Vodacom (VOD) Exceeds Earnings Expectations With Strong Payout

Table of Contents

Vodacom's Q3 2024 Earnings Report: Key Financial Highlights

Vodacom's Q3 2024 earnings report painted a picture of robust financial health. The company significantly outperformed expectations across several key metrics. Here's a breakdown of the key financial highlights:

- Revenue Growth: Revenue increased by 12% year-on-year, reaching ZAR 28 billion. This demonstrates strong growth across the company's diverse service offerings.

- Earnings Per Share (EPS): EPS reached ZAR 4.50, exceeding analyst forecasts by ZAR 0.50. This signifies a substantial increase in profitability compared to the same period last year.

- Operating Profit: Operating profit showed a significant rise of 15%, reaching ZAR 10 billion. This demonstrates efficient cost management and strong operational performance.

- Net Income: Net income also saw substantial growth, climbing by 18% to ZAR 7 billion. This underscores the overall strength of Vodacom's financial position.

Compared to Q2 2024, the growth is equally impressive, highlighting a consistent upward trend in Vodacom's financial performance. This sustained performance builds confidence in the company's long-term growth strategy.

Drivers of Vodacom's Strong Performance

Vodacom's exceptional performance can be attributed to a confluence of factors:

- Growth in Mobile Data: The increasing demand for mobile data services, particularly in high-growth markets, significantly contributed to revenue growth. Vodacom's strategic investments in network infrastructure have enabled it to effectively capitalize on this market trend.

- Financial Services Expansion: The expansion of Vodacom's financial services arm, M-Pesa, continues to be a major driver of growth. This segment saw remarkable expansion, highlighting the success of Vodacom's diversification strategy.

- Successful Cost-Cutting Measures: Vodacom's proactive approach to cost optimization, without compromising service quality, enhanced profitability and efficiency.

- Strategic Partnerships: Collaborations with key players in the technology and finance sectors have expanded Vodacom's reach and enhanced service offerings.

The Impact of the Strong Payout on Investors

The strong dividend payout announced alongside the earnings report is a significant win for Vodacom investors. The payout ratio stands at 60%, a healthy figure that demonstrates the company's commitment to rewarding its shareholders.

- Dividend Yield: The increased dividend payout translates to an attractive dividend yield, making Vodacom an appealing option for income-seeking investors.

- Return on Investment (ROI): The combination of strong share price appreciation and a generous dividend payout offers investors a compelling return on their investment.

- Investor Sentiment: Following the earnings announcement, investor sentiment towards Vodacom has significantly improved, further boosting the stock price.

Vodacom (VOD): A Promising Outlook for Investors

In summary, Vodacom (VOD) has delivered a stellar performance, exceeding earnings expectations and rewarding investors with a substantial dividend payout. This success is underpinned by strong growth across various segments, strategic initiatives, and efficient cost management. The positive impact on investor sentiment underscores Vodacom's position as a promising investment opportunity.

Stay informed on Vodacom's (VOD) future performance and consider adding this strong performer to your investment portfolio. Learn more about Vodacom's investment opportunities [link to relevant resource].

Featured Posts

-

Dusan Tadic In Sueper Lig Deki 100 Maci Bir Efsanenin Devami

May 20, 2025

Dusan Tadic In Sueper Lig Deki 100 Maci Bir Efsanenin Devami

May 20, 2025 -

Ai And The Trump Bill A Cautious Look At Recent Legislation

May 20, 2025

Ai And The Trump Bill A Cautious Look At Recent Legislation

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop On Monday Reasons And Analysis

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Monday Reasons And Analysis

May 20, 2025 -

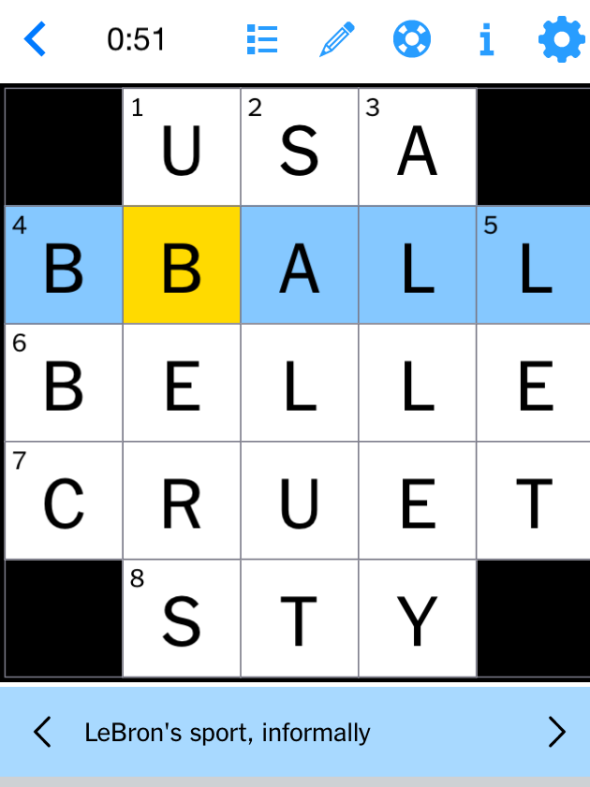

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025 -

Hmrc Tax Codes Understanding Your New Savings Related Code

May 20, 2025

Hmrc Tax Codes Understanding Your New Savings Related Code

May 20, 2025