Market Volatility And Elon Musk's Diminishing Net Worth

Table of Contents

H2: The Impact of Market Volatility on Billionaire Wealth

Market fluctuations are intrinsically linked to the fortunes of high-net-worth individuals. Billionaire wealth, often heavily concentrated in specific sectors like technology, is particularly vulnerable to market shifts. A downturn in the tech sector, for example, can significantly impact the net worth of individuals whose wealth is largely tied to technology stocks.

- Stock Market Downturns: Stock market downturns directly reduce the value of assets held by billionaires. When stock prices fall, the net worth of individuals holding those stocks decreases proportionally.

- Examples: Elon Musk isn't alone. Many other billionaires have witnessed substantial fluctuations in their net worth due to market volatility. This highlights the inherent risk associated with concentrating wealth in volatile assets.

- Diversification: Diversification across asset classes (stocks, bonds, real estate, etc.) is a crucial strategy for mitigating the impact of market volatility. A diversified portfolio can help cushion the blow of losses in one sector.

H2: Tesla Stock Performance and its Influence on Musk's Net Worth

Tesla's stock performance is undeniably a major driver of Elon Musk's net worth. Recent declines in Tesla's stock price, linked to broader market trends like rising interest rates and persistent inflation, have directly contributed to the decrease in his overall wealth.

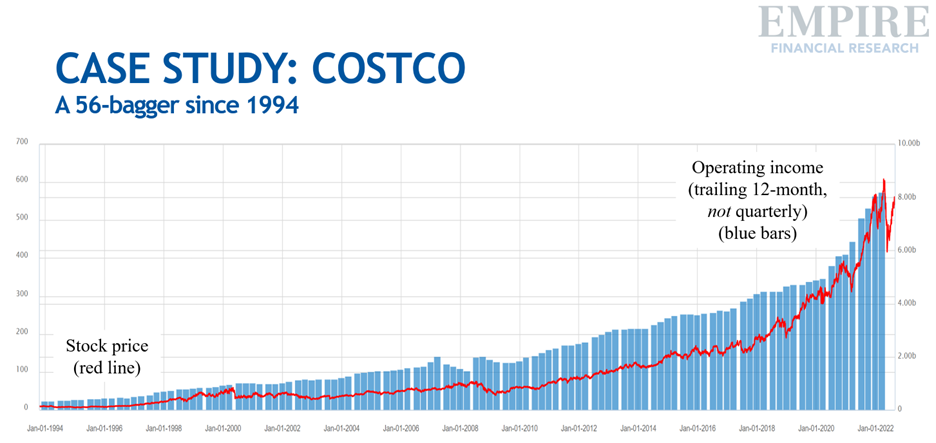

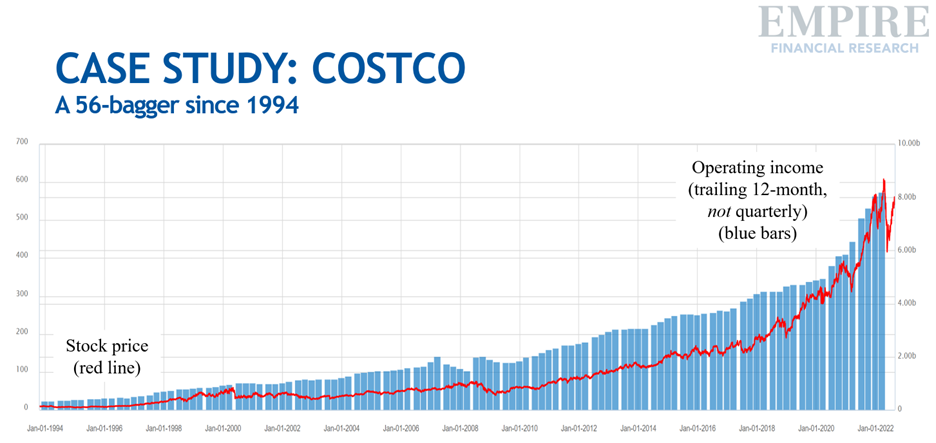

- Tesla Stock Fluctuations: Charts clearly demonstrate a correlation between Tesla's stock price and Musk's net worth. Significant drops in the stock price translate directly into a reduction in his net worth. (Insert relevant chart/graph here)

- Musk's Public Statements: Elon Musk's public statements and actions, often unpredictable and controversial, can significantly influence investor confidence in Tesla. Negative news or controversial tweets can lead to sell-offs, impacting the stock price.

- Long-Term Outlook: The long-term outlook for Tesla remains a subject of debate among analysts. Future innovation, competition, and global economic conditions will all play a significant role in shaping Tesla's stock price and, consequently, Elon Musk's net worth.

H2: The Twitter Acquisition and its Financial Ramifications

The acquisition of Twitter represents a significant financial undertaking for Elon Musk. The substantial debt financing involved, coupled with Twitter's declining advertising revenue, has undoubtedly contributed to the decrease in his net worth.

- Debt Financing: Musk took on considerable debt to finance the Twitter acquisition. Servicing this debt adds a significant financial burden, impacting his overall financial position.

- Declining Advertising Revenue: Twitter's advertising revenue has been declining, creating further financial pressure on the company and, consequently, on Musk's investment.

- Long-Term Risks and Opportunities: The long-term success of Twitter under Musk's ownership remains uncertain. While there are potential opportunities for growth and innovation, there are also considerable risks involved.

H3: Broader Economic Factors Contributing to Market Volatility

Macroeconomic factors play a crucial role in exacerbating market volatility. Inflation, interest rate hikes, and geopolitical instability all contribute to investor uncertainty and influence investment decisions.

- Inflation and Stock Market Performance: High inflation erodes purchasing power and can lead to decreased investor confidence, impacting stock market performance.

- Rising Interest Rates: Rising interest rates increase borrowing costs for businesses and individuals, potentially slowing economic growth and impacting stock valuations.

- Geopolitical Instability: Geopolitical events, such as wars or international tensions, introduce uncertainty into the market, causing investors to become more cautious.

3. Conclusion

Market volatility significantly impacts billionaire net worth, as evidenced by the recent decline in Elon Musk's wealth. Tesla's stock performance is intrinsically linked to his financial standing, and the Twitter acquisition has added a layer of financial complexity. Overarching economic factors, such as inflation and interest rate hikes, further amplify market instability. Understanding these interconnected factors is crucial for navigating the complexities of the global economy.

Call to Action: Understand market volatility and its impact on your investments. Learn more about managing risk today! Stay informed about market trends and the factors influencing billionaire wealth by exploring reputable financial news sources and investment analysis tools. Don't underestimate the power of understanding market volatility to protect your own financial future.

Featured Posts

-

Is The Bitcoin Rebound Sustainable Factors To Consider

May 09, 2025

Is The Bitcoin Rebound Sustainable Factors To Consider

May 09, 2025 -

Investing In Palantir Weighing The Potential For 40 Growth By 2025

May 09, 2025

Investing In Palantir Weighing The Potential For 40 Growth By 2025

May 09, 2025 -

Wynne Evans Dropped From Go Compare Ads After Sex Slur Scandal

May 09, 2025

Wynne Evans Dropped From Go Compare Ads After Sex Slur Scandal

May 09, 2025 -

Kyle Kuzmas Response To Jayson Tatums Controversial Instagram Post

May 09, 2025

Kyle Kuzmas Response To Jayson Tatums Controversial Instagram Post

May 09, 2025 -

Trumps Surgeon General Nominee Examining Casey Means Background And The Maha Movement

May 09, 2025

Trumps Surgeon General Nominee Examining Casey Means Background And The Maha Movement

May 09, 2025