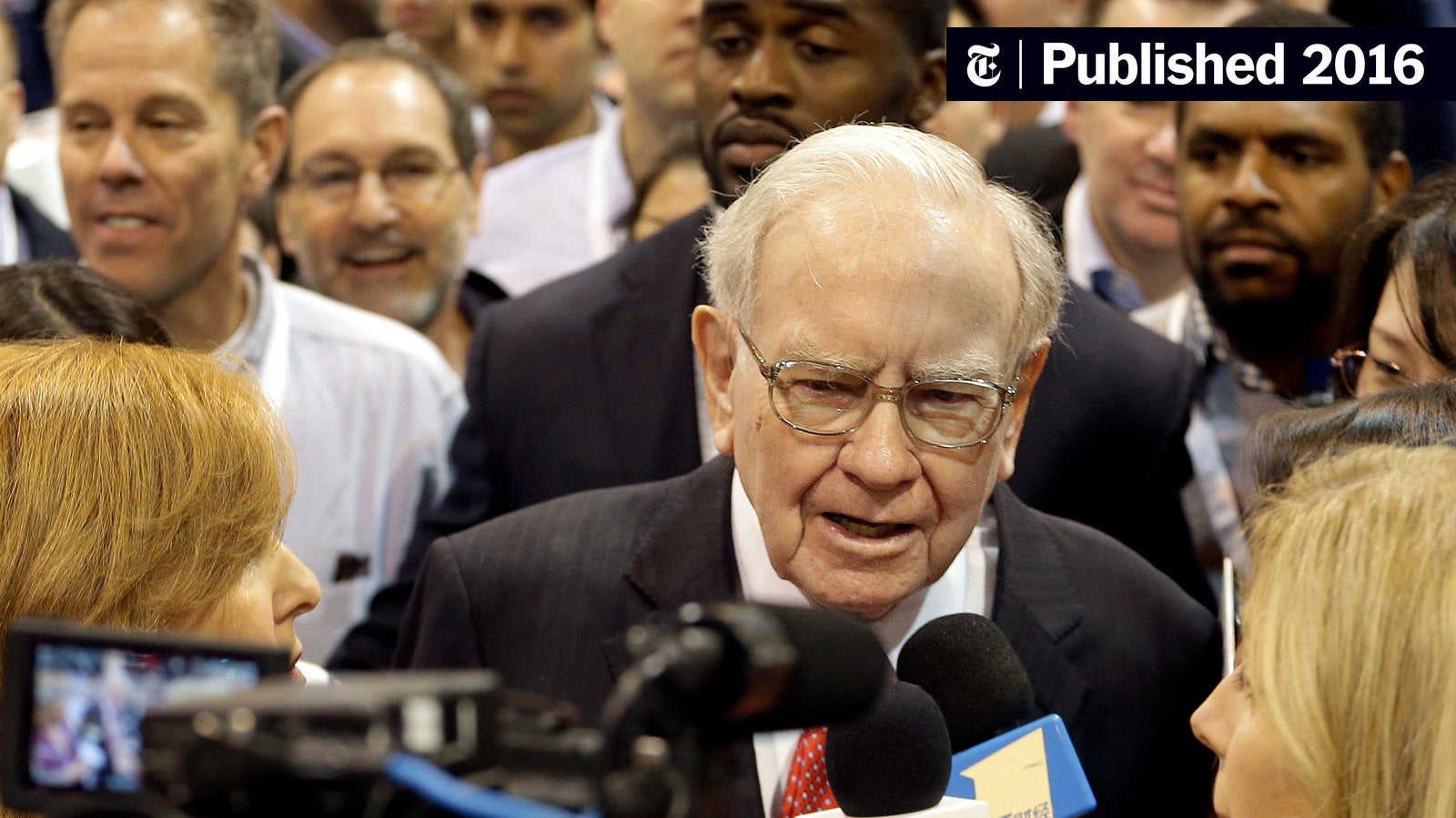

Warren Buffett, Bezos Among Billionaires Hit By Trump's $174 Billion Tariff Impact

Table of Contents

The Impact on Warren Buffett's Berkshire Hathaway

The tariffs negatively impacted several Berkshire Hathaway holdings, significantly affecting the company's overall performance and demonstrating the vulnerability of even the most diversified portfolios to protectionist trade measures.

Reduced Investment Returns

Berkshire Hathaway's diverse portfolio includes numerous companies heavily reliant on global trade and supply chains. The tariffs led to several challenges:

- Decreased demand for certain products due to higher prices caused by tariffs: Increased prices on imported goods reduced consumer demand, impacting the profitability of companies within Berkshire Hathaway's portfolio that relied on these imports.

- Supply chain disruptions leading to production delays and increased costs: Tariffs disrupted established supply chains, leading to delays in production and significantly higher costs for raw materials and finished goods. This affected several Berkshire Hathaway subsidiaries.

- Reduced profitability for Berkshire Hathaway subsidiaries reliant on Chinese imports: Many Berkshire Hathaway subsidiaries experienced decreased profitability due to increased input costs and reduced sales volume resulting from tariffs on imported Chinese goods. This impacted their bottom line and consequently Berkshire Hathaway's overall financial health.

Strategic Adjustments to Mitigate Losses

Buffett's famously conservative investment strategy likely played a role in mitigating some of the negative impacts. While specific details of internal adjustments might not be publicly available, potential responses include:

- Potential shift towards domestic suppliers: Berkshire Hathaway may have sought to diversify its supply chains by increasing reliance on domestic suppliers to reduce its vulnerability to future tariff increases.

- Increased focus on businesses less susceptible to tariff impacts: Buffett might have strategically adjusted investment strategies by allocating more capital to businesses less exposed to international trade friction.

Jeff Bezos and Amazon's Tariff Challenges

Amazon, as a global e-commerce giant, faced significant challenges due to the tariffs, impacting both its operational costs and consumer prices. The scale of Amazon's operations magnified the impact of these trade barriers.

Increased Costs for Consumers

As a massive importer and retailer of goods from China, Amazon absorbed a considerable portion of the increased costs resulting from the tariffs. This resulted in several consequences:

- Rising prices on electronics and household goods: Consumers faced higher prices on a wide range of products imported from China and sold through Amazon's platform. This impacted consumer spending and Amazon's market share.

- Impact on Amazon's own-brand products: Amazon's own-brand products, many manufactured in China, also saw increased costs, impacting profitability and potentially affecting pricing strategies.

- Pressure on Amazon's already thin profit margins: The increased costs further squeezed Amazon's already notoriously thin profit margins, impacting overall profitability despite its massive sales volume.

Navigating Supply Chain Disruptions

To mitigate the effects of tariff-induced supply chain disruptions, Amazon likely implemented several strategies:

- Diversification of sourcing locations: Amazon likely shifted some of its sourcing to countries outside of China to reduce reliance on a single supplier nation and mitigate future trade risks.

- Investment in automation to offset increased labor costs: Automation can help reduce reliance on labor-intensive processes, potentially offsetting increased labor costs driven by higher prices on imported goods.

- Potential increased investment in logistics and warehousing to manage inventory: Diversifying supply chains requires investment in logistics and warehousing to manage inventory efficiently across multiple locations.

Broader Impacts of the Tariffs on Billionaires

The ripple effects of the tariffs extended far beyond Buffett and Bezos, affecting the investment portfolios of numerous other billionaires.

Ripple Effect on Investment Portfolios

The tariffs' impact wasn't limited to specific companies; it created wider market instability, significantly affecting many investment portfolios:

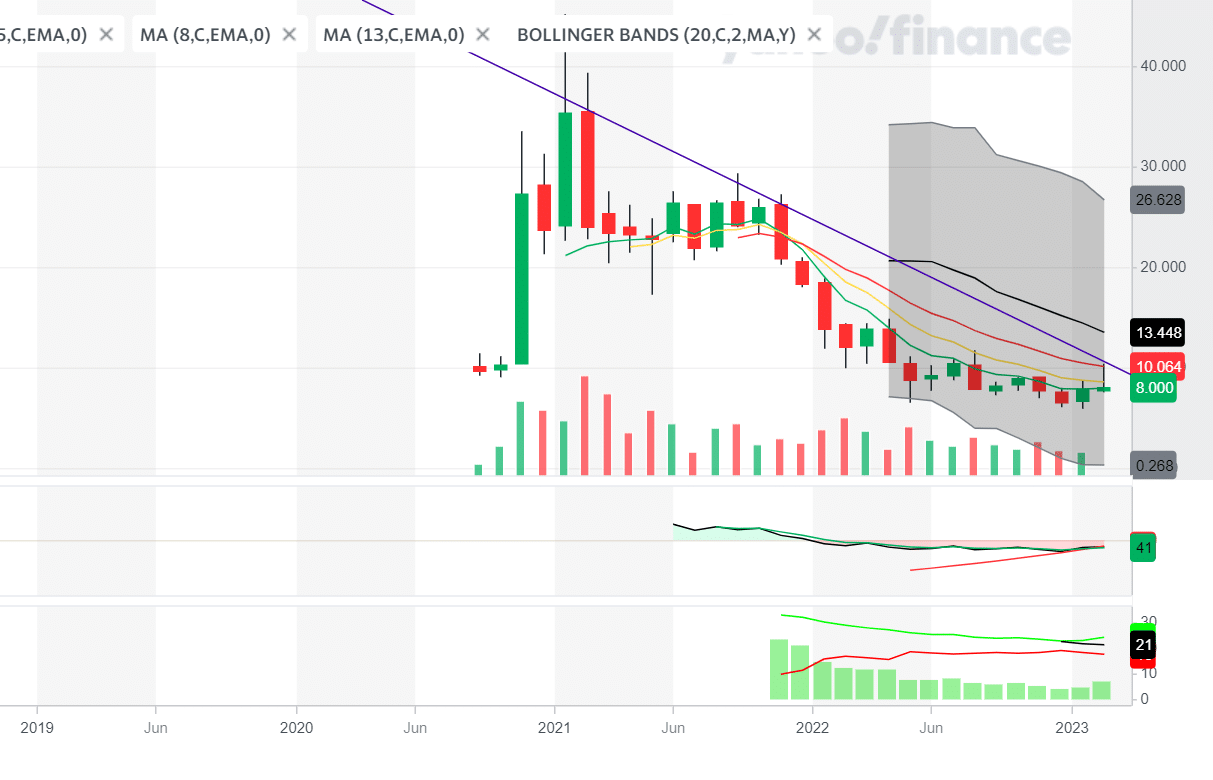

- Decline in stock prices of companies vulnerable to tariffs: Shares of companies heavily reliant on imports or with significant operations in China experienced price declines, eroding the value of many investment portfolios.

- Increased volatility in the stock market: The uncertainty surrounding tariffs contributed to increased volatility in the stock market, making it more difficult to predict future market performance.

- Difficulty in predicting future market performance: The unpredictability associated with trade wars and tariff policies created increased difficulties for investors in forecasting future market performance.

Implications for Global Trade and Economic Growth

The tariffs and their impact on billionaires' wealth serve as a stark reminder of the potential negative consequences of protectionist trade policies. These policies can destabilize global markets, impacting economic growth and investor confidence worldwide. The experience highlights the interconnected nature of global finance and underscores the importance of international cooperation in trade.

Conclusion

The $174 billion tariff imposed by the Trump administration had a tangible and significant impact on the wealth of prominent billionaires like Warren Buffett and Jeff Bezos. These tariffs created increased costs, supply chain disruptions, and reduced investment returns, showcasing the far-reaching consequences of protectionist trade policies. While some billionaires may have mitigated some losses through strategic adjustments, the overall effect highlights the interconnectedness of global finance and the considerable risks associated with trade wars. Understanding the impact of these tariffs – and similar economic policies – is crucial for investors, businesses, and policymakers alike. To stay informed about the ongoing implications of trade policies on global markets and the wealth of the world’s leading investors, continue to follow news and analysis on the effects of tariffs on billionaires, impact of tariffs on wealth, and global trade and tariffs.

Featured Posts

-

2025 Stephen King Film Adaptations High Hopes Despite The Monkeys Uncertain Future

May 10, 2025

2025 Stephen King Film Adaptations High Hopes Despite The Monkeys Uncertain Future

May 10, 2025 -

Sensex Surges 1 400 Points Nifty Above 23 800 Top 5 Reasons For Todays Market Rise

May 10, 2025

Sensex Surges 1 400 Points Nifty Above 23 800 Top 5 Reasons For Todays Market Rise

May 10, 2025 -

The Cost Of Supporting Trump Tech Billionaires 194 Billion Loss

May 10, 2025

The Cost Of Supporting Trump Tech Billionaires 194 Billion Loss

May 10, 2025 -

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 10, 2025

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 10, 2025 -

Elon Musks Fortune Explodes Teslas Rise And Dogecoin Departure

May 10, 2025

Elon Musks Fortune Explodes Teslas Rise And Dogecoin Departure

May 10, 2025

Latest Posts

-

Indian Stock Market Update Sensex And Nifty Performance Today

May 10, 2025

Indian Stock Market Update Sensex And Nifty Performance Today

May 10, 2025 -

Is Palantirs 30 Fall A Buying Signal A Stock Market Analysis

May 10, 2025

Is Palantirs 30 Fall A Buying Signal A Stock Market Analysis

May 10, 2025 -

Stock Market Live Sensex Nifty Close Higher Despite Early Dip

May 10, 2025

Stock Market Live Sensex Nifty Close Higher Despite Early Dip

May 10, 2025 -

Palantir Stock A Pre May 5th Investment Strategy

May 10, 2025

Palantir Stock A Pre May 5th Investment Strategy

May 10, 2025 -

Indian Stock Market Rally 5 Key Factors Behind Sensex And Niftys Sharp Increase

May 10, 2025

Indian Stock Market Rally 5 Key Factors Behind Sensex And Niftys Sharp Increase

May 10, 2025