Ethereum Price To Reach $2,700? Wyckoff Accumulation Signals

Table of Contents

Understanding Wyckoff Accumulation in the Ethereum Market

What is Wyckoff Accumulation?

The Wyckoff Method is a sophisticated technical analysis approach used to identify market manipulation and predict significant price changes. Unlike simpler methods focusing solely on price action, Wyckoff emphasizes the interplay of price, volume, and time to pinpoint key accumulation and distribution phases. In cryptocurrency markets like Ethereum, where volatility is high, identifying these phases can be crucial for informed trading decisions. The method breaks down market phases into distinct stages, each characterized by specific price and volume behavior. Key phases include the Spring, a test of selling pressure; the Markup, a period of rising prices; and the Secondary Test, a retest of support levels. Understanding these phases within the context of Wyckoff Accumulation and Wyckoff Method technical analysis is key to predicting Ethereum's price movement using this technique.

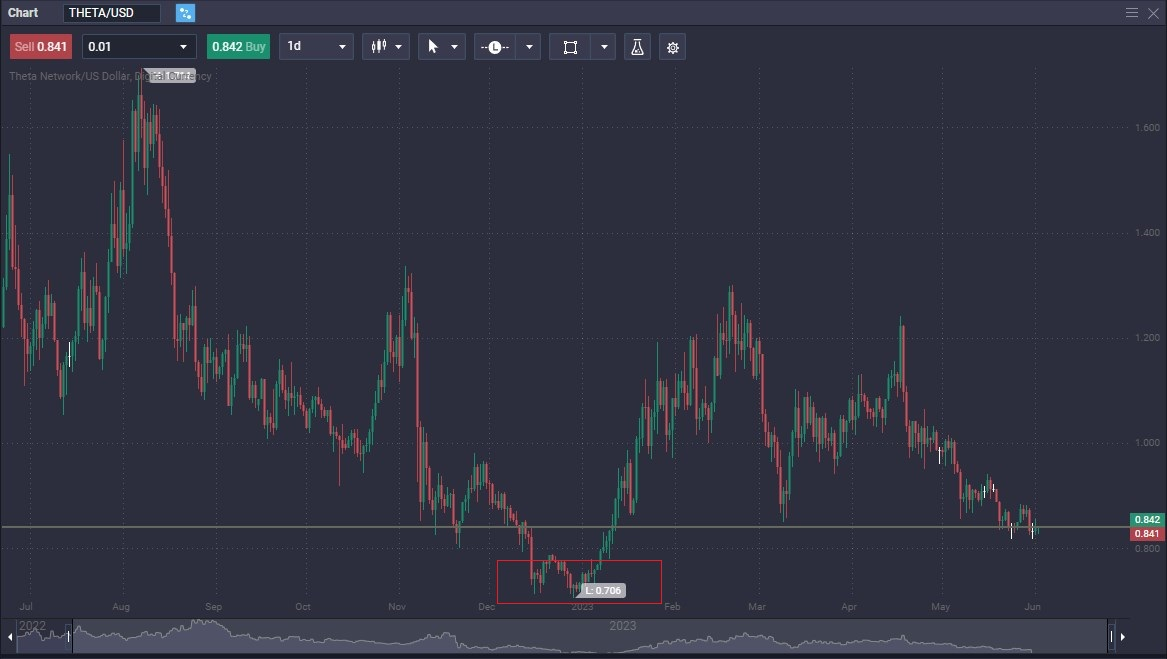

Identifying Wyckoff Accumulation Signals in Ethereum's Chart

Identifying Wyckoff accumulation on Ethereum's price chart requires careful observation of several key characteristics. This involves a combination of Ethereum chart analysis, price consolidation, and volume analysis. Visual examples (charts, which would be included in a published article) clearly show these patterns.

- Low volume during price consolidation: A period of sideways trading with relatively low trading volume suggests a period of accumulation, where large players are quietly accumulating positions.

- Higher lows and higher highs in price action: This gradual upward trend within a defined range indicates increasing buying pressure overcoming selling pressure.

- Signs of increased buying pressure: Observe increased volume specifically on upward price movements. This confirms the accumulation phase is active.

- Specific chart patterns indicative of accumulation: Sideways trading ranges, often followed by a break above resistance, are classic signs. This is where analyzing candlestick patterns becomes particularly valuable.

Historical Examples of Wyckoff Accumulation in Ethereum

Analyzing Ethereum price history and historical price data reveals past instances where Wyckoff accumulation signals accurately predicted subsequent price increases. (Again, charts showing specific examples from the past would be included here). By examining past instances where successful predictions were made through the application of the Wyckoff method, we can increase our confidence in its effectiveness. These examples highlight the potential power of the Wyckoff method in forecasting Ethereum price movement. Specific dates and price ranges would be included in a complete article to provide context and validation.

Factors Supporting Ethereum's Potential Rise to $2,700

Fundamental Factors Influencing Ethereum's Price

Several fundamental factors contribute to the positive outlook for Ethereum's price. These developments fuel the argument that $2700 is a realistic price target:

- Ethereum 2.0 upgrades and scalability improvements: These upgrades significantly enhance the network's efficiency and transaction speeds, addressing previous scalability concerns.

- Growing DeFi (Decentralized Finance) adoption: The burgeoning DeFi ecosystem built on Ethereum continues to drive demand for ETH.

- NFT (Non-Fungible Token) market growth: The explosive growth of the NFT market, largely facilitated by Ethereum's blockchain, further increases demand.

- Increased institutional investment in Ethereum: Major institutional investors are increasingly allocating capital to Ethereum, boosting its market capitalization and price stability. These factors significantly influence the blockchain technology’s market dominance.

Technical Indicators Supporting the Price Target

Beyond Wyckoff analysis, other technical indicators support a potential price increase to $2,700. For instance, a convergence of moving averages could suggest an upcoming upward trend. RSI and MACD readings, when analyzed in conjunction with Wyckoff signals, can strengthen the prediction. These indicators act as additional layers of confirmation, providing a more robust analysis. Identifying key support levels and resistance levels on the chart helps refine price targets and gauge potential volatility.

Conclusion: Is $2,700 a Realistic Ethereum Price Target?

The confluence of Wyckoff accumulation signals, supported by positive fundamental factors and corroborating technical indicators, presents a compelling case for Ethereum's potential price appreciation to $2,700. However, it’s crucial to remember that price predictions are inherently uncertain, and market conditions can change rapidly. There are inherent risks involved in any cryptocurrency investment. Therefore, thorough risk management is essential.

While not guaranteed, the evidence suggests a strong possibility. Conduct your own research, analyze Ethereum price prediction models, and consider incorporating the Wyckoff method into your cryptocurrency investment and trading strategy. By understanding the nuances of Wyckoff analysis, you can improve your decision-making process and potentially capitalize on future price movements. Dive deeper into Wyckoff analysis and determine if an investment in Ethereum aligns with your risk tolerance.

Featured Posts

-

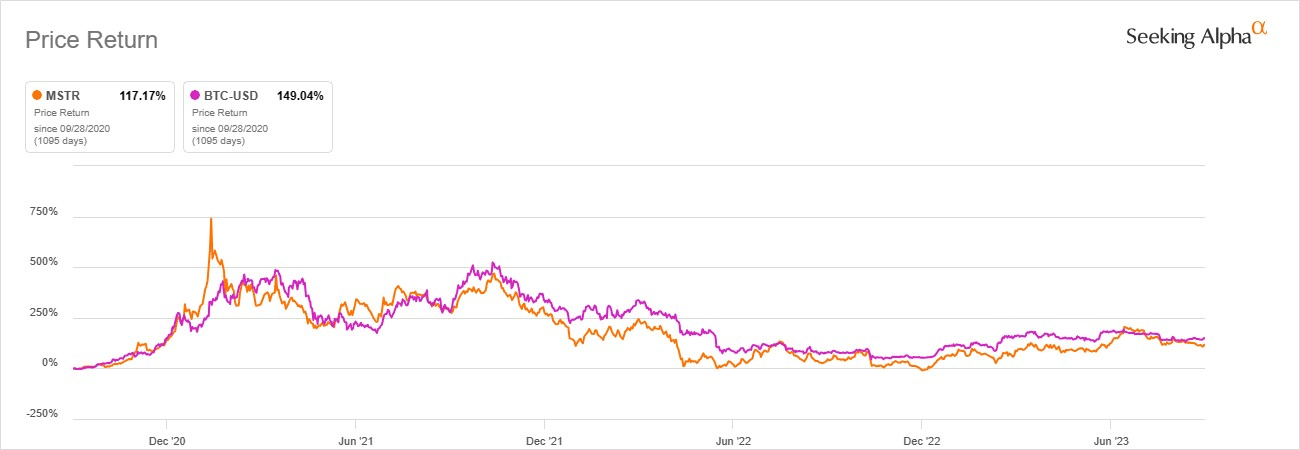

Micro Strategy Vs Bitcoin Investment A Comparative Outlook For 2025

May 08, 2025

Micro Strategy Vs Bitcoin Investment A Comparative Outlook For 2025

May 08, 2025 -

Resilient Ethereum Price Signs Of An Upcoming Breakout

May 08, 2025

Resilient Ethereum Price Signs Of An Upcoming Breakout

May 08, 2025 -

Stephen Kings The Long Walk Trailer Reaction And Adaptation Analysis

May 08, 2025

Stephen Kings The Long Walk Trailer Reaction And Adaptation Analysis

May 08, 2025 -

Saturday Night Live A Turning Point For Counting Crows

May 08, 2025

Saturday Night Live A Turning Point For Counting Crows

May 08, 2025 -

Ceku I Neymar Te Psg Zbulimet E Agjentit Per Transferimin Prej 222 Milione Eurosh

May 08, 2025

Ceku I Neymar Te Psg Zbulimet E Agjentit Per Transferimin Prej 222 Milione Eurosh

May 08, 2025