Trump Attacks Fed Chair Powell: Calls For Termination

Table of Contents

Trump's Criticism of Jerome Powell's Monetary Policy

Trump's criticism of Jerome Powell's monetary policy has been consistent and vehement. He accuses Powell of raising interest rates too aggressively, a move he believes is harming the US economy.

Accusations of Raising Interest Rates Too Aggressively

Trump consistently argued that Powell's interest rate hikes were unnecessarily harsh, stifling economic growth and potentially pushing the country into a recession.

- Economic Indicators: Trump frequently cited slowing GDP growth, rising unemployment claims, and cooling consumer spending as evidence of Powell's mismanagement.

- Specific Policy Decisions: Trump specifically opposed Powell's decision to raise interest rates in [insert specific date and rate increase] and [insert another date and rate increase], arguing that these moves were premature and unwarranted given the state of the economy.

Allegations of Political Motivation

Trump repeatedly insinuated that Powell's actions were politically motivated, aimed at undermining his administration and the Republican party.

- Statements Suggesting Political Bias: Trump publicly stated that Powell was "working against" his agenda and that the Fed's policies were designed to hurt the Republican party's chances in the upcoming elections. [Insert specific quotes if available].

- Implications for the Fed's Independence: These accusations represent a direct threat to the long-standing tradition of the Federal Reserve's independence from political influence. Such overt pressure raises concerns about the potential for future political interference in monetary policy decisions.

Calls for Powell's Removal/Termination

Trump's attacks on Powell weren't simply criticisms; they culminated in explicit calls for his removal or termination from his position as Fed Chair.

Analysis of Trump's Power to Remove Powell

Despite Trump's calls for Powell's removal, a former president lacks the direct authority to influence or remove a sitting Fed Chair.

- Process of Appointing and Removing a Fed Chair: The Fed Chair is appointed by the President and confirmed by the Senate. Removal requires a formal process, typically involving justifiable cause and congressional involvement.

- Legal Protections Afforded to the Fed Chair's Independence: The Federal Reserve Act and established legal precedent provide significant protections to the Fed Chair's independence, shielding them from direct political pressure.

The Potential Consequences of Removing Powell

The potential consequences of removing Powell, even if hypothetically possible, are significant and potentially destabilizing.

- Impact on Investor Confidence: Removing Powell could severely damage investor confidence, potentially leading to market volatility and capital flight.

- Effects on US and Global Financial Markets: Such an unprecedented action could trigger a global crisis of confidence in the stability and predictability of US monetary policy, with potentially severe repercussions for global financial markets.

Public and Expert Reactions to Trump's Attacks

The reaction to Trump's attacks on Powell has been swift and largely critical, both from experts and the general public.

Responses from Economists and Financial Analysts

Economists and financial analysts overwhelmingly condemned Trump's attacks on Powell, emphasizing the importance of the Fed's independence and the potential harm of politicizing monetary policy.

- Quotes from Prominent Economists and Financial Analysts: [Insert quotes from renowned economists expressing concern about Trump's actions and their potential consequences].

- Range of Opinions and Differing Perspectives: While there might be some disagreement on the effectiveness of specific Fed policies, there was a broad consensus on the dangers of politicizing the Fed's decision-making process.

Public Opinion and Political Ramifications

Public opinion on Trump's attacks on Powell is divided along partisan lines, with Republicans more likely to support Trump's position and Democrats more likely to defend Powell and the Fed's independence.

- Relevant Polling Data: [Include any relevant polling data on public opinion regarding the issue].

- Political Implications for Both Republicans and Democrats: Trump's attacks could have significant political repercussions, potentially impacting the upcoming elections and shaping the debate on economic policy.

Conclusion

Former President Trump's unprecedented attacks on Fed Chair Powell, culminating in calls for his termination, represent a significant threat to the independence of the Federal Reserve and the stability of the US economy. His criticisms of Powell's monetary policy, coupled with accusations of political motivation, sparked widespread concern among economists and financial analysts. The potential consequences of removing Powell – from severely damaged investor confidence to a global crisis of confidence in US monetary policy – are immense. The public and political reactions highlight the deep divisions surrounding this critical issue. The long-term implications of this episode remain to be seen, underscoring the ongoing need for careful consideration of the balance between political influence and the independent functioning of the Federal Reserve. Stay updated on the latest developments concerning Trump's attacks on Fed Chair Powell and the potential for termination by following [link to relevant news source or your website].

Featured Posts

-

Planning For 2025 Your Complete Us Holiday Calendar

Apr 23, 2025

Planning For 2025 Your Complete Us Holiday Calendar

Apr 23, 2025 -

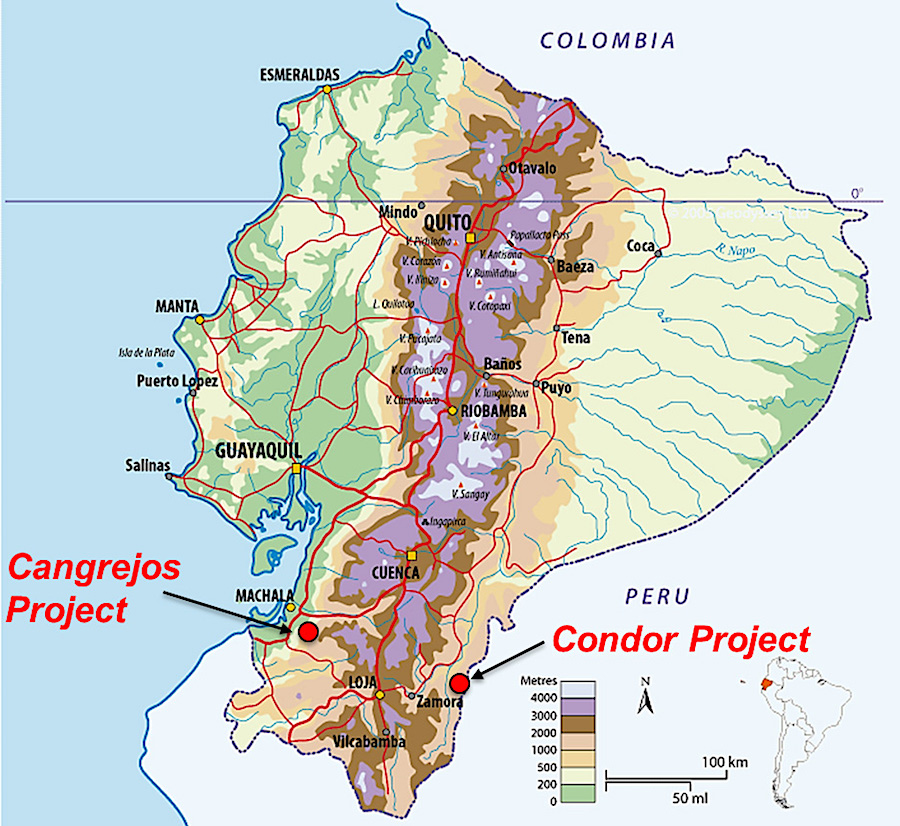

581 Million Deal Cmocs Acquisition Of Lumina Gold Reshapes The Mining Landscape

Apr 23, 2025

581 Million Deal Cmocs Acquisition Of Lumina Gold Reshapes The Mining Landscape

Apr 23, 2025 -

Trumps Fda And Biotech A Bullish Market Signal

Apr 23, 2025

Trumps Fda And Biotech A Bullish Market Signal

Apr 23, 2025 -

Yankees Historic Night 9 Home Runs Judges Triple Power Display

Apr 23, 2025

Yankees Historic Night 9 Home Runs Judges Triple Power Display

Apr 23, 2025 -

Switzerland Expands Eu Sanctions On Russian Media

Apr 23, 2025

Switzerland Expands Eu Sanctions On Russian Media

Apr 23, 2025