London Real Estate Fraud: British Court Decision Impacts Vatican

Table of Contents

The Case Details: Unraveling the London Real Estate Fraud

The case revolves around a complex network of fraudulent transactions involving luxury apartments and commercial buildings in prestigious London locations like Mayfair and Knightsbridge. The alleged scheme involved a sophisticated operation using falsified documents, shell companies, and offshore accounts to conceal the true nature of the transactions and launder illicit funds. The scale of the fraud is estimated to be in the tens of millions of pounds, impacting numerous investors.

- Key Players: The investigation implicated several key players, including prominent developers, investment firms, and intermediaries who facilitated the fraudulent transactions. Specific names may be withheld due to ongoing investigations and legal proceedings.

- Methods of Fraud: The perpetrators allegedly used forged documents to inflate property values, falsified financial statements to secure loans, and engaged in bribery to expedite transactions and gain approvals. Money laundering was a significant component of the operation.

- Financial Losses: The financial losses incurred by victims are substantial, impacting both individual investors and larger institutional players, including, as we will see, the Vatican.

The Vatican's Involvement

The Vatican's involvement stems from an investment made through its financial arm in a development project linked to the fraudulent scheme. While the precise details remain partially confidential due to ongoing legal proceedings, it's understood that the Holy See invested a significant sum in a property development that turned out to be part of the broader network of fraudulent activities.

- Nature of Involvement: The Vatican's investment was made through an intermediary firm, highlighting the risks associated with indirect investments and the need for thorough due diligence.

- Financial Losses: While the exact financial loss suffered by the Vatican has not been publicly disclosed, it is believed to be substantial, emphasizing the global reach of this London real estate fraud.

- Vatican's Response: The Vatican has cooperated fully with the British authorities during the investigation and has publicly expressed its commitment to recovering any misappropriated funds. This cooperation highlights the international nature of combating financial crimes.

The British Court Decision and its Ramifications

The British court delivered a landmark judgment, finding several individuals and entities guilty of various charges including fraud, money laundering, and conspiracy to defraud. Significant penalties were imposed, including substantial fines, prison sentences, and asset forfeiture orders. This ruling sets a significant legal precedent for future cases involving complex real estate fraud.

- Significance for Future Transactions: The decision serves as a warning to potential investors in London’s property market and significantly raises the bar for due diligence requirements in real estate transactions.

- Regulatory Changes: The case is likely to prompt reviews of existing regulations and potentially lead to stricter anti-money laundering legislation and enhanced transparency measures within the UK real estate sector.

- Impact on Investor Confidence: While the long-term impact on investor confidence remains to be seen, the case undoubtedly raises concerns and may lead to a more cautious approach to investments in the London property market.

Impact on the Global Real Estate Market and Investor Confidence

The implications of this London real estate fraud extend far beyond the UK. It underscores the global nature of financial crime and highlights the need for enhanced international cooperation to combat illicit activities within the real estate sector.

- International Investment: The case may deter international investors from investing in UK property, particularly those from countries with less stringent anti-money laundering regulations.

- Increased Scrutiny: Expect increased scrutiny of real estate transactions globally, particularly those involving significant sums and cross-border investments. Due diligence will become even more critical.

- Global Transparency: The case reinforces the need for greater transparency and stricter regulations across the luxury property sector globally, emphasizing the need for standardized international practices.

Preventing Future London Real Estate Fraud: Best Practices

Protecting against future real estate fraud requires a multi-pronged approach involving investors, developers, and regulatory bodies.

- Due Diligence: Thorough due diligence is paramount. This includes verifying the identity of all parties involved, scrutinizing property documents, and independently verifying financial statements.

- Transparency and Accountability: Promoting transparency and accountability in the property sector through improved record-keeping and open data initiatives is crucial.

- Anti-Money Laundering Regulations: Robust anti-money laundering regulations and their strict enforcement are vital in preventing the use of the property market for illicit financial activities.

Conclusion

The British court's decision in the high-profile London real estate fraud case involving the Vatican has significant ramifications for the global real estate market. The case underscores the vulnerabilities within the luxury London property sector and the need for increased transparency, stricter regulations, and improved due diligence practices. Understanding the intricacies of London real estate fraud is crucial for anyone involved in the market. Stay informed on developments in this area and take proactive steps to protect yourself against potential scams. Learn more about navigating the complexities of London real estate and mitigating the risks of London real estate fraud.

Featured Posts

-

David Rosenberg On Bank Of Canada Too Timid Too Late

Apr 29, 2025

David Rosenberg On Bank Of Canada Too Timid Too Late

Apr 29, 2025 -

Natural Remedies For Adhd Exploring Holistic Treatment Options

Apr 29, 2025

Natural Remedies For Adhd Exploring Holistic Treatment Options

Apr 29, 2025 -

Louisville Downtown Evacuations Dangerous Natural Gas Levels

Apr 29, 2025

Louisville Downtown Evacuations Dangerous Natural Gas Levels

Apr 29, 2025 -

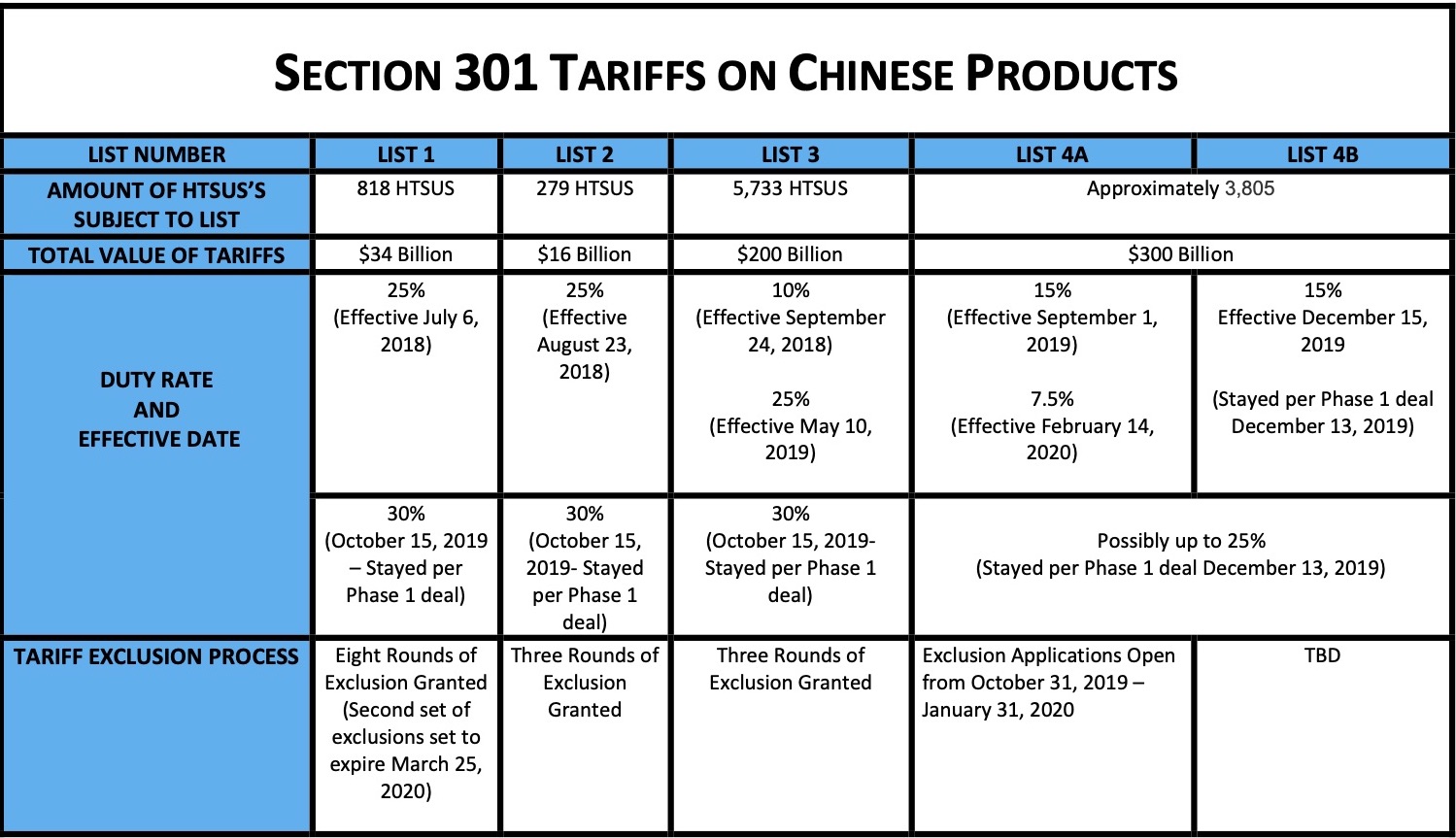

U S Businesses Implement Cost Cutting Strategies In Response To Tariffs

Apr 29, 2025

U S Businesses Implement Cost Cutting Strategies In Response To Tariffs

Apr 29, 2025 -

Aiims Opd Sees Rise In Young People With Adhd Whats The Cause

Apr 29, 2025

Aiims Opd Sees Rise In Young People With Adhd Whats The Cause

Apr 29, 2025