Tesla's Board Under Fire From State Treasurers For Musk's Focus

Table of Contents

State Treasurers' Concerns Regarding Musk's Diversions

State treasurers, responsible for managing billions of dollars in public funds, often hold significant investments in publicly traded companies like Tesla. Their concerns regarding Elon Musk's leadership are not trivial; they represent the anxieties of a substantial portion of Tesla's investor base. These concerns stem primarily from Musk's increasingly divided attention and the potential negative impact on Tesla's performance and stability.

- Diverted Focus: Musk's considerable time and energy commitment to SpaceX and, particularly, his tumultuous takeover of Twitter, have raised serious questions about his ability to effectively lead Tesla. Critics argue that his focus is diffused, leaving Tesla vulnerable.

- Stock Performance Impact: Tesla's stock price has experienced significant volatility in recent years, partly attributed to Musk's unpredictable actions and pronouncements. This volatility directly impacts the value of state treasuries' investments and the returns for taxpayers.

- Risk to Shareholder Value: The perception of mismanagement, particularly in light of the Twitter acquisition and its associated financial strain, poses a significant risk to shareholder value. State treasurers are entrusted with maximizing returns for their constituents and view Musk's actions as potentially detrimental to this objective.

- The Twitter Acquisition Example: The Twitter acquisition, financed partly through Tesla stock sales, stands as a prime example of the concerns. This deal not only diverted substantial resources but also fueled uncertainty within the investment community, causing significant market fluctuations. News outlets like the Financial Times and the Wall Street Journal have extensively reported on the negative sentiment among investors following this event.

The financial implications of Musk's actions are undeniable. The massive debt incurred during the Twitter acquisition has led to concerns about Tesla's financial stability and its ability to fund crucial R&D and expansion projects.

The Role of Tesla's Board of Directors in Addressing the Concerns

Tesla's board of directors carries the crucial responsibility of overseeing the company's strategic direction and ensuring its long-term success. Their handling of Musk's activities, or lack thereof, is now under intense scrutiny.

- Effectiveness in Addressing Concerns: The board's effectiveness in responding to shareholder concerns remains a significant question mark. Critics argue that the board has been insufficiently proactive in addressing the issues arising from Musk's divided attention.

- Board Composition and Conflicts of Interest: The composition of the board and the presence of any potential conflicts of interest also warrants scrutiny. The board's capacity for independent oversight needs to be thoroughly examined.

- Potential Board Actions: The board could implement stricter oversight mechanisms, including more rigorous performance evaluations for Musk and clear guidelines regarding his external commitments. They could also explore succession planning to mitigate the risks associated with over-reliance on a single individual.

- Board Response to Criticism: While the board may have issued statements defending their actions, the adequacy of these responses is debatable and continues to generate discussion among shareholders and analysts.

The question remains: is the Tesla board adequately representing the interests of all shareholders, particularly those who are increasingly vocal about their concerns?

Potential Consequences for Tesla and its Stock Price

The ongoing controversy surrounding Tesla's leadership carries significant potential consequences for the company's future.

- Impact on Stock Price and Investor Confidence: Continued uncertainty regarding Musk's leadership and the board's responsiveness could further erode investor confidence, resulting in sustained pressure on Tesla's stock price.

- Regulatory Scrutiny and Investigations: Regulatory bodies could launch investigations into Tesla's corporate governance practices, particularly concerning the management of conflicts of interest and potential breaches of fiduciary duty.

- Brand Image and Reputation: The negative publicity surrounding Musk's actions and the board's perceived inaction could tarnish Tesla's brand image and reputation, impacting its ability to attract customers and talent.

- Risks to Future Growth and Market Position: The internal turmoil and uncertainty could hinder Tesla's ability to innovate and compete effectively in the increasingly competitive electric vehicle market.

The possibility of shareholder lawsuits and calls for board changes is not insignificant, highlighting the seriousness of the current situation.

Comparison to Other Companies Facing Similar Challenges

Several companies have faced similar challenges with CEO distractions. For instance, [insert example company A] experienced a period of uncertainty when its CEO became heavily involved in a separate venture, ultimately impacting the company's stock performance and requiring intervention from the board. Similarly, [insert example company B] demonstrated how effective board oversight and transparent communication can mitigate the negative effects of a CEO's divided attention. These comparisons highlight the crucial role of strong corporate governance and the consequences of inadequate board oversight.

Tesla's Board and Musk's Focus: A Critical Crossroads

In conclusion, the concerns raised by state treasurers about Elon Musk's leadership and the perceived inaction of Tesla's board are significant and warrant close attention. The board's role in safeguarding shareholder value and ensuring Tesla's long-term success is paramount. The coming months will be critical in determining how Tesla navigates these challenges and whether the board can effectively address the concerns of its investors. Stay informed about further developments related to Tesla's board and Musk's leadership. Share your opinions and concerns regarding Tesla's board response to Musk’s focus. The future of this electric vehicle giant hinges on decisive action and transparent communication.

Featured Posts

-

Mlb Betting Player Props And Best Bets For Todays Games

Apr 23, 2025

Mlb Betting Player Props And Best Bets For Todays Games

Apr 23, 2025 -

Renewed Opposition Car Dealers Push Back Against Ev Mandate Requirements

Apr 23, 2025

Renewed Opposition Car Dealers Push Back Against Ev Mandate Requirements

Apr 23, 2025 -

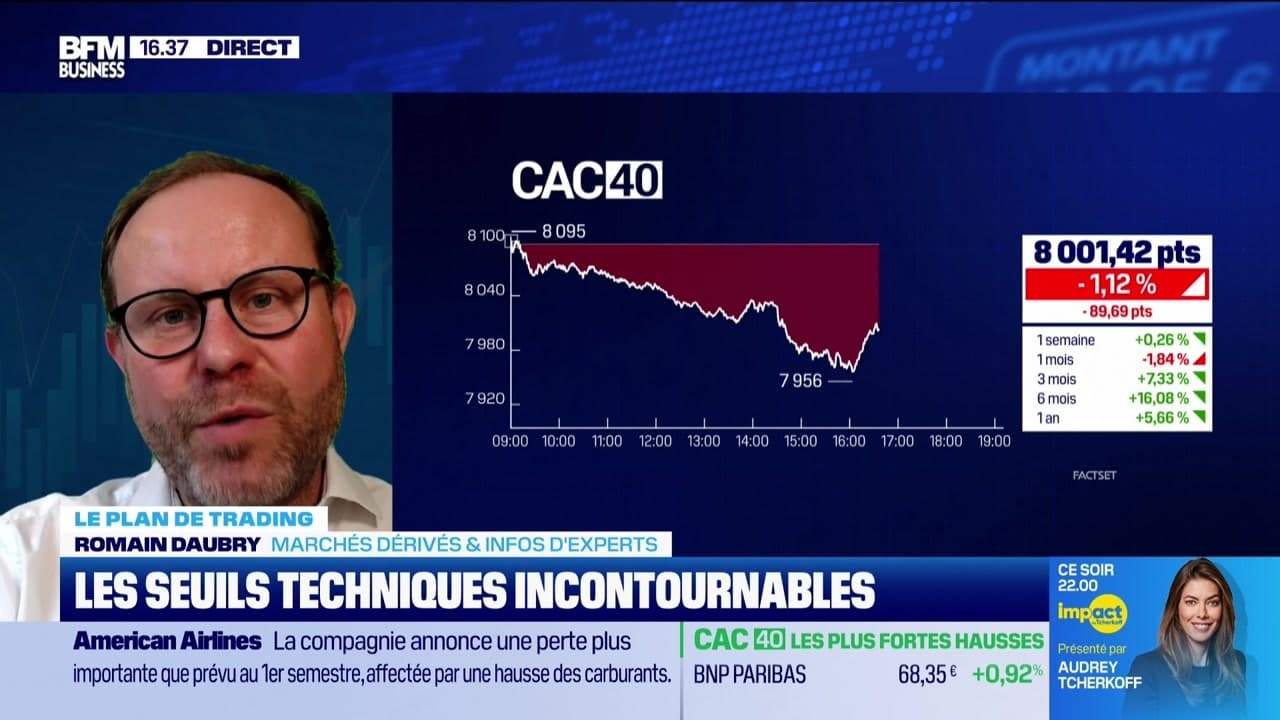

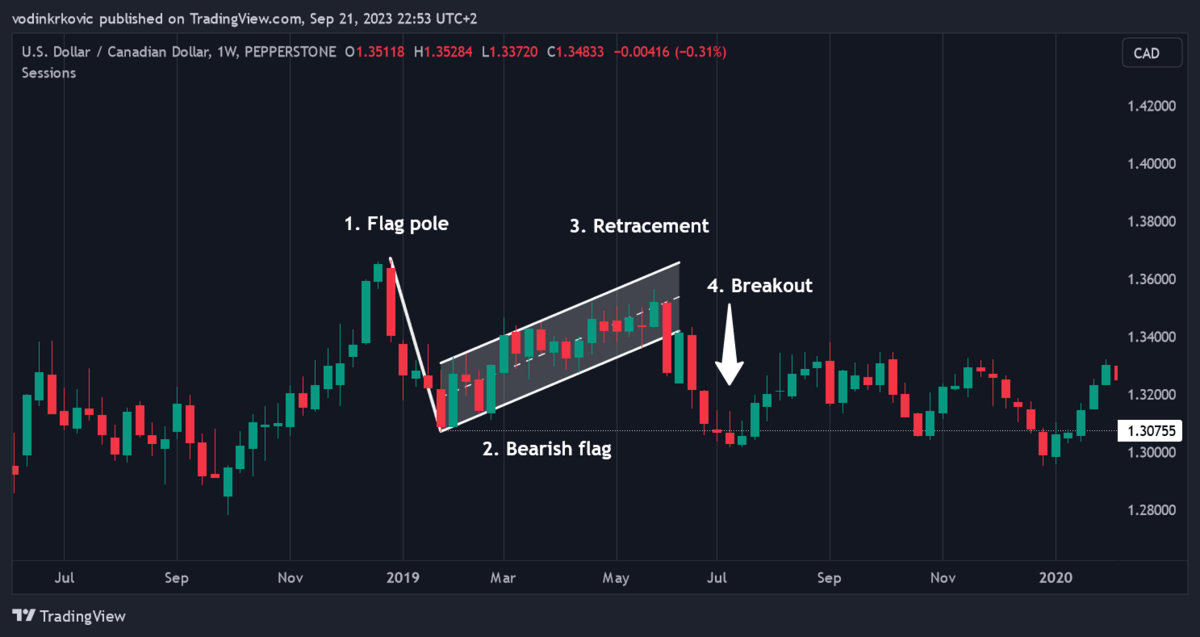

Maitriser Les Seuils Techniques Ameliorer Votre Strategie De Trading

Apr 23, 2025

Maitriser Les Seuils Techniques Ameliorer Votre Strategie De Trading

Apr 23, 2025 -

Trumps Fda And Biotech A Bullish Market Signal

Apr 23, 2025

Trumps Fda And Biotech A Bullish Market Signal

Apr 23, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Times

Apr 23, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Times

Apr 23, 2025