Regulatory Announcement: PNE AG - WpHG § 40 Abs. 1

Table of Contents

What is WpHG § 40 Abs. 1 and its Significance for PNE AG?

WpHG § 40 Abs. 1, part of the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG), mandates the prompt disclosure of inside information. This is crucial for maintaining a fair and transparent stock market. The core principle is to ensure all investors have equal access to material information that could significantly impact the price of a company's securities. Failure to comply with WpHG § 40 Abs. 1 can result in severe penalties, including substantial fines and even criminal charges. This regulation significantly impacts investor confidence; timely and accurate disclosure fosters trust, contributing to market stability and attracting investment.

- Definition of "price-sensitive information": Information that, if made public, would likely have a significant impact on the price of PNE AG's shares. This includes, but isn't limited to, major contracts, financial results (e.g., unexpected losses or profits), significant changes in strategy, mergers and acquisitions, and legal disputes.

- Process for disclosure: PNE AG is obligated to release this information immediately upon becoming aware of it, utilizing approved channels like official press releases and the German Federal Financial Supervisory Authority (BaFin) website.

- Examples relevant to PNE AG: Securing a major wind farm project, a significant change in management, a substantial loss or gain, or announcements regarding strategic partnerships would all fall under this regulation.

PNE AG's Specific Announcement: Details and Implications

[Insert a direct link to the official PNE AG press release or regulatory filing here]. PNE AG's recent announcement regarding WpHG § 40 Abs. 1 [insert specific date] detailed [summarize the key points of the announcement concisely and clearly, avoiding jargon]. This disclosure [analyze the potential market impact – positive or negative, supporting your analysis with evidence].

- Specific information disclosed: [List bullet points of the specific information released by PNE AG]

- Date of the announcement: [Insert the date]

- Relevant stakeholders: This announcement directly impacts current shareholders, potential investors, analysts, and financial institutions.

- Anticipated future actions: [Mention any future actions related to this disclosure mentioned in the announcement.]

Analyzing PNE AG's Compliance with WpHG § 40 Abs. 1

Based on the information provided in their announcement, PNE AG appears to have [assess their adherence to the regulation – positive or negative, being specific].

- Timeliness of the disclosure: [Analyze how promptly PNE AG disclosed the information, considering the time sensitivity and relevant legal deadlines.]

- Clarity and comprehensiveness: [Evaluate the clarity and comprehensiveness of the information presented in the announcement.]

- Accessibility of the announcement: [Evaluate how easily investors could access the announcement, considering its availability on PNE AG's website and other channels.]

- Potential future improvements: [Suggest potential areas for improvement in PNE AG’s compliance procedures, such as enhancing internal communication systems or refining the disclosure process.]

Comparing PNE AG's approach to industry best practices, [compare and contrast, referencing relevant examples from other companies if possible].

Conclusion: Staying Informed on PNE AG and WpHG § 40 Abs. 1 Compliance

PNE AG's recent announcement concerning WpHG § 40 Abs. 1 underscores the importance of transparent and timely disclosure for maintaining investor confidence and market stability. Understanding WpHG § 40 Abs. 1 is vital for anyone investing in German companies. This regulation is central to ensuring fair market practices and protecting investor interests. Staying abreast of future announcements from PNE AG and any regulatory changes related to WpHG § 40 Abs. 1 is crucial.

Call to action: Stay informed about PNE AG's ongoing compliance with WpHG § 40 Abs. 1 by regularly checking their official website and investor relations section for further announcements. Understanding this key aspect of German capital market law is essential for informed investment decisions.

Featured Posts

-

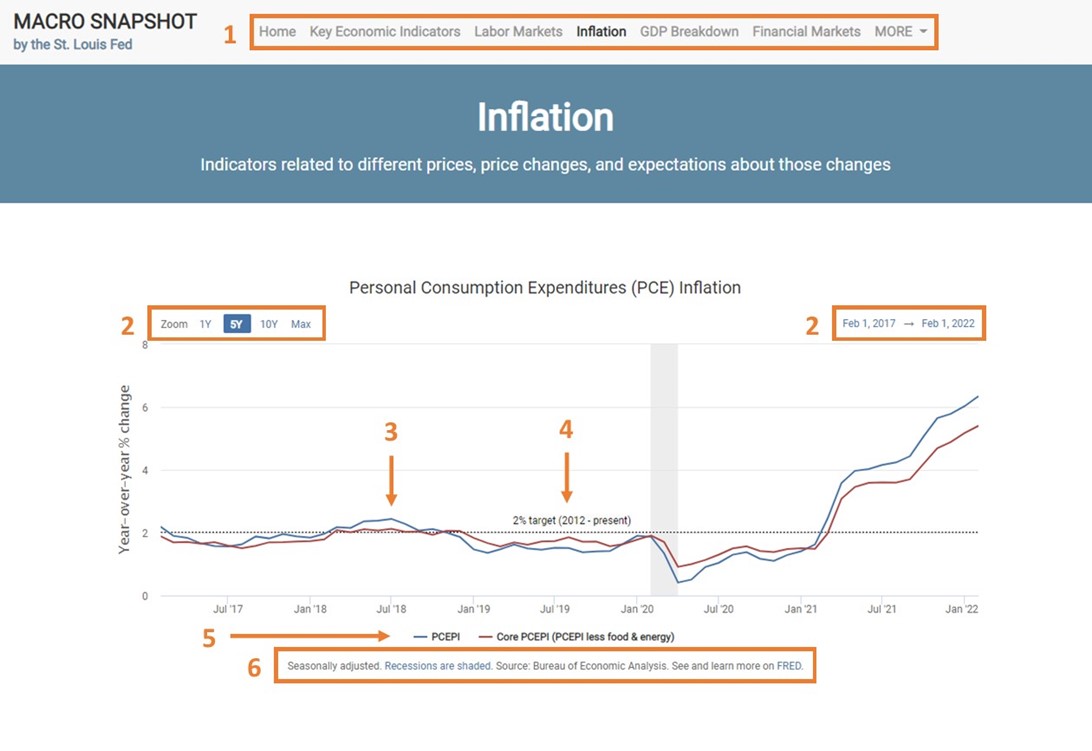

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 27, 2025

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 27, 2025 -

Kalinskaya Upsets Keys In Charleston Quarterfinal Clash

Apr 27, 2025

Kalinskaya Upsets Keys In Charleston Quarterfinal Clash

Apr 27, 2025 -

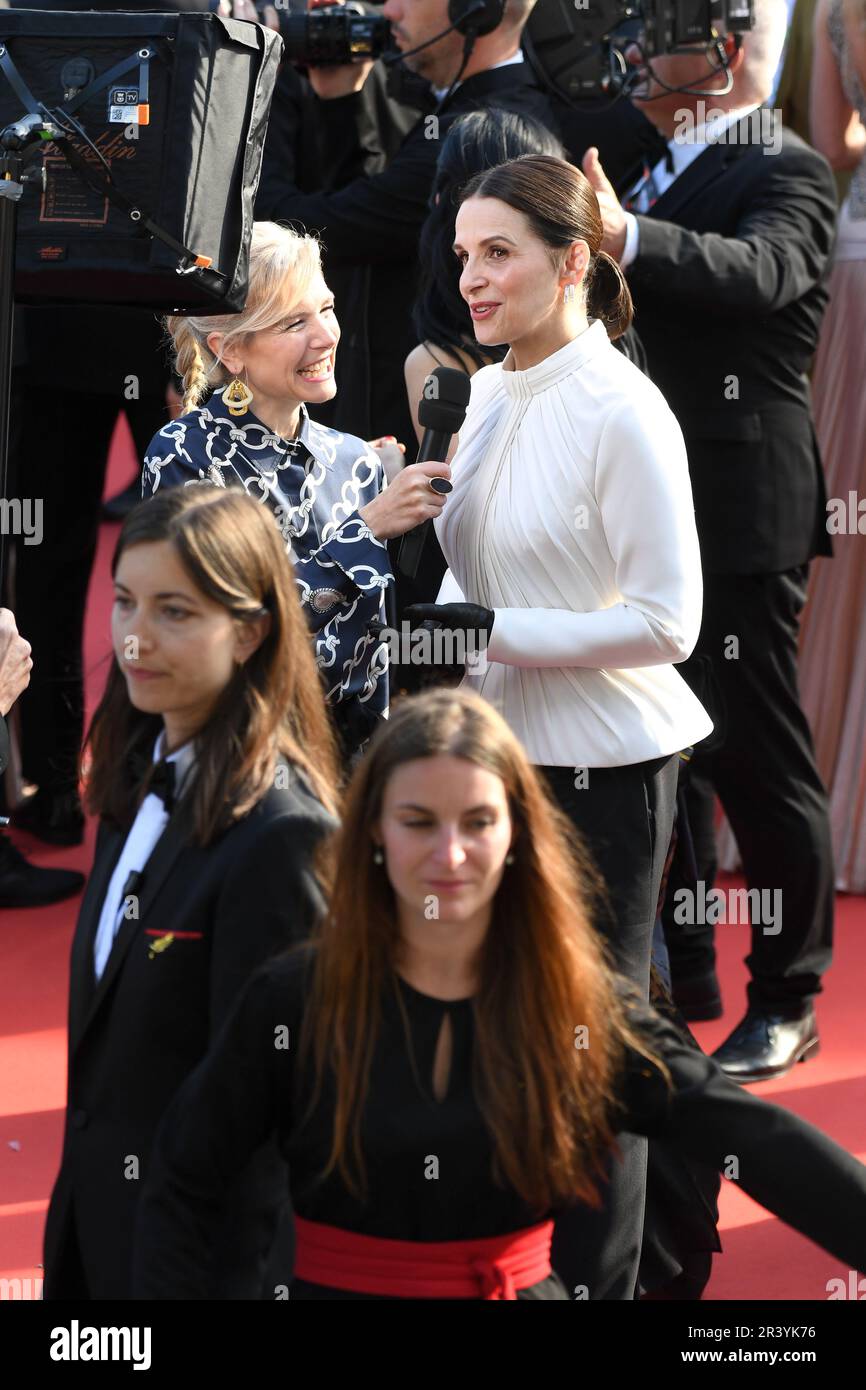

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025 -

Pfc To Announce Fourth Dividend For Fy 25 On March 12 2025

Apr 27, 2025

Pfc To Announce Fourth Dividend For Fy 25 On March 12 2025

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Latest Posts

-

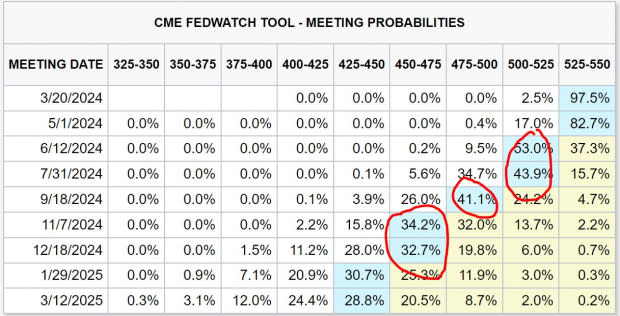

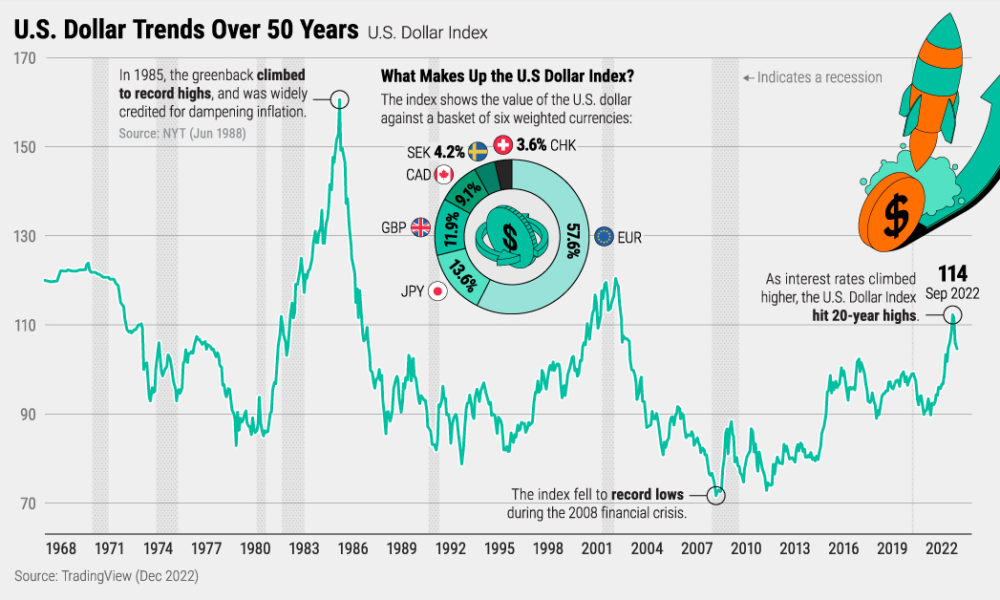

Nixons Shadow Evaluating The U S Dollars Performance After 100 Days

Apr 28, 2025

Nixons Shadow Evaluating The U S Dollars Performance After 100 Days

Apr 28, 2025 -

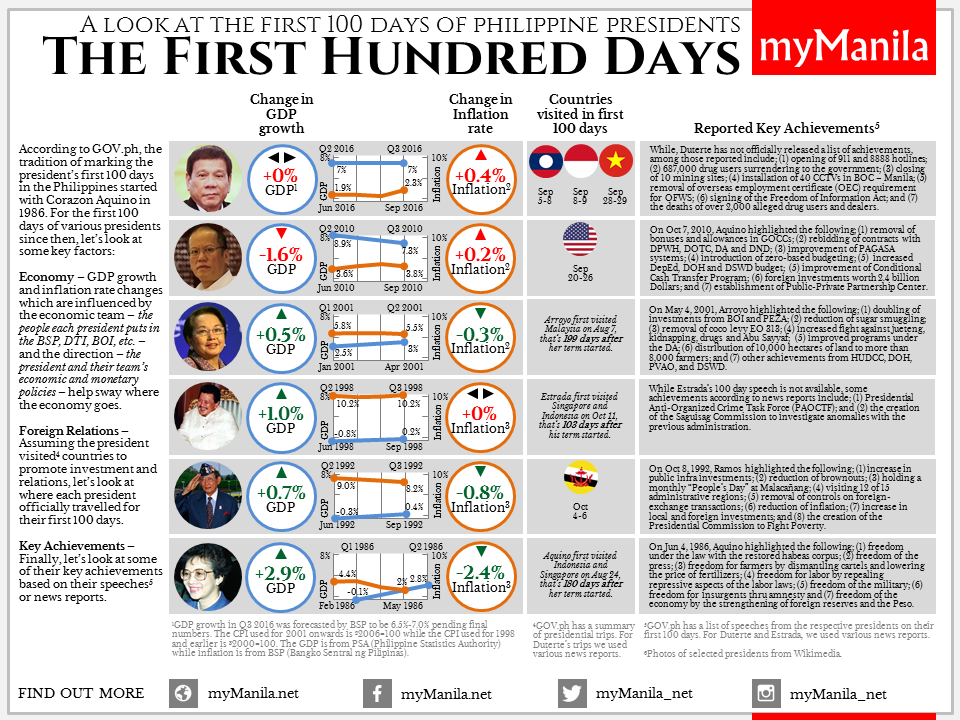

The First 100 Days Assessing The U S Dollars Performance Under The Current Presidency

Apr 28, 2025

The First 100 Days Assessing The U S Dollars Performance Under The Current Presidency

Apr 28, 2025 -

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025 -

U S Dollars Troubled Beginning A Comparison To Nixons Presidency

Apr 28, 2025

U S Dollars Troubled Beginning A Comparison To Nixons Presidency

Apr 28, 2025 -

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 28, 2025

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 28, 2025