Selling Stakes In Elon Musk's Private Ventures: A Lucrative Side Business

Table of Contents

Identifying Potential Investments in Musk's Private Companies

Information about investment opportunities in Musk's private companies—SpaceX, The Boring Company, Neuralink, and others—is often scarce and tightly controlled. Gaining access requires a multi-pronged approach combining research, networking, and financial expertise. Simply searching for "Elon Musk investments" online won't suffice; you'll need to dig deeper.

- Researching Opportunities: Thoroughly investigate each company's business model, financial performance (if publicly available), and future projections. Analyze industry trends and potential market disruptions. Understanding the competitive landscape is crucial for assessing risk and potential reward.

- Networking: Building relationships within the venture capital and private equity communities is paramount. Attending industry events, conferences, and leveraging professional networks can provide invaluable insights and potentially uncover investment opportunities. Knowing individuals involved in similar high-growth ventures can open doors otherwise inaccessible.

- Due Diligence: This is critical. Before committing any capital, conduct comprehensive due diligence. This includes verifying information, assessing the management team, and understanding the company's legal and regulatory compliance. Consulting with experienced financial advisors specializing in high-risk investments is highly recommended. Ignoring this step can lead to significant financial losses.

Navigating the Legal and Regulatory Landscape

Buying and selling stakes in private companies like those associated with Elon Musk involves navigating a complex legal and regulatory landscape. The rules surrounding securities and private placements vary significantly depending on jurisdiction and the specific structure of the investment.

- Securities Laws and Regulations: Understand the relevant securities laws in your jurisdiction. Failing to comply with these regulations can result in hefty fines and legal repercussions.

- Legal Counsel: Engaging experienced legal professionals is crucial. They can advise on structuring the transaction, ensuring compliance with all regulations, and protecting your interests throughout the process.

- Disclosure Requirements: Be fully aware of, and comply with, all disclosure requirements to avoid legal pitfalls. Transparency and adherence to the law are paramount.

- Tax Implications: Seek professional tax advice to understand the potential tax implications of your investments and any subsequent sales. Proper planning can minimize your tax liability.

Strategic Exit Strategies for Maximizing Profit

Maximizing profit from your investment requires a well-defined exit strategy. This includes understanding the timing of your sale and the various methods available. The "Elon Musk effect" can significantly influence valuations, making timing critical.

- Identifying Potential Buyers: Identify potential buyers early on. This could range from other individual investors to larger corporations seeking strategic acquisitions.

- Valuation Methods: Understand the different methods used to value private company shares. These include discounted cash flow analysis, comparable company analysis, and precedent transactions.

- Market Conditions: Keep a close eye on market conditions. Economic downturns or negative news surrounding a specific company can drastically impact valuations.

- Developing an Exit Strategy: Craft a comprehensive exit strategy that aligns with your financial goals and risk tolerance. This plan should account for various scenarios and market fluctuations.

Mitigating Risks Associated with High-Growth Ventures

Investing in high-growth ventures, particularly those tied to Elon Musk, inherently involves significant risks. Market volatility, company setbacks, and unexpected changes can severely impact your investment.

- Market Volatility: Understand the inherent volatility of the market and its impact on valuations. Private company shares can experience wild swings in value.

- Investment Diversification: Diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket, especially in high-risk ventures.

- Risk Management Plan: Develop a thorough risk management plan that outlines potential scenarios and strategies for mitigating losses.

- Market Monitoring: Continuously monitor market trends and adjust your strategy accordingly. Staying informed is vital for making informed decisions.

Capitalizing on the Musk Effect: Your Path to Profiting from Private Ventures

Successfully navigating the world of "Elon Musk investments" requires a combination of thorough research, informed decision-making, legal expertise, and a robust risk management strategy. While the potential for high returns is undeniable, the inherent risks demand caution. This article highlights the key steps involved, from identifying potential investments to executing a strategic exit. Remember, seeking professional advice from financial and legal experts is essential.

Start your journey towards securing a stake in the future by conducting thorough research on Elon Musk's private ventures today. Remember to proceed with caution and seek expert advice before investing in these high-growth, high-risk opportunities. Understanding the complexities of private venture capital and "Elon Musk investments" is the first step towards potentially unlocking significant financial rewards.

Featured Posts

-

Deion Sanders Addresses Nfl Teams Interest In Son Shedeur

Apr 26, 2025

Deion Sanders Addresses Nfl Teams Interest In Son Shedeur

Apr 26, 2025 -

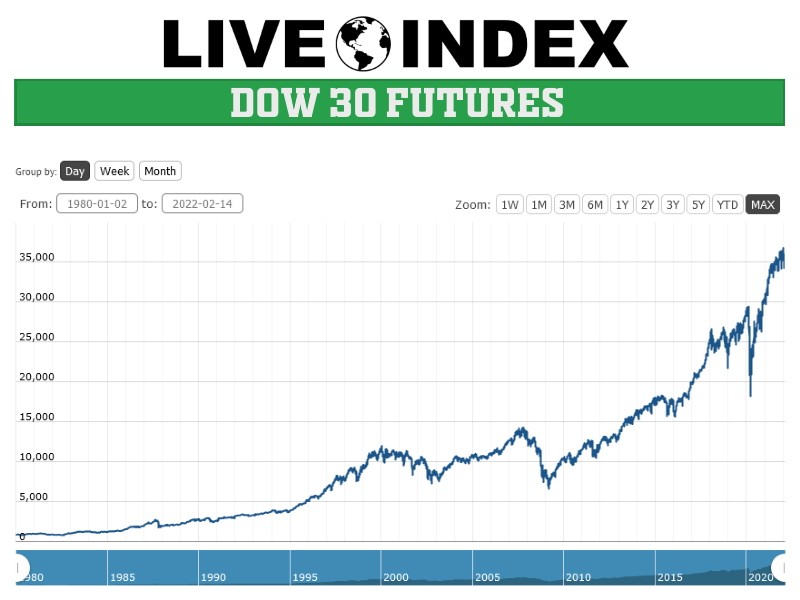

Stock Market Update Dow Futures Point To Strong Week End

Apr 26, 2025

Stock Market Update Dow Futures Point To Strong Week End

Apr 26, 2025 -

Why Is Gold Reaching Record Highs Amidst Trade Disputes

Apr 26, 2025

Why Is Gold Reaching Record Highs Amidst Trade Disputes

Apr 26, 2025 -

Party Injury Sidelines Formula 1 Star Lando Norris

Apr 26, 2025

Party Injury Sidelines Formula 1 Star Lando Norris

Apr 26, 2025 -

The Visuals Of Sinners A Deep Dive Into The Mississippi Deltas Cinematic Representation

Apr 26, 2025

The Visuals Of Sinners A Deep Dive Into The Mississippi Deltas Cinematic Representation

Apr 26, 2025