Sharp Rise In Ethereum Address Activity: A 10% Jump In Two Days

Table of Contents

Potential Factors Driving Increased Ethereum Address Activity

Several factors could be contributing to this dramatic increase in Ethereum network activity, impacting both Ethereum transaction volume and the overall price of ETH. Let's explore some of the key potential drivers:

Surge in Decentralized Finance (DeFi) Activity

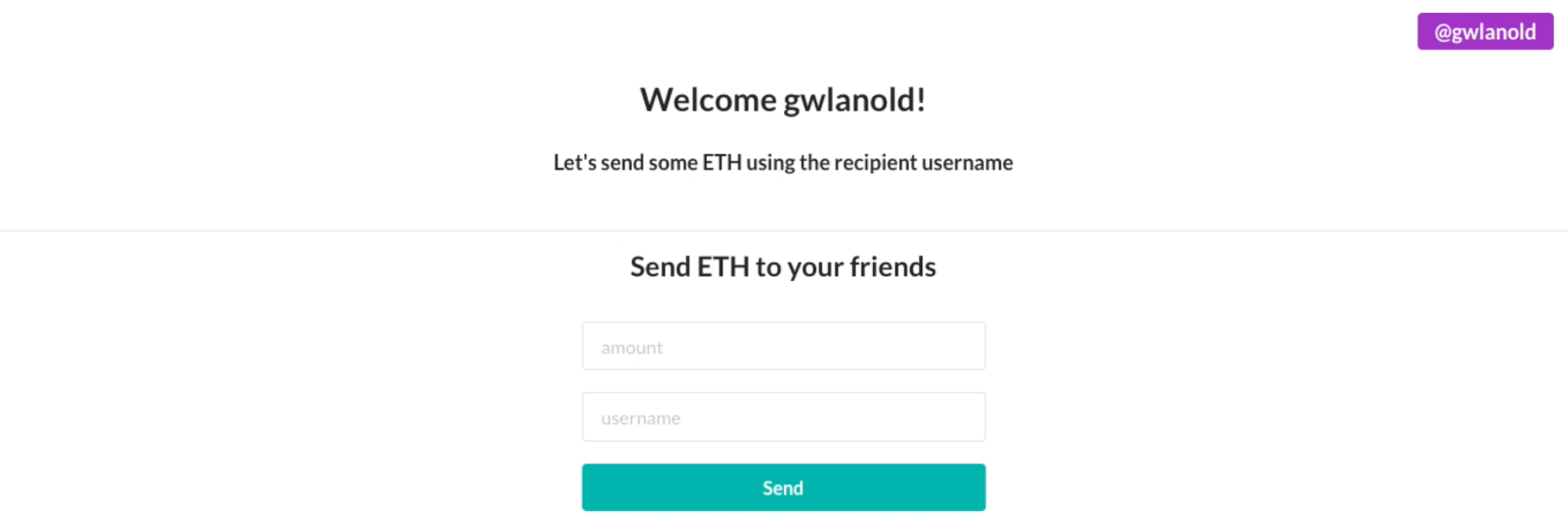

The booming Decentralized Finance (DeFi) ecosystem is heavily reliant on the Ethereum blockchain. Increased activity on DeFi platforms directly translates into higher Ethereum address activity. The rise in users interacting with DeFi protocols significantly impacts the overall network usage.

- Increased lending and borrowing activity on DeFi platforms: Platforms like Aave and Compound facilitate borrowing and lending of crypto assets, generating numerous transactions on the Ethereum network.

- Growth in yield farming and staking: Users seeking passive income participate in yield farming and staking, locking up their ETH and interacting with smart contracts, leading to increased address activity.

- New DeFi projects launching on Ethereum: The constant influx of innovative DeFi projects attracts new users and developers, further driving up transaction volume and Ethereum address activity.

Non-Fungible Token (NFT) Market Revival

The NFT market, a significant user of the Ethereum blockchain, has shown signs of renewed vigor. Increased NFT trading volume directly correlates with higher Ethereum address activity. The resurgence of interest in digital collectibles and artwork is contributing to this growth.

- Increased NFT sales and trading: Popular NFT marketplaces like OpenSea and Rarible are experiencing a surge in trading activity, driving up the demand for ETH and network usage.

- New NFT projects gaining traction: The emergence of innovative NFT projects and collections attracts new users and investors, resulting in a higher number of transactions on the Ethereum network.

- Potential for renewed interest in the NFT space: The NFT market's cyclical nature suggests that periods of increased activity are common, and the current surge might be a sign of a broader market revival.

Ethereum 2.0 and Network Upgrades

The ongoing development and implementation of Ethereum 2.0 and other network upgrades are crucial in enhancing the network's scalability and efficiency. These improvements can attract new users and increase overall activity.

- Impact of successful network upgrades on user confidence: Successful upgrades demonstrate the Ethereum team's commitment to improvement, boosting user confidence and attracting new investment.

- Anticipation for future upgrades driving increased engagement: The anticipation of future upgrades, particularly the complete transition to Ethereum 2.0, keeps users engaged and actively participating in the network.

- Improved efficiency attracting new users to the Ethereum network: Faster transaction speeds and reduced gas fees make the network more attractive to users, leading to increased adoption and activity.

Speculative Trading and Price Volatility

Price fluctuations in ETH significantly influence trader activity. Periods of price volatility often attract both short-term speculators and long-term investors, leading to increased transaction volume and Ethereum address activity.

- Price increases attracting new investors: When the price of ETH rises, it attracts new investors, boosting the overall transaction volume on the network.

- Increased trading volume due to price fluctuations: Regardless of whether the price is rising or falling, price volatility generally spurs increased trading activity.

- Potential for short-term speculation driving activity: Short-term speculators often participate in rapid trading, contributing to the overall surge in Ethereum address activity.

Analyzing the Significance of the Increase

The sharp increase in Ethereum address activity holds significant implications for both Ethereum's market position and the broader cryptocurrency market.

Impact on Ethereum's Market Position

The heightened network activity strengthens Ethereum's position as a leading cryptocurrency. The robust growth indicates a thriving ecosystem with high user engagement and participation.

- Increased network activity signaling robust ecosystem health: High network activity demonstrates a healthy and vibrant ecosystem, attracting further investment and development.

- Comparison to Bitcoin and other altcoins regarding network usage: Comparing Ethereum's network activity to that of Bitcoin and other altcoins provides valuable insights into its relative strength and market dominance.

- Implications for Ethereum's long-term dominance: Sustained high levels of network activity could solidify Ethereum's position as a leading blockchain platform for years to come.

Implications for the broader Cryptocurrency Market

Increased Ethereum activity can have a ripple effect on the broader cryptocurrency market, influencing investor sentiment and potentially impacting other crypto assets.

- Positive sentiment potentially spilling over to other crypto assets: Positive developments in the Ethereum ecosystem can create a positive sentiment across the entire crypto market.

- Increased investor confidence in the overall crypto market: High network activity in a major cryptocurrency like Ethereum can enhance investor confidence in the cryptocurrency market as a whole.

- Potential impact on overall market capitalization: A sustained increase in Ethereum's network activity could contribute to a rise in the overall market capitalization of the cryptocurrency market.

Conclusion

The recent 10% jump in Ethereum address activity over two days points to a significant increase in network usage, likely stemming from a combination of factors including the resurgence of DeFi, NFT market activity, and anticipated Ethereum 2.0 upgrades. This substantial increase highlights the robust health of the Ethereum ecosystem and its enduring relevance in the cryptocurrency space.

Call to Action: Stay informed about the latest developments affecting Ethereum address activity and the broader crypto market. Monitor the rise and fall of Ethereum network activity to make informed decisions about your cryptocurrency investments. Keep a close eye on Ethereum address activity for crucial insights into future trends.

Featured Posts

-

Ravens Sign De Andre Hopkins One Year Deal Details

May 08, 2025

Ravens Sign De Andre Hopkins One Year Deal Details

May 08, 2025 -

Washingtons Openness To Canadas Trade Proposals

May 08, 2025

Washingtons Openness To Canadas Trade Proposals

May 08, 2025 -

Boston Celtics Gear Shop The Latest Collection At Fanatics For The Playoffs

May 08, 2025

Boston Celtics Gear Shop The Latest Collection At Fanatics For The Playoffs

May 08, 2025 -

Conflicto Entre Jugadores De Flamengo Y Botafogo Una Batalla Campal Sin Precedentes

May 08, 2025

Conflicto Entre Jugadores De Flamengo Y Botafogo Una Batalla Campal Sin Precedentes

May 08, 2025 -

Charlotte Hornets Potential Veteran Replacements For Taj Gibson

May 08, 2025

Charlotte Hornets Potential Veteran Replacements For Taj Gibson

May 08, 2025