Live Stock Market Updates: Dow Futures Decline, Dollar Dips On Trade Worries

Table of Contents

Dow Futures Decline: Analyzing the Dip

Impact of Trade Tensions

Increased trade tensions between major global economies are a primary driver of the decline in Dow futures. The uncertainty surrounding trade policies, such as new tariffs and escalating trade wars, creates significant volatility and discourages investment. Businesses are hesitant to invest in expansion or new projects when the future of international trade remains unclear.

- Specific examples: The ongoing trade dispute between the US and China, including tariffs on various goods, has significantly impacted numerous sectors, leading to decreased corporate profits and lowered investor confidence.

- Affected companies: Companies heavily reliant on international trade, particularly those with significant operations in China, have experienced considerable stock price declines. Examples include technology companies and manufacturers.

- Data points: As of [Time of writing], Dow futures are down by [Percentage]%, with trading volume exceeding [Volume] shares, indicating significant investor activity and concern.

Other Contributing Factors

Beyond trade tensions, other factors contributed to the Dow's downturn. These include:

- Economic data releases: Weaker-than-expected GDP growth in [Country/Region] raised concerns about global economic slowdown, impacting investor sentiment negatively.

- Geopolitical events: Ongoing geopolitical instability in [Region] added to the overall uncertainty in the market, prompting investors to adopt a more cautious approach.

- Changes in interest rates: [Mention any recent changes in interest rates and their impact on the market].

Dollar Dips Amidst Uncertainty

Inverse Relationship with Risk Appetite

The weakening dollar often inversely correlates with increased risk aversion in the market. When uncertainty rises, investors often move towards "safe-haven" assets like gold, perceived as less risky investments during times of economic or political instability. This increased demand for safe-haven assets puts downward pressure on the dollar.

- Safe-haven assets: Safe-haven assets are considered less volatile and are sought after during times of market stress. They typically include government bonds, gold, and other precious metals.

- Data points: The US dollar index (DXY) has fallen by [Percentage]% today, reflecting the shift in investor sentiment.

- Other safe-haven assets: The price of gold has risen [Percentage]% today, further confirming the increased demand for safe-haven assets.

Impact on Global Trade and Investments

A weaker dollar can significantly impact global trade and investment flows. While it makes US exports more competitive in the global market, it can also increase the cost of imports for US businesses and consumers.

- Sectoral impacts: Industries heavily reliant on imports, such as consumer goods, may face increased costs, while export-oriented sectors could benefit from a weaker dollar.

- Multinational corporations: Multinational corporations with international operations are particularly sensitive to currency fluctuations, as their profits can be significantly affected by exchange rate movements.

- International trade agreements: Currency fluctuations can complicate international trade negotiations and agreements, adding another layer of uncertainty to the global economic landscape.

Navigating Market Volatility: Strategies for Investors

Diversification

Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is a crucial strategy to mitigate risk during periods of market volatility. Don't put all your eggs in one basket!

- Importance of diversification: Diversification helps to reduce the overall risk of your portfolio by spreading investments across different asset classes with varying levels of risk and return.

- Diversification strategies: Consider diversifying geographically as well, investing in companies and assets from various countries to reduce your dependence on any single economy.

Risk Management

Implementing robust risk management strategies is essential for navigating volatile markets. This involves setting realistic expectations and understanding your risk tolerance.

- Stop-loss orders: Stop-loss orders are crucial tools to limit potential losses. They automatically sell your assets when they reach a predetermined price, minimizing your potential losses.

- Risk tolerance: Understanding your personal risk tolerance – your comfort level with potential investment losses – is critical to making appropriate investment decisions. Avoid investments that exceed your risk tolerance.

Staying Informed

Keeping up-to-date on live stock market updates and economic news is essential for informed investment decisions.

- Reliable sources: Utilize reputable financial news sources and market data providers for accurate and timely information.

- Financial analysis tools: Employ financial analysis tools and software to better understand market trends and make data-driven investment decisions.

Conclusion

Today's live stock market updates reveal significant declines in Dow futures and a weakening dollar, primarily due to escalating trade worries and broader economic uncertainty. Understanding these factors and implementing sound investment strategies, including diversification and robust risk management techniques, are crucial for navigating market volatility. Staying informed with continuous live stock market updates and consulting with a financial advisor are vital steps to making informed investment decisions. Continue to monitor live stock market updates and adjust your portfolio accordingly to effectively manage risk and potentially capitalize on opportunities within this dynamic environment.

Featured Posts

-

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025 -

88 Year Old Pope Francis Dies Following Pneumonia Illness

Apr 22, 2025

88 Year Old Pope Francis Dies Following Pneumonia Illness

Apr 22, 2025 -

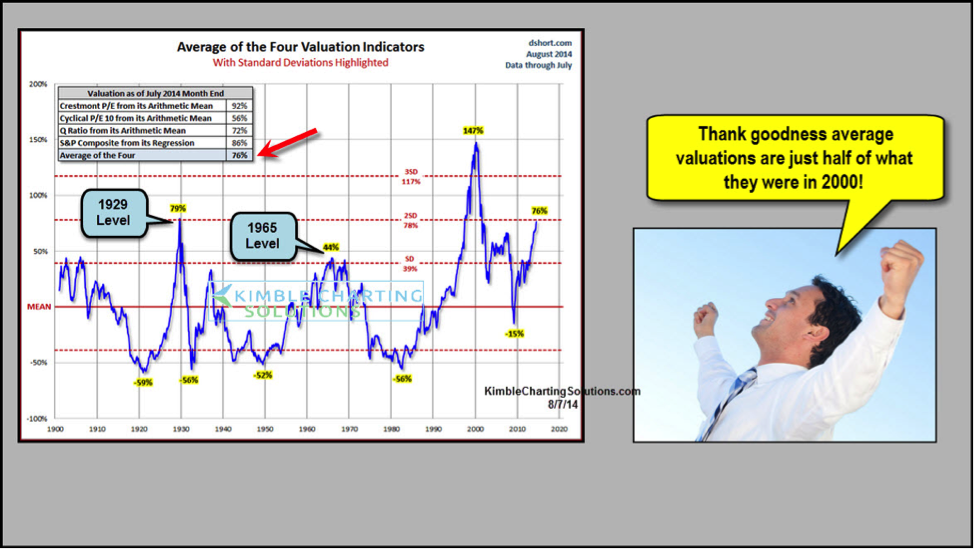

The Bof A View Why Current Stock Market Valuations Are Not A Cause For Alarm

Apr 22, 2025

The Bof A View Why Current Stock Market Valuations Are Not A Cause For Alarm

Apr 22, 2025 -

High Stock Market Valuations Why Investors Shouldnt Panic According To Bof A

Apr 22, 2025

High Stock Market Valuations Why Investors Shouldnt Panic According To Bof A

Apr 22, 2025 -

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025