PFC's Action Against Gensol Promoters: EoW Based On Fake Documents

Table of Contents

The Allegations Against Gensol Promoters

The allegations against Gensol's promoters are serious and involve a range of fraudulent activities aimed at misleading investors and manipulating the market. The PFC investigation centers on accusations of deliberate misrepresentation of the company's financial health and operational performance. This alleged deception appears to have been orchestrated to inflate the company's valuation and attract investments.

- Falsification of financial statements: The PFC alleges that Gensol's promoters manipulated financial records, inflating revenues and profits to present a more positive picture than the reality. This includes potential misreporting of assets, liabilities, and expenses.

- Misrepresentation of company performance: Beyond falsified financials, accusations include misleading statements about the company's projects, operational capabilities, and future prospects. These misrepresentations were allegedly used to attract investors and secure funding.

- Use of forged documents to secure funding or other advantages: A key element of the PFC's case is the alleged use of forged documents. These documents were supposedly used to obtain loans, secure contracts, or gain other advantages for the company.

- Potential insider trading: The investigation also explores the possibility of insider trading, where promoters may have used non-public information to their advantage, potentially harming other investors.

- Violation of SEBI regulations: The alleged actions constitute serious breaches of various SEBI regulations concerning transparency, disclosure, and fair trading practices.

The PFC's Investigation and Evidence

The PFC's investigation into PFC's action against Gensol promoters was thorough and meticulous, employing various methods to gather evidence. The investigation spanned several months and involved a team of experts.

- Timeline of the investigation: The investigation commenced [Insert Start Date, if available], following initial complaints and suspicious activity reports. The investigation involved numerous stages, including document review, witness interviews, and forensic analysis.

- Methods used to gather evidence: The investigation utilized forensic accounting techniques to analyze Gensol's financial records, identify discrepancies, and trace the flow of funds. Witness testimonies from former employees and other stakeholders provided valuable insights into the alleged fraudulent schemes.

- Key pieces of evidence supporting the allegations: The PFC has reportedly uncovered significant evidence, including forged contracts, manipulated financial documents, and email communications that allegedly demonstrate the promoters' intent to defraud investors. (Note: Specific details of evidence are not disclosed here to maintain confidentiality).

- Role of forensic experts in validating the forged documents: Forensic document examiners played a crucial role in establishing the authenticity of the documents. Their expertise was critical in proving the forgery, supporting the PFC’s case against the promoters.

The Enforcement of Warrant (EoW): Implications and Next Steps

The issuance of the EoW against Gensol's promoters has significant legal implications. This is a major step in the legal process, signaling the PFC's determination to hold the promoters accountable.

- Potential penalties and sanctions: The promoters face severe penalties, including hefty fines, imprisonment, and potential debarment from the securities market.

- Impact on the company's reputation and stock price: The allegations have already significantly damaged Gensol's reputation, leading to a likely negative impact on its stock price and investor confidence.

- Further investigations and potential legal proceedings: The EoW is just one stage in the process. Further investigations are likely, potentially leading to protracted legal battles and civil lawsuits.

- Possible consequences for investors: Investors who suffered losses due to the alleged fraudulent activities may have grounds to pursue legal action to recover their investments.

- The ongoing legal battle and likely next steps in the process: The case is expected to go through a lengthy legal process, including potential appeals and court hearings. The next steps will largely depend on the outcome of the ongoing investigation and legal proceedings.

The Wider Implications for the Renewable Energy Sector

The PFC's action against Gensol promoters has broader implications for the renewable energy sector in India. It highlights the importance of robust regulatory oversight and underscores the risks associated with fraudulent activities within this rapidly growing industry.

- Increased scrutiny of companies in the sector: This case is likely to lead to increased scrutiny of other renewable energy companies, prompting regulators to enhance their surveillance and enforcement efforts.

- Potential tightening of regulatory frameworks: SEBI may introduce stricter regulations and compliance requirements to prevent similar incidents in the future.

- Impact on future investments in renewable energy projects: Investor confidence in the sector may be temporarily affected, potentially slowing down investments in new projects until the dust settles and greater transparency is ensured.

- Importance of due diligence for investors: The case underlines the crucial importance of conducting thorough due diligence before investing in any company, especially in a relatively new and rapidly evolving sector.

Conclusion

PFC's action against Gensol promoters, based on the alleged use of forged documents, sends a strong message regarding zero tolerance for fraudulent activities in the Indian securities market. The EoW highlights the importance of stringent regulatory oversight and due diligence for investors. This case underscores the risks associated with investing in companies with questionable practices and the potential consequences for those involved in fraudulent schemes. Understanding the intricacies of PFC's action against Gensol promoters and similar cases is crucial for all investors to protect themselves from fraudulent activities in the market. Stay informed about the ongoing developments in this case and others like it by following reputable financial news sources. Learn more about investor protection and due diligence to make informed investment decisions.

Featured Posts

-

Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Guidance

Apr 27, 2025

Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Guidance

Apr 27, 2025 -

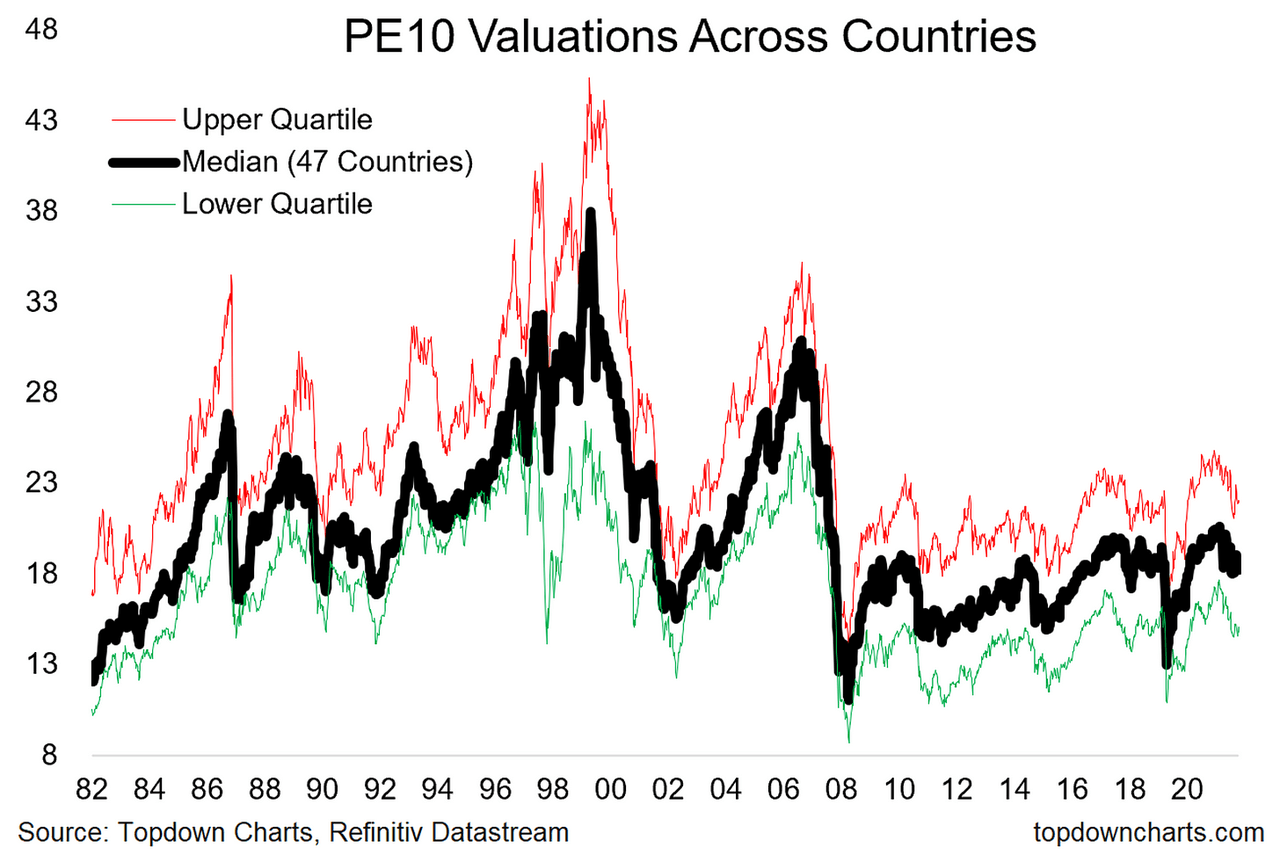

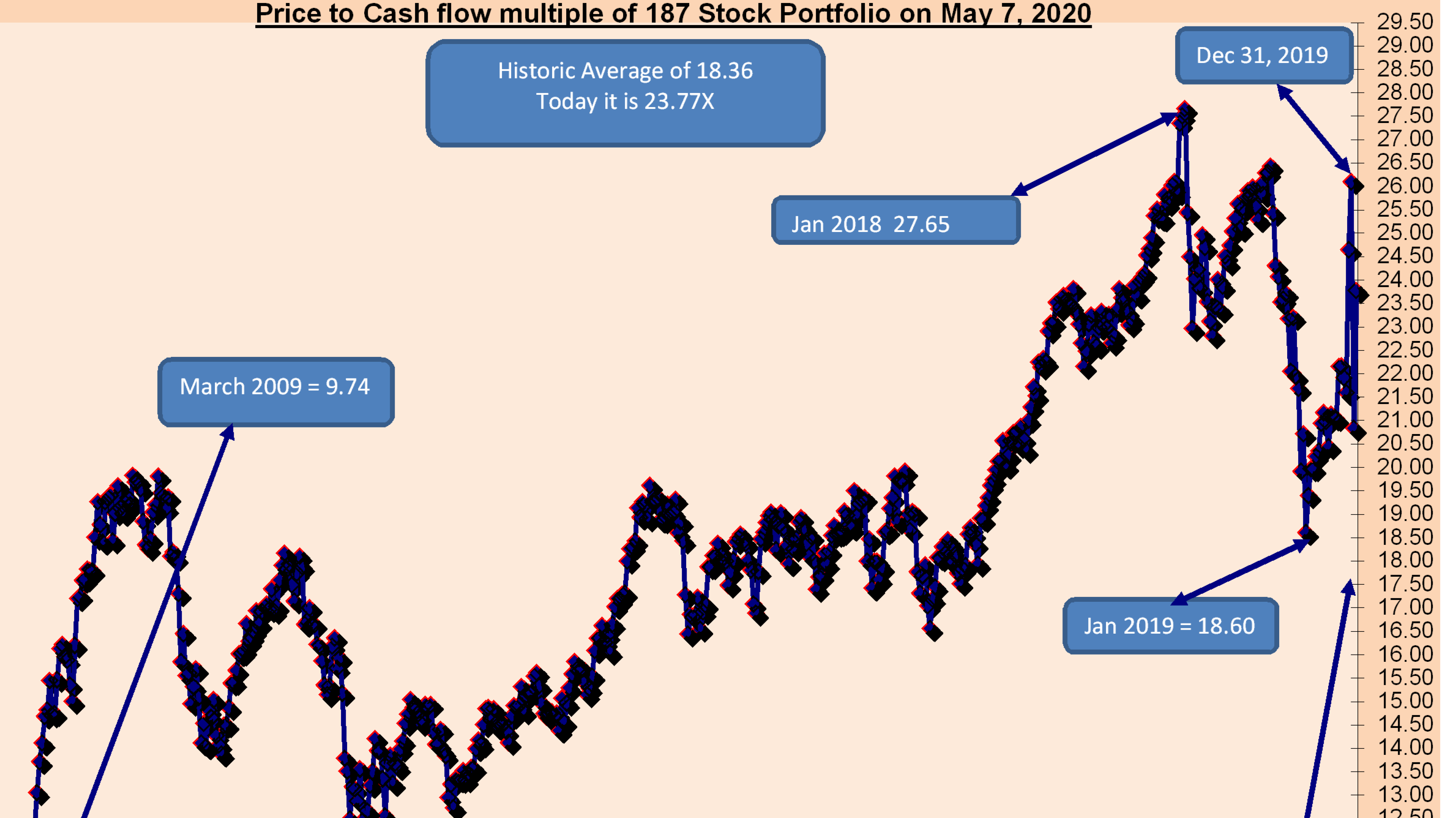

Bof As View Why High Stock Market Valuations Are Not A Red Flag For Investors

Apr 27, 2025

Bof As View Why High Stock Market Valuations Are Not A Red Flag For Investors

Apr 27, 2025 -

Investors Bof As Reasons To Remain Calm Despite High Stock Market Valuations

Apr 27, 2025

Investors Bof As Reasons To Remain Calm Despite High Stock Market Valuations

Apr 27, 2025 -

Local Jeweler Aids Nfl Players Fresh Start In Mc Cook

Apr 27, 2025

Local Jeweler Aids Nfl Players Fresh Start In Mc Cook

Apr 27, 2025 -

Pne Group Expands Wind Energy Portfolio With Two New Farms

Apr 27, 2025

Pne Group Expands Wind Energy Portfolio With Two New Farms

Apr 27, 2025

Latest Posts

-

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 28, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 28, 2025 -

Open Ai Facing Ftc Probe Concerns Regarding Chat Gpts Data Practices

Apr 28, 2025

Open Ai Facing Ftc Probe Concerns Regarding Chat Gpts Data Practices

Apr 28, 2025 -

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025 -

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 28, 2025 -

Hollywood Production Halted Writers And Actors Strikes Combine

Apr 28, 2025

Hollywood Production Halted Writers And Actors Strikes Combine

Apr 28, 2025