Palantir Technologies: Buy Or Sell Before May 5th? Wall Street's View

Table of Contents

Recent Palantir Technologies Performance and Financial Results

Understanding Palantir's recent financial health is crucial for any investment decision. Analyzing key performance indicators (KPIs) like revenue growth, profitability, and operating margins provides valuable insights into the company's trajectory. Let's delve into the details:

-

Quarterly Earnings Reports: Palantir's recent quarterly earnings reports have shown [insert specific data on revenue growth percentage, profitability, and key performance indicators from recent reports]. These figures [reflect positive or negative growth/trends, explain why]. This data needs to be backed up by verifiable sources for accuracy.

-

Financial Outlook: The company's outlook for [mention the coming quarter/year] indicates [explain the company's projected growth, profitability, and potential challenges based on official statements]. Analyzing these projections is essential to predict future stock price movements.

-

Analyst Estimates: Analyst estimates for Palantir's upcoming quarters have [mention if estimates have been revised upwards or downwards and explain the reasoning behind it]. Understanding the rationale behind these revisions can inform your investment strategy.

-

Competitor Analysis: Comparing Palantir's performance against competitors like [mention key competitors in the big data analytics market, e.g., Databricks, Snowflake] reveals [mention how Palantir stacks up against its competition in terms of market share, revenue growth, and innovation].

-

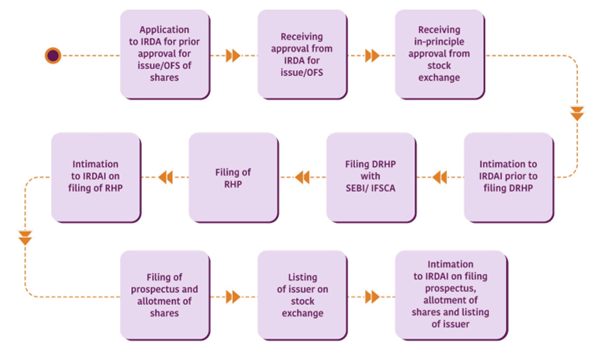

Visual Representation: [Include relevant charts and graphs to visually represent financial data, such as revenue growth over time, profit margins, and stock price performance. Ensure these are sourced and clearly labeled].

Wall Street Analyst Ratings and Price Targets for Palantir

Wall Street analysts provide valuable insights, albeit with varying viewpoints. Understanding the consensus rating and price targets can offer a clearer picture of the market sentiment surrounding PLTR stock.

-

Consensus Rating: The current consensus rating among leading Wall Street analysts for Palantir is [mention the overall consensus – buy, sell, or hold – and cite sources]. This reflects the overall sentiment towards the stock's future performance.

-

Price Targets: Analyst price targets for Palantir stock range from [mention the lowest price target] to [mention the highest price target]. The wide range indicates [explain the reasons for the varying price targets – differing views on future growth, risk assessment, etc.].

-

Rationale Behind Ratings: Analysts' differing opinions stem from [explain the reasons for the different ratings, for example, some might emphasize the strong government contract pipeline while others might highlight the high stock valuation or competitive landscape]. It's crucial to understand these nuances before making any investment decisions.

-

Specific Analyst Views: [Mention specific analysts and their ratings and price targets, citing their reports or statements. For example, "Analyst X at Firm Y issued a buy rating with a $XX price target, citing…"].

-

Implications for Investors: These ratings and price targets provide valuable information but shouldn't be considered the sole basis for investment decisions. Individual investors should conduct their own thorough research and consider their personal risk tolerance.

Key Factors Influencing Palantir's Stock Price Before May 5th

Several factors beyond Palantir's financials can significantly influence its stock price. Understanding these external forces is crucial for predicting potential price movements.

-

Market Sentiment: The overall market sentiment (bullish or bearish) can greatly impact Palantir's stock price, regardless of the company's performance. [Explain current market conditions and their potential influence on PLTR].

-

Geopolitical Risks: Geopolitical instability can create uncertainty and affect investor confidence in tech stocks, including Palantir. [Discuss any relevant geopolitical events and their potential impact on Palantir's business, especially government contracts].

-

Competition: Increased competition in the big data analytics market could put pressure on Palantir's growth and profitability. [Analyze the competitive landscape and the potential threat from competitors].

-

Government Contracts: Palantir relies heavily on government contracts. Changes in government spending or policy could significantly impact its revenue and future growth. [Discuss the significance of government contracts to Palantir's revenue and future growth].

-

Technological Innovation: Palantir's ability to innovate and adapt to the changing technological landscape will be crucial for its long-term success. [Discuss Palantir's ongoing technological innovation and its potential impact on its future performance].

Risks and Opportunities Associated with Investing in Palantir Before May 5th

Before investing in Palantir, it's vital to assess both the potential upside and downside risks.

-

Investment Risks: Investing in Palantir involves several risks, including high stock price volatility, dependence on government contracts, and competition from larger established players. [Provide specific examples and explain the potential impact of these risks].

-

Potential Upside: Despite the risks, Palantir has significant growth potential in the rapidly expanding big data analytics market. Its unique technology and strong government relationships provide a competitive advantage. [Highlight the potential upside, such as market expansion, new product launches, and increased profitability].

-

Risk-Reward Profile: The risk-reward profile of Palantir stock is [explain whether it's high-risk/high-reward, or low-risk/low-reward, and justify your assessment]. Investors should carefully consider their risk tolerance before making any investment decisions.

-

Specific Examples: [Provide specific examples of potential risks and opportunities. For instance, a risk might be a loss of a major government contract, while an opportunity might be the successful expansion into a new market segment].

Conclusion

The decision to buy or sell Palantir Technologies stock before May 5th requires careful consideration of the mixed signals from Wall Street, Palantir's financial performance, and the various external factors that may influence its stock price. While Palantir offers significant growth potential in the big data analytics market, investors should carefully weigh the inherent risks, particularly its dependence on government contracts and the competitive landscape. Remember, this analysis offers insights, not financial advice.

Call to Action: Ultimately, the decision to buy or sell Palantir Technologies stock (PLTR) before May 5th, or at any time, is a personal one. Conduct thorough due diligence, consider consulting a financial advisor, and carefully assess your risk tolerance before making any investment decisions regarding Palantir stock. Weigh the potential risks and rewards carefully before investing in Palantir. Remember to regularly review your investment strategy and adjust as needed based on new information.

Featured Posts

-

The Bangkok Post And The Push For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Push For Transgender Equality In Thailand

May 10, 2025 -

Regulatory Relief Urged By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Relief Urged By Indian Insurers For Bond Forwards

May 10, 2025 -

High Potential The Surprising Choice For The Actor Playing David In Episode 13

May 10, 2025

High Potential The Surprising Choice For The Actor Playing David In Episode 13

May 10, 2025 -

Air Traffic Safety Crisis Internal Warnings Ignored Before Newark System Failure

May 10, 2025

Air Traffic Safety Crisis Internal Warnings Ignored Before Newark System Failure

May 10, 2025 -

February 15th Nyt Strands Solutions Game 349

May 10, 2025

February 15th Nyt Strands Solutions Game 349

May 10, 2025

Latest Posts

-

Analysis The Uks New Approach To Student Visas And Asylum

May 10, 2025

Analysis The Uks New Approach To Student Visas And Asylum

May 10, 2025 -

Proposed Changes To Uk Student Visas And Asylum Claims

May 10, 2025

Proposed Changes To Uk Student Visas And Asylum Claims

May 10, 2025 -

Uk Government Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka Analysis

May 10, 2025

Uk Government Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka Analysis

May 10, 2025 -

Visa Crackdown Uks Potential New Rules For Pakistani Nigerian And Sri Lankan Applicants

May 10, 2025

Visa Crackdown Uks Potential New Rules For Pakistani Nigerian And Sri Lankan Applicants

May 10, 2025 -

Uk Government Announces Stricter Visa Policies For Nigeria And Pakistan

May 10, 2025

Uk Government Announces Stricter Visa Policies For Nigeria And Pakistan

May 10, 2025