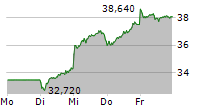

Simkus (ECB): Two Further Interest Rate Cuts On The Table Due To Trade Slowdown

Table of Contents

The Impact of the Global Trade Slowdown on the Eurozone

The global trade slowdown is significantly impacting the Eurozone economy, creating ripples across various sectors and dampening growth prospects.

Weakening Export Markets

The decline in exports from the Eurozone to key trading partners like China and the US is a major contributing factor. This contraction is evident in several key indicators:

- Decreased trade volume: Statistics from Eurostat show a consistent decline in the volume of goods exported from the Eurozone in recent quarters.

- Falling GDP growth: The reduced export demand directly contributes to slower GDP growth within the Eurozone, impacting overall economic output.

- Industry-specific impacts: Export-oriented sectors such as automotive manufacturing, machinery, and chemicals are particularly vulnerable, experiencing reduced orders and production cuts.

Reduced Investment and Business Confidence

The uncertainty surrounding the global trade outlook is leading to a significant decline in business investment. Companies are hesitant to commit to large-scale projects and expansion plans due to the unpredictable nature of future demand.

- Falling business confidence indices: Eurozone business confidence indices have fallen considerably in recent months, reflecting this heightened uncertainty.

- Decreased capital expenditure: Businesses are delaying or canceling investments in new equipment and technologies, further hindering economic growth.

- Link to slowing economic growth: The decrease in investment directly translates to slower economic expansion and reduced job creation.

Rising Unemployment Concerns

The trade slowdown's impact on export-oriented sectors is leading to concerns about rising unemployment. Job losses in these industries can have far-reaching consequences:

- Job losses in export sectors: Companies facing reduced demand are forced to cut costs, often leading to layoffs and redundancies.

- Social and political consequences: Increased unemployment can lead to social unrest and political instability, placing further strain on the Eurozone economy.

- Unemployment forecasts: Several economic forecasts predict a rise in unemployment rates across the Eurozone in the coming months.

Simkus's Rationale for Predicting Two Further Interest Rate Cuts

Simkus's prediction of two further interest rate cuts is rooted in his assessment of the current economic climate and the need for proactive intervention by the ECB.

Combating Deflationary Pressures

The trade slowdown risks pushing the Eurozone into deflation. Decreased demand and weak price pressures create a downward spiral, potentially harming economic recovery.

- Deflationary risks: The combination of reduced demand and excess capacity increases the likelihood of falling prices.

- ECB's response to deflation: The ECB aims to maintain price stability, and cutting interest rates is a common tool to combat deflationary pressures.

- Simkus's assessment: Simkus believes the risks of deflation are significant and warrant decisive action from the ECB.

Stimulating Economic Growth

Lower interest rates aim to stimulate economic activity by encouraging borrowing and spending. This can boost investment, consumption, and overall economic growth.

- Incentivizing borrowing: Lower interest rates make borrowing cheaper for businesses and consumers, incentivizing investment and expenditure.

- Boosting consumption: Increased consumer spending can help to offset the negative impacts of reduced exports.

- Simkus's perspective: Simkus believes that interest rate cuts are necessary to counteract the negative effects of the trade slowdown and stimulate economic growth.

Comparison to Previous ECB Responses to Economic Slowdowns

Simkus's prediction is informed by the ECB's historical responses to economic downturns. Analyzing past actions provides valuable insights into potential future strategies.

- Historical precedent: The ECB has implemented interest rate cuts in previous periods of economic weakness.

- Effectiveness of past cuts: Analyzing the effectiveness of past interest rate cuts helps to understand their potential impact in the current situation.

- Simkus's comparison: Simkus draws parallels between the current economic climate and past downturns to justify his prediction.

Potential Challenges and Alternative Scenarios

While interest rate cuts can be beneficial, they also carry potential risks and might not be the only solution.

Risks Associated with Further Rate Cuts

Cutting interest rates too aggressively might lead to undesirable consequences:

- Inflationary pressures: Extremely low interest rates could potentially fuel inflation in the long run.

- Asset bubbles: Low interest rates can lead to an increase in asset prices, potentially creating financial instability.

- Simkus's risk assessment: Simkus likely acknowledges these risks and considers how the ECB might mitigate them.

Alternative Monetary Policy Options

The ECB might explore other policy options besides interest rate cuts:

- Quantitative easing: The ECB could increase its bond-buying program to inject liquidity into the market.

- Targeted lending programs: The ECB could provide loans at favorable rates to specific sectors of the economy.

- Simkus's alternatives: Simkus might discuss the likelihood of the ECB employing these alternative strategies alongside or instead of interest rate cuts.

Conclusion: Simkus's Prediction and the Future of the ECB's Monetary Policy

Simkus's prediction of two further interest rate cuts by the ECB stems from a thorough analysis of the ongoing global trade slowdown, its impact on the Eurozone, and the need to combat potential deflationary pressures and stimulate economic growth. While he acknowledges the potential risks associated with further rate cuts and considers alternative monetary policy options, his assessment points towards a proactive approach by the ECB. To stay informed about the ECB's decisions and the evolving economic landscape, follow Simkus's analysis and stay updated on future ECB monetary policy announcements regarding Simkus (ECB) interest rate cuts. [Link to relevant source/Simkus's website].

Featured Posts

-

Revealed Patrick Schwarzeneggers Missing Part In Ariana Grandes White Lotus

Apr 27, 2025

Revealed Patrick Schwarzeneggers Missing Part In Ariana Grandes White Lotus

Apr 27, 2025 -

Ariana Grandes Transformation Exploring The Professional Expertise Involved

Apr 27, 2025

Ariana Grandes Transformation Exploring The Professional Expertise Involved

Apr 27, 2025 -

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025 -

Pressemitteilung Pne Ag Veroeffentlicht Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Pressemitteilung Pne Ag Veroeffentlicht Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Prioridad Materna Wta Lidera Con Pago Por Licencia De Maternidad

Apr 27, 2025

Prioridad Materna Wta Lidera Con Pago Por Licencia De Maternidad

Apr 27, 2025

Latest Posts

-

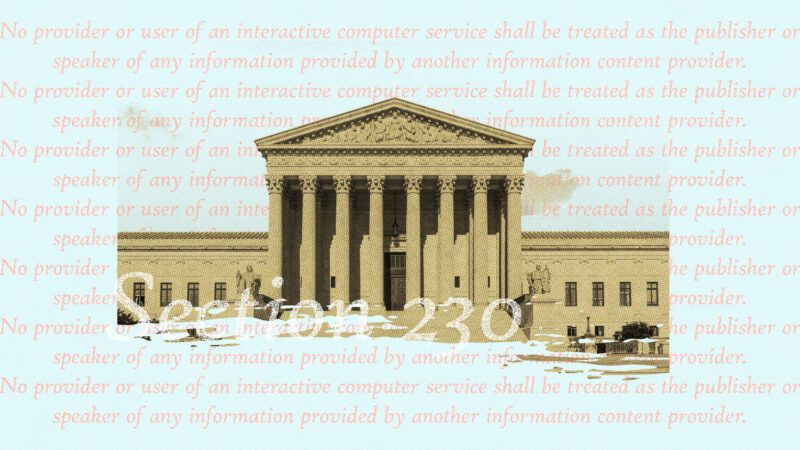

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

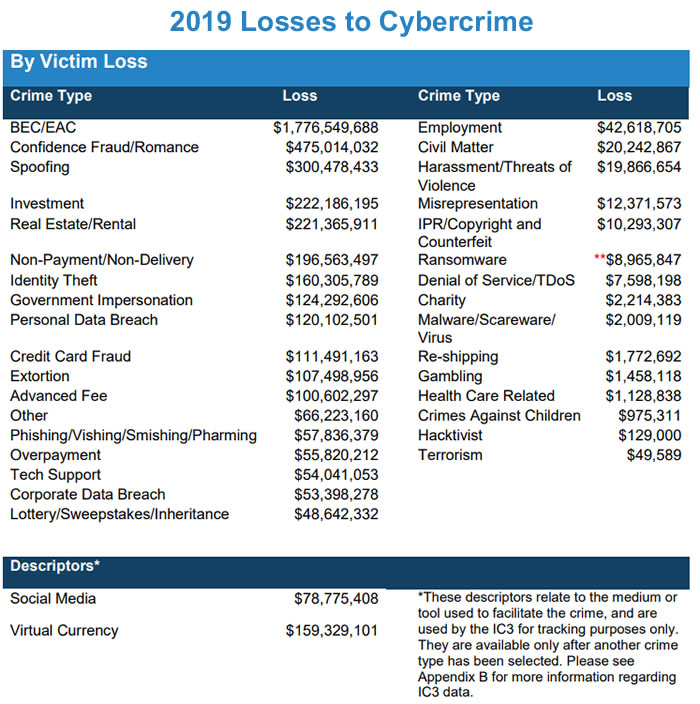

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025