LVMH Q1 Sales Miss Expectations, Shares Drop 8.2%

Table of Contents

Q1 Sales Figures Fall Short of Analyst Predictions

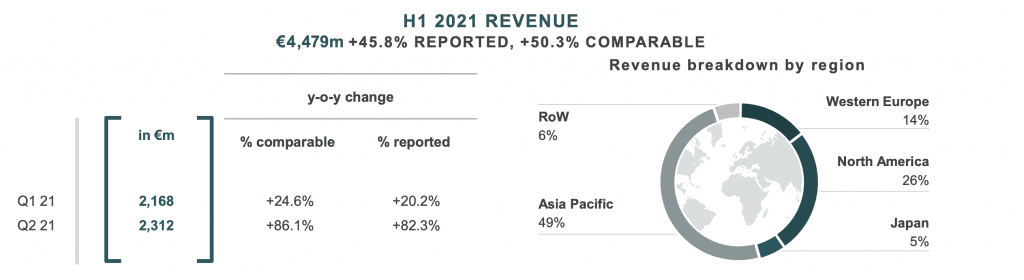

LVMH's Q1 2024 sales figures fell short of analysts' predictions, triggering the significant share price decline. While the exact figures were [insert actual LVMH Q1 sales figures in Euros or relevant currency here], consensus estimates from financial analysts had anticipated [insert analyst consensus figures]. This represents a [insert percentage difference] shortfall against expectations. Specific divisions bore the brunt of this underperformance; for instance, the Fashion & Leather Goods division, a key revenue generator for LVMH, showed [insert percentage growth/decline] compared to the same period last year.

- Specific Sales Numbers: [Insert precise sales figures broken down by division if available, e.g., Fashion & Leather Goods: €X billion, Wines & Spirits: €Y billion]

- Year-on-Year Growth/Decline: [Insert percentage change in sales compared to Q1 2023 for each major division]

- Geographical Breakdown: [Insert data on regional performance, highlighting any significant variations. For example, "Sales in Asia-Pacific were particularly weak, showing a decline of X%."]

Impact of Macroeconomic Factors

Several macroeconomic factors likely contributed to LVMH's disappointing Q1 sales performance. The current global economic climate, marked by persistent inflation, significantly impacts consumer spending, particularly in the luxury goods sector. Consumers are becoming more discerning and cautious with their discretionary spending. Geopolitical instability, including the ongoing war in Ukraine and other regional conflicts, further dampened demand for luxury goods. Supply chain disruptions continue to pose challenges, affecting production and distribution, impacting product availability and potentially increasing costs.

- Inflation's Impact: High inflation erodes purchasing power, leading to reduced consumer spending on non-essential items like luxury goods. The high cost of living affects even high-net-worth individuals, who may postpone luxury purchases.

- Geopolitical Instability: The war in Ukraine and other geopolitical tensions create uncertainty in global markets, impacting consumer confidence and affecting international trade and tourism, crucial for luxury brands.

- Supply Chain Disruptions: Ongoing supply chain issues increase production costs and lead to delays in delivering products to market, potentially impacting sales and customer satisfaction.

Market Reaction and Investor Sentiment

The announcement of LVMH's weaker-than-expected Q1 results immediately triggered a negative market reaction. The 8.2% drop in the company's share price reflects the severity of investor concerns. This significant decline signals a loss of confidence in LVMH's short-term prospects. Financial analysts have expressed mixed views on the company's future performance, with some predicting a recovery while others remain cautious, citing the persistence of macroeconomic headwinds.

- Share Price Movement: [Insert details of share price fluctuations before, during, and after the announcement. Include specific dates and price points if possible.]

- Analyst Quotes: [Include quotes from reputable financial analysts expressing their views on the situation and future projections for LVMH.]

- Investor Confidence: [Discuss any changes in credit ratings or other indicators of investor confidence in LVMH.]

Potential Long-Term Implications for LVMH

The disappointing Q1 performance has significant implications for LVMH's long-term strategy. The company may need to adapt its approach to maintain its market position and profitability. This could involve adjustments to its marketing strategies, pricing policies, and product offerings. Exploring new markets and diversifying its product portfolio might also become key priorities.

- Marketing Strategy Adjustments: LVMH might need to refine its marketing campaigns to better resonate with a potentially more price-sensitive consumer base.

- Pricing and Product Adjustments: Potential price adjustments or the introduction of new product lines targeting a wider range of consumers might be considered.

- Market Diversification: Expanding into new, potentially less volatile markets, could help mitigate risks associated with economic downturns in key regions.

Conclusion: Analyzing the LVMH Q1 Performance and Future Outlook

LVMH's Q1 2024 performance fell significantly short of expectations, resulting in an 8.2% drop in its share price. Macroeconomic factors, including global inflation, geopolitical instability, and supply chain disruptions, contributed significantly to this disappointing outcome. While the short-term outlook remains uncertain, LVMH's long-term prospects depend on its ability to adapt to the evolving market conditions and maintain its position as a leader in the luxury goods sector. The impact of these Q1 results on future LVMH financial reports and the overall luxury goods market remains to be seen. Stay informed on the latest developments in the luxury goods sector and LVMH's performance by following [your website/news source] for continued analysis of LVMH's Q1 results and future financial reports.

Featured Posts

-

Strong Pmi Data Supports Dow Jones Steady Ascent

May 24, 2025

Strong Pmi Data Supports Dow Jones Steady Ascent

May 24, 2025 -

Glastonbury 2024 Unannounced Us Band To Play

May 24, 2025

Glastonbury 2024 Unannounced Us Band To Play

May 24, 2025 -

U S Penny Phase Out No More Pennies In Circulation By Early 2026

May 24, 2025

U S Penny Phase Out No More Pennies In Circulation By Early 2026

May 24, 2025 -

Kering Reports Sales Dip Demnas Gucci Debut Set For September

May 24, 2025

Kering Reports Sales Dip Demnas Gucci Debut Set For September

May 24, 2025 -

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 24, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 24, 2025