025 -

Apple Stock Aapl Price Analysis Identifying Crucial Support And Resistance

May 24, 2025

Apple Stock Aapl Price Analysis Identifying Crucial Support And Resistance

May 24, 2025 -

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025 -

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025