Private Credit's Growing Instability: Warning Signs Before The Turmoil

Table of Contents

Rising Default Rates and Increased Delinquency

Recent data reveals a concerning upward trend in default rates within the private credit market. This increase in private credit defaults and private debt delinquency reflects a confluence of factors impacting the ability of borrowers to meet their repayment obligations. High-profile defaults, though not yet widespread, serve as stark reminders of the potential for significant losses. For example, [Insert example of a recent high-profile private credit default here, citing a reliable source].

- Increased leverage among borrowers: Many companies have taken on substantial debt in recent years, leaving them vulnerable to economic downturns.

- Economic slowdown impacting repayment ability: The current economic climate, characterized by [mention relevant economic factors like inflation, recessionary fears, etc.], is making it harder for businesses to generate the cash flow needed to service their debt.

- Less stringent underwriting practices in recent years: The pursuit of higher returns in a low-interest-rate environment may have led to less cautious lending practices.

- Impact of rising interest rates on debt servicing: The sharp increase in interest rates has significantly increased the cost of borrowing, making it more challenging for companies to meet their debt obligations. This surge in interest rates has exacerbated the private credit defaults problem.

Reduced Liquidity and Market Volatility

Unlike publicly traded bonds, private credit investments lack a readily available secondary market, creating significant liquidity challenges. This private credit liquidity issue is a key driver of private debt market volatility. The difficulty in quickly exiting investments means that valuations can become significantly distorted, particularly during periods of stress.

- Lack of a readily available secondary market for private credit: This makes it difficult to sell investments quickly without accepting a substantial discount.

- Increased price volatility due to limited trading activity: The absence of a liquid market amplifies price fluctuations, making it challenging to accurately assess the value of holdings.

- Difficulty in accurately assessing fair market value: The lack of frequent trading makes it difficult to determine a reliable market price for private credit investments, leading to illiquidity risk.

- Potential for fire sales in a distressed market: When investors need to liquidate their positions quickly, they may be forced to sell at significantly depressed prices, resulting in substantial losses.

Concentrated Investments and Lack of Transparency

The private credit market often features concentrated investments, exposing lenders to significant risk if a specific borrower or sector experiences distress. This private credit concentration risk is further compounded by a relative lack of transparency compared to publicly traded securities. This information asymmetry presents a challenge for investors seeking to assess the true risk profile of their investments.

- Limited due diligence information available to investors: Information about borrowers and underlying collateral may be less readily available than for publicly traded companies.

- Difficulty in comparing performance across different funds: The lack of standardized reporting makes it challenging to compare the performance and risk profiles of different private credit funds.

- Increased risk of systemic shocks impacting specific sectors: Concentrated investments in specific sectors increase vulnerability to sector-specific downturns.

- Challenges in assessing overall portfolio risk: The opaque nature of many private credit funds makes it difficult for investors to fully assess the overall risk of their portfolio. Understanding private debt transparency limitations is critical.

Regulatory Scrutiny and Potential Reforms

The increased frequency of private credit defaults has brought renewed regulatory focus onto the private credit market. Authorities are increasingly concerned about the potential systemic risks posed by this rapidly growing sector. This private credit regulation is likely to evolve, potentially leading to significant changes in the industry.

- Enhanced reporting requirements for private credit funds: Regulators are likely to mandate more detailed and frequent reporting to improve transparency.

- Increased capital requirements for lenders: Higher capital requirements could make it more expensive for lenders to operate, potentially reducing lending activity.

- Strengthened investor protection measures: New regulations could aim to enhance the protection of investors against losses.

- Potential for stricter lending guidelines: Regulators may impose stricter lending guidelines to reduce the risk of excessive leverage and improve underwriting standards. This evolution in private debt reform is expected.

Conclusion

The private credit market, while offering attractive returns, is exhibiting several concerning signs of instability. Rising default rates, reduced liquidity, concentrated investments, and a lack of transparency all point to a potential increase in turmoil. Increased regulatory scrutiny adds another layer of complexity. Understanding the growing risks associated with private credit instability is crucial for investors and lenders. Thorough due diligence, diversification strategies, and a realistic assessment of market risks are essential for navigating the evolving landscape of private debt. Stay informed about the latest developments in private credit to mitigate potential losses.

Featured Posts

-

Kalinskaya Upsets Keys In Charleston Quarterfinal Clash

Apr 27, 2025

Kalinskaya Upsets Keys In Charleston Quarterfinal Clash

Apr 27, 2025 -

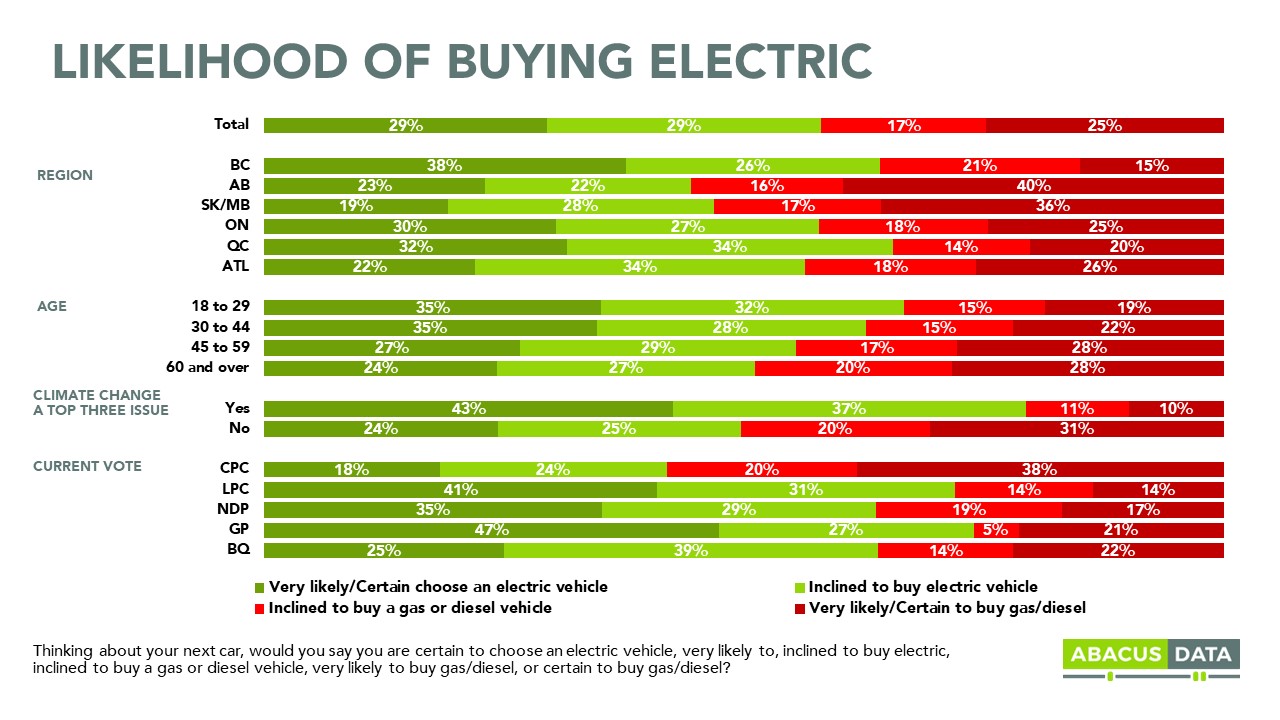

Falling Demand For Electric Vehicles In Canada

Apr 27, 2025

Falling Demand For Electric Vehicles In Canada

Apr 27, 2025 -

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025 -

Interpreting The Dax The Significance Of Bundestag Elections And Economic Data

Apr 27, 2025

Interpreting The Dax The Significance Of Bundestag Elections And Economic Data

Apr 27, 2025 -

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025

Latest Posts

-

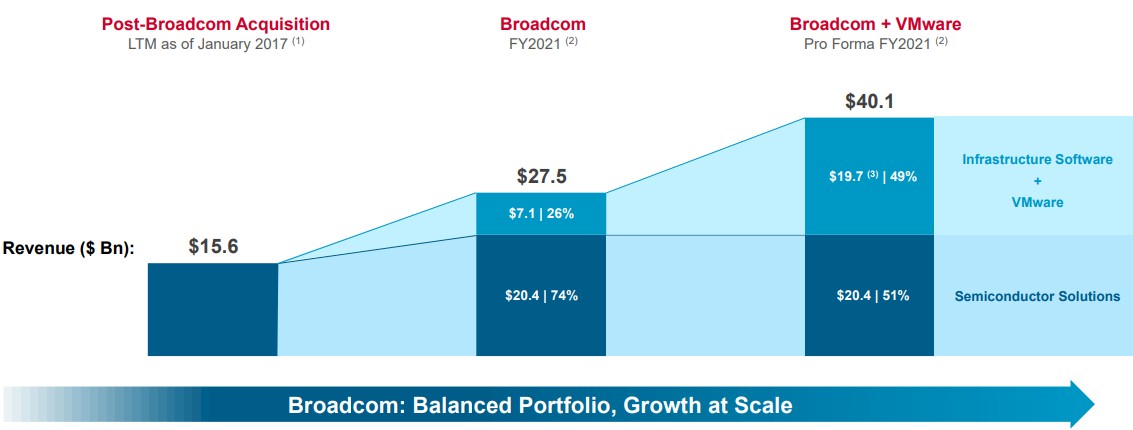

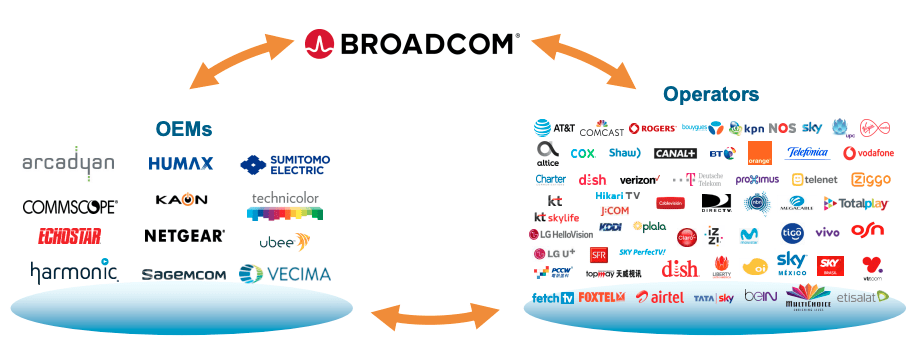

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025