Understanding The Stock Market's Reaction To The 'Liberation Day' Tariffs

Table of Contents

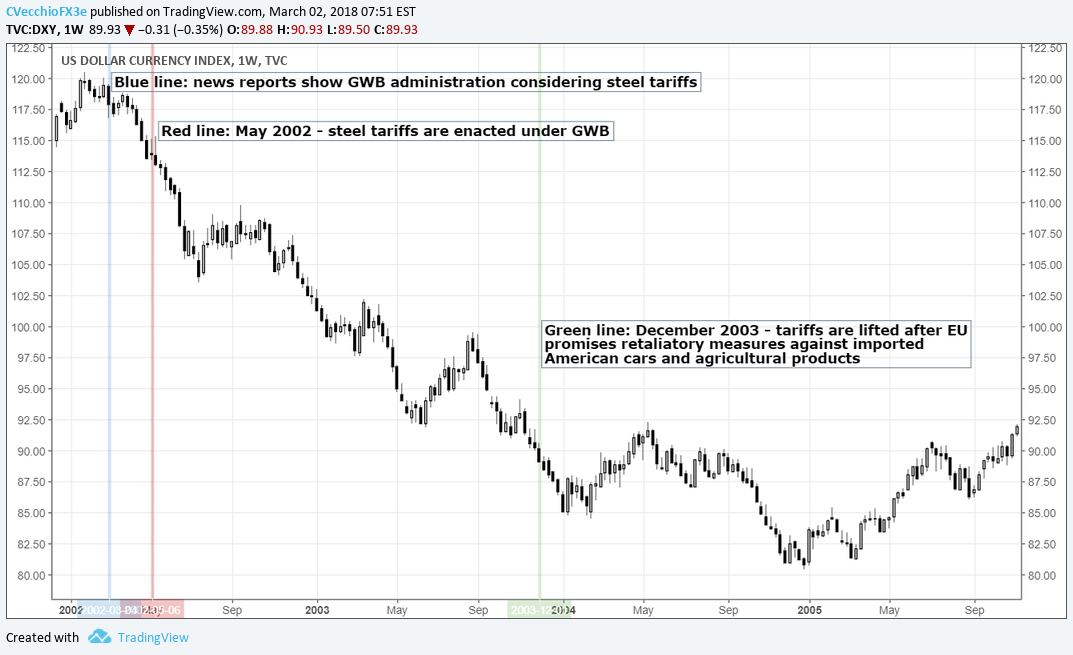

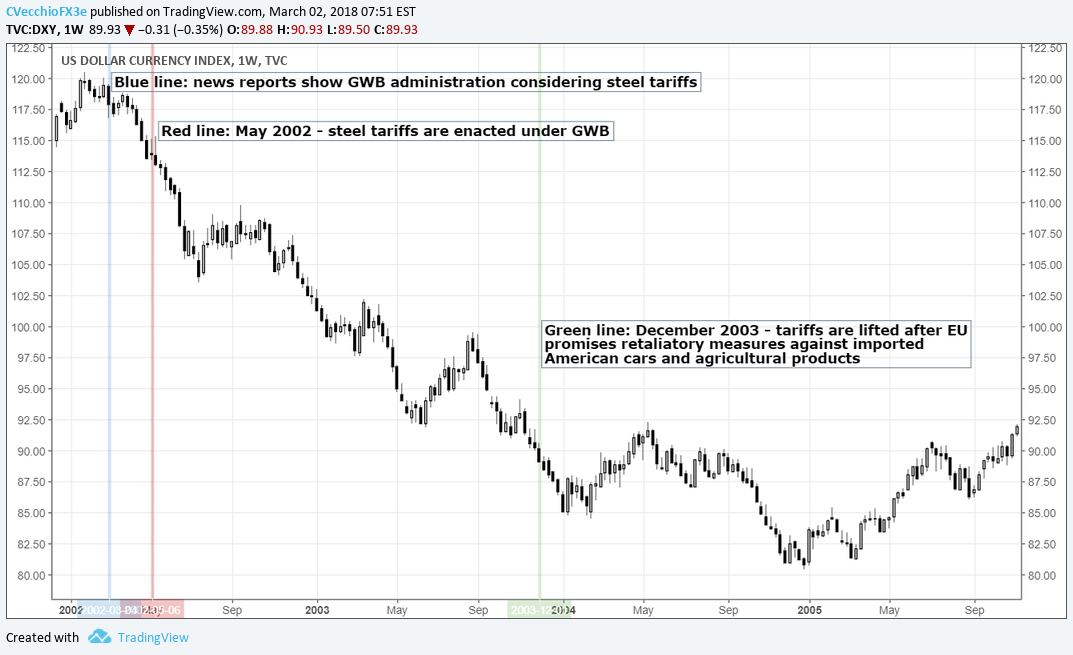

Immediate Market Impact of the 'Liberation Day' Tariffs

The announcement of the "Liberation Day" tariffs triggered a swift and significant reaction in the stock market. Many indices experienced a sharp initial drop, reflecting immediate investor concern. The extent of the decline varied depending on sector-specific vulnerabilities to the new tariffs. Increased market volatility, as measured by heightened VIX index values, was also immediately apparent, signaling uncertainty and fear among investors.

Sector-Specific Analysis

The impact of the "Liberation Day" tariffs wasn't uniform across all sectors. Some experienced more pronounced effects than others.

-

Technology Sector: This sector saw a moderate dip, primarily due to its reliance on imported components from countries now subject to higher tariffs. Companies heavily reliant on global supply chains, like XYZ Tech (XYZT) and ABC Semiconductors (ABCS), saw their stock prices decline by an average of 3-5% in the initial days following the announcement.

-

Manufacturing Sector: The manufacturing sector experienced sharper declines. Increased input costs, stemming from the tariffs on imported raw materials and intermediate goods, squeezed profit margins. Companies like DEF Manufacturing (DEF-M) and GHI Steel (GHI-S) faced significant challenges, resulting in stock price drops exceeding 7% in some cases.

-

Agricultural Sector: The agricultural sector faced uncertainty regarding export markets. Tariffs imposed by other nations in retaliation for the "Liberation Day" tariffs created significant headwinds for agricultural exporters. The stock prices of companies involved in agricultural exports showed considerable volatility, reflecting the uncertainty surrounding future demand.

Investor Sentiment and Volatility

Investor confidence plummeted following the tariff announcement. The increased uncertainty regarding future economic growth and corporate profits fueled a wave of selling pressure. The VIX index, a key measure of market volatility, spiked significantly in the days following the announcement, reaching levels not seen in several months. This surge in volatility indicates a heightened level of investor anxiety and uncertainty regarding the market's future direction in the face of the "Liberation Day" tariffs.

Underlying Factors Influencing Market Reaction

The market's reaction to the "Liberation Day" tariffs was influenced by a complex interplay of factors extending beyond the tariffs themselves.

Geopolitical Considerations

The geopolitical context surrounding the implementation of the "Liberation Day" tariffs significantly impacted investor perception. The tariffs were viewed by some as a move to exert geopolitical influence, while others saw it as a protectionist measure that could escalate trade tensions. Potential retaliatory measures from affected countries added to the uncertainty, contributing to the negative market reaction. The ongoing state of international relations and geopolitical stability, therefore, played a crucial role in shaping investor sentiment.

Economic Implications and Inflationary Pressures

The "Liberation Day" tariffs have significant economic implications, including inflationary pressures. Increased costs of imported goods are likely to translate into higher prices for consumers, potentially reducing consumer spending and slowing economic growth. Supply chain disruptions due to trade restrictions and logistical challenges also add to inflationary pressures and reduce overall economic efficiency. Economists have revised GDP growth forecasts downward, reflecting concerns about the negative impact of these tariffs on overall economic activity.

Long-Term Implications and Strategic Responses

The long-term implications of the "Liberation Day" tariffs are still unfolding, but companies and governments are already implementing strategies to adapt.

Corporate Strategies for Mitigation

Businesses are actively seeking ways to mitigate the negative effects of these tariffs. Strategies include:

- Relocation of production facilities: Some companies are considering shifting production to countries not subject to the tariffs.

- Diversification of supply chains: Businesses are actively seeking alternative suppliers to reduce their dependence on affected regions.

- Price adjustments: Companies are passing some of the increased costs onto consumers through price increases.

The long-term competitiveness of businesses will be significantly impacted by their ability to effectively implement these mitigation strategies.

Government Policies and Regulatory Responses

Governments are also responding to the challenges posed by the "Liberation Day" tariffs. Measures include:

- Subsidies and financial aid packages: Some governments are offering financial support to businesses affected by the tariffs to help them navigate the increased costs.

- Regulatory changes: Governments might introduce new regulations to address supply chain disruptions and ensure domestic industries remain competitive.

Potential for Market Recovery and Growth

Despite the initial shock, the potential for market recovery and future growth remains. The long-term effects on industry structure and competitiveness will depend on the effectiveness of corporate adaptation strategies and government responses. A careful analysis of the sector-specific impacts, coupled with continuous monitoring of geopolitical developments, will be crucial in assessing the market's future trajectory.

Conclusion

The "Liberation Day" tariffs have had a significant and multifaceted impact on the stock market. The immediate reaction involved sharp declines in various sectors, heightened market volatility, and a decline in investor confidence. Underlying factors such as geopolitical tensions and potential inflationary pressures exacerbated the market's response. In the long term, companies are adapting through strategies like supply chain diversification and relocation, while governments are implementing policies to mitigate the negative impacts. Understanding the impact of the "Liberation Day" tariffs on the stock market is crucial for informed investment decisions. Stay updated on the latest developments and continue to monitor the market's response to these significant trade policies. Further research into the specific sectors affected by the "Liberation Day" tariffs will provide a more comprehensive understanding of the market's future trajectory.

Featured Posts

-

Bitcoins Future Exploring The Possibility Of A 1 500 Rise

May 08, 2025

Bitcoins Future Exploring The Possibility Of A 1 500 Rise

May 08, 2025 -

Rising Taiwan Dollar A Catalyst For Economic Overhaul

May 08, 2025

Rising Taiwan Dollar A Catalyst For Economic Overhaul

May 08, 2025 -

How Inter Milan Defeated Barcelona To Reach The Champions League Final

May 08, 2025

How Inter Milan Defeated Barcelona To Reach The Champions League Final

May 08, 2025 -

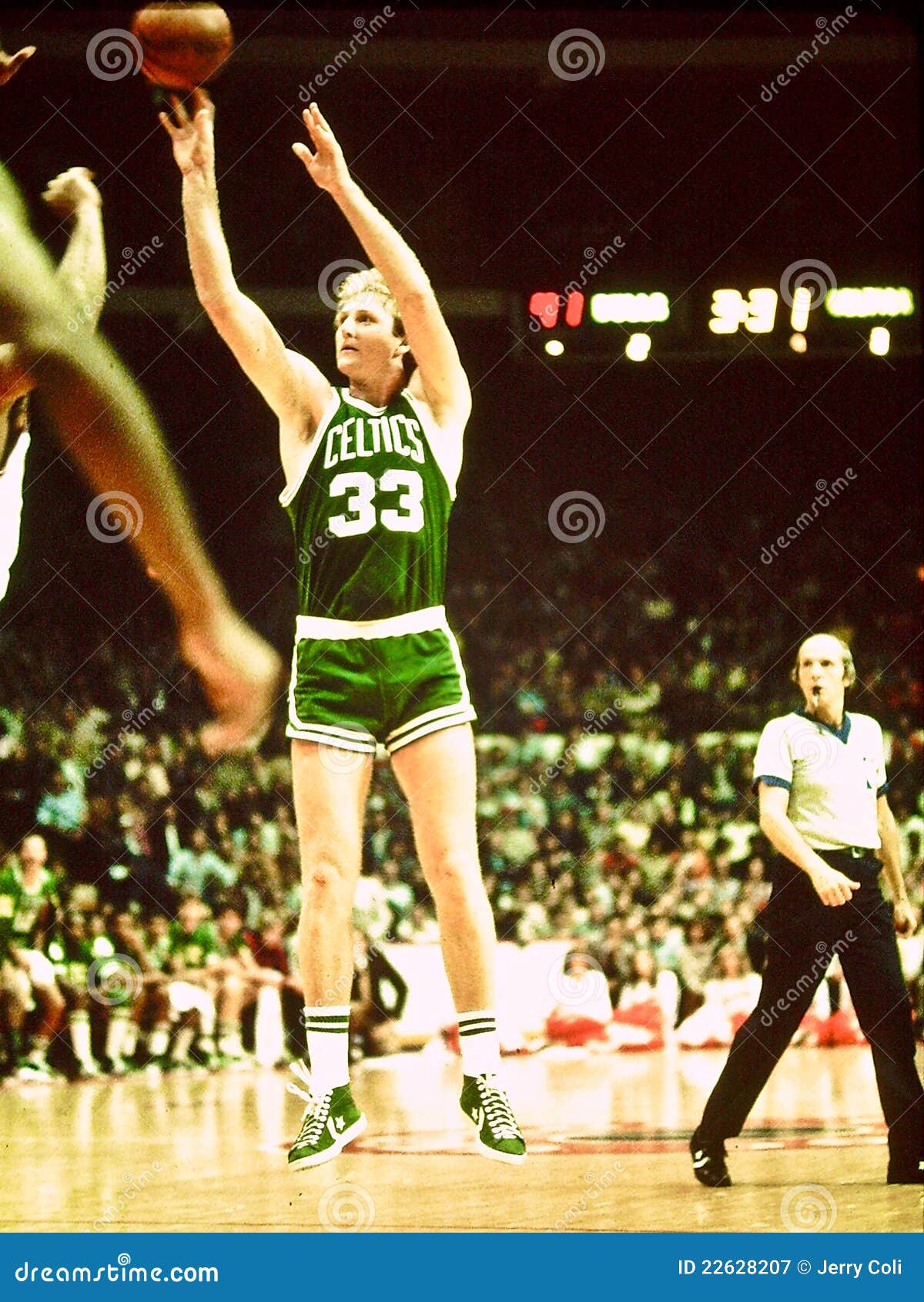

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025 -

January 6th Falsehoods Trump Supporter Ray Epps Files Defamation Lawsuit Against Fox News

May 08, 2025

January 6th Falsehoods Trump Supporter Ray Epps Files Defamation Lawsuit Against Fox News

May 08, 2025