The Future Of XRP: ETF Potential, SEC Scrutiny, And Ripple's Next Chapter

Table of Contents

H2: XRP's Potential Inclusion in Crypto ETFs

H3: The Growing ETF Market and its Impact on XRP

The cryptocurrency investment landscape is rapidly evolving, with a surge in interest in cryptocurrency exchange-traded funds (ETFs). The potential approval of a Bitcoin or Ethereum ETF could be a watershed moment, potentially paving the way for altcoins like XRP to gain similar ETF listings. This would represent a significant step towards mainstream adoption.

- Examples of ETF applications: Several firms have filed applications for Bitcoin and Ethereum ETFs with the SEC, setting a precedent for future crypto ETF approvals.

- Potential benefits of ETF listing for XRP: An XRP ETF could dramatically increase liquidity, making it significantly easier for institutional and retail investors to access and trade XRP. This increased accessibility could attract substantial capital inflow and boost its market capitalization.

- Challenges to overcome: Regulatory hurdles remain a significant obstacle. SEC approval is paramount, and the commission's stance on XRP remains uncertain given the ongoing legal battle with Ripple.

H3: Analyzing the Regulatory Landscape for XRP ETFs

The regulatory landscape for XRP ETFs is complex and heavily influenced by the SEC's stance on cryptocurrencies in general. Unlike Bitcoin and Ethereum, which have established themselves as leading cryptocurrencies, XRP faces added challenges due to the ongoing SEC lawsuit against Ripple.

- SEC's stance on cryptocurrencies: The SEC's approach to regulating cryptocurrencies has been inconsistent, leading to uncertainty for investors and hindering the development of a clear regulatory framework.

- Potential scenarios for XRP ETF approval: The timeline and conditions for XRP ETF approval are uncertain. A favorable resolution to the SEC lawsuit against Ripple would significantly increase the likelihood of approval. Conversely, an unfavorable ruling could delay or even prevent approval indefinitely.

- Role of lobbying and public pressure: Lobbying efforts by Ripple and industry stakeholders, along with public pressure, can play a significant role in shaping regulatory outcomes and influencing the SEC's decision-making process.

H2: Navigating the SEC Lawsuit and its Implications for XRP's Future

H3: Understanding the SEC's Case Against Ripple

The SEC's lawsuit against Ripple alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This case has cast a long shadow over XRP's future, creating significant volatility in its price and impacting investor sentiment.

- Key allegations: The SEC claims that Ripple's sale of XRP constituted an unregistered securities offering, violating the Howey Test.

- Ripple's defense: Ripple contends that XRP is a decentralized digital asset and not a security, arguing that it lacks the characteristics of an investment contract.

- Potential outcomes of the lawsuit: The case could end in a settlement, a court decision in favor of the SEC, or a court decision in favor of Ripple. Each outcome would have significantly different implications for XRP's price and future.

- Impact on XRP price: The ongoing uncertainty surrounding the lawsuit has resulted in substantial price fluctuations, making XRP a highly volatile investment.

H3: The Ripple Defense and Potential Outcomes

Ripple's defense strategy focuses on demonstrating that XRP is a decentralized digital asset distinct from a security. The outcome of the lawsuit will significantly impact XRP's future.

- Potential for a settlement: A settlement between Ripple and the SEC remains a possibility, though the terms of any such settlement would have to be carefully evaluated for their impact on XRP.

- Positive and negative scenarios depending on the court decision: A favorable ruling for Ripple could propel XRP's price and adoption. Conversely, a ruling in favor of the SEC could lead to a significant decline in price and damage investor confidence.

- Impact on investor confidence: Investor confidence is closely tied to the outcome of the SEC lawsuit. A positive outcome would likely restore confidence and attract new investment, while a negative outcome could lead to widespread selling and a prolonged bear market.

H2: Ripple's Strategic Moves and Future Roadmap for XRP

H3: Ripple's Technological Advancements and Partnerships

Despite the legal challenges, Ripple continues to invest in technological advancements and forge strategic partnerships. This demonstrates a long-term commitment to XRP and its underlying technology, the XRP Ledger.

- Recent partnerships: Ripple has been actively collaborating with various financial institutions globally to integrate XRP into their cross-border payment systems. These partnerships are crucial for expanding XRP's reach and adoption.

- Improvements to the XRP Ledger: Ripple continues to enhance the XRP Ledger's functionality and scalability, making it more efficient and secure.

- Adoption of XRP in cross-border payments: The speed and low cost of XRP transactions are attractive features for international payments, and Ripple is actively promoting its adoption in this sector.

- Ripple's efforts to engage regulators: Ripple is actively engaging with regulators to foster a more conducive regulatory environment for cryptocurrencies and clarify the legal status of XRP.

H3: The Long-Term Vision for XRP and its Ecosystem

Ripple's long-term vision for XRP extends beyond payments. The company envisions a broader ecosystem encompassing various applications leveraging the XRP Ledger's capabilities.

- Ripple's roadmap: Ripple's roadmap includes plans for further technological improvements, expansion of partnerships, and increased community engagement.

- Potential use cases beyond payments: Potential future use cases include the NFT market and decentralized finance (DeFi) applications, expanding XRP's utility and potential.

- Community development strategies: Ripple actively fosters community development to build a strong and engaged user base around XRP.

3. Conclusion:

The future of XRP hinges on the interplay between its potential for ETF inclusion, the resolution of the SEC lawsuit, and Ripple's strategic actions. The uncertainties remain considerable, and the cryptocurrency's volatility is likely to persist in the near term. However, Ripple's ongoing technological development and expansion of partnerships suggest a long-term commitment to the project.

The XRP future remains dynamic, and continuous monitoring of legal updates, technological advancements, and market trends is crucial for anyone interested in understanding the full potential and risks associated with this cryptocurrency. Thorough research is essential before making any investment decisions related to XRP and its future.

Featured Posts

-

Wall Street Predicts 110 Gain Billionaire Backed Black Rock Etf For 2025

May 08, 2025

Wall Street Predicts 110 Gain Billionaire Backed Black Rock Etf For 2025

May 08, 2025 -

Zasto Se Dzordan I Jokic Ljube Tri Puta Bobi Marjanovic Krivac

May 08, 2025

Zasto Se Dzordan I Jokic Ljube Tri Puta Bobi Marjanovic Krivac

May 08, 2025 -

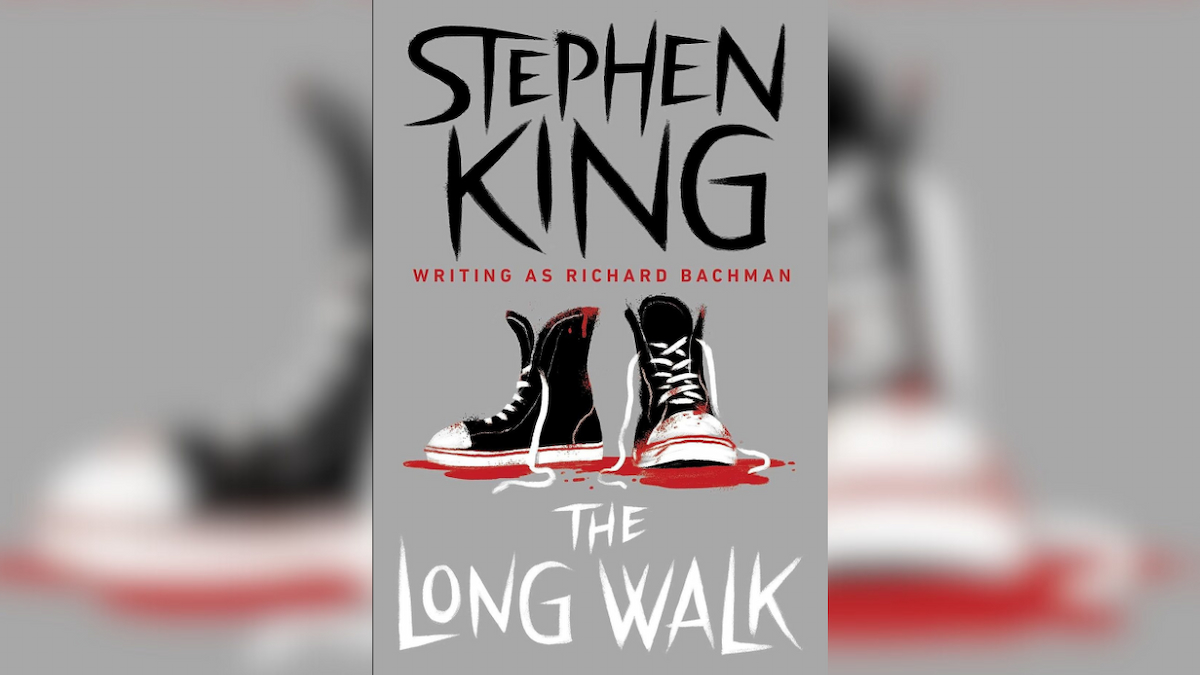

First Look At The Stephen King Long Walk Movie Adaptation

May 08, 2025

First Look At The Stephen King Long Walk Movie Adaptation

May 08, 2025 -

Andor Season 1 Where To Watch Episodes Online

May 08, 2025

Andor Season 1 Where To Watch Episodes Online

May 08, 2025 -

Understanding The Xrp Rise The Role Of President Trumps Actions

May 08, 2025

Understanding The Xrp Rise The Role Of President Trumps Actions

May 08, 2025