The Dax's Reaction To German Elections And Key Business Data

Table of Contents

The Impact of the German Elections on the DAX

The German elections always hold significant weight for the DAX, given the country's position as Europe's largest economy. The period leading up to and following the election often introduces uncertainty, influencing investor decisions and market behavior.

Coalition Negotiations and Market Uncertainty

The formation of a new German government is rarely a swift process. This period of coalition negotiations often creates uncertainty within the market, directly impacting the DAX.

- Increased volatility in the DAX during the formation of a new government: Historical data shows a clear increase in DAX volatility during coalition talks, as investors react to potential policy shifts and the overall political climate. This uncertainty can lead to both short-term gains for some and significant losses for others.

- Analysis of investor sentiment based on polling data and expert opinions: Pre-election polling data and post-election expert analysis play a vital role in shaping investor sentiment. Positive forecasts often lead to an upward trend in the DAX, while negative predictions can cause declines.

- Specific examples of DAX companies affected by election-related uncertainty: Companies heavily reliant on government contracts or those in sectors sensitive to regulatory changes (e.g., automotive, energy) are particularly susceptible to fluctuations during this period. Analyzing the performance of these specific companies provides valuable insights into the DAX's overall reaction.

Policy Changes and Their Effect on Key Sectors

Once a new government is formed, its policies significantly affect the DAX. Specific policy changes can either boost or hinder certain sectors.

- The automotive industry and its response to new emission standards: Germany's automotive sector is a cornerstone of the DAX. New emission standards and environmental regulations directly impact the performance of automotive companies listed on the DAX.

- The impact on renewable energy companies due to government investment in green technologies: Government investment in renewable energy and green technologies can dramatically boost the performance of companies in this sector, leading to a positive influence on the DAX.

- Analysis of potential winners and losers in the DAX based on policy changes: Identifying sectors likely to benefit or suffer from the new government's policies is crucial for understanding future DAX performance. This requires careful analysis of the proposed legislation and its potential impact on different industries.

Key Business Data and its Influence on the DAX

Beyond political factors, key business data plays a critical role in shaping the DAX's trajectory. Economic indicators such as GDP growth, inflation rates, and unemployment figures directly influence investor sentiment and market performance.

GDP Growth and its Correlation with the DAX

German GDP growth is strongly correlated with DAX performance. Positive growth typically leads to increased investor confidence and upward pressure on the index.

- Statistical analysis of historical data demonstrating the correlation: A strong correlation exists between German GDP growth and DAX performance, which can be clearly demonstrated through statistical analysis of historical data.

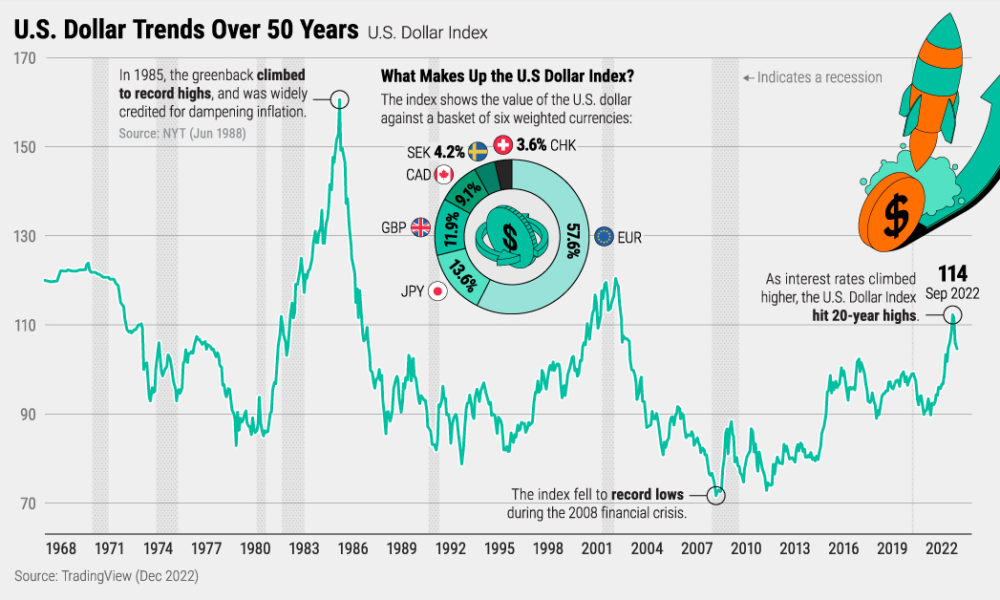

- Discussion of factors beyond GDP that can influence the DAX (e.g., inflation, interest rates): While GDP is a key indicator, other factors, such as inflation and interest rates, can also influence the DAX independently or in conjunction with GDP growth.

- Projection of DAX performance based on current GDP forecasts: Current GDP forecasts are vital in projecting potential future DAX performance, offering investors valuable insights for their investment strategies.

Inflation Rates and Their Impact on Investor Sentiment

Inflation rates significantly impact investor sentiment and consequently the DAX. High inflation erodes purchasing power and can lead to decreased investor confidence.

- Explanation of how high inflation can lead to decreased investor confidence and DAX decline: High inflation discourages investment and can lead to a sell-off, negatively impacting the DAX.

- Discussion of the role of the European Central Bank (ECB) and its monetary policy in managing inflation: The ECB's monetary policy plays a significant role in controlling inflation and its impact on the DAX.

- Analysis of the relationship between inflation and the value of the Euro: Inflation can also impact the value of the Euro, influencing the DAX, which is denominated in Euros.

Unemployment Figures and Their Reflection in the DAX

Unemployment figures are another crucial indicator impacting the DAX. High unemployment generally reflects lower consumer spending and decreased economic activity.

- Analysis of the historical relationship between unemployment rates and DAX movement: Historical data reveals a clear correlation between unemployment rates and DAX movement, indicating a significant influence on investor sentiment.

- Discussion of the impact of unemployment on consumer spending and its ripple effect on the DAX: High unemployment reduces consumer spending, impacting company revenues and affecting the DAX negatively.

- Comparison of German unemployment figures to other major European economies: Comparing German unemployment rates to other major European economies provides context and helps assess the relative strength of the German economy and its influence on the DAX.

Conclusion

The DAX's performance is inextricably linked to the political landscape and the economic indicators of Germany. The recent German elections and the release of key business data have demonstrably impacted the DAX, highlighting the importance of understanding these factors for investors. While the short-term volatility remains, a long-term perspective based on sound economic analysis and political foresight is crucial for navigating the complexities of the DAX market. To stay informed about the ongoing influence of German elections and key business data on the DAX, continue to follow our market analysis and insights. Understanding the DAX's reaction to these factors is critical for successful investment strategies. Stay tuned for further DAX analysis and market updates.

Featured Posts

-

Ramiro Helmeyers Dedication To Fc Barcelona

Apr 27, 2025

Ramiro Helmeyers Dedication To Fc Barcelona

Apr 27, 2025 -

Cuartos De Final Indian Wells Cerundolo Aprovecha Las Ausencias De Fritz Y Gauff

Apr 27, 2025

Cuartos De Final Indian Wells Cerundolo Aprovecha Las Ausencias De Fritz Y Gauff

Apr 27, 2025 -

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025 -

Trumps Trade Demands Carneys Warning To Canadian Voters

Apr 27, 2025

Trumps Trade Demands Carneys Warning To Canadian Voters

Apr 27, 2025 -

Trade Deal Delay Carney Suggests Canadas Strategic Patience

Apr 27, 2025

Trade Deal Delay Carney Suggests Canadas Strategic Patience

Apr 27, 2025

Latest Posts

-

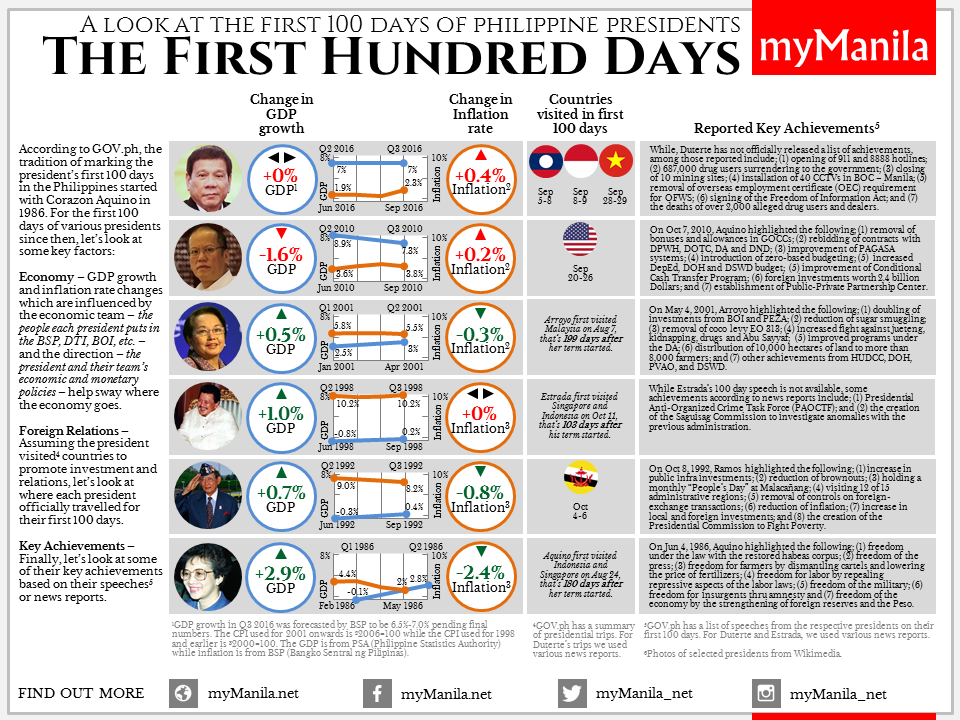

Nixons Shadow Evaluating The U S Dollars Performance After 100 Days

Apr 28, 2025

Nixons Shadow Evaluating The U S Dollars Performance After 100 Days

Apr 28, 2025 -

The First 100 Days Assessing The U S Dollars Performance Under The Current Presidency

Apr 28, 2025

The First 100 Days Assessing The U S Dollars Performance Under The Current Presidency

Apr 28, 2025 -

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025 -

U S Dollars Troubled Beginning A Comparison To Nixons Presidency

Apr 28, 2025

U S Dollars Troubled Beginning A Comparison To Nixons Presidency

Apr 28, 2025 -

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 28, 2025

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 28, 2025