Traders Pare Bets On BOE Rate Cuts: Pound Rises After UK Inflation Data

Table of Contents

Impact of UK Inflation Data on BOE Rate Cut Expectations

The latest inflation figures released significantly deviated from market consensus, triggering a reassessment of the BOE's likely monetary policy response. Market analysts had predicted a further easing of inflationary pressures, fueling expectations of imminent rate cuts to stimulate economic growth. However, the reality painted a different picture.

- Key Takeaways from the Data Release:

- Consumer Price Index (CPI) inflation remained stubbornly high, exceeding predictions by 0.5%.

- Producer Price Index (PPI) showed continued upward pressure, indicating persistent inflationary pressures within the supply chain.

- Retail Price Index (RPI) also surpassed expectations, demonstrating the broad-based nature of the inflationary pressures.

- This higher-than-predicted inflation significantly reduced the likelihood of immediate BOE rate cuts.

The market's initial reaction was swift. The Pound experienced an immediate and noticeable uplift against major currencies, reflecting the altered expectations surrounding BOE policy. The unexpected resilience of inflation indicated a stronger economy than previously thought, reducing the need for immediate stimulus through rate cuts.

Pound Strengthens: Analyzing the Currency's Response

The correlation between the unexpected inflation data and the Pound's appreciation is clear. The stronger-than-anticipated inflation figures bolstered investor confidence in the UK economy, leading to increased demand for the British Pound.

- Key Indicators of Pound Strength:

- The GBP/USD exchange rate saw a noticeable increase, climbing by [insert percentage or specific figures] following the data release.

- GBP/EUR also experienced gains, indicating a broader strengthening of the Pound against major European currencies.

- Trading volumes increased significantly, reflecting heightened market activity driven by the unexpected inflation data and subsequent shift in BOE rate cut expectations.

- Improved market sentiment towards the UK economy contributed significantly to the Pound's rise.

Technical analysis of the GBP/USD and GBP/EUR charts further confirmed this trend, with key indicators showing a clear shift towards a stronger Pound.

Market Reaction and Trader Sentiment

The overall market reaction to the inflation data was one of surprise and recalibration. Traders rapidly adjusted their positions, significantly reducing their bets on BOE rate cuts. The unexpected resilience of inflation shifted the focus from imminent rate cuts to the potential for the BOE to maintain, or even slightly increase, interest rates to control inflation.

- Key Changes in Trader Sentiment:

- A dramatic reduction in bets on BOE rate cuts became immediately apparent.

- Market pricing now incorporates a lower probability of rate cuts in the near term.

- Increased expectations of a period of interest rate stability, or even potential hikes, are emerging.

- Investor confidence in the UK economy has seen a modest increase.

This shift in sentiment highlights the significant influence of inflation data on market expectations regarding monetary policy.

Implications for UK Businesses and Consumers

Higher-than-expected inflation, coupled with the reduced likelihood of rate cuts, carries implications for both UK businesses and consumers. Businesses may face increased borrowing costs, potentially impacting investment decisions and expansion plans. Consumers may also experience a squeeze on disposable income if wages fail to keep pace with inflation. The potential for higher interest rates further exacerbates these concerns, potentially dampening consumer spending and economic growth.

Looking Ahead: Future Predictions and BOE Policy

Predicting the future path of UK inflation and BOE policy is inherently challenging. However, several factors will likely play a significant role in influencing future decisions.

- Factors Influencing Future BOE Decisions:

- The trajectory of global economic growth and its impact on UK inflation.

- The evolution of domestic economic data, particularly wage growth and employment figures.

- Geopolitical events and their potential impact on the UK economy.

While the immediate probability of BOE rate cuts has diminished, the central bank will continue to monitor inflation closely. Future policy decisions will depend on the evolution of these factors. Many experts predict a period of rate stability, with the possibility of future rate increases contingent on persistent inflationary pressures. The Pound's future trajectory is also linked to these factors, with continued strength likely if inflation remains high and the BOE maintains a hawkish stance.

Conclusion: Traders Pare Bets on BOE Rate Cuts: A Summary and Call to Action

The unexpected UK inflation data has significantly altered the market's outlook on BOE monetary policy. Traders have drastically reduced their bets on rate cuts, leading to a noticeable strengthening of the Pound Sterling. This shift reflects a reassessment of the UK economic outlook, with inflation proving more resilient than anticipated. The implications for UK businesses, consumers, and the future direction of the Pound remain significant and warrant close monitoring.

Stay updated on the latest developments concerning traders' bets on BOE rate cuts and the fluctuating Pound by subscribing to our newsletter for daily market analysis. Understanding the nuances of BOE policy and its impact on the British Pound is crucial for navigating the complexities of the global financial markets.

Featured Posts

-

Bof As Analysis Addressing Concerns Over High Stock Market Valuations

May 25, 2025

Bof As Analysis Addressing Concerns Over High Stock Market Valuations

May 25, 2025 -

Gucci Supply Chain Officer Massimo Vians Departure Analysis And Implications

May 25, 2025

Gucci Supply Chain Officer Massimo Vians Departure Analysis And Implications

May 25, 2025 -

Naomi Kempbell V Biliy Tunitsi Na Londonskomu Zakhodi

May 25, 2025

Naomi Kempbell V Biliy Tunitsi Na Londonskomu Zakhodi

May 25, 2025 -

Hamburg Jubelt Hsv Steigt Nach Sieben Jahren Wieder In Die Bundesliga Auf

May 25, 2025

Hamburg Jubelt Hsv Steigt Nach Sieben Jahren Wieder In Die Bundesliga Auf

May 25, 2025 -

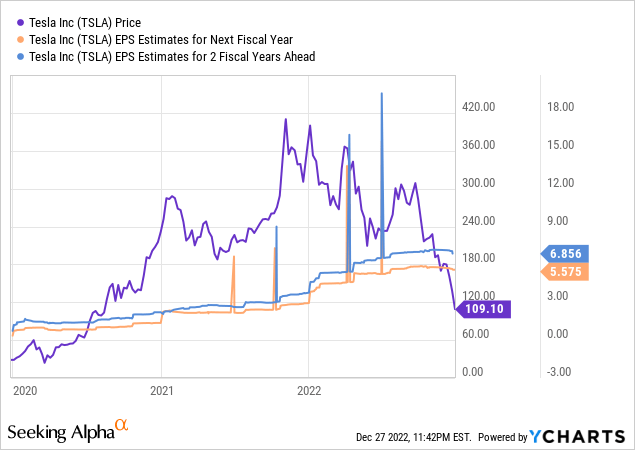

Tesla Stock And Elon Musks Recent Outbursts

May 25, 2025

Tesla Stock And Elon Musks Recent Outbursts

May 25, 2025