Simplifying Banking: ECB Establishes New Regulatory Task Force

Table of Contents

The Need for Simplified Banking Regulation

The current regulatory environment for banks in the Eurozone presents significant challenges. Years of accumulating regulations, often overlapping and inconsistently applied, have created an excessively complex system.

Current Challenges Faced by Banks:

Banks currently grapple with:

- Excessive bureaucracy and administrative burden: The sheer volume of paperwork and compliance requirements diverts valuable resources away from core banking activities.

- Difficulty in complying with fragmented and overlapping regulations: Navigating the intricate web of rules across different jurisdictions and regulatory bodies is a significant hurdle.

- High compliance costs: The expense of ensuring regulatory compliance places a strain on profitability, hindering investment and growth.

- Increased operational risks: Complexity increases the risk of non-compliance, leading to potential fines and reputational damage.

- Inconsistent application of regulations across different member states: This creates an uneven playing field for banks operating in multiple jurisdictions.

- Lack of clarity and transparency in regulatory requirements: Ambiguity in regulations often leads to uncertainty and difficulties in interpretation.

Benefits of Simplified Banking:

Simplified banking regulation offers numerous advantages:

- Reduced compliance costs: Streamlined regulations will free up resources, allowing banks to focus on core business activities and innovation.

- Improved efficiency and operational effectiveness: Clearer and simpler rules will reduce administrative burden and operational risks.

- Enhanced competitiveness within the European banking sector: A level playing field fostered by consistent and simplified regulations will boost competitiveness.

- Increased resilience and stability of the financial system: A simpler, more transparent regulatory framework can improve the overall health and stability of the financial system.

- Greater clarity and predictability for banks regarding regulatory expectations: This will reduce uncertainty and improve long-term planning.

- Stimulated innovation and growth within the financial sector: Reduced compliance burdens will free up resources for investment in new technologies and services.

The ECB's Regulatory Task Force: Mandate and Objectives

The ECB's newly established task force will play a crucial role in achieving regulatory simplification.

Composition and Expertise:

The task force is likely to comprise representatives from various ECB departments, including banking supervision and monetary policy, as well as experts from national central banks across the Eurozone. The inclusion of external experts from academia and the private sector could further enhance the task force's expertise and ensure a balanced perspective.

Key Objectives:

The primary objectives of the task force include:

- Identifying areas of unnecessary complexity in existing regulations: A thorough review of existing regulations to pinpoint areas ripe for simplification.

- Proposing concrete measures to streamline and simplify the regulatory framework: Developing specific proposals for regulatory reform to achieve greater clarity and efficiency.

- Improving the clarity and consistency of regulations across the Eurozone: Harmonizing regulations to create a level playing field for banks across the Eurozone.

- Enhancing the effectiveness and efficiency of supervisory processes: Improving supervisory practices to ensure efficient and effective monitoring of banks’ compliance.

- Developing a roadmap for implementing regulatory simplification measures: Creating a clear plan for the phased implementation of the proposed changes.

- Engaging with stakeholders (banks, industry associations, etc.) to gather feedback and ensure a practical approach: A collaborative approach involving all stakeholders will be crucial for ensuring the success of the initiative.

Potential Impact and Expected Outcomes

The ECB's regulatory simplification efforts hold significant potential for positive change.

Benefits for Banks:

Simplified banking regulation can translate into:

- Reduced capital requirements: Streamlining certain activities could lead to lower capital requirements, freeing up capital for lending and investment.

- Simplified reporting procedures: Less complex reporting requirements will reduce administrative burden and free up resources.

- Improved access to funding: A more efficient regulatory environment can improve banks' access to funding.

Benefits for Consumers:

Consumers can expect:

- Better services: More efficient banks can offer improved customer service and a wider range of products.

- Lower costs: Reduced compliance costs for banks could translate into lower fees and interest rates for consumers.

- Increased innovation: Greater freedom for banks to invest in innovation can lead to more advanced and convenient financial products and services.

Challenges and Potential Risks:

While the initiative offers many benefits, potential challenges include:

- Unintended loopholes: Overly simplified regulations could inadvertently create loopholes that could be exploited.

- Risks to financial stability: Inadequate regulation could pose risks to the overall stability of the financial system.

- Assessment of the impact on smaller banks versus larger institutions: Ensuring that simplification benefits all banks, regardless of size, will be crucial.

- Potential impact on competition and market dynamics: The task force needs to carefully assess how the changes might affect competition within the banking sector.

Conclusion

The ECB's establishment of a new regulatory task force marks a significant step towards simplifying banking in the Eurozone. This initiative directly addresses the challenges posed by overly complex regulations, paving the way for a more efficient, competitive, and resilient financial sector. The task force's work will be instrumental in shaping the future of banking regulation across Europe. The success of this initiative hinges on a careful balancing act – simplifying the rules without compromising financial stability or creating unintended consequences.

Call to Action: Stay informed about the progress of the ECB's regulatory task force and its impact on banking simplification. Follow the ECB's website and other reputable financial news sources to stay updated on this important development. The future of simplified banking is being shaped now; let's work together to make it a success.

Featured Posts

-

The Troubling Trend Of Wildfire Betting A Los Angeles Case Study

Apr 27, 2025

The Troubling Trend Of Wildfire Betting A Los Angeles Case Study

Apr 27, 2025 -

Understanding Ariana Grandes Hair And Tattoo Choices Professional Perspectives

Apr 27, 2025

Understanding Ariana Grandes Hair And Tattoo Choices Professional Perspectives

Apr 27, 2025 -

Canadian Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025

Canadian Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025 -

Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Guidance

Apr 27, 2025

Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Guidance

Apr 27, 2025 -

Understanding The Professional Help Behind Ariana Grandes Stunning Makeover

Apr 27, 2025

Understanding The Professional Help Behind Ariana Grandes Stunning Makeover

Apr 27, 2025

Latest Posts

-

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

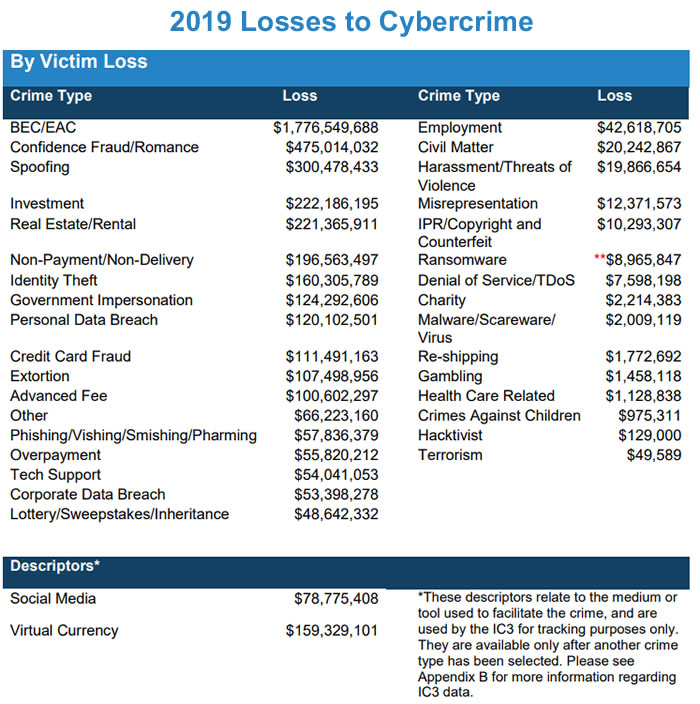

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025