Pound Sterling Gains After UK Inflation Report Dampens BOE Rate Cut Speculation

Table of Contents

UK Inflation Data Surprises Markets

The recently released UK inflation figures significantly diverged from analysts' predictions, sending shockwaves through the financial markets. The unexpected strength in inflation indicates a more resilient economy than previously anticipated, impacting the BOE's monetary policy decisions. This unexpected resilience challenges the narrative of a weakening economy necessitating further rate cuts.

- CPI (Consumer Price Index): The CPI rose to X%, exceeding the forecasted Y% and significantly higher than last month's Z%.

- RPI (Retail Price Index): Similar upward pressure was observed in the RPI, reaching A% against predictions of B%.

- Core Inflation: Excluding volatile energy prices, core inflation remained stubbornly high at C%, suggesting underlying inflationary pressures within the UK economy. This persistent core inflation is a key factor influencing the BOE's decision-making.

- Impact of Energy Prices: While energy prices have shown some moderation, their influence on overall inflation remains significant, contributing to the higher-than-expected figures.

BOE Rate Cut Speculation Diminishes

The unexpectedly high inflation figures have considerably reduced market expectations of an imminent BOE rate cut. The central bank is now less likely to further loosen monetary policy, a development that has positively impacted the Pound Sterling. This shift in sentiment reflects a reassessment of the UK's economic outlook.

- BOE Monetary Policy Stance: The BOE's current stance appears to be one of cautious observation, monitoring the evolving economic data before making any further decisions regarding interest rates.

- Analyst Forecasts: Many analysts have revised their forecasts, now predicting a lower probability of a rate cut in the near term, or even the possibility of a rate hike further down the line.

- Impact on Borrowing Costs: The diminished likelihood of a rate cut will likely maintain borrowing costs for businesses and consumers at their current levels, potentially impacting investment and spending decisions.

Pound Sterling's Reaction and Market Impact

The Pound Sterling’s response to the inflation data was immediate and pronounced. The GBP strengthened significantly against major global currencies, reflecting increased investor confidence in the UK economy.

- GBP/USD: The Pound rose against the US dollar, reaching a level not seen in several months.

- GBP/EUR: Similar gains were observed against the Euro, indicating increased demand for the Pound within the European market.

- GBP/JPY: Strengthening was also evident against the Japanese Yen.

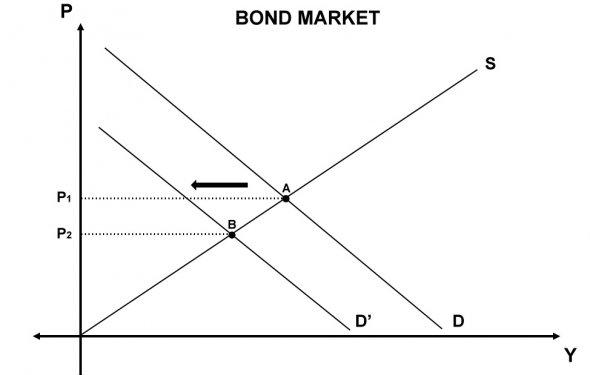

- Impact on UK Assets: The increased confidence resulted in a rise in the prices of UK government bonds and equities.

- Market Sentiment: Overall market sentiment towards the GBP is now more optimistic, driven by the positive inflation surprise.

Long-Term Outlook for the Pound Sterling

While the short-term outlook for the Pound Sterling is positive, the long-term trajectory remains subject to several factors. Continued economic growth, alongside global economic stability, will be crucial in sustaining the Pound’s strength. However, uncertainties remain.

- Brexit’s lingering effects: The long-term impacts of Brexit on the UK economy continue to be a source of uncertainty for the Pound Sterling.

- Global Economic Conditions: Global economic downturns or geopolitical events could negatively impact the GBP.

- Political Stability: Domestic political stability is also a crucial factor influencing investor confidence and GBP valuations.

- Analyst Predictions: Analysts' predictions for the GBP vary, with some forecasting further gains while others highlight potential risks.

Conclusion: Understanding the Pound Sterling's Rise

The Pound Sterling's recent surge is a direct consequence of the unexpected UK inflation data, which has significantly reduced expectations of a BOE rate cut. This development has boosted investor confidence, leading to increased demand for the GBP. Monitoring UK economic indicators, including inflation data and BOE pronouncements, is critical for understanding and anticipating future movements in the Pound Sterling. Stay informed about future movements in the Pound Sterling by subscribing to our newsletter for daily market updates. Understanding the factors influencing the Pound Sterling’s value is crucial for navigating the forex market effectively. Monitor the Pound Sterling's performance and learn more about the factors influencing its value.

Featured Posts

-

Annie Kilner And Kyle Walker A Diamond Ring And Relationship Update

May 24, 2025

Annie Kilner And Kyle Walker A Diamond Ring And Relationship Update

May 24, 2025 -

Global Bond Market Instability A Posthaste Warning

May 24, 2025

Global Bond Market Instability A Posthaste Warning

May 24, 2025 -

Escape To The Country Practical Tips For A Smooth Transition

May 24, 2025

Escape To The Country Practical Tips For A Smooth Transition

May 24, 2025 -

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025 -

Explanation Of Kyle Walkers Partying After Annie Kilners Flight Home

May 24, 2025

Explanation Of Kyle Walkers Partying After Annie Kilners Flight Home

May 24, 2025