Retail Leaders From Walmart And Target Confer With Trump On Tariffs

Table of Contents

The Stakes for Walmart and Target

Walmart and Target, two of the largest retailers in the world, are heavily reliant on imported goods. Their business models are built upon efficient global supply chains that source products from numerous countries. This dependence, while historically beneficial for keeping prices low, makes them acutely vulnerable to tariff increases.

- High percentage of products sourced internationally: A significant portion of their inventory, encompassing everything from clothing and electronics to home goods and groceries, originates overseas.

- Potential for increased prices due to tariffs: Tariffs directly increase the cost of imported goods, squeezing profit margins and potentially forcing retailers to pass these increased costs onto consumers.

- Risk of decreased profit margins and reduced competitiveness: Higher prices can lead to decreased sales volume and reduced competitiveness, especially against smaller retailers who may source more domestically.

The impact on their intricate supply chains is substantial. Disruptions in the flow of goods from international suppliers could lead to stock shortages, impacting sales and potentially damaging their brand reputation. Furthermore, the threat of job losses looms, both within their own operations and within the broader manufacturing and logistics sectors that support their supply chains.

Key Discussion Points During the Meeting

The meeting between Walmart, Target executives, and President Trump likely covered several critical areas. The primary focus was undoubtedly on mitigating the negative impacts of tariffs on both the retailers and American consumers.

- Negotiations for tariff exemptions or reductions: A key objective would have been to secure exemptions or reductions on specific goods, thereby lessening the financial burden on their businesses.

- Exploration of alternative sourcing strategies: Discussions likely revolved around exploring alternative sourcing locations, potentially shifting production to domestic suppliers or other international markets.

- Discussion of the impact on consumer prices: Understanding and managing the potential inflationary pressure on consumers was likely a major point of discussion.

- Potential for government assistance or support: The possibility of government assistance, such as subsidies or financial aid to offset tariff costs, may have been explored.

While the specifics of the meeting remain largely confidential, the potential for compromises – perhaps partial tariff relief on certain product categories or a phased implementation of increased duties – remains a possibility.

Consumer Impact of Tariffs on Retail Giants

The ramifications of increased import duties extend directly to American consumers. Higher prices on everyday goods, driven by the Walmart Target Trump Tariffs discussion, will undoubtedly impact consumer purchasing power.

- Reduced consumer purchasing power: Increased prices mean consumers have less disposable income to spend on other goods and services.

- Shift in consumer spending habits: Consumers may be forced to cut back on spending, shift their purchasing habits to cheaper alternatives, or delay purchases altogether.

- Potential for inflation: Widespread price increases across various consumer goods can contribute to a broader inflationary trend within the economy.

Consumer backlash and negative public opinion are likely. Consumers may express dissatisfaction through reduced spending, social media campaigns, or even political action. While retailers may attempt to absorb some of the cost increases, they can only do so to a limited extent before passing the costs onto consumers to maintain profitability.

Alternative Sourcing Strategies

To mitigate the effects of tariffs, Walmart and Target may explore alternative sourcing strategies. This might involve:

- Reshoring: Bringing manufacturing back to the United States. This is challenging due to higher labor costs and less developed manufacturing infrastructure compared to other countries.

- Nearshoring: Shifting production to countries geographically closer to the US, like Mexico or Canada. This reduces transportation costs and lead times but may not entirely avoid tariff impacts.

Long-Term Implications for the Retail Industry

The long-term implications of the Walmart Target Trump Tariffs scenario extend beyond the immediate effects on these two retail giants. The retail industry may undergo significant restructuring and strategic shifts.

- Increased focus on domestic manufacturing: Retailers may increasingly prioritize sourcing goods from domestic manufacturers to avoid tariffs and reduce supply chain vulnerabilities.

- Changes in product selection and pricing: Retailers may alter their product offerings, focusing on items less susceptible to tariff impacts or finding ways to absorb increased costs without significantly raising prices.

- Potential for increased competition from smaller, domestically-focused retailers: Smaller retailers that have always focused on domestic sourcing may gain a competitive advantage.

The potential for industry consolidation is also a factor. Larger retailers with greater resources may be better equipped to navigate the challenges of tariffs, potentially leading to the absorption or failure of smaller competitors.

Conclusion

The meeting between Walmart and Target executives and President Trump regarding tariffs represents a critical juncture for the retail industry. The outcome significantly impacts not only these retail giants but also millions of consumers and the broader economy. Understanding the ramifications of these tariffs – and the strategies employed by major players like Walmart and Target – is essential for navigating the evolving landscape of retail. Staying informed on developments regarding Walmart Target Trump Tariffs is vital for businesses and consumers alike. Continue to follow reputable news sources for the latest updates on this developing story.

Featured Posts

-

Greene Advocates For Moderate Qe In Response To Future Economic Shocks

Apr 23, 2025

Greene Advocates For Moderate Qe In Response To Future Economic Shocks

Apr 23, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 23, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 23, 2025 -

Analyse De La Strategie De Marc Fiorentino La Carte Blanche

Apr 23, 2025

Analyse De La Strategie De Marc Fiorentino La Carte Blanche

Apr 23, 2025 -

Tigers Brewers Series Brewers Secure 5 1 Victory

Apr 23, 2025

Tigers Brewers Series Brewers Secure 5 1 Victory

Apr 23, 2025 -

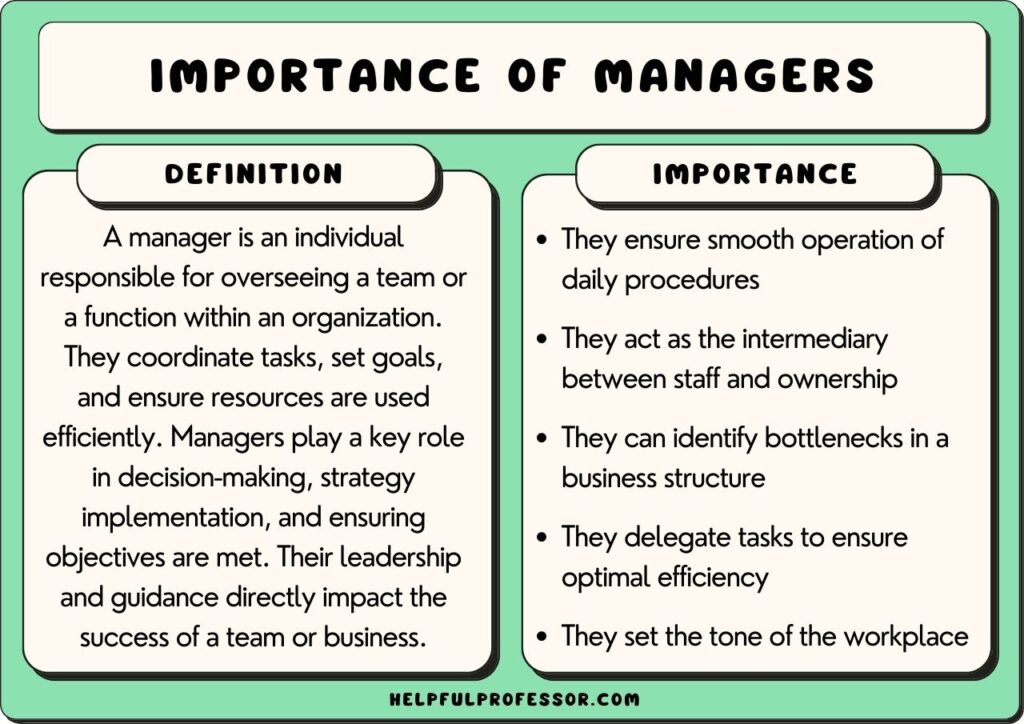

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 23, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 23, 2025