MicroStrategy Vs. Bitcoin Investment: A Comparative Outlook For 2025

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy, a business intelligence company, has famously adopted Bitcoin as a treasury reserve asset. This bold strategy, spearheaded by CEO Michael Saylor, has seen them accumulate a substantial amount of Bitcoin, making them one of the largest corporate holders of the cryptocurrency. This decision significantly impacts their financial statements, creating both opportunities and challenges.

- Rationale: MicroStrategy's Bitcoin purchases are driven by a belief in Bitcoin's long-term value as a store of value and a hedge against inflation. They see it as a superior alternative to traditional fiat currencies.

- Holdings: The size of MicroStrategy's Bitcoin holdings fluctuates with market prices but remains considerable, influencing their overall financial position. Regular updates on their holdings are publicly available.

- Balance Sheet Impact: The value of their Bitcoin holdings directly affects MicroStrategy's balance sheet. While this can lead to significant gains during bull markets, it also exposes them to substantial losses during bear markets. This volatility impacts their reported earnings and overall financial performance.

- Risks: The major risk associated with MicroStrategy's Bitcoin strategy is the inherent volatility of Bitcoin's price. A sharp downturn in the Bitcoin market could significantly impact their financial health and negatively affect investor confidence in the company's stock.

Investing in MicroStrategy Stock as a Proxy for Bitcoin

Investing in MicroStrategy stock offers an indirect way to gain Bitcoin exposure. By owning MicroStrategy shares, you indirectly own a portion of their Bitcoin holdings. However, this approach has its own set of advantages and disadvantages.

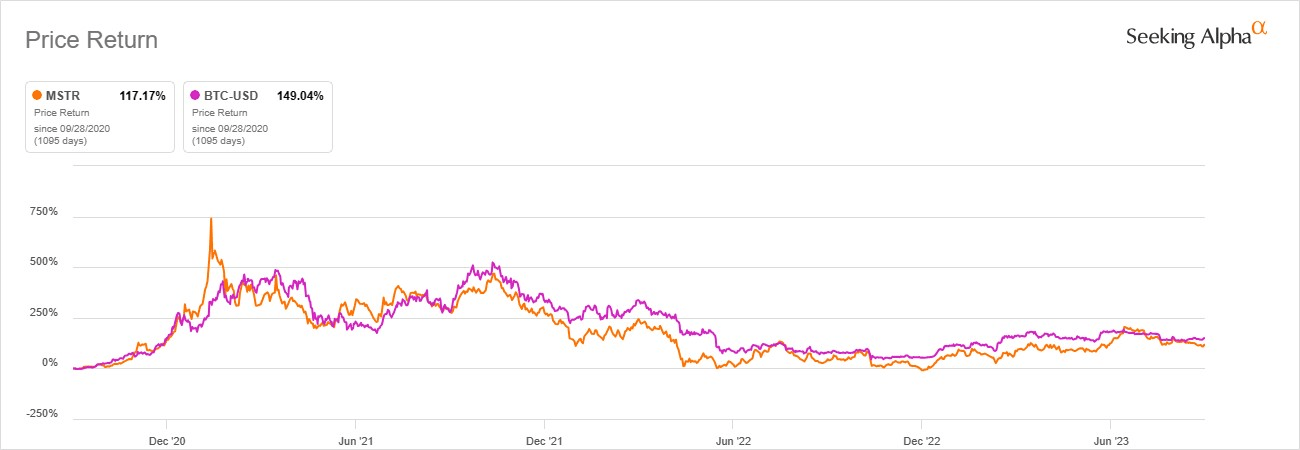

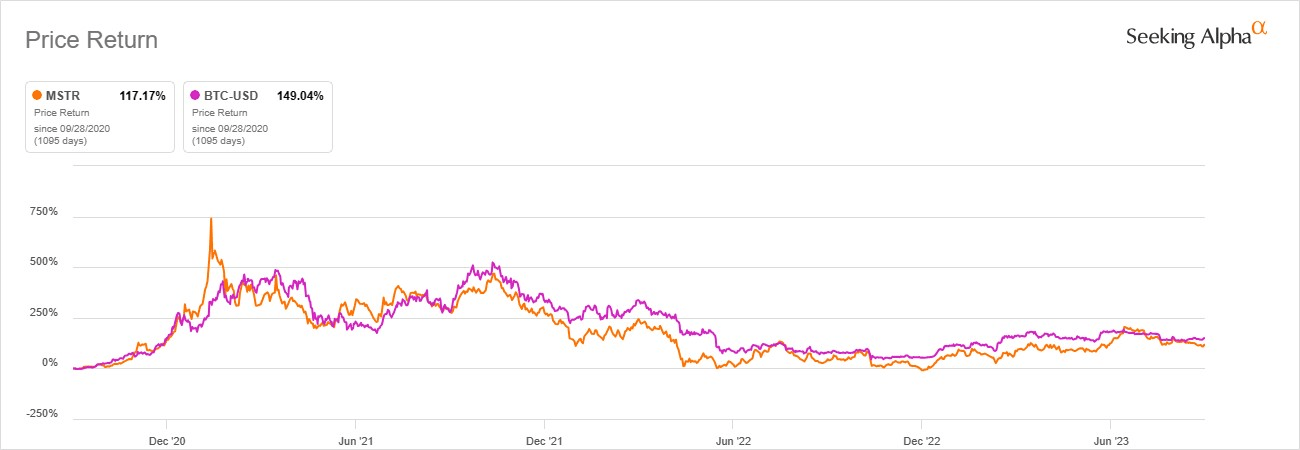

- Correlation: MicroStrategy's stock price is highly correlated with Bitcoin's price. When Bitcoin's value increases, MicroStrategy's stock price generally follows suit, and vice-versa.

- Diversification: This approach offers limited diversification. Your investment is heavily tied to the performance of a single company and the cryptocurrency market, making it a relatively high-risk investment.

- Potential for Higher Returns: MicroStrategy's core business operations could potentially contribute to higher overall returns compared to simply holding Bitcoin. However, this is dependent on the success of their business independent of their Bitcoin holdings.

- Company-Specific Risks: Investing in MicroStrategy carries inherent risks associated with any individual company, including management decisions, operational challenges, and broader economic factors impacting their business.

Direct Bitcoin Investment: Risks and Rewards

Understanding Bitcoin's Volatility and Market Dynamics

Direct Bitcoin investment offers greater control but involves significant risks. The cryptocurrency market is known for its extreme volatility.

- Volatility: Bitcoin's price has historically shown significant fluctuations, experiencing both dramatic gains and steep losses.

- Regulatory Uncertainty: Regulatory landscapes around Bitcoin are still evolving, and changes in regulations could significantly impact its value and accessibility.

- Self-Custody Risks: Storing Bitcoin yourself (self-custody) requires strong security measures to prevent theft or loss. Losing your private keys means losing access to your Bitcoin.

- Psychological Challenges: Holding Bitcoin through periods of significant market downturns can be psychologically challenging, requiring a long-term perspective and risk tolerance.

Strategies for Direct Bitcoin Investment

Several ways exist to invest in Bitcoin directly, each with its own set of implications.

- Investment Strategies: Dollar-cost averaging (DCA), where you invest a fixed amount regularly regardless of price, can help mitigate risk compared to lump-sum investing, where you invest a large amount at once.

- Secure Storage: Using secure storage methods like hardware wallets is crucial for protecting your Bitcoin from theft or loss. Exchanges offer convenience but carry custodial risks.

- Fees and Costs: Trading fees, network fees (gas fees), and storage costs can eat into profits, so consider these expenses when planning your investment strategy.

Comparative Analysis: MicroStrategy vs. Direct Bitcoin Investment in 2025

Risk Tolerance and Investment Goals

The suitability of investing in MicroStrategy versus Bitcoin directly depends heavily on your risk tolerance and investment goals.

- Risk Profiles: Direct Bitcoin investment carries significantly higher risk than investing in MicroStrategy stock, which offers some diversification through its business operations.

- Potential Returns/Losses: Both strategies offer the potential for substantial returns but also expose investors to significant losses. Direct Bitcoin investment has a higher potential upside and downside.

- Investment Time Horizon: Direct Bitcoin investment may be better suited for long-term investors with a higher risk tolerance, while MicroStrategy stock might appeal to investors seeking slightly less volatile exposure.

Predicting Future Performance

Predicting the future performance of both MicroStrategy and Bitcoin in 2025 is inherently speculative. However, considering market factors and potential regulatory changes offers a glimpse into potential scenarios. (Disclaimer: This is speculative analysis and should not be considered financial advice.)

- Market Factors: Macroeconomic conditions, adoption rates of Bitcoin, and technological advancements in the cryptocurrency space will all influence prices.

- Regulatory Changes: Government regulations could significantly impact both Bitcoin's price and MicroStrategy's business operations. Positive regulatory developments might drive up prices, while negative ones could cause downturns.

- Potential Scenarios: Both investments carry the potential for substantial gains or losses. A bullish Bitcoin market would likely benefit both, while a bearish market would negatively affect both.

Conclusion

This comparative analysis of MicroStrategy versus direct Bitcoin investment highlights the diverse approaches to gaining exposure to the cryptocurrency market. Investing in MicroStrategy offers indirect exposure with the added element of a publicly traded company’s performance, while direct Bitcoin investment offers greater control and potential for higher returns, but with significantly higher risk. The best approach depends on your individual risk tolerance, investment goals, and understanding of the volatile nature of Bitcoin. Carefully consider your options before making a decision regarding MicroStrategy vs Bitcoin investment and consult with a financial advisor if needed. Start your research today to make an informed investment decision for 2025.

Featured Posts

-

Lahwr Ke Telymy Adarwn Ke Nye Shydwl Py Ays Ayl 2024

May 08, 2025

Lahwr Ke Telymy Adarwn Ke Nye Shydwl Py Ays Ayl 2024

May 08, 2025 -

A Look Back The Best Krypto Stories Ever Written

May 08, 2025

A Look Back The Best Krypto Stories Ever Written

May 08, 2025 -

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025 -

The Long Walk Trailer Stephen Kings Bleakest Story On Film

May 08, 2025

The Long Walk Trailer Stephen Kings Bleakest Story On Film

May 08, 2025