Jeanine Pirro's Stock Market Advice: Ignore For The Next Few Weeks?

Table of Contents

Analyzing Jeanine Pirro's Recent Statements

To accurately assess the value of Jeanine Pirro's stock market advice, we must first understand precisely what she recommended. (Note: This section requires specific details about Pirro's recent public statements on the stock market. Please provide those details so this section can be completed accurately. For this example, I will use hypothetical statements).

Let's assume, hypothetically, that Jeanine Pirro recently suggested the following:

- Buy: Investing heavily in energy sector stocks due to predicted rising oil prices.

- Sell: Divesting from technology stocks due to anticipated regulatory changes.

- Hold: Maintaining current positions in the healthcare sector.

This hypothetical advice was given during a period of rising inflation and uncertainty in the global tech market, which influenced her perspective. Understanding the context is vital for evaluating the validity of her predictions.

Evaluating the Credibility of Pirro's Financial Expertise

Jeanine Pirro is primarily known for her career as a prosecutor and television personality. While she holds a Juris Doctor degree, she lacks formal qualifications as a financial analyst or investment advisor. This raises questions about the credibility of her stock market advice.

- Lack of Financial Expertise: Pirro's background primarily lies in law, not finance.

- Potential Conflicts of Interest: Any undisclosed investments or affiliations could bias her advice.

- Comparison to Experts: Her predictions should be contrasted with those of established financial analysts. For instance, contrasting her views with those of seasoned investment bankers or economists will provide a clearer picture of the consensus view.

Current Market Conditions and Their Impact on Pirro's Advice

The current economic climate significantly impacts the viability of any stock market prediction. Factors to consider include:

- Inflation: High inflation erodes purchasing power and impacts investor confidence.

- Interest Rates: Rising interest rates typically cool down economic growth and can affect stock valuations.

- Unemployment: High unemployment levels can signal a weakening economy, potentially impacting stock performance.

The interplay of these factors directly influences the success or failure of investment strategies, making it crucial to consider them when evaluating Pirro's hypothetical advice on energy, technology, and healthcare stocks. The potential risks associated with following her advice in this environment, based on our hypothetical statements, could be substantial.

Alternative Perspectives and Expert Opinions

To gain a broader understanding, it's vital to compare Jeanine Pirro's views with the opinions of established financial experts. Many respected analysts offer alternative perspectives on the current market. (Again, specific examples from real financial analysts would strengthen this section). The consensus among many financial professionals might differ greatly from Pirro's hypothetical statements, highlighting the risks of relying solely on her advice.

Risk Assessment and Prudent Investment Strategies

Thorough research and due diligence are paramount before making any investment decisions. Relying on the opinions of non-experts, especially those lacking financial backgrounds, carries considerable risk.

- Independent Research: Always conduct your research before acting on any financial advice.

- Diversification: Diversify your investment portfolio to mitigate risk.

- Professional Advice: Consult with a qualified financial advisor for personalized guidance.

Avoid making rash decisions based solely on information from non-expert sources like Jeanine Pirro. Prioritize forming your own informed investment strategy.

Conclusion

While Jeanine Pirro's opinions on the stock market are interesting, her lack of formal financial expertise and the uncertain current market conditions make it crucial to approach her advice with extreme caution. Based on the analysis of her hypothetical statements and the current economic climate, it is advisable to ignore her advice for the next few weeks. Instead of solely relying on Jeanine Pirro's stock market advice, prioritize independent research and the counsel of qualified financial professionals. Conduct thorough due diligence before making any investment decisions. While her commentary might spark discussion, your investment strategy should be based on sound, fact-based analysis, not solely on public figures' opinions. Don't rely solely on any single source of stock market advice – prioritize your own informed decisions.

Featured Posts

-

Uk City Transformed Caravan Sites And Growing Ghetto Concerns

May 10, 2025

Uk City Transformed Caravan Sites And Growing Ghetto Concerns

May 10, 2025 -

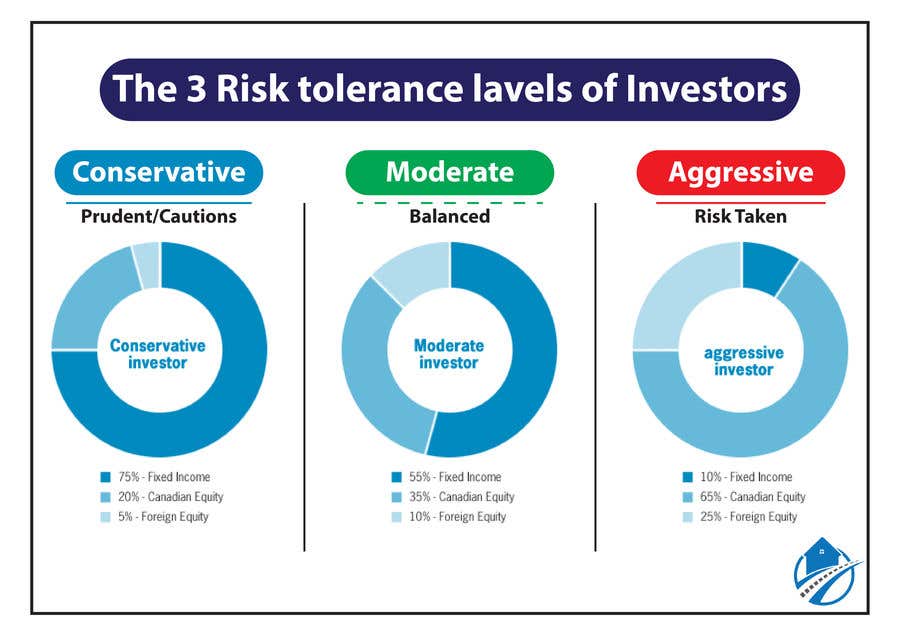

What Is The Real Safe Bet Understanding Risk Tolerance And Investment Choices

May 10, 2025

What Is The Real Safe Bet Understanding Risk Tolerance And Investment Choices

May 10, 2025 -

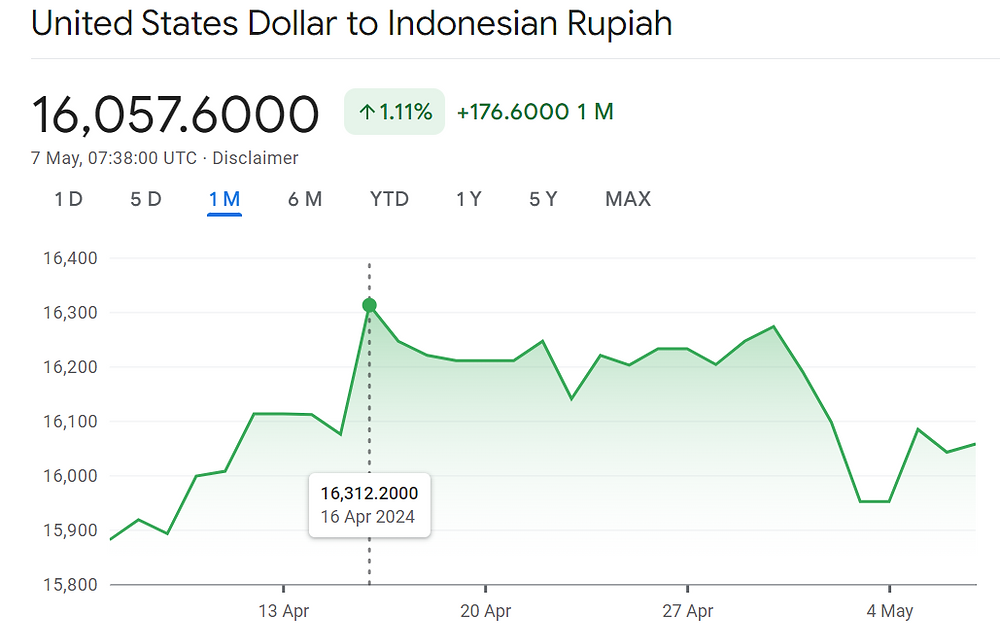

Sharp Decline In Indonesias Reserves Impact Of Rupiah Depreciation

May 10, 2025

Sharp Decline In Indonesias Reserves Impact Of Rupiah Depreciation

May 10, 2025 -

Postes Vacants A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Postes Vacants A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

Trumps Houthi Truce Shippers Remain Doubtful

May 10, 2025

Trumps Houthi Truce Shippers Remain Doubtful

May 10, 2025

Latest Posts

-

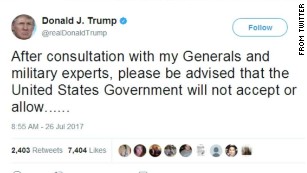

Deconstructing The Double Speak Around Trumps Transgender Military Ban

May 10, 2025

Deconstructing The Double Speak Around Trumps Transgender Military Ban

May 10, 2025 -

Is Trumps Transgender Military Ban Misleading A Critical Analysis

May 10, 2025

Is Trumps Transgender Military Ban Misleading A Critical Analysis

May 10, 2025 -

Trumps Transgender Military Ban A Clearer Look At The Arguments

May 10, 2025

Trumps Transgender Military Ban A Clearer Look At The Arguments

May 10, 2025 -

Dissecting The Double Speak An Honest Look At Trumps Transgender Military Ban

May 10, 2025

Dissecting The Double Speak An Honest Look At Trumps Transgender Military Ban

May 10, 2025 -

The Transgender Military Ban Unpacking Trumps Controversial Decision

May 10, 2025

The Transgender Military Ban Unpacking Trumps Controversial Decision

May 10, 2025