The Pain And Patience Of Buy-and-Hold: A Long-Term Investing Strategy

Table of Contents

Understanding the Buy-and-Hold Strategy

Buy-and-hold is a long-term investment strategy where you purchase assets, such as stocks or bonds, and hold them for an extended period, typically years or even decades, regardless of short-term market fluctuations. Its core principle is to let your investments grow over time through compounding returns, minimizing the impact of market volatility. This contrasts sharply with active trading, which involves frequent buying and selling of assets based on short-term market predictions. Active trading requires significant time, expertise, and often results in higher transaction costs.

The importance of diversification within a buy-and-hold portfolio cannot be overstated. Diversification reduces risk by spreading your investments across different asset classes and within each asset class.

- Diversification across asset classes: This means allocating your investments across various asset classes like stocks, bonds, real estate, and potentially others like commodities or alternative investments. This helps mitigate the risk associated with any single asset class underperforming.

- Diversification within asset classes: Within each asset class, further diversification is key. For example, in stocks, you might invest in different sectors (technology, healthcare, energy), company sizes (large-cap, mid-cap, small-cap), and geographical regions.

Dollar-cost averaging is a valuable tool within a buy-and-hold strategy. This involves investing a fixed amount of money at regular intervals, regardless of the market price. This helps to mitigate the risk of investing a lump sum at a market high.

The Pain Points of Buy-and-Hold Investing

While buy-and-hold offers long-term potential, it's not without its challenges. Understanding these pain points is crucial for successful long-term investing.

Market Volatility and Emotional Rollercoaster

The stock market is inherently volatile. Buy-and-hold investors must withstand periods of significant market downturns, which can be emotionally challenging.

- Fear of missing out (FOMO): Seeing quick gains in other investment strategies can tempt investors to abandon their buy-and-hold approach.

- The temptation to panic sell: During market corrections or crashes, the urge to sell assets at a loss to avoid further losses can be overwhelming. This often leads to locking in losses and missing out on potential future gains.

- Strategies for managing emotional responses: Regular portfolio reviews focusing on long-term goals, rather than daily fluctuations, can help manage emotional responses. Having a well-defined investment plan and sticking to it is also essential.

Opportunity Cost and Missed Short-Term Gains

A key pain point is the potential opportunity cost. Active trading strategies, while riskier, might yield higher returns in the short term.

- Comparison to active trading: While active trading can potentially generate higher short-term returns, it comes with significantly higher risk and requires considerable time and expertise.

- Risk tolerance and investment timeline: Buy-and-hold is best suited for investors with a long-term investment horizon (10+ years ideally) and a higher risk tolerance.

Taxes and Transaction Costs

Buy-and-hold investors benefit from minimizing transaction costs due to infrequent trading. However, tax implications are crucial to consider.

- Long-term vs. short-term capital gains: Holding investments for longer than one year typically qualifies for lower long-term capital gains tax rates.

- Minimizing transaction costs: Infrequent trading significantly reduces brokerage fees and other transaction costs.

- Tax-advantaged accounts: Utilizing tax-advantaged accounts such as 401(k)s and IRAs can significantly reduce the tax burden on long-term investments.

The Patience and Perseverance Required for Success

The success of a buy-and-hold strategy hinges on patience and perseverance.

Time Horizon and Compound Interest

The power of compounding is central to the buy-and-hold philosophy. Compounding refers to earning returns on your initial investment and on the accumulated returns over time.

- Illustrative examples: A small investment consistently growing over 20-30 years can generate substantial wealth due to the magic of compounding.

- Long-term investment horizon: A longer time horizon allows the power of compounding to work its magic, mitigating the impact of short-term market volatility.

Developing a Long-Term Investment Plan

A well-defined investment plan is essential.

- Clear financial goals: Define your specific financial goals (retirement, education, etc.) to guide your investment decisions.

- Realistic budget: Create a realistic budget to determine how much you can consistently invest.

- Regular review and adjustment: Regularly review your investment plan and adjust it as your circumstances and goals change.

Seeking Professional Advice When Necessary

While many investors manage their portfolios independently, seeking professional advice can be invaluable.

- Tailored investment strategy: A financial advisor can help tailor a long-term investment strategy to your specific circumstances, risk tolerance, and financial goals.

- Guidance during market uncertainty: Professional advice can be particularly helpful during periods of market uncertainty, offering guidance and reassurance.

Conclusion

The buy-and-hold strategy, while requiring patience and the ability to withstand market fluctuations, offers a powerful approach to long-term wealth building. Understanding the pain points and developing strategies to manage them is crucial for success. By focusing on diversification, a long-term perspective, and potentially seeking professional guidance, you can harness the power of compounding and navigate the challenges of buy-and-hold investing to achieve your financial goals. Are you ready to embark on your long-term investment journey with a well-defined buy-and-hold strategy? Start planning your long-term investment strategy today!

Featured Posts

-

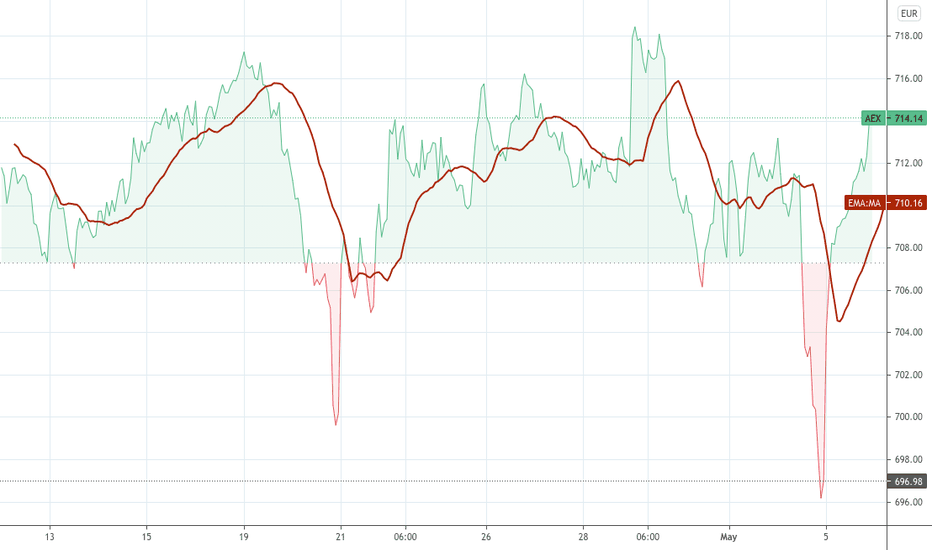

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025 -

Michael Schumacher And His Rivals Fact Vs Fiction

May 25, 2025

Michael Schumacher And His Rivals Fact Vs Fiction

May 25, 2025 -

The Jenson Fw 22 Extended Collection A Comprehensive Guide

May 25, 2025

The Jenson Fw 22 Extended Collection A Comprehensive Guide

May 25, 2025 -

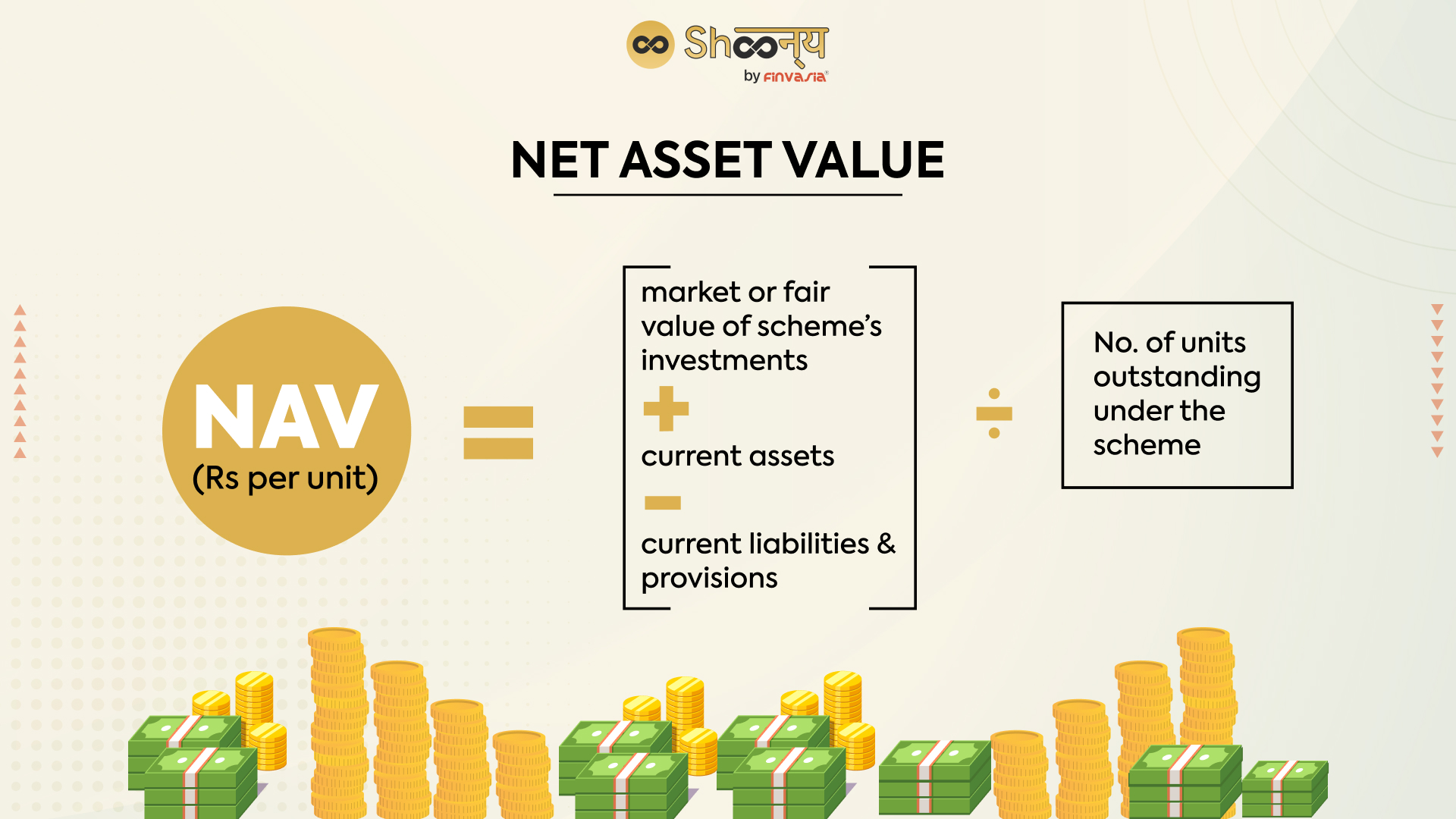

Investment In Amundi Djia Ucits Etf Monitoring Net Asset Value Nav

May 25, 2025

Investment In Amundi Djia Ucits Etf Monitoring Net Asset Value Nav

May 25, 2025 -

80 Millio Forintert Extrak Ez A Porsche 911

May 25, 2025

80 Millio Forintert Extrak Ez A Porsche 911

May 25, 2025