Three More Rate Cuts Predicted By Desjardins: Bank Of Canada Outlook

Table of Contents

Desjardins's Rationale for Predicted Rate Cuts

Desjardins's prediction of three more Bank of Canada interest rate cuts stems from their analysis of several key economic indicators. Their economic analysis points towards a weakening Canadian economy, necessitating further monetary policy easing.

-

Weakening Economic Indicators: Desjardins's assessment highlights a slowing GDP growth rate, suggesting a potential economic slowdown. Rising unemployment figures further support this concern, indicating reduced consumer spending and a dampening of economic activity. These factors are crucial in understanding why Desjardins believes further intervention from the Bank of Canada is necessary.

-

Inflation Cooling Faster Than Projected: While inflation remains a concern, Desjardins's analysis suggests it's cooling more rapidly than the Bank of Canada's current projections. This divergence in forecasts is a key element in their argument for additional rate cuts. They believe that the current rate is already sufficiently restrictive to curb inflation, and further tightening could unnecessarily stifle economic growth.

-

Impact of Previous Rate Hikes: Desjardins's economic model considers the full impact of previous Bank of Canada interest rate hikes. They argue that the lagged effects of these hikes haven't fully manifested in the economy yet, suggesting that further rate cuts are needed to prevent an overly sharp economic contraction. This consideration of lagged effects is a critical component of their overall analysis.

-

Data and Economic Models: Desjardins's prediction is supported by a detailed analysis of various economic indicators and models, likely including data on consumer confidence, business investment, and housing market activity. While the specific details of their models may not be publicly available, the firm's reputation for rigorous economic analysis lends credibility to their forecast.

Potential Impact of Further Rate Cuts on the Canadian Economy

The potential impact of further Bank of Canada rate cuts on the Canadian economy is multifaceted, presenting both opportunities and risks.

-

Stimulating Economic Growth: Lower interest rates can stimulate consumer spending and business investment. Reduced borrowing costs make it cheaper for businesses to expand and for consumers to make significant purchases, potentially boosting overall economic activity and creating jobs. This is a key argument supporting Desjardins's prediction.

-

Increased Inflation Risks: Conversely, rate cuts could reignite inflationary pressures if the economy heats up too quickly. This is a major risk associated with such a policy, and Desjardins likely factored this into their analysis, arguing that the benefit of stimulating growth outweighs the risk in this scenario.

-

Impact on the Housing Market: Lower mortgage rates could further fuel the housing market, potentially leading to increased home prices and potentially unsustainable levels of household debt. This effect is particularly important in the Canadian context, where housing is a significant portion of the economy. Desjardins's analysis likely considers the potential impact on housing affordability.

-

Impact on Businesses: Smaller businesses, often more reliant on credit, could benefit from reduced borrowing costs, potentially leading to increased investment and job creation. Conversely, larger companies might not see as significant an impact.

Alternative Perspectives and Market Reactions

While Desjardins's prediction of three more Bank of Canada rate cuts is noteworthy, it’s essential to consider alternative viewpoints and market reactions.

-

Other Economic Forecasts: Not all economists share Desjardins's optimistic view. Some believe the Bank of Canada will maintain its current interest rate or even implement further hikes to combat inflation. Understanding the range of forecasts provides a more balanced perspective on the likely path of future interest rates.

-

Market Reaction: The market's reaction to Desjardins's prediction likely involved shifts in bond yields and stock market performance. Lower interest rates typically lead to lower bond yields, and stock markets often react positively to expectations of economic stimulus. However, the actual market response could be more nuanced, dependent on investor sentiment and broader global economic conditions.

-

Uncertainties and Risks: Desjardins's forecast, like all economic predictions, is subject to uncertainty. Unforeseen global events, shifts in consumer behaviour, and changes in government policy could significantly impact the accuracy of their projections. These uncertainties should be carefully considered when interpreting their prediction.

-

Contrasting Viewpoints: It's crucial to acknowledge that other financial institutions and experts may hold differing opinions. Some might argue that the risks of increased inflation outweigh the benefits of further rate cuts. Examining these contrasting viewpoints provides a more comprehensive understanding of the situation.

Conclusion

This article has examined Desjardins's prediction of three more Bank of Canada rate cuts, exploring the underlying rationale, the potential economic impacts, and alternative viewpoints. The forecast paints a complex picture with both opportunities and risks for the Canadian economy. While stimulating economic growth is a key objective, managing inflation remains paramount. The predicted Bank of Canada rate cuts will likely have wide-ranging effects on the Canadian economy, from mortgage rates and consumer spending to business investment and overall economic growth.

Call to Action: Stay informed about the evolving Bank of Canada interest rate outlook. Continuously monitor updates and analysis from reputable sources like Desjardins and the Bank of Canada itself to effectively navigate this period of economic uncertainty regarding Bank of Canada rate cuts and their effect on the Canadian economy. Understanding the implications of these potential future rate cuts is crucial for making informed financial decisions.

Featured Posts

-

Sharp Decline Amsterdam Stock Exchange Experiences Third Straight Day Of Losses

May 24, 2025

Sharp Decline Amsterdam Stock Exchange Experiences Third Straight Day Of Losses

May 24, 2025 -

Escape To The Country Financing Your Rural Dream

May 24, 2025

Escape To The Country Financing Your Rural Dream

May 24, 2025 -

Escape To The Country Nicki Chapmans Successful 700 000 Home Investment

May 24, 2025

Escape To The Country Nicki Chapmans Successful 700 000 Home Investment

May 24, 2025 -

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025 -

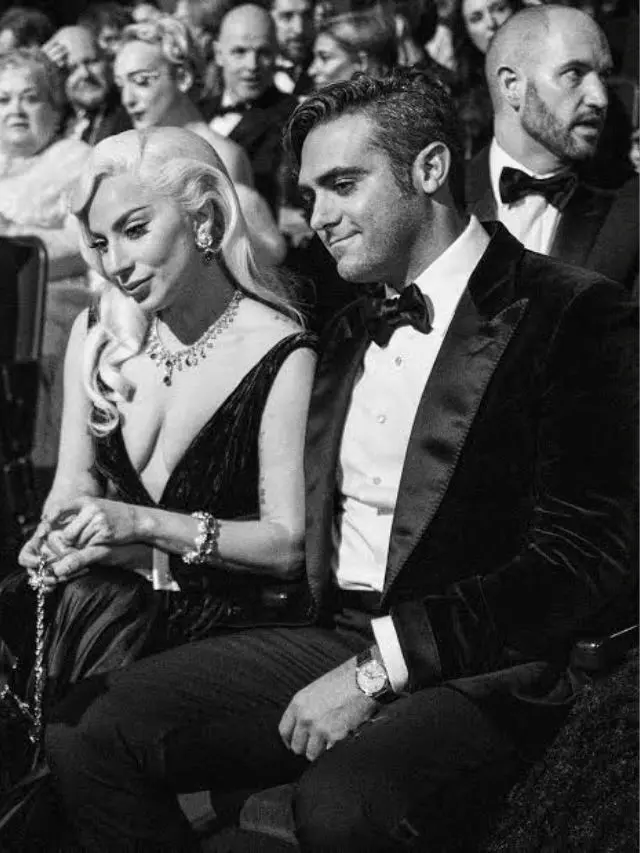

Lady Gaga And Michael Polansky At The Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polansky At The Snl Afterparty

May 24, 2025