Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Palantir's Recent Performance and Upcoming Earnings Report

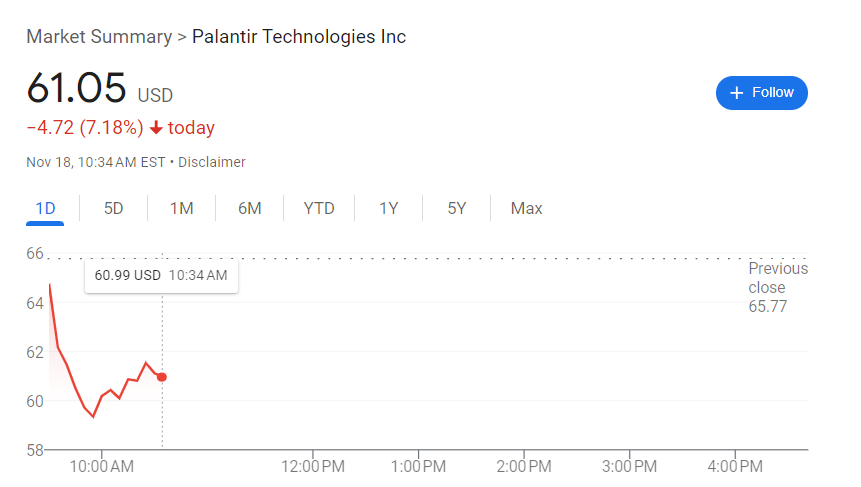

Palantir's recent stock price has fluctuated considerably, reflecting the inherent volatility within the tech sector and the company's unique position in the data analytics and government contracting space. The upcoming May 5th earnings report is paramount for investor sentiment. A strong performance could send the PLTR stock price soaring, while disappointing results could trigger a significant drop.

- Key Financial Metrics: Investors will be closely scrutinizing revenue growth, particularly from the commercial sector, as well as progress towards profitability. Operating margins and cash flow will also be key indicators of Palantir's financial health.

- Recent Contract Wins and Partnerships: New contract announcements, especially large government contracts or strategic partnerships, could significantly influence investor confidence and the PLTR stock price. Any details regarding these partnerships in the earnings report will be crucial.

- Analyst Predictions for Q1 2024 Earnings: While predictions vary widely, analysts generally anticipate continued revenue growth, though the pace of growth might be a determining factor in the market reaction. Specific expectations for earnings per share (EPS) will also be closely watched.

- Potential Market Reaction: A beat on earnings expectations, combined with positive guidance for the remainder of the year, could lead to a substantial rally in PLTR stock. Conversely, a miss on expectations could trigger a sell-off.

Analyst Ratings and Price Targets: A Divided Wall Street

Wall Street analysts are sharply divided on Palantir's prospects. While some maintain a bullish outlook, citing the company's potential for long-term growth in the AI and government data analytics sectors, others express concerns about valuation and profitability. This divergence creates significant uncertainty for potential investors.

- Analyst Ratings and Price Targets: A range of ratings, from "buy" to "sell," exists across various financial institutions. Prominent analysts such as [insert examples of analysts and their ratings/price targets here – ensure you cite sources] showcase the spectrum of opinions. (Insert a chart here visualizing the distribution of buy, hold, and sell ratings.)

- Factors Contributing to Differing Opinions: Disagreements stem from differing assessments of Palantir's growth trajectory, the sustainability of its government contracts, and its valuation relative to its peers. Risk tolerance also plays a significant role in shaping individual analyst opinions.

Factors Influencing Palantir's Stock Price Beyond Earnings

Several factors beyond the May 5th earnings report could influence Palantir's stock price. Macroeconomic conditions, geopolitical events, and the company's long-term strategy all play a crucial role.

- Macroeconomic Indicators: Interest rate hikes, inflation levels, and overall economic growth significantly impact the tech sector, including Palantir. A slowdown in economic activity could negatively affect demand for Palantir's services.

- Geopolitical Events and Government Contracts: Palantir's reliance on government contracts makes it susceptible to geopolitical shifts. Changes in government priorities or international relations could influence future contract awards.

- Palantir's Long-Term Growth Strategy: The company's investments in artificial intelligence (AI) and its expansion into new markets are key drivers of its long-term growth potential. Success in these areas could significantly boost investor confidence.

- Risk Assessment: Investing in Palantir carries inherent risks, including stock price volatility and the potential for earnings misses. The company's dependence on government contracts adds another layer of risk.

Should You Buy Before May 5th? A Risk Assessment

The decision of whether to buy Palantir stock before the May 5th earnings report involves carefully weighing the potential benefits against the considerable risks.

- Potential Benefits: A successful earnings report could lead to significant capital appreciation. Long-term investors believe in Palantir's growth potential in the expanding AI and data analytics markets.

- Potential Risks: The stock is highly volatile, and a disappointing earnings report could trigger a sharp decline. Uncertainty surrounding government contracts and macroeconomic factors adds further risk.

- Alternative Investment Strategies: Risk-averse investors might consider alternative investment strategies, such as diversifying their portfolio or focusing on more established tech companies.

- Further Research: Before making any investment decision, conduct thorough due diligence, review Palantir's financial statements, and consider consulting with a qualified financial advisor.

Conclusion

The decision of whether to buy Palantir stock before May 5th is complex. Wall Street's divided sentiment highlights the uncertainty surrounding the company's future performance. While Palantir offers significant long-term growth potential in the AI and data analytics sectors, its stock price remains highly volatile. The upcoming earnings report will be a critical factor, but macroeconomic conditions and geopolitical events also play a role.

Ultimately, the decision of whether to buy Palantir stock (PLTR) before May 5th depends on your individual investment goals and risk tolerance. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions regarding Palantir stock. Carefully weigh the potential rewards against the risks before investing in Palantir Technologies. Remember that this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

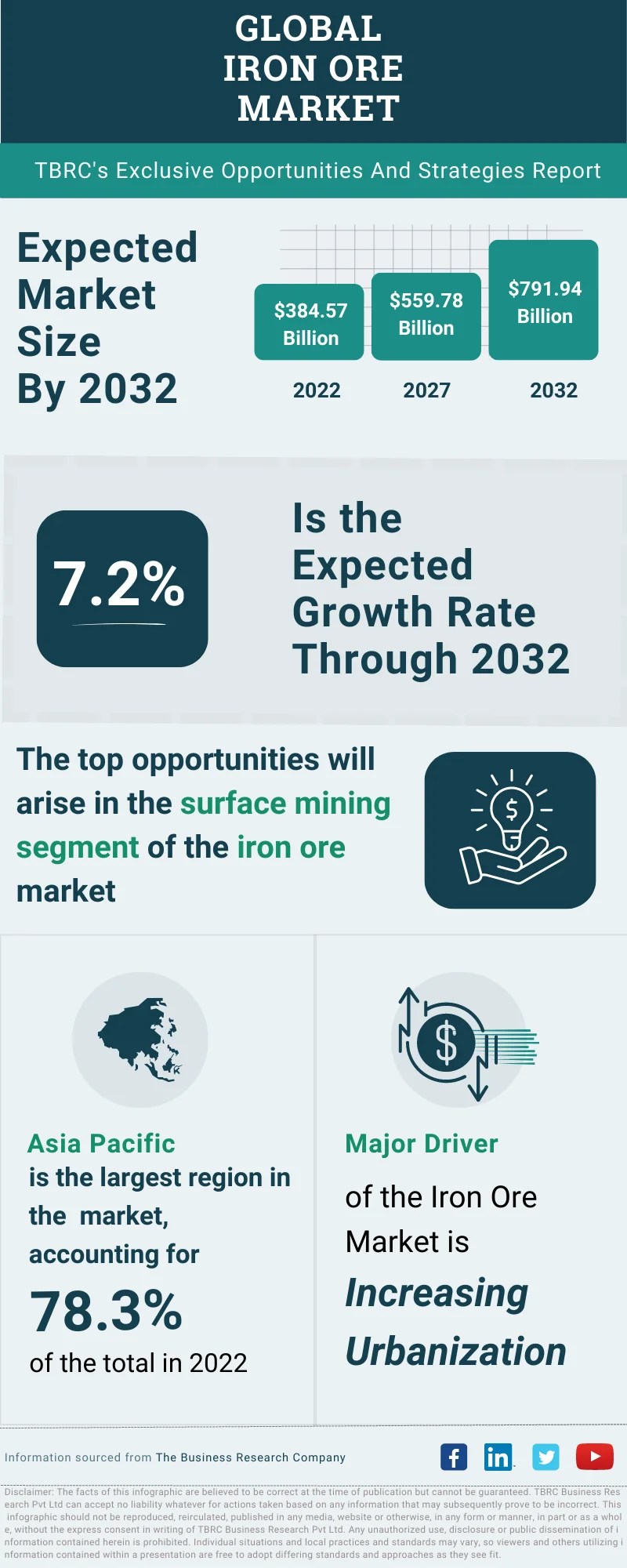

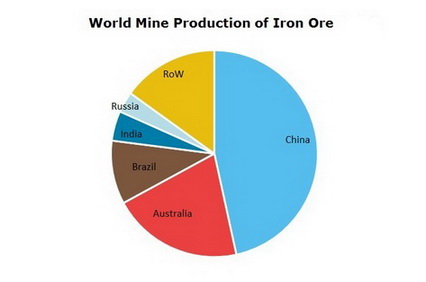

Iron Ore Market Volatility Understanding Chinas Steel Production Cuts

May 09, 2025

Iron Ore Market Volatility Understanding Chinas Steel Production Cuts

May 09, 2025 -

Reduced Steel Production In China The Plunge In Iron Ore Prices

May 09, 2025

Reduced Steel Production In China The Plunge In Iron Ore Prices

May 09, 2025 -

Hsad Fyraty Me Alerby Alqtry Hl Njh Bed Rhylh En Alahly Almsry

May 09, 2025

Hsad Fyraty Me Alerby Alqtry Hl Njh Bed Rhylh En Alahly Almsry

May 09, 2025 -

Stock Market Today Sensex Nifty Surge Ultra Tech Cement Dips

May 09, 2025

Stock Market Today Sensex Nifty Surge Ultra Tech Cement Dips

May 09, 2025 -

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025

3 000 Babysitter 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025