To Buy Or Not To Buy Palantir Stock Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Performance and Financial Health

Understanding Palantir's recent performance is crucial before considering investment. Analyzing quarterly earnings reports reveals key insights into the company's financial health and future prospects. Let's examine some vital metrics:

-

Revenue Growth Trend: [Insert data on Palantir's revenue growth for the last few quarters – positive or negative percentage change]. This trend indicates the company's ability to generate sales and expand its market presence. A consistently upward trend is generally positive, but investors should investigate the underlying factors.

-

Profit Margin Analysis: [Insert data on Palantir's profit margins – gross, operating, and net]. High profit margins suggest efficient operations and strong pricing power, while declining margins might raise concerns about competitiveness or cost pressures.

-

Key Drivers of Revenue Growth: Palantir's revenue growth stems from two primary sources: government contracts and commercial sales. [Discuss the relative contribution of each sector to overall revenue, and any notable trends]. A strong reliance on government contracts, while providing stability, might also introduce vulnerability to changes in government spending.

-

Comparison to Competitors: [Compare Palantir's key financial metrics to its main competitors in the data analytics sector, such as Databricks, Snowflake, and others]. This comparison will provide a context for evaluating Palantir's performance relative to industry benchmarks.

Upcoming Events and Catalysts Affecting Palantir Stock Before May 5th

Several upcoming events might significantly impact Palantir stock before May 5th. Careful consideration of these events and their potential market reactions is vital for informed investment decisions.

-

Specific Dates of Important Events: [List all scheduled announcements, earnings calls, product launches, or any other relevant events before May 5th].

-

Expected Impact of Events on Stock Price: [Analyze the potential positive or negative impact of each event. For instance, strong earnings could boost the stock price, while disappointing results may lead to a decline]. Consider the historical market reaction to similar events.

-

Analysis of Market Sentiment Towards Palantir: [Gauge the overall market sentiment towards Palantir. Are investors optimistic or pessimistic? News articles, social media discussions, and other sources can provide valuable insights].

-

Risk Assessment Related to Upcoming Events: [Identify potential risks associated with these events. For example, a product launch failure could negatively impact the stock price, while a successful earnings call could boost it significantly].

Wall Street Analyst Ratings and Predictions for Palantir Stock

Wall Street analysts offer valuable insights into Palantir's stock outlook. Examining their ratings and predictions can inform investment strategies.

-

Key Analyst Ratings (Buy, Hold, Sell): [Summarize the consensus rating from major investment banks and research firms. Note the number of analysts providing each rating].

-

Average Price Target and Range of Targets: [Present the average price target set by analysts and the range of targets (high and low)]. This range reflects the uncertainty in future price movements.

-

Reasons Behind Different Analyst Predictions: [Explain the rationale behind varying analyst opinions. Different analysts may use different valuation methodologies and assumptions about future growth].

-

Potential for Upward or Downward Revisions in Price Targets: [Assess the likelihood of analysts revising their price targets based on upcoming events or changing market conditions].

Risks and Considerations Before Investing in Palantir Stock

Investing in Palantir stock, or any technology stock, involves inherent risks. A balanced assessment of potential downsides is crucial.

-

Market Volatility and its Impact on Tech Stocks: The technology sector is known for its volatility. Market downturns can significantly impact even the strongest tech companies.

-

Competition in the Data Analytics Market: Palantir faces intense competition from established players and emerging startups in the data analytics market.

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could negatively impact the company's financial performance.

-

Potential for Technological Disruption: Rapid technological advancements could render Palantir's existing technologies obsolete.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on our analysis of Palantir's financial health, upcoming events, analyst predictions, and inherent risks, the decision of whether to buy Palantir stock before May 5th is complex and depends on your individual risk tolerance and investment goals. While Palantir shows promise in certain areas, significant risks remain. Remember, this is not financial advice.

Before making any decisions regarding Palantir stock before May 5th, conduct your own thorough research and consider consulting with a financial advisor to determine the best strategy for your investment portfolio. Remember, investing in the stock market always involves risk.

Featured Posts

-

Zayavi Stivena Kinga Pro Trampa Ta Maska Na Platformi Kh

May 09, 2025

Zayavi Stivena Kinga Pro Trampa Ta Maska Na Platformi Kh

May 09, 2025 -

Sto Xamilotero Epipedo 23 Eton I Krisimi Meiosi Ton Xionoptoseon Sta Imalaia

May 09, 2025

Sto Xamilotero Epipedo 23 Eton I Krisimi Meiosi Ton Xionoptoseon Sta Imalaia

May 09, 2025 -

Evaluating Palantir Stock Is It A Smart Investment For You

May 09, 2025

Evaluating Palantir Stock Is It A Smart Investment For You

May 09, 2025 -

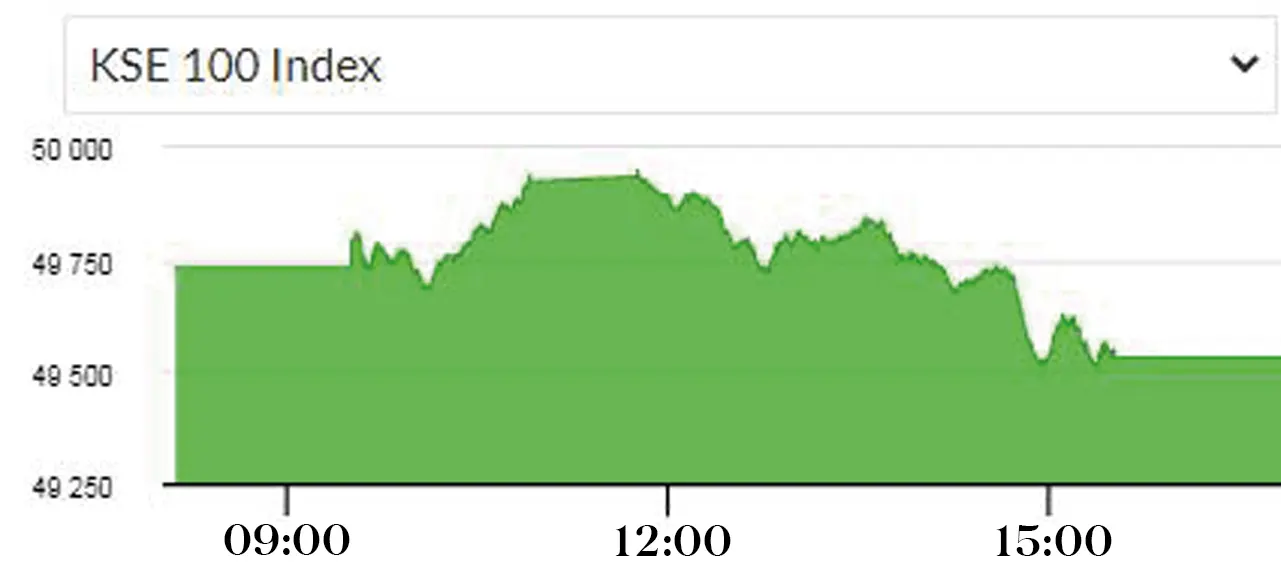

Pakistani Market Instability Causes Stock Exchange Portal Outage

May 09, 2025

Pakistani Market Instability Causes Stock Exchange Portal Outage

May 09, 2025 -

Rio Ferdinands Altered Champions League Final Prediction Psg Or Arsenal

May 09, 2025

Rio Ferdinands Altered Champions League Final Prediction Psg Or Arsenal

May 09, 2025