Stock Market Rally: Trump's Influence On US Futures

Table of Contents

Tax Cuts and Their Impact on Stock Market Performance

The 2017 Tax Cuts and Jobs Act significantly lowered corporate tax rates from 35% to 21%. This was intended to boost corporate profitability, stimulate investment, and ultimately drive economic growth, leading to a stock market rally.

-

Increased corporate profits leading to higher stock prices: The lower tax burden theoretically freed up more capital for companies, allowing them to reinvest in their businesses, increase dividends, or buy back their own stock, thus pushing stock prices higher. Many companies did report increased profits following the tax cuts, contributing to a positive market sentiment.

-

Potential for short-term gains versus long-term sustainable growth: While the initial impact on stock prices was positive, the long-term effects are a subject of ongoing debate. Some economists argue that the tax cuts primarily benefited large corporations and the wealthy, failing to generate widespread economic growth or significantly improve the lives of average Americans. Critics point to a lack of substantial investment in infrastructure or research and development as evidence of this.

-

Criticism regarding the distribution of tax benefits and its impact on income inequality: The tax cuts disproportionately benefited high-income earners and corporations, exacerbating existing income inequality. This led to concerns that the economic gains were not broadly shared, undermining the overall long-term sustainability of the stock market rally.

-

Specific sectors that benefited most from the tax cuts: The technology and finance sectors, already performing well, experienced significant gains following the tax cuts. These sectors' high profitability and ability to utilize the tax advantages contributed to their outsized performance in the market. Analysis shows a disproportionate increase in the stock prices of companies in these industries compared to others.

-

Statistics and charts: [Insert relevant charts and graphs illustrating the correlation between the tax cuts, corporate profits, and stock market performance. Include data on market indices before and after the tax cut implementation. Source data should be clearly cited].

Deregulation and its Effect on US Futures Markets

The Trump administration pursued a policy of deregulation across various sectors, aiming to reduce regulatory burdens on businesses and encourage investment. This approach had a noticeable impact on certain markets.

-

Reduced regulatory burdens on businesses, potentially leading to increased investment and growth: By lessening the compliance costs and complexities associated with government regulations, businesses could potentially invest more freely, leading to increased productivity and economic growth. This, in theory, should have boosted investor confidence and contributed to the stock market rally.

-

Potential risks associated with reduced oversight and environmental regulations: The decreased regulatory oversight raised concerns about potential negative consequences, including increased environmental damage and a higher risk of financial instability. Critics argued that the long-term costs of such deregulation could outweigh any short-term benefits.

-

Impact on specific sectors significantly impacted by deregulation: The energy sector, for example, saw a notable easing of environmental regulations, potentially boosting profits for fossil fuel companies. This impact however, varied considerably across the sector and was not uniformly positive.

-

Controversies surrounding specific deregulation policies: Many deregulation initiatives faced strong opposition and legal challenges. These controversies, and the uncertainty they created, affected investor confidence and market volatility.

-

Charts illustrating the impact on market volatility and economic indicators: [Insert relevant charts illustrating the impact of deregulation on various sectors and economic indicators. Show data on market volatility and relevant economic data to support the analysis. Source data should be clearly cited].

Trade Wars and Their Unpredictable Influence

Trump's trade policies, marked by tariffs and trade disputes, introduced significant uncertainty into the market. This unpredictability had both short-term and long-term effects on US futures.

-

Short-term market reactions to trade announcements and escalations: Trade announcements and escalations often led to sharp market fluctuations, reflecting investors' anxieties about the potential economic consequences.

-

Long-term effects on global trade relationships and US economic competitiveness: The trade wars damaged US relationships with key trading partners and raised questions about the long-term health of the global economy. This uncertainty likely dampened investor enthusiasm.

-

Industries significantly affected by tariffs: The agriculture and manufacturing sectors were particularly hard-hit by tariffs imposed by other countries in response to US actions.

-

The role of market uncertainty in driving volatility: The overall uncertainty created by the trade wars was a major driver of market volatility throughout this period.

-

Data on market performance during periods of heightened trade tensions: [Include charts and data showing market reactions during specific periods of increased trade tension. Clearly cite data sources].

The Role of Confidence and Market Sentiment

Trump's communication style and political rhetoric played a significant role in shaping investor confidence and market sentiment.

-

Impact of tweets and public statements on market reactions: His frequent and often unpredictable tweets and public statements frequently caused immediate market reactions, reflecting the market's sensitivity to his pronouncements.

-

Investor sentiment influenced market behavior: Market behavior was heavily influenced by investor sentiment, which was often directly correlated with Trump's pronouncements and actions.

-

Periods of market optimism and pessimism correlated with political events: Periods of heightened optimism often coincided with announcements of positive economic news or favorable policy decisions, while negative news or controversial actions often resulted in market downturns.

-

Separating real economic effects from sentiment-driven market swings: Distinguishing between actual economic factors and sentiment-driven market fluctuations is crucial when evaluating the true impact of Trump's policies on the stock market rally.

Conclusion

This article examined the complex relationship between the stock market rally and Donald Trump's economic policies. While tax cuts and deregulation potentially boosted corporate profits and stock prices in the short term, the impact of trade wars and the unpredictable nature of market sentiment complicate the picture. Analyzing the lasting effects requires a nuanced understanding of both economic realities and the psychological forces driving market behavior. To gain a deeper understanding of these complex interactions and learn how to navigate future market fluctuations, further research into stock market rally analysis, including the study of specific policy impacts and market sentiment, is crucial. Stay informed and make informed investment decisions.

Featured Posts

-

All Star Weekend Recap Herros 3 Point Victory And Cavs Skills Challenge Domination

Apr 24, 2025

All Star Weekend Recap Herros 3 Point Victory And Cavs Skills Challenge Domination

Apr 24, 2025 -

65 Hudsons Bay Leases Generate Strong Investor Interest

Apr 24, 2025

65 Hudsons Bay Leases Generate Strong Investor Interest

Apr 24, 2025 -

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

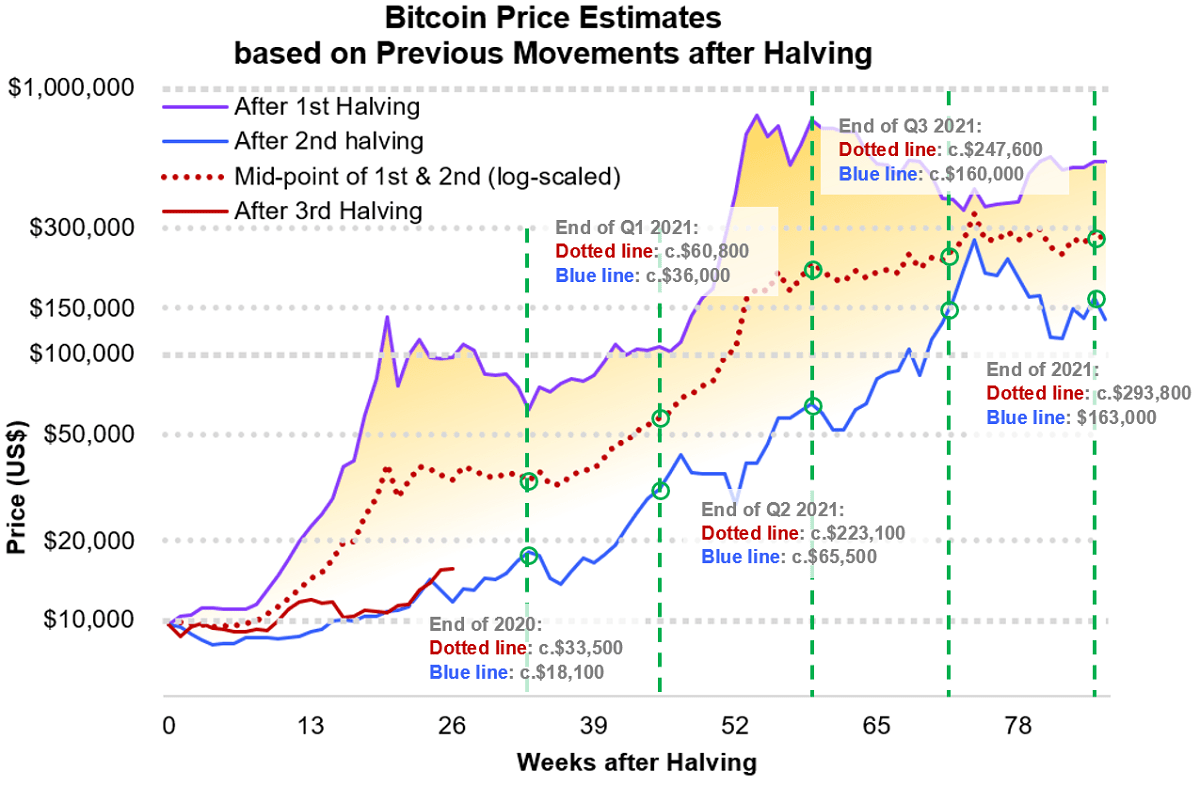

Trumps Trade Policy And The Federal Reserve How They Are Fueling Bitcoins Btc Growth

Apr 24, 2025

Trumps Trade Policy And The Federal Reserve How They Are Fueling Bitcoins Btc Growth

Apr 24, 2025