Ethereum Price Prediction: $2,700 Target As Wyckoff Accumulation Concludes

Table of Contents

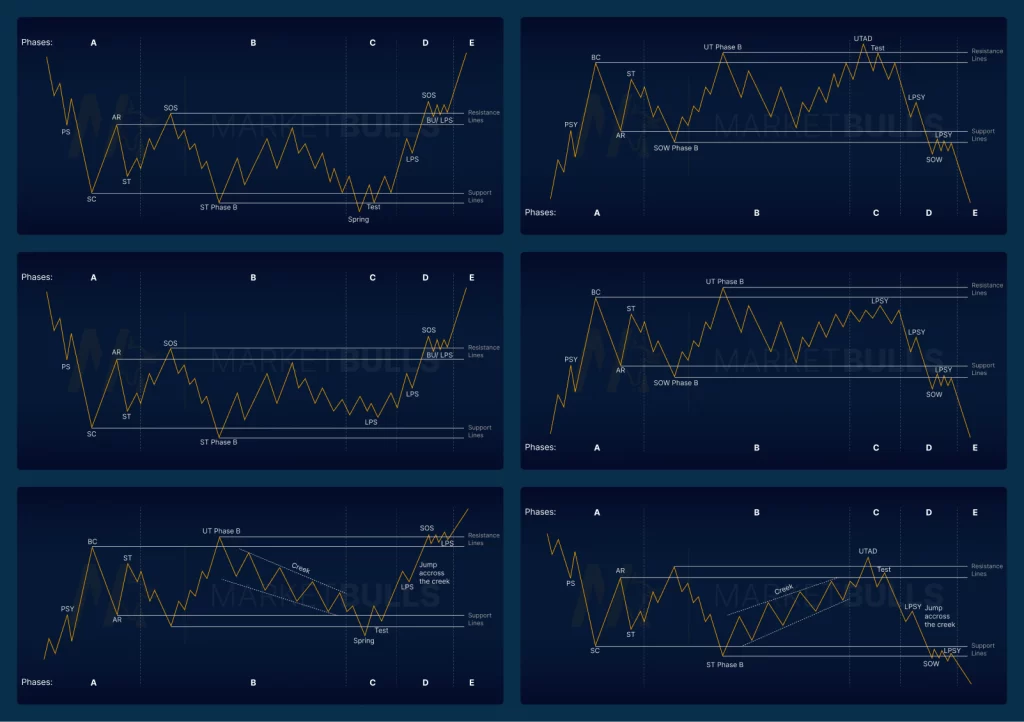

Understanding the Wyckoff Accumulation Pattern

What is Wyckoff Accumulation?

The Wyckoff Accumulation method is a technical analysis technique used to identify periods of significant price consolidation where large investors ("smart money") are quietly accumulating assets before a substantial price increase. It's a powerful tool for identifying potential price reversals. Instead of a sudden breakout, Wyckoff Accumulation shows a period of sideways trading characterized by specific behaviors:

- Testing Support Levels: The price repeatedly tests and holds a key support level, showing strong buying pressure at those lows.

- Increasing Volume During Accumulation: While the price remains relatively flat, trading volume often increases during periods of accumulation, suggesting large-scale buying.

- Signs of Smart Money Accumulation: This includes subtle clues in price action and volume, such as "spring" (a sharp drop to attract weak sellers) and "upthrust" (a brief price surge to shake out potential buyers).

- Clear signs of distribution: The opposite of accumulation, where large holders are selling. The absence of this is supportive of a bullish outlook.

[Insert a chart illustrating a classic Wyckoff Accumulation pattern here]

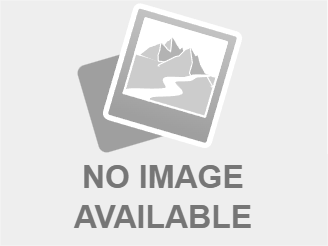

Evidence of Wyckoff Accumulation in Ethereum's Chart

Recent Ethereum price action shows compelling evidence aligning with a Wyckoff Accumulation pattern. For instance, the period between [Insert Date] and [Insert Date] displayed a clear consolidation phase. The price repeatedly tested support around $[Support Price], showing strong buying pressure. Volume increased significantly during this period, particularly around the support level. We also observed a "spring" around [Insert Date] which attracted weaker sellers, creating a buying opportunity for smart money.

[Insert a chart showing Ethereum's price action with annotated key points mentioned above]

On-Chain Metrics Supporting the Bullish Outlook

Analyzing Ethereum's Network Activity

Several on-chain metrics corroborate the bullish outlook. Network activity remains robust, suggesting sustained interest and adoption:

- Active Addresses: The number of active Ethereum addresses has [Increased/Remained Stable/Decreased – Choose the accurate description] indicating [positive/neutral/negative implication] on network activity.

- Transaction Fees: Transaction fees are [high/low/stable] reflecting [high/low/stable] network usage.

- Development Activity: Ethereum's development activity, tracked by metrics such as GitHub commits and developer contributions, remains high, indicating continuous improvement and innovation.

Data from [cite source, e.g., Glassnode, Etherscan] shows a clear trend of [specific on-chain metric data, showing growth/strength].

Impact of Ethereum's Development and Upgrades

The successful implementation of upgrades like the Shanghai upgrade has significantly reduced the risk of holding ETH, boosting investor confidence. The ability to withdraw staked ETH has unlocked a significant portion of the supply, thereby potentially reducing selling pressure. Further upgrades on the horizon promise even greater scalability and efficiency, further fueling the potential for price appreciation. However, it is important to note the possibility of unforeseen technical challenges that could impact price negatively.

Potential Risks and Challenges

Macroeconomic Factors Affecting Crypto Prices

Broader macroeconomic factors remain a significant risk. High inflation, rising interest rates, and geopolitical uncertainty can negatively impact the entire crypto market, including Ethereum. A global recession could lead to reduced risk appetite among investors, impacting ETH price negatively.

Market Sentiment and Volatility

Market sentiment is highly volatile in the crypto market. Sudden shifts in investor sentiment, driven by news events or regulatory changes, could significantly impact the price of Ethereum, regardless of underlying fundamentals. Therefore, the $2700 price prediction is not guaranteed and should be considered within the context of this volatility.

Conclusion

This Ethereum price prediction of $2700 is supported by the apparent completion of a Wyckoff Accumulation pattern, strong on-chain metrics, and ongoing positive developments within the Ethereum ecosystem. However, macroeconomic factors and inherent market volatility pose significant risks. While the technical analysis and on-chain data paint a bullish picture, remember that cryptocurrency investments are speculative and involve considerable risk. Conduct your own thorough research and consider your risk tolerance before investing in Ethereum. Stay updated on the latest Ethereum news and analysis to make informed choices regarding your Ethereum investment strategy and refine your Ethereum price prediction understanding.

Featured Posts

-

Jhl Privatization Ghas Strong Opposition And The Potential Consequences

May 08, 2025

Jhl Privatization Ghas Strong Opposition And The Potential Consequences

May 08, 2025 -

Wall Street Ten Kripto Paraya Artan Ilgi Yatirim Stratejileri Degisiyor Mu

May 08, 2025

Wall Street Ten Kripto Paraya Artan Ilgi Yatirim Stratejileri Degisiyor Mu

May 08, 2025 -

Filipe Luis Reciente Victoria Y Nuevo Titulo

May 08, 2025

Filipe Luis Reciente Victoria Y Nuevo Titulo

May 08, 2025 -

Lahwr Ky Panch Ahtsab Edaltyn Khtm Kya Yh Fyslh Drst He

May 08, 2025

Lahwr Ky Panch Ahtsab Edaltyn Khtm Kya Yh Fyslh Drst He

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Sht Ky Bymh Shwlt Ka Aghaz

May 08, 2025

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Sht Ky Bymh Shwlt Ka Aghaz

May 08, 2025