Should You Invest In XRP (Ripple) While It's Under $3? A Prudent Investor's Guide

Table of Contents

1. Introduction

The cryptocurrency market is notoriously volatile, and XRP is no exception. Before considering whether to invest in XRP, it's vital to understand its purpose and the underlying technology driving its value. XRP serves as a bridge currency within RippleNet, a payment settlement system designed to facilitate faster and cheaper international transactions for financial institutions. Ripple's history is intertwined with XRP's development, and its success is intrinsically linked to the adoption of RippleNet. However, remember that investing in any cryptocurrency, including XRP, involves significant risk. This guide aims to provide you with the information needed to make an informed decision about whether to invest in XRP.

2. Main Points

H2: Understanding XRP and Ripple's Technology

H3: RippleNet and its Global Reach

RippleNet is a real-time gross settlement system (RTGS) that connects banks and payment providers globally. Its functionality relies on XRP to enable fast and efficient cross-border payments. The network's growing adoption by major financial institutions is a significant factor influencing XRP's value. Key partnerships with banks worldwide demonstrate RippleNet's increasing global reach and potential for future growth. This growing network effect is a critical component to consider when evaluating an XRP investment.

- XRP transactions are significantly faster and cheaper than traditional banking systems, offering a compelling alternative for international money transfers.

- The number of banks and payment providers utilizing RippleNet is steadily increasing, signifying growing confidence in the technology and potentially boosting XRP demand.

- Recent developments and upgrades to RippleNet technology continuously enhance its efficiency and scalability, further strengthening its position in the global financial landscape. Staying updated on these advancements is crucial for any serious XRP investment consideration.

H2: Analyzing the Current Market Conditions for XRP

H3: Assessing the Risks

Investing in XRP, like any cryptocurrency, carries inherent risks. Market volatility is a primary concern, and XRP's price can fluctuate dramatically in short periods. The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) also presents a significant risk factor. The outcome of this case could substantially impact XRP's price and future prospects.

- The SEC lawsuit against Ripple remains a major uncertainty for XRP investors. A negative ruling could lead to a significant price drop.

- Regulatory decisions worldwide can significantly influence the price of cryptocurrencies, including XRP. Staying informed about regulatory developments is essential for managing risk.

- Current market sentiment towards XRP is a crucial factor to consider. Analyzing news, social media discussions, and expert opinions can help gauge market sentiment and potential price movements.

H3: Evaluating the Potential Rewards

Despite the risks, XRP's potential rewards are considerable. Increased adoption of RippleNet by financial institutions could significantly boost demand for XRP, driving its price higher. A positive resolution to the SEC lawsuit would also likely lead to a substantial price increase. Technological advancements and partnerships could further enhance XRP's value proposition.

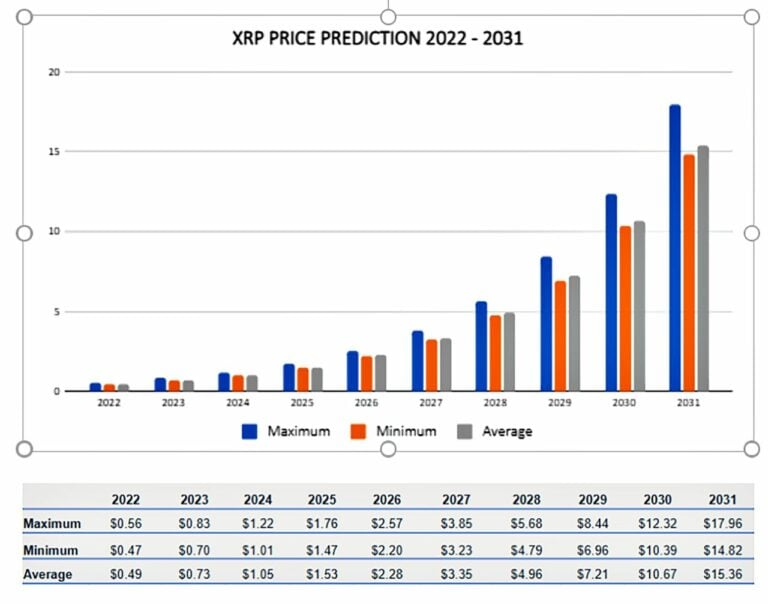

- Potential price targets vary widely depending on market conditions and regulatory outcomes. It’s crucial to conduct your own research and consider multiple perspectives.

- The long-term potential of XRP as a global payment solution remains a significant driver for investors. The potential for widespread adoption is a key factor in its appeal.

- Increased demand driven by broader adoption could lead to substantial price appreciation.

H2: Building a Diversified Investment Portfolio

H3: The Importance of Diversification

A well-diversified portfolio is crucial for mitigating risk. Investing solely in XRP, or any single cryptocurrency, exposes you to significant volatility. XRP should be a part of a broader investment strategy, not your entire investment strategy.

- Diversification across asset classes (stocks, bonds, real estate, etc.) is essential for reducing overall portfolio risk.

- Understanding your risk tolerance is critical. XRP is a high-risk, high-reward investment, suitable only for investors comfortable with significant price fluctuations.

- Consider complementing your XRP investment with other assets to balance risk and potential returns.

H2: Practical Steps to Invest in XRP

H3: Choosing a Reputable Exchange

Selecting a secure and reputable cryptocurrency exchange is paramount. Research exchanges carefully, considering factors such as security measures, fees, and user reviews before investing in XRP.

- Reputable cryptocurrency exchanges include Coinbase, Binance, Kraken, and others. However, always conduct your own due diligence.

- The process of creating an account and verifying your identity is typically straightforward but crucial for security.

- Robust security measures, such as two-factor authentication (2FA), are essential to protect your XRP investment from theft or loss.

H3: Understanding Transaction Fees and Costs

Buying, holding, and selling XRP involves various fees. Understanding these costs is crucial for budgeting your XRP investment.

- Trading fees on different exchanges vary, so compare fees before choosing an exchange.

- There may be gas fees associated with XRP transactions, especially on certain platforms.

- Tax implications of investing in XRP vary significantly depending on your jurisdiction. Consult a tax advisor for personalized guidance.

3. Conclusion

Investing in XRP presents both significant opportunities and considerable risks. The potential for high rewards is counterbalanced by the volatility of the cryptocurrency market and the uncertainties surrounding the SEC lawsuit. Understanding RippleNet's technology, analyzing market conditions, and building a diversified portfolio are all critical steps in making an informed decision. Remember to conduct thorough research and only invest what you can afford to lose.

With careful consideration of the factors discussed above, you can decide if investing in XRP at its current price aligns with your financial goals. Remember to conduct thorough research and only invest what you can afford to lose. Make informed decisions about whether to invest in XRP today!

Featured Posts

-

Kate And Lila Mosss Identical Lbds Steal The Show At London Fashion Week

May 02, 2025

Kate And Lila Mosss Identical Lbds Steal The Show At London Fashion Week

May 02, 2025 -

Knapriga Kycklingnuggets I Majsflingor Recept Med Asiatisk Kalsallad

May 02, 2025

Knapriga Kycklingnuggets I Majsflingor Recept Med Asiatisk Kalsallad

May 02, 2025 -

Xrp Price Prediction Analyzing The Post Sec Lawsuit Market Outlook

May 02, 2025

Xrp Price Prediction Analyzing The Post Sec Lawsuit Market Outlook

May 02, 2025 -

Is Fortnite Offline Checking Server Status And Update 34 30 Details

May 02, 2025

Is Fortnite Offline Checking Server Status And Update 34 30 Details

May 02, 2025 -

Streamlining Workboat Operations A Collaboration Between Tbs Safety And Nebofleet

May 02, 2025

Streamlining Workboat Operations A Collaboration Between Tbs Safety And Nebofleet

May 02, 2025