Market Volatility Ahead: Billions In Bitcoin And Ethereum Options Expire Soon

Table of Contents

Understanding Crypto Options Expiry and its Impact

Crypto options, like their traditional counterparts, are contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specified amount of Bitcoin or Ethereum at a predetermined price (strike price) on or before a specific date (expiration date). The seller of the option is obligated to fulfill the contract if the buyer exercises their right.

Options expiry is the point at which these contracts cease to exist. If the option is "in the money" (the market price is above the strike price for a call, or below for a put), the buyer may choose to exercise the option, potentially creating significant buying or selling pressure. Conversely, if it's "out of the money," the option expires worthless. This influx of buying or selling pressure near the expiry date can significantly influence the market price of Bitcoin and Ethereum.

- Open Interest: Open interest represents the total number of outstanding options contracts. High open interest before expiry indicates significant potential for market movement as these contracts resolve.

- Buying and Selling Pressure: Expiring options contracts can dramatically increase either buying or selling pressure, depending on whether the contracts are in the money and whether the holders choose to exercise them.

- Institutional Investors: Large institutional investors often participate heavily in options markets, their actions potentially amplifying price movements during expiry periods.

Historical Precedents

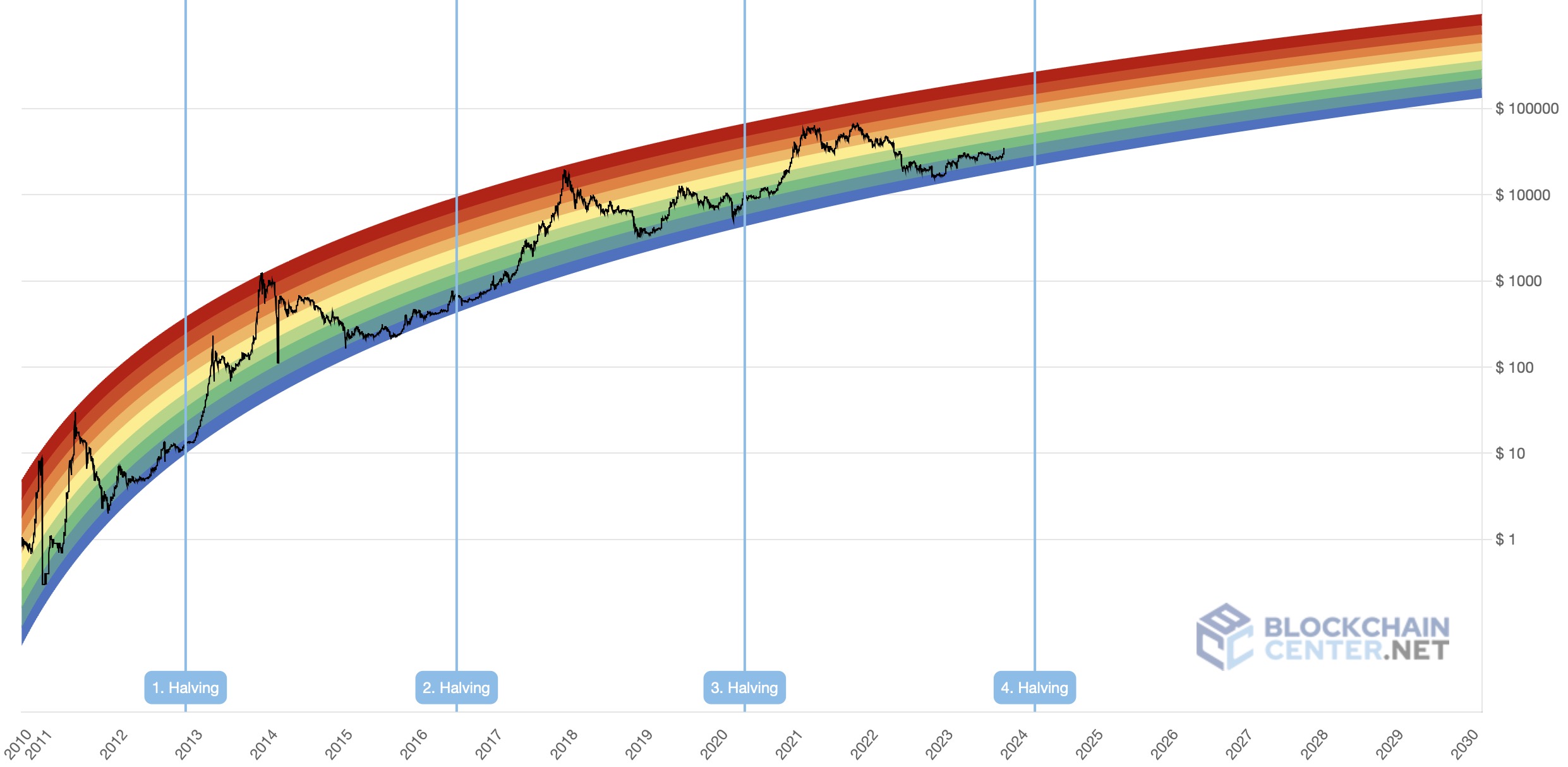

Analyzing past large crypto options expiries reveals a pattern of increased volatility. For example, [insert specific example with data and chart showing price movement around a past options expiry date – ideally referencing a reputable source]. This demonstrates the potential for significant price swings around these events, highlighting the need for careful risk management. [Insert another example with chart, if possible, for a different expiry event]. These historical precedents underscore the importance of understanding the mechanics of options expiry and its potential impact on the crypto market.

Billions at Stake: The Scale of the Upcoming Expiry

The upcoming expiry involves billions of dollars worth of Bitcoin and Ethereum options. Data from [Source - e.g., a reputable cryptocurrency data provider] shows that the total open interest for Bitcoin options is currently at [amount] and for Ethereum options at [amount].

- Expiry Dates: The major expiry dates are [list key dates]. The cumulative effect of these expiries could lead to amplified volatility across the crypto market.

- Strike Price Concentration: A significant concentration of options contracts at specific strike prices suggests that the price could experience substantial movements if the market price approaches these levels.

- Influencing News: [Mention any significant news or events, such as regulatory announcements or major market developments, that might influence the options expiry's impact].

Identifying Potential Price Targets

Based on the open interest and strike price concentration, potential price targets can be estimated. [Include a chart or graph visually representing a price prediction based on the options data, clearly labeling axes and sources]. However, it's crucial to remember that these are merely potential scenarios, and actual price movements may deviate significantly. Factors outside of options expiry, such as general market sentiment and news events, can heavily influence Bitcoin and Ethereum prices.

Navigating the Volatility: Strategies for Traders and Investors

The upcoming volatility presents both challenges and opportunities. Effective risk management is paramount to navigate these turbulent waters successfully.

- Hedging: Hedging strategies, such as using options themselves to offset potential losses in your Bitcoin and Ethereum holdings, can mitigate risk.

- Stop-Loss Orders: Setting stop-loss orders to automatically sell assets when they reach a certain price level can limit potential losses.

- Diversification: Diversifying your crypto portfolio beyond just Bitcoin and Ethereum reduces exposure to volatility specific to those assets.

Opportunities Amidst the Uncertainty

While the potential for losses exists, the increased volatility also creates opportunities for experienced traders.

- Arbitrage: Opportunities for arbitrage – exploiting price differences across different exchanges – could arise during periods of high volatility.

- Scalping: Scalping, a short-term trading strategy, can capitalize on short-term price fluctuations. However, this requires significant technical skills and a high risk tolerance. Always remember to practice rigorous risk management.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves significant risk and may not be suitable for all investors. Conduct thorough research and consult with a financial advisor before making any trading decisions.

Conclusion

The upcoming expiry of billions in Bitcoin and Ethereum options presents a period of heightened uncertainty and increased potential for market volatility. Understanding the scale of the expiry, the dynamics of options trading, and implementing effective risk management strategies are crucial for navigating this potentially volatile period. The potential for significant price swings offers both opportunities and challenges, requiring traders and investors to be well-informed and prepared. The key takeaway is to approach the market with caution, employing risk management techniques, and staying well-informed about market trends. Don't miss out on understanding how the Bitcoin and Ethereum options expiry will impact your crypto portfolio. Learn more about effective options trading strategies and crypto market analysis by visiting [link to relevant resource].

Featured Posts

-

Xrp Etf Approval A Realistic Look At Potential Initial Investment Flows

May 08, 2025

Xrp Etf Approval A Realistic Look At Potential Initial Investment Flows

May 08, 2025 -

Analysis Grand Theft Auto Vis Second Trailer And Its Bonnie And Clyde Pair

May 08, 2025

Analysis Grand Theft Auto Vis Second Trailer And Its Bonnie And Clyde Pair

May 08, 2025 -

Bitcoin Price Prediction Could Trumps 100 Day Speech Send Btc To 100 000

May 08, 2025

Bitcoin Price Prediction Could Trumps 100 Day Speech Send Btc To 100 000

May 08, 2025 -

Can Ripple Xrp Hit 3 40 Analyzing The Potential

May 08, 2025

Can Ripple Xrp Hit 3 40 Analyzing The Potential

May 08, 2025 -

Check Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Check Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025