Interest Rate Cuts: Why The Federal Reserve Is Lagging Behind

Table of Contents

The Fed's Dual Mandate and the Inflation Focus

The Federal Reserve operates under a dual mandate: maintaining maximum employment and price stability. Currently, inflation is the primary concern. The soaring Consumer Price Index (CPI) and Producer Price Index (PPI) figures paint a clear picture of the challenges the Fed faces. High inflation erodes purchasing power, reduces consumer confidence, and can lead to economic instability. This necessitates a careful approach to interest rate adjustments.

- High inflation erodes purchasing power and can lead to economic instability. The rising cost of living significantly impacts household budgets, forcing consumers to cut back on spending and potentially triggering a recession.

- The Fed's focus on price stability justifies a more measured approach to interest rate cuts. Premature or aggressive rate cuts risk reigniting inflation before it's sufficiently controlled, leading to a prolonged period of economic uncertainty.

- Aggressive rate cuts risk exacerbating inflation before it's sufficiently controlled. A sudden influx of money into the economy could further fuel demand-pull inflation, making it harder to achieve price stability in the long run.

The trade-offs involved in balancing employment and inflation control are significant. While lower interest rates can stimulate employment, they also risk fueling inflation. The Fed must carefully weigh the potential benefits of stimulating economic growth against the risks of exacerbating inflationary pressures. Recent economic data, including stubbornly high inflation rates despite slowing economic growth, has influenced the Fed's decision-making process, pushing them towards a cautious approach to interest rate cuts.

Concerns about Potential for Further Inflationary Pressures

The Fed's caution stems from lingering concerns about persistent inflationary pressures. Several factors contribute to this apprehension:

- Supply chain disruptions continue to impact prices. While improving, global supply chains remain fragile, susceptible to further shocks that could push prices higher.

- Wage growth, while slowing, remains elevated in some sectors. Strong wage growth, particularly in certain industries, can contribute to cost-push inflation, as businesses pass increased labor costs onto consumers.

- Unexpected geopolitical events could further fuel inflation. Global instability and unforeseen circumstances can significantly disrupt supply chains and energy markets, leading to further price increases.

These factors contribute to the Fed's reluctance to aggressively cut interest rates. Premature rate cuts could lock in high inflation, potentially necessitating even more drastic measures later. The potential negative consequences of such a scenario, including a more severe recession, are significant considerations for the Fed. Analyzing data such as the core CPI (which excludes volatile food and energy prices) provides a more nuanced understanding of underlying inflationary pressures.

Data Dependence and the Gradual Approach

The Federal Reserve's decision-making is highly data-dependent. They carefully analyze various economic indicators before making adjustments to monetary policy.

- CPI (Consumer Price Index) and PPI (Producer Price Index) data are closely monitored. These indices provide crucial insights into the overall price levels in the economy.

- Employment reports, such as the Nonfarm Payroll figures, influence rate decisions. The Fed assesses the labor market's health to understand the impact of its policies on employment.

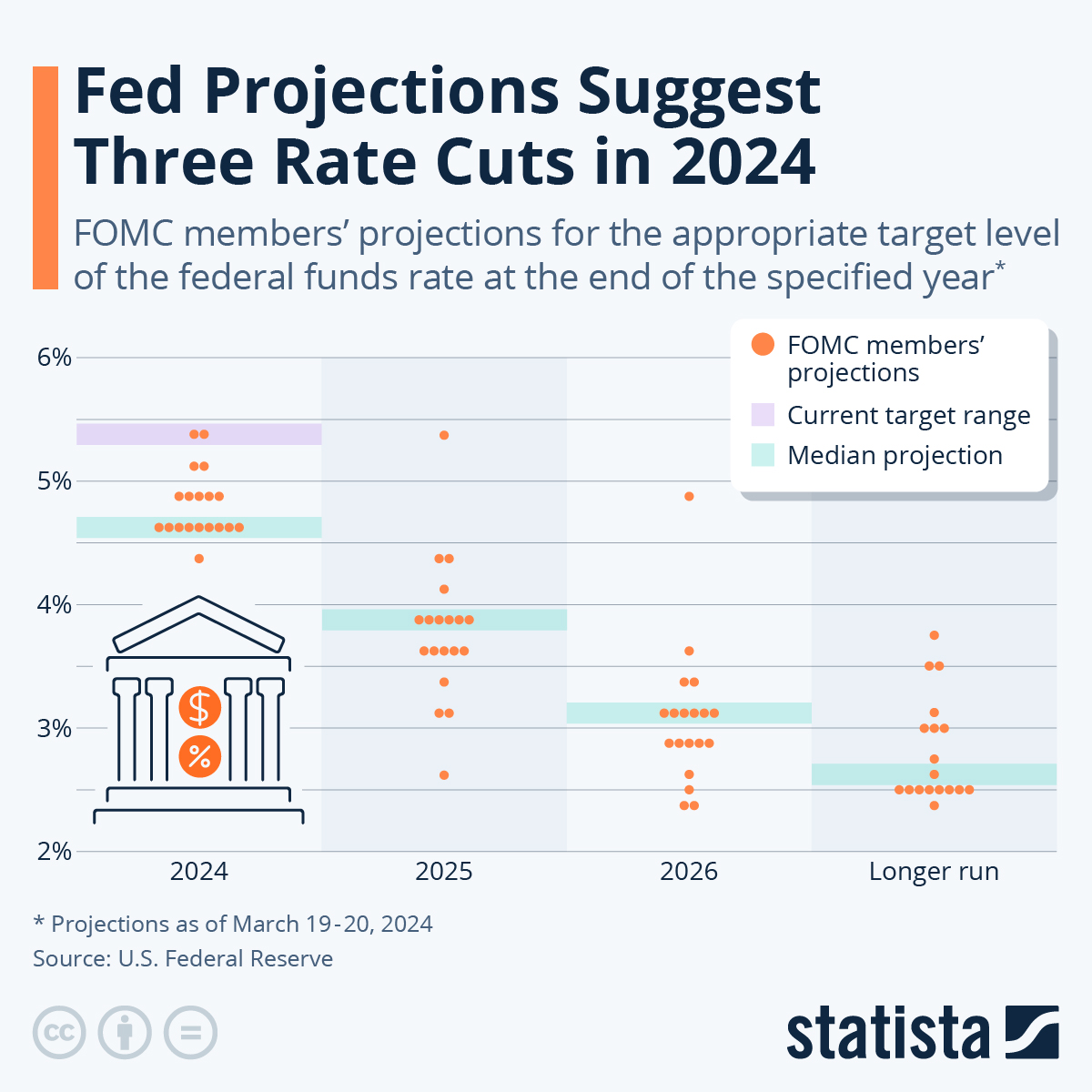

- The Fed prefers a gradual approach to minimize market volatility. Sudden shifts in interest rates can trigger significant market fluctuations, potentially undermining economic stability.

This data-driven approach contributes to the perceived lag in implementing interest rate cuts. The Fed's commitment to a gradual approach ensures that their decisions are informed and minimize unintended consequences. Avoiding abrupt shifts in monetary policy is crucial to maintain market confidence and economic stability.

The Role of Forward Guidance and Market Expectations

The Fed's communication strategy, including forward guidance, shapes market expectations.

- Clear communication is vital to manage market expectations around interest rate adjustments. Transparency helps businesses and investors make informed decisions.

- Unexpected rate cuts can create uncertainty and market volatility. Unforeseen changes can destabilize markets and hinder economic planning.

- Gradual adjustments offer more predictability for businesses and investors. A predictable policy approach fosters confidence and encourages long-term investment.

The importance of transparency and communication in the Fed’s monetary policy decisions cannot be overstated. Managing market expectations influences the timing and pace of interest rate changes, ensuring a smoother transition and minimizing disruption.

Conclusion

The Federal Reserve's approach to interest rate cuts, while perceived by some as lagging, is a carefully considered response to complex economic factors. The dual mandate, concerns about persistent inflation, data dependence, and a commitment to clear communication all contribute to a more measured strategy. Understanding these nuances is crucial for navigating the current economic climate. For further insights into the Federal Reserve's actions and their implications, continue researching current economic indicators and official Fed statements on interest rate policies and future expectations for interest rate cuts. Stay informed about the latest developments in interest rate cuts to make informed financial decisions.

Featured Posts

-

Recent Spike In Bitcoin Mining A Deep Dive

May 09, 2025

Recent Spike In Bitcoin Mining A Deep Dive

May 09, 2025 -

Is 40 Palantir Stock Growth In 2025 Achievable Investment Analysis

May 09, 2025

Is 40 Palantir Stock Growth In 2025 Achievable Investment Analysis

May 09, 2025 -

Palantir Stock Prediction 2 Potential Investments For Higher Returns In 3 Years

May 09, 2025

Palantir Stock Prediction 2 Potential Investments For Higher Returns In 3 Years

May 09, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025 -

Nottingham Attack Survivors Break Silence Their Stories Of Resilience

May 09, 2025

Nottingham Attack Survivors Break Silence Their Stories Of Resilience

May 09, 2025