Ripple's XRP Soars: Analysis And $3.40 Price Target

Table of Contents

Factors Driving XRP's Recent Surge

Several key factors are contributing to XRP's recent price surge. These positive developments have significantly improved investor sentiment and fueled speculation about future price appreciation.

Positive Ripple-SEC Lawsuit Developments

The ongoing legal battle between Ripple and the SEC has been a major factor influencing XRP's price. Recent positive developments in the case have significantly boosted investor confidence.

- Partial Summary Judgment Victory: The court's decision on certain aspects of the case has been interpreted favorably by many, reducing the regulatory uncertainty surrounding XRP. [Link to relevant news article]

- Growing Legal Precedent: The Ripple case is setting legal precedent for how other cryptocurrencies are regulated, potentially benefiting XRP in the long run. [Link to relevant legal analysis]

- Positive Public Opinion Shift: The narrative around the case has shifted, with increased support for Ripple's arguments within the crypto community.

This improved outlook has led to a considerable influx of new investors and a renewed interest in XRP as a viable investment.

Increased Institutional Adoption

Institutional investors are increasingly showing interest in XRP, further contributing to its price increase. This level of involvement lends an air of stability and legitimacy to the cryptocurrency.

- Strategic Partnerships: Ripple has formed partnerships with several major financial institutions, expanding its reach and credibility. [Link to examples of partnerships]

- On-Chain Activity: Increased on-chain activity, including transaction volume and network usage, reflects the growing adoption of XRP within the financial sector.

- Market Capitalization Growth: The increasing market capitalization indicates a growing confidence in XRP's long-term potential.

This institutional adoption signifies a shift towards mainstream acceptance, contributing to price stability and potential future growth.

Growing Use Cases for XRP

XRP's utility as a bridge currency for cross-border payments is a major driver of its value. Its efficiency and low transaction costs compared to traditional methods are attractive to financial institutions and businesses.

- RippleNet Expansion: The RippleNet network continues to expand, adding new partners and increasing the volume of transactions processed using XRP.

- Enhanced Cross-Border Payments: XRP is increasingly used for faster and cheaper international remittances, disrupting traditional banking systems.

- Decentralized Finance (DeFi) Integration: Exploring potential integration into DeFi platforms could further broaden XRP's use cases and enhance its appeal.

The expanding use cases demonstrate XRP's real-world utility, making it more than just a speculative asset.

Overall Market Sentiment

The broader cryptocurrency market sentiment also impacts XRP's price. While XRP is often correlated with Bitcoin, its price can also be influenced by broader market trends and investor sentiment towards altcoins.

- Altcoin Season: Periods of increased interest in altcoins often lead to higher XRP prices, as investors diversify their portfolios.

- Bitcoin's Performance: A strong Bitcoin market often correlates with positive performance for altcoins like XRP.

- Market Volatility: It's crucial to acknowledge that the cryptocurrency market is inherently volatile, and XRP's price can fluctuate significantly due to market-wide events.

Understanding these broader market factors is vital for predicting XRP's price movements.

Analysis of the $3.40 Price Target

Reaching a $3.40 XRP price requires a confluence of positive developments and favorable market conditions. A thorough analysis requires examining both technical and fundamental aspects.

Technical Analysis

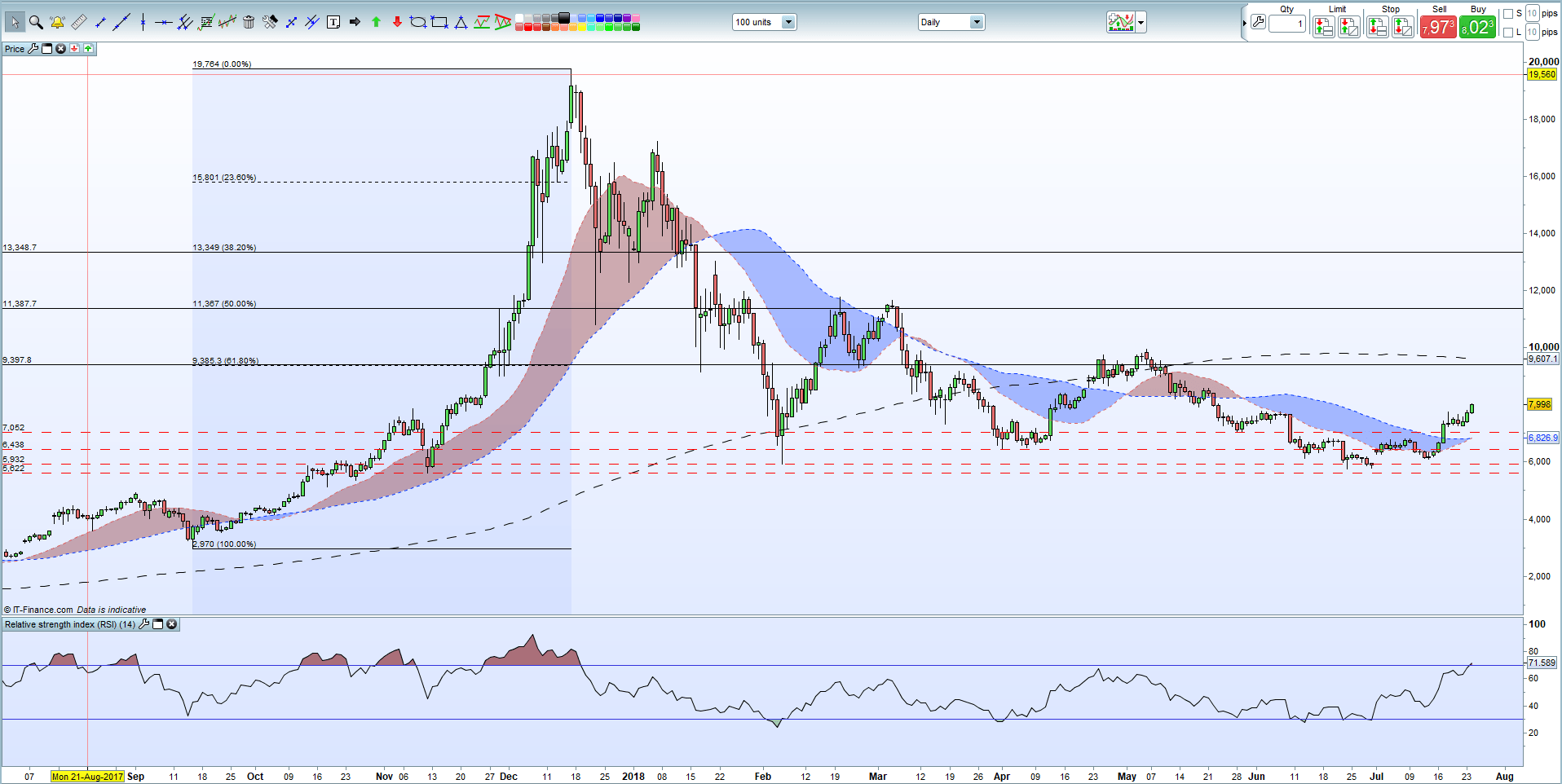

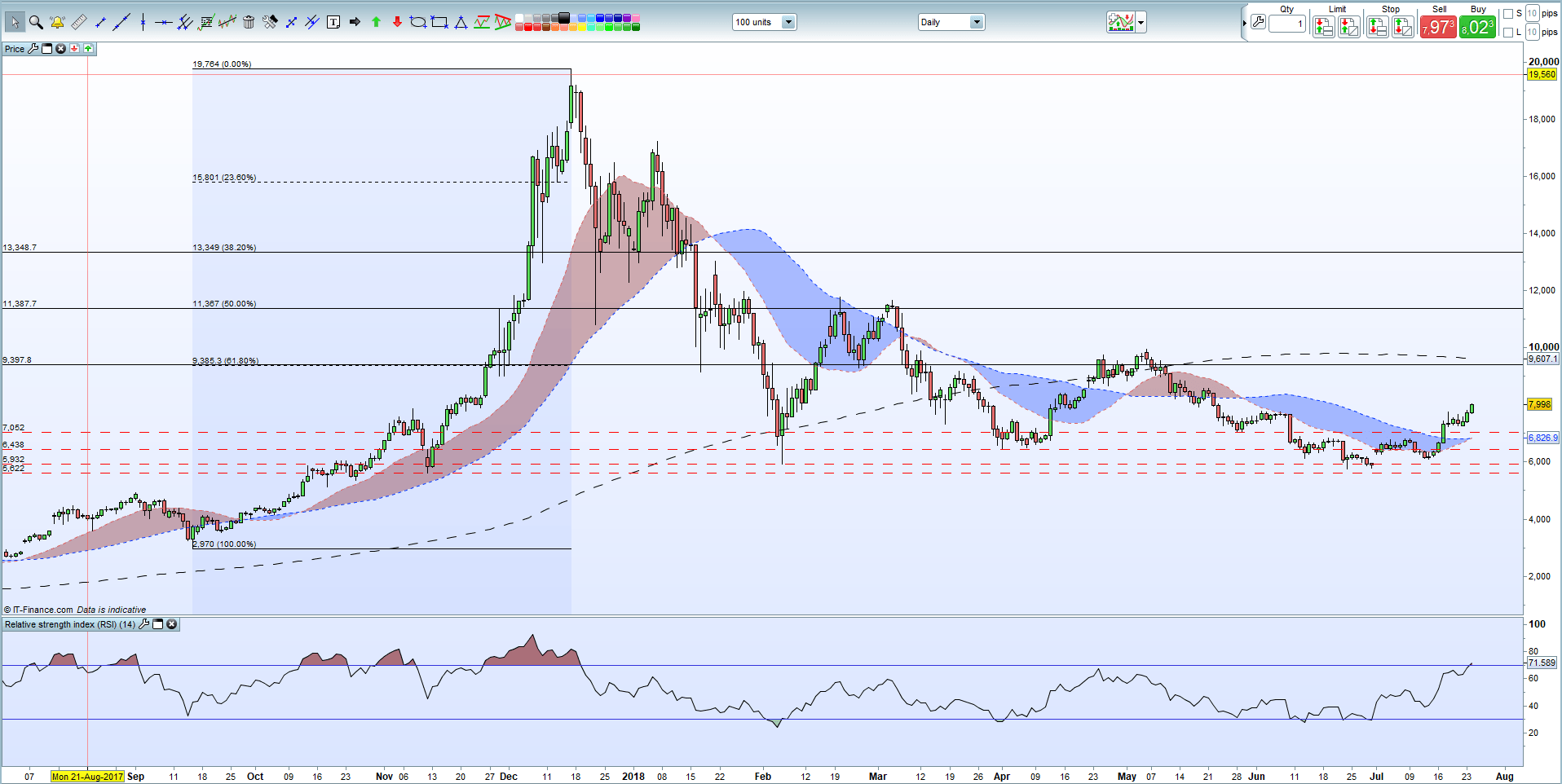

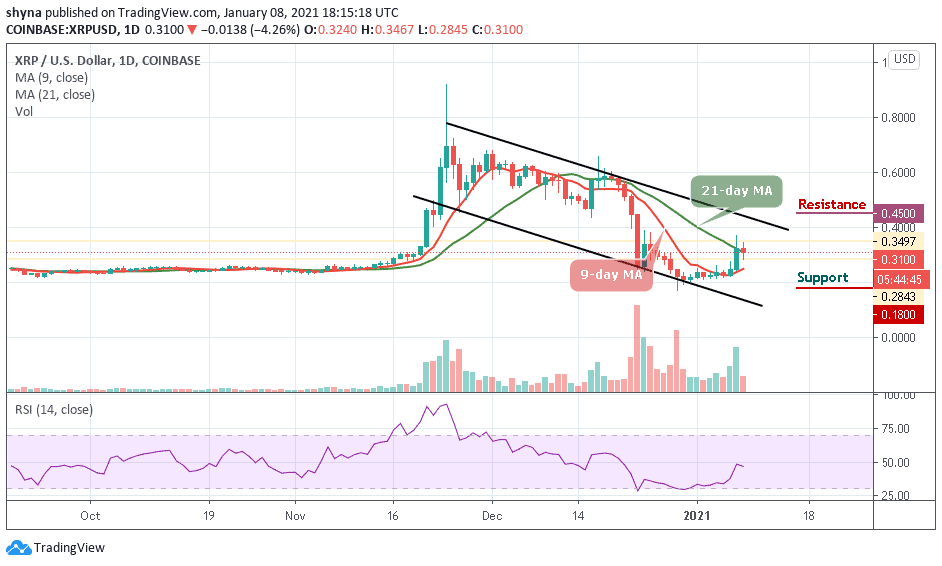

Technical analysis suggests different viewpoints on the $3.40 target. Studying chart patterns, indicators like moving averages and RSI, and support/resistance levels helps assess the price's potential.

- Moving Averages: The intersection and behavior of different moving averages (e.g., 50-day, 200-day) can indicate potential trend reversals or continuations. [Insert relevant chart]

- Relative Strength Index (RSI): RSI can signal overbought or oversold conditions, providing insight into potential price corrections or further upward momentum. [Insert relevant chart]

- Support and Resistance Levels: Identifying key support and resistance levels helps to understand potential price ceilings and floors.

Careful technical analysis is crucial for navigating the volatility of the cryptocurrency market.

Fundamental Analysis

Fundamental analysis focuses on Ripple's underlying business and technological advancements.

- Network Growth: Continued growth of the RippleNet network and increased adoption of XRP for payments are crucial factors impacting its value.

- Technological Advancements: Innovations in Ripple's technology and its integration with other financial systems can enhance XRP's functionality and appeal.

- Financial Health: A strong financial position for Ripple itself adds confidence to the long-term prospects of XRP.

A strong fundamental foundation provides a more robust basis for price appreciation than solely relying on speculation.

Risks and Challenges

Several factors could hinder XRP's price from reaching $3.40.

- Regulatory Uncertainty: The outcome of the Ripple-SEC lawsuit, as well as broader regulatory developments, still holds significant uncertainty.

- Market Volatility: The cryptocurrency market is notoriously volatile, susceptible to dramatic price swings driven by various factors.

- Competition: XRP faces competition from other cryptocurrencies in the cross-border payment space.

These risks must be considered before making any investment decisions.

Conclusion

Ripple's XRP has seen a significant price increase driven by several positive factors, including developments in the Ripple-SEC lawsuit, increased institutional adoption, expanding use cases, and overall market sentiment. While the $3.40 price target is ambitious, a combination of technical and fundamental factors suggests some potential. However, investors should be aware of the considerable risks and volatility inherent in the cryptocurrency market. It's crucial to conduct thorough research and understand the potential risks before investing in any cryptocurrency, including Ripple's XRP.

Call to Action: Stay updated on Ripple's XRP price and developments by following reputable news sources and Ripple's official website. Learn more about investing in XRP and consider its potential, always acknowledging the inherent risks involved. Track the Ripple's XRP price regularly and make informed decisions based on your own risk tolerance and investment strategy.

Featured Posts

-

Nba Free Agency 2024 Warriors Pursue Kevon Looney

May 07, 2025

Nba Free Agency 2024 Warriors Pursue Kevon Looney

May 07, 2025 -

5 Publikacji Onetu Jacka Harlukowicza Z Najwiekszym Zasiegiem W 2024

May 07, 2025

5 Publikacji Onetu Jacka Harlukowicza Z Najwiekszym Zasiegiem W 2024

May 07, 2025 -

Popcorn Prank On Cavs Rookie Mitchells Accurate Prediction

May 07, 2025

Popcorn Prank On Cavs Rookie Mitchells Accurate Prediction

May 07, 2025 -

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025 -

Simone Biles La Terapia Clave Para Mi Enfoque Y Seguridad

May 07, 2025

Simone Biles La Terapia Clave Para Mi Enfoque Y Seguridad

May 07, 2025

Latest Posts

-

Xrp Etf Prospects Dimmed By Abundant Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Prospects Dimmed By Abundant Supply And Limited Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Investors Due To Supply And Demand Imbalances

May 08, 2025

Will Xrp Etfs Disappoint Investors Due To Supply And Demand Imbalances

May 08, 2025 -

Xrp Etf High Supply And Low Institutional Interest Pose Significant Risk

May 08, 2025

Xrp Etf High Supply And Low Institutional Interest Pose Significant Risk

May 08, 2025 -

Ripple Xrp And The 3 40 Price Point A Technical Analysis

May 08, 2025

Ripple Xrp And The 3 40 Price Point A Technical Analysis

May 08, 2025 -

Analyzing Ripples Xrp Potential To Reach 3 40

May 08, 2025

Analyzing Ripples Xrp Potential To Reach 3 40

May 08, 2025