The Dax Index: A Comprehensive Look At Political And Economic Drivers

Table of Contents

Macroeconomic Factors Influencing the Dax Index

The German economy's health significantly impacts the Dax Index. Several key macroeconomic indicators provide valuable insights into its potential trajectory.

GDP Growth and Economic Outlook

The German GDP is a primary driver of Dax performance. A robust GDP generally translates to increased corporate profits and higher investor confidence, boosting the Dax. Conversely, a slowdown in GDP growth can lead to lower earnings and a decline in the index.

- Analyze forecasts: Regularly review GDP growth forecasts from reputable organizations like the IMF and OECD to anticipate future trends and their potential impact on the Dax.

- Domestic factors: Consider the impact of domestic consumption, investment, and net exports on the German GDP and, subsequently, the Dax. Strong consumer spending and business investment usually correlate with positive Dax performance.

- Corporate earnings: Directly relate GDP growth to corporate earnings. Higher GDP growth typically leads to increased corporate earnings, driving up stock prices and the Dax Index.

- Investor sentiment: A positive economic outlook fostered by strong GDP growth improves investor sentiment, leading to increased investment in the German stock market and pushing the Dax higher.

Inflation and Interest Rates

Inflation and interest rates are intertwined factors significantly impacting the Dax.

- Inflation's effect: Rising inflation erodes corporate profitability by increasing production costs and potentially dampening consumer spending. This can negatively impact the Dax.

- ECB's influence: The European Central Bank (ECB) influences interest rates. Interest rate hikes can curb inflation but might also slow economic growth, potentially affecting Dax performance. Conversely, rate cuts can stimulate the economy but may also fuel inflation.

- Inflation expectations: Investor behavior is heavily influenced by inflation expectations. High inflation expectations can lead to investors seeking higher returns elsewhere, putting downward pressure on the Dax.

- Monetary policy's impact: The ECB's monetary policy plays a crucial role in shaping market sentiment and, consequently, the Dax Index. Clear and predictable monetary policies tend to foster stability and investor confidence.

Unemployment Rate and Labor Market Dynamics

The German unemployment rate is a key indicator of consumer spending power and overall economic health.

- Consumer confidence: Lower unemployment translates to higher consumer confidence and increased spending, supporting business growth and positively influencing the Dax.

- Strong labor market: A strong labor market, characterized by low unemployment and robust wage growth, is generally associated with positive Dax performance.

- Sectoral shifts: Changes in employment across different sectors can impact specific Dax companies. For example, a decline in the automotive sector could negatively affect companies like Volkswagen, impacting the Dax.

- Skills gaps: Skills gaps and workforce shortages can constrain business growth, potentially dampening the Dax's performance.

Political Factors Affecting the Dax Index

Political stability and government policies are crucial for the German economy and the Dax.

Government Policies and Regulations

Government actions significantly influence business activity and investor confidence.

- Fiscal policy's impact: Fiscal policy (taxation and government spending) directly impacts business activity. Tax cuts can boost corporate profits, while increased government spending can stimulate demand.

- Regulatory changes: Regulatory changes, particularly in environmentally sensitive sectors or financial regulations, can affect specific Dax companies and the overall index.

- Political stability: Political stability is vital for investor confidence. Uncertainty stemming from political instability can lead to capital flight and negatively impact the Dax.

- Government interventions: Government support packages or interventions, such as economic stimulus programs, can influence the Dax's trajectory, often providing a short-term boost.

Geopolitical Risks and International Relations

Global events significantly impact the German economy, highly reliant on international trade.

- Global events: Trade wars, pandemics, and geopolitical conflicts can negatively impact the German economy and the Dax. Supply chain disruptions and reduced consumer demand can lead to lower corporate earnings.

- Eurozone stability: The stability of the Eurozone is paramount for Germany. Economic weakness in other Eurozone countries can negatively affect German exports and the Dax.

- Trading partner relations: Germany's relationship with its key trading partners influences its export performance, impacting the Dax. Trade disputes or sanctions can negatively affect German companies.

- Brexit and trade disputes: Events like Brexit or other international trade disputes can significantly impact German businesses and, consequently, the Dax.

Elections and Political Uncertainty

Political uncertainty can create volatility in the Dax.

- Government changes: Changes in government or significant elections can lead to market volatility as investors assess the potential impact of new policies.

- Economic policies: Different political parties have varying economic policies. Changes in government can lead to shifts in fiscal and monetary policies, impacting the Dax.

- Policy uncertainty: Uncertainty regarding future policies can discourage investment, leading to a decline in the Dax.

- Business confidence: Political instability can undermine business confidence, leading to reduced investment and negative impacts on the Dax Index.

Sectoral Performance within the Dax Index

The Dax Index is composed of various sectors, each contributing differently to its overall performance. Analyzing sectoral trends is crucial.

- Automotive: The automotive sector, with companies like Volkswagen and BMW, is a significant Dax component. News regarding electric vehicles, autonomous driving, or regulatory changes related to emissions can significantly impact this sector and the Dax.

- Technology: The tech sector's performance, encompassing companies involved in software, hardware, and telecommunications, will directly influence the Dax. Technological advancements and global tech trends will play a major role.

- Financials: The performance of financial institutions within the Dax reflects overall market confidence and economic health. Interest rate changes and regulatory changes impact this sector.

- Diversification: Diversifying investments within the DAX based on a thorough analysis of sector performance is a key strategy for mitigating risk and maximizing returns.

Conclusion

The Dax Index serves as a vital barometer of the German economy, reflecting the interplay of numerous political and economic factors. Understanding these drivers – macroeconomic conditions, government policies, geopolitical risks, and sectoral trends – is essential for navigating the complexities of the German stock market and developing effective investment strategies. By closely monitoring these influences and adapting investment approaches accordingly, investors can better position themselves to capitalize on opportunities and mitigate risks associated with the Dax Index. Stay informed and continue your research into the Dax Index and its dynamic drivers for informed decision-making. Learn more about effective Dax Index investment strategies to optimize your portfolio performance.

Featured Posts

-

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025 -

The Ceremony And The Controversy Trump At Pope Benedict Xvis Funeral Mass

Apr 27, 2025

The Ceremony And The Controversy Trump At Pope Benedict Xvis Funeral Mass

Apr 27, 2025 -

Ariana Grandes Style Evolution The Role Of Professional Experts

Apr 27, 2025

Ariana Grandes Style Evolution The Role Of Professional Experts

Apr 27, 2025 -

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Study

Apr 27, 2025

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Study

Apr 27, 2025 -

Trump Claims Imminent Trade Deals A 3 4 Week Timeline

Apr 27, 2025

Trump Claims Imminent Trade Deals A 3 4 Week Timeline

Apr 27, 2025

Latest Posts

-

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025 -

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

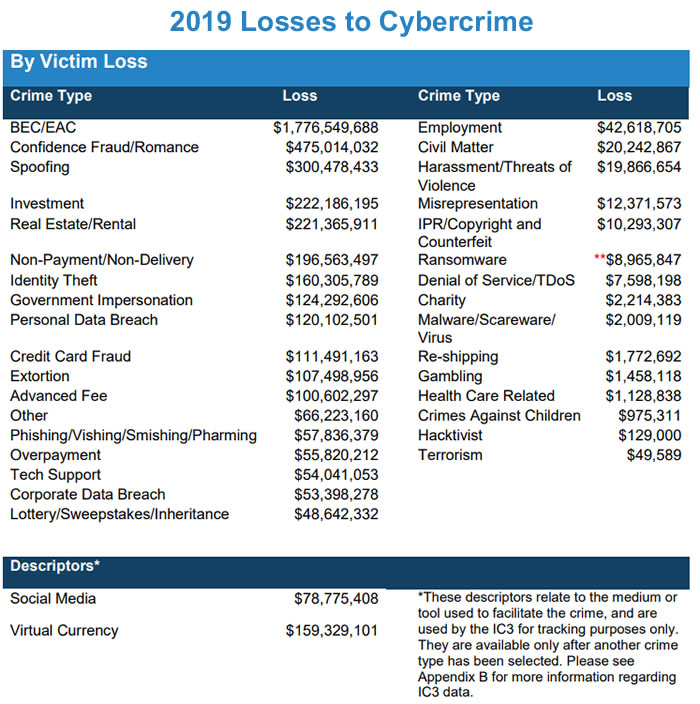

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025