Ethereum Price Analysis: Sustained Strength And Future Outlook

Table of Contents

Recent Price Performance and Key Support Levels

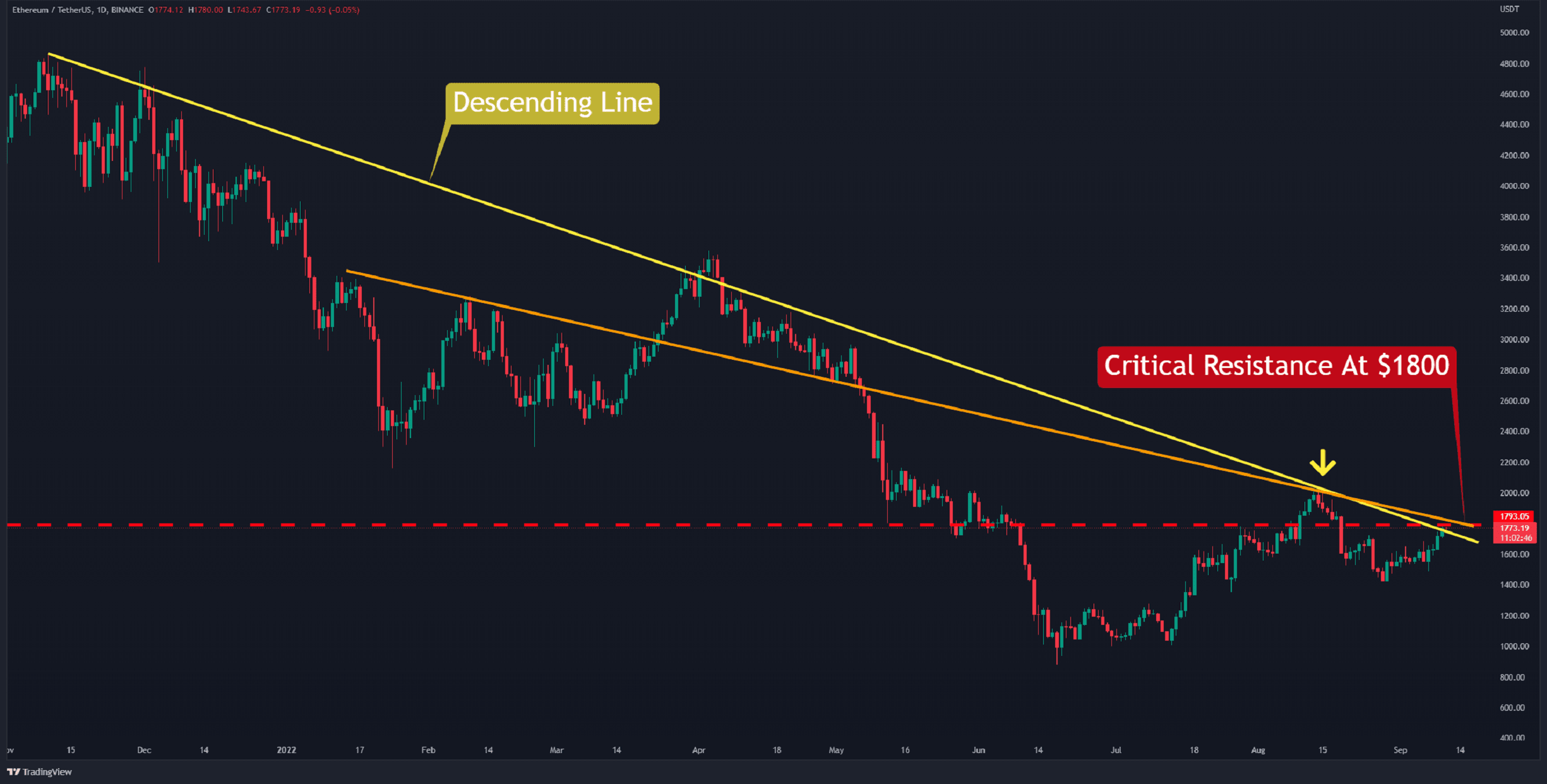

Analyzing recent Ethereum price movements reveals a period of sustained strength, punctuated by periods of consolidation. Over the past quarter, we've seen ETH navigate significant market volatility, demonstrating resilience against broader cryptocurrency market downturns. Identifying key support and resistance levels is crucial for understanding potential future price action.

-

Chart illustrating price movement over the past month/quarter: [Insert chart here – ideally an interactive chart showing price action with key support/resistance levels clearly marked]. This chart will visually represent the price fluctuations, highlighting highs and lows.

-

Specific price levels acting as support/resistance: Historically, the $1,500-$1,600 range has acted as a strong support level for ETH. Resistance levels have been observed around the $2,000 mark and higher, depending on market sentiment. Breakouts above these levels often lead to significant price increases.

-

Discussion of moving averages (e.g., 50-day, 200-day): The 50-day moving average has consistently acted as a dynamic support level in recent weeks, indicating underlying bullish momentum. The 200-day moving average, a longer-term indicator, provides a crucial benchmark for assessing the overall trend.

-

Mention of relevant technical indicators (e.g., RSI, MACD): Technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can provide further insights into the strength of the current trend and potential reversals. Analyzing these indicators alongside price action is essential for a comprehensive Ethereum price analysis.

Factors Influencing Ethereum's Price

Several key factors influence Ethereum's price, creating a complex interplay of market forces. Understanding these elements is crucial for accurate Ethereum price prediction.

Network Activity and Adoption

On-chain metrics paint a picture of robust network activity and growing adoption.

-

Statistics on transaction volume and active addresses: Transaction volume on the Ethereum network continues to grow steadily, reflecting increased usage of decentralized applications (dApps). The number of active addresses also shows a positive trend, indicating rising user engagement.

-

Examples of successful DeFi projects on Ethereum: The flourishing DeFi ecosystem, with projects like Aave, Uniswap, and Compound, significantly contributes to Ethereum's demand and price appreciation. These projects drive network activity and attract new users.

-

Data on NFT market capitalization and trading volume: The NFT (Non-Fungible Token) market, largely built on Ethereum, has experienced periods of explosive growth, contributing significantly to network congestion and demand for ETH. This fuels further price increases.

Regulatory Landscape and Institutional Investment

Regulatory clarity and institutional investment are significant drivers of Ethereum's price.

-

Summary of recent regulatory developments: While regulatory uncertainty remains a concern for the entire cryptocurrency market, ongoing dialogues and potential regulatory frameworks could significantly impact Ethereum's price. Positive regulatory developments tend to increase investor confidence.

-

Examples of institutional investors entering the Ethereum market: Major financial institutions are increasingly allocating assets to Ethereum, viewing it as a valuable store of value and a key component of the evolving digital asset landscape. This institutional interest further stabilizes and boosts the price.

-

Details of significant partnerships and collaborations: Partnerships between Ethereum and traditional financial institutions are vital for driving mainstream adoption and price appreciation.

Technological Developments and Upgrades

Ethereum's ongoing development and technological upgrades are paramount to its long-term success and price appreciation.

-

Timeline for Ethereum 2.0 rollout: The transition to Ethereum 2.0, with its improved scalability and security, is a key catalyst for price increases. As the rollout progresses and more features are implemented, we can expect increased price appreciation.

-

Explanation of sharding and its benefits: Sharding, a crucial part of Ethereum 2.0, dramatically improves scalability by dividing the network into smaller, more manageable parts. This enhancement addresses current limitations and makes Ethereum more efficient.

-

Discussion of other relevant technological developments: Continuous development of layer-2 scaling solutions, such as Optimism and Arbitrum, further enhances Ethereum's scalability and usability, reducing transaction costs and congestion.

Predicting Future Ethereum Price: Bullish and Bearish Scenarios

Predicting the future price of Ethereum involves analyzing both potential bullish and bearish scenarios.

-

Bullish scenario: Price targets and supporting factors: A sustained increase in network adoption, coupled with successful Ethereum 2.0 rollout and positive regulatory developments, could push ETH to significantly higher price targets.

-

Bearish scenario: Price targets and potential risks: Negative regulatory actions, major security breaches, or a broader cryptocurrency market downturn could lead to a price correction.

-

Discussion of market sentiment and investor confidence: Market sentiment plays a crucial role in Ethereum's price. Positive news and increasing investor confidence generally lead to price appreciation.

Conclusion

This Ethereum price analysis reveals a complex interplay of factors influencing ETH's price. While recent performance has been strong, future price movements will depend on the ongoing development of the Ethereum network, regulatory clarity, and overall market sentiment. Understanding these key dynamics is crucial for informed investment decisions. Conduct your own thorough research and consider consulting with a financial advisor before making any investment in Ethereum or any other cryptocurrency. Stay tuned for our next Ethereum price analysis to track the market's ongoing evolution and keep up-to-date with the latest insights on Ethereum price analysis and predictions.

Featured Posts

-

Stream Andor Season 1 Episodes Before Season 2

May 08, 2025

Stream Andor Season 1 Episodes Before Season 2

May 08, 2025 -

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025 -

Alterya Acquired By Chainalysis Implications For The Future Of Blockchain Technology

May 08, 2025

Alterya Acquired By Chainalysis Implications For The Future Of Blockchain Technology

May 08, 2025 -

Jayson Tatum Game Status Celtics Vs Nets Injury Update

May 08, 2025

Jayson Tatum Game Status Celtics Vs Nets Injury Update

May 08, 2025 -

Inter Milan Four Players Out Of Contract In 2026

May 08, 2025

Inter Milan Four Players Out Of Contract In 2026

May 08, 2025