Hidden HMRC Refunds: Claim Your Unclaimed Savings

Table of Contents

Common Reasons for Unclaimed HMRC Refunds

Many taxpayers unknowingly overpay tax each year. Understanding the common reasons can help you identify if you're eligible for a refund.

Overpaid Income Tax

Many taxpayers overpay income tax due to incorrect PAYE settings, changes in circumstances not reported to HMRC, or complex tax calculations. This often happens unintentionally.

- Incorrect tax code: An incorrect tax code provided by your employer can lead to significant overpayment over time.

- Changes in employment status: Changes like starting a new job, becoming self-employed, or a change in your marital status often require updates to your tax information which are sometimes missed.

- Self-assessment errors: Mistakes on your self-assessment tax return can lead to overpayment. Double-checking your return is crucial.

- Marriage allowance eligibility: If you're married or in a civil partnership, you might be eligible for the marriage allowance, reducing your tax bill. Many eligible couples don't claim this.

Overpayment can build up significantly over several years. For example, an incorrect tax code could result in hundreds of pounds overpayment annually. Similarly, failing to report a change in circumstances promptly can lead to a substantial overpayment by the end of the tax year.

Unclaimed Tax Reliefs

Numerous tax reliefs are available for various expenses, but many go unclaimed due to a lack of awareness or understanding.

- Marriage allowance: As mentioned above, this can significantly reduce your tax bill.

- Childcare expenses: Tax relief is available for childcare costs, helping parents reduce their tax burden.

- Pension contributions: Tax relief on pension contributions can boost your retirement savings and reduce your tax liability.

- Charitable donations: If you donate to charity, you might be entitled to Gift Aid tax relief.

- Working from home expenses: If you worked from home during the pandemic or regularly work from home, you may be able to claim tax relief on certain expenses.

Understanding the eligibility criteria and claiming these reliefs is vital to maximizing your tax refund. Each relief has its own rules and requirements, so it's important to check if you meet the criteria.

Pension Contributions

Individuals who contribute to pensions may be eligible for tax relief on their contributions, a benefit often overlooked.

- Checking contributions made: Regularly review your pension statements to ensure all contributions are accurately recorded.

- Verifying tax relief received: Check your tax return to confirm you've received the correct amount of tax relief.

- Understanding different pension schemes: Different pension schemes have different tax implications. Understanding these nuances is crucial for maximizing tax relief.

Failing to claim tax relief on pension contributions can result in a significant loss of potential savings over time. Ensure you understand the tax relief available to you, depending on the type of pension scheme you contribute to.

How to Check for Hidden HMRC Refunds

Checking for unclaimed refunds is straightforward with the right tools and knowledge.

Accessing Your HMRC Online Account

Regularly checking your HMRC online account is crucial for identifying potential refunds.

- Registering for an online account: If you don't already have one, registering is quick and easy. You'll need your National Insurance number and other personal details.

- Logging in securely: Ensure you use a strong password and follow security best practices.

- Navigating to relevant sections: Your tax summaries and details of any claimed reliefs are all accessible within your online account.

Your HMRC online account provides a clear overview of your tax affairs, making it easy to spot any potential discrepancies or missed opportunities for tax relief.

Using HMRC's Check Your Tax Calculation Tool

HMRC provides a handy tool to verify the accuracy of your tax calculations.

- Accessing the tool: The tool is readily available on the HMRC website.

- Inputting necessary information: You'll need details such as your income, expenses, and other relevant information.

- Interpreting the results: The tool will show you your calculated tax liability and highlight any potential overpayments or underpayments.

While this tool is generally accurate, it’s always a good idea to review the results carefully and consult a tax professional if you're unsure about anything.

Contacting HMRC Directly

If you have any questions or require clarification, contacting HMRC directly is essential.

- Methods of contact: You can contact HMRC by phone, email, or post.

- What information to provide: Be prepared to provide relevant information such as your National Insurance number, tax year, and details of any discrepancies.

- Expected response times: Be aware that response times can vary depending on the method of contact and the complexity of your query.

Keep records of all correspondence with HMRC for your reference.

Claiming Your HMRC Refund

Once you've identified a potential refund, claiming it is relatively straightforward.

Completing the Relevant Forms

HMRC provides various forms for claiming different types of refunds.

- Identifying the correct form: Use the correct form for the specific type of refund you're claiming.

- Gathering necessary documentation: Collect all necessary supporting documents such as payslips, receipts, or bank statements.

- Submitting the form: You can usually submit forms online or by post.

Providing Supporting Evidence

Providing sufficient evidence to support your claim is crucial for a successful outcome.

- Types of acceptable evidence: HMRC specifies the acceptable evidence; ensure you have the right documents.

- Keeping records for future reference: Keep copies of all submitted documents for your records.

Understanding the Timescale

It takes time for HMRC to process refund claims.

- Factors affecting processing time: The complexity of your claim and the volume of applications can affect processing time.

- Potential delays: Be aware that unexpected delays can occur.

- Checking the refund status: You can usually track the status of your claim online through your HMRC account.

Conclusion

Don't let potential hidden HMRC refunds slip away! Take control of your finances and claim back what's rightfully yours. By following the steps outlined in this guide, you can actively check for unclaimed savings and easily claim your hidden HMRC refunds. Start exploring your HMRC online account today and begin your journey towards reclaiming your money! Remember, accessing and regularly checking your HMRC online account is crucial for identifying and claiming all your rightful tax refunds. Don’t delay – start your claim for your hidden HMRC refunds now!

Featured Posts

-

Analyzing Qbts Stocks Potential Movement Following Upcoming Earnings

May 20, 2025

Analyzing Qbts Stocks Potential Movement Following Upcoming Earnings

May 20, 2025 -

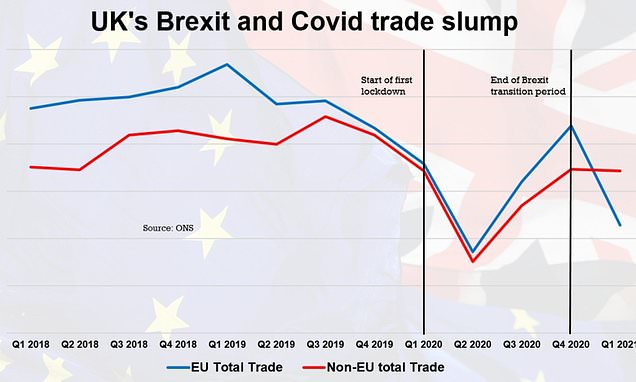

How Brexit Is Affecting Uk Luxury Exports To The Eu

May 20, 2025

How Brexit Is Affecting Uk Luxury Exports To The Eu

May 20, 2025 -

Lufthansa Co Pilot Fainting Incident Flight Flies Pilotless For 10 Minutes

May 20, 2025

Lufthansa Co Pilot Fainting Incident Flight Flies Pilotless For 10 Minutes

May 20, 2025 -

Huuhkajien Kaellmanin Ja Hoskosen Laehtoe Puolasta Vahvistui Mitae Seuraavaksi

May 20, 2025

Huuhkajien Kaellmanin Ja Hoskosen Laehtoe Puolasta Vahvistui Mitae Seuraavaksi

May 20, 2025 -

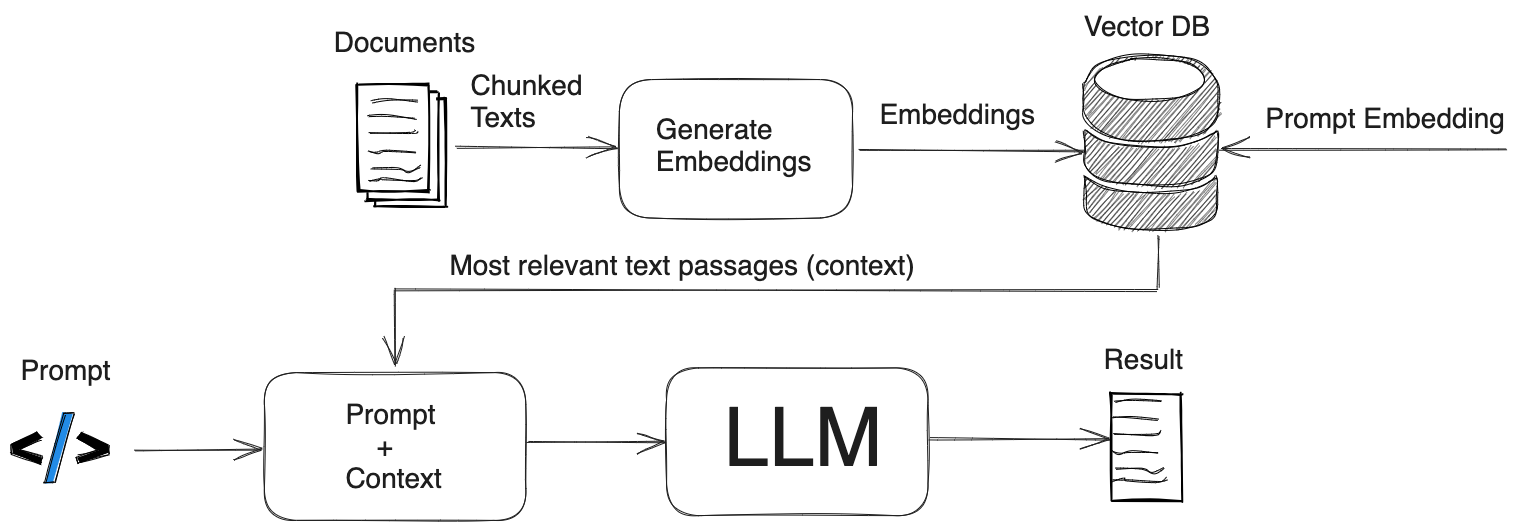

Apples Next Generation Siri Powered By Llms

May 20, 2025

Apples Next Generation Siri Powered By Llms

May 20, 2025