Understanding Today's Personal Loan Interest Rates

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several factors significantly impact the personal loan interest rates you'll receive. Understanding these elements is key to securing a favorable rate.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most significant factor influencing personal loan interest rates. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay the loan.

- Higher credit score = lower interest rates: A higher credit score demonstrates a history of responsible borrowing, making you a lower-risk borrower. Lenders are more willing to offer you lower interest rates on your personal loan.

- Ways to improve your credit score: Improving your credit score for better loan rates involves paying bills on time, keeping credit utilization low, and maintaining a diverse credit history.

- Consequences of a low credit score: A low credit score can result in significantly higher interest rates, making your loan more expensive overall. You might even be denied a loan altogether. Improving your credit score before applying is crucial.

Loan Amount and Term: Size and Duration Matter

The amount you borrow and the length of your repayment term also play a significant role in determining your personal loan interest rates.

- Larger loan amounts may come with higher rates: Lenders perceive larger loan amounts as inherently riskier, potentially leading to higher interest rates to compensate for this perceived risk.

- Longer loan terms can lead to higher overall interest paid: While a longer repayment term lowers your monthly payments, it typically results in paying significantly more interest over the life of the loan.

- Illustrative examples: For instance, a $10,000 loan over 3 years will typically have a lower interest rate than a $20,000 loan over the same period. Similarly, a $10,000 loan over 5 years will generally have a higher overall interest cost than the same loan spread over 3 years.

Debt-to-Income Ratio (DTI): A Key Indicator of Repayment Ability

Your debt-to-income ratio (DTI) measures your monthly debt payments relative to your gross monthly income. Lenders use DTI to assess your ability to manage additional debt.

- Definition of DTI: DTI is calculated by dividing your total monthly debt payments (excluding mortgage payments, for some loans) by your gross monthly income.

- How lenders use DTI: A high DTI indicates you might struggle to repay a new loan, potentially resulting in higher interest rates or loan denial.

- Strategies to improve DTI: Reducing existing debt, increasing income, or both are effective strategies to improve your DTI and secure better loan terms.

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying personal loan interest rates.

- Advantages and disadvantages of each lender type: Banks often have stricter requirements but may offer competitive rates. Credit unions typically have more lenient requirements for their members but might offer a narrower range of loan products. Online lenders offer convenience but may have higher rates or less personalized service.

- Typical interest rate ranges for each: Interest rates vary considerably depending on the lender, your creditworthiness, and the loan terms. It's crucial to compare offers from different lenders to find the best personal loan interest rates.

Types of Personal Loans and Their Interest Rates

Understanding the different types of personal loans and how they impact interest rates is vital for making informed choices.

Unsecured vs. Secured Loans: Collateral and Interest Rates

The biggest difference lies in collateral.

- Definition and examples of each: Unsecured personal loans don't require collateral (e.g., a car or savings account), while secured loans do. Secured loans typically have lower interest rates because the lender has collateral to seize if you default.

- Risk factors for lenders: Unsecured loans carry higher risk for lenders, hence the higher interest rates.

- Interest rate differences: Expect significantly lower interest rates on secured loans compared to unsecured ones.

Fixed vs. Variable Interest Rates: Predictability vs. Potential Savings

The type of interest rate directly affects your monthly payments.

- Advantages and disadvantages of fixed vs. variable: Fixed interest rates remain constant throughout the loan term, offering predictability. Variable rates fluctuate with market conditions, potentially leading to lower initial payments but higher overall costs if rates rise.

- Predictability of payments: Fixed rates provide budget certainty, while variable rates introduce uncertainty.

- Risk tolerance: Choose a fixed rate if you prefer predictable payments, or a variable rate if you're comfortable with some risk in exchange for potentially lower initial payments.

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rates requires proactive steps.

Shop Around: Compare, Compare, Compare

Comparing offers is paramount.

- Use online comparison tools: Many websites allow you to compare personal loan offers from multiple lenders simultaneously.

- Contact multiple lenders directly: Don't rely solely on online tools; contact lenders directly to get personalized quotes and negotiate terms.

- Negotiate for better rates: Don't be afraid to negotiate with lenders. If you have a strong credit score and a good financial profile, you might be able to negotiate a lower interest rate.

Improve Your Credit Score: A Long-Term Strategy

Improving your credit score remains a crucial strategy.

- Steps to improve credit: Pay bills on time, keep credit utilization low, and maintain a diverse credit history.

- Timeframe for seeing results: Credit score improvement takes time, so start early.

- Resources for credit score improvement: Many resources are available online and from credit counseling agencies.

Consider Your Financial Needs: Borrow Responsibly

Choosing the right loan involves careful consideration of your financial situation.

- Calculate affordability: Determine how much you can comfortably repay each month without straining your budget.

- Understand loan terms: Carefully review all loan terms and conditions before signing anything.

- Avoid overborrowing: Only borrow what you absolutely need.

Conclusion

Understanding today's personal loan interest rates involves considering various factors, including your credit score, the loan amount, the repayment term, your debt-to-income ratio, and the type of lender. By shopping around, comparing offers from multiple lenders, improving your credit score, and carefully considering your financial needs, you can significantly improve your chances of securing the best personal loan interest rates available. Don't settle for high personal loan interest rates. Start comparing offers today and find the best deal for your financial needs!

Featured Posts

-

Personal Loan Interest Rates Current Low Rates

May 28, 2025

Personal Loan Interest Rates Current Low Rates

May 28, 2025 -

Abd De Tueketici Kredileri Mart Ayinda Artti Detayli Analiz

May 28, 2025

Abd De Tueketici Kredileri Mart Ayinda Artti Detayli Analiz

May 28, 2025 -

Mitchell Explodes For 43 As Cavaliers Defeat Pacers 126 104 Series Now 2 1

May 28, 2025

Mitchell Explodes For 43 As Cavaliers Defeat Pacers 126 104 Series Now 2 1

May 28, 2025 -

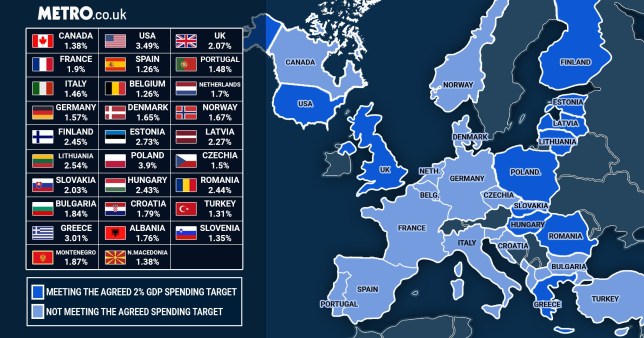

Nato Defense Spending Progress Towards Trump Era Goal

May 28, 2025

Nato Defense Spending Progress Towards Trump Era Goal

May 28, 2025 -

Prakiraan Cuaca Bandung Besok 26 Maret Antisipasi Hujan Di Jawa Barat

May 28, 2025

Prakiraan Cuaca Bandung Besok 26 Maret Antisipasi Hujan Di Jawa Barat

May 28, 2025